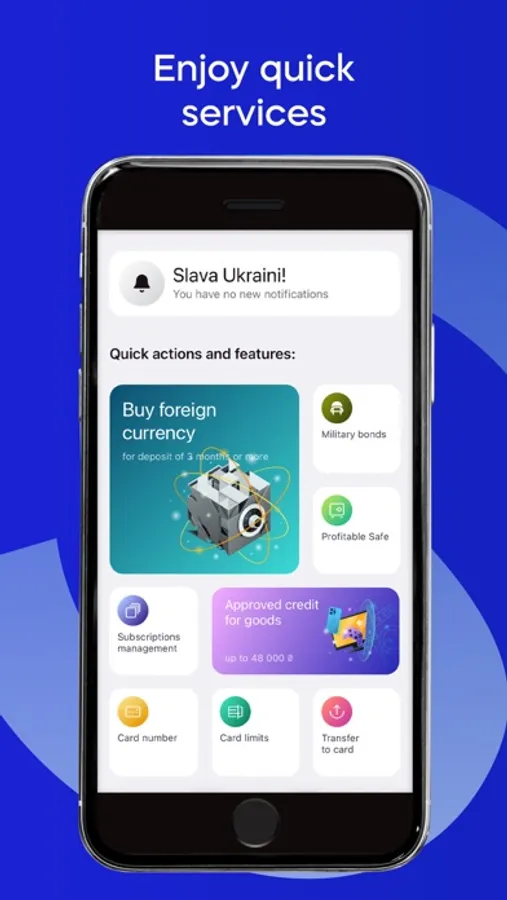

In this financial management app, you can open accounts, make payments, and manage your finances. Includes features such as bill payments, money transfers, and credit application options.

AppRecs review analysis

AppRecs rating 3.9. Trustworthiness 0 out of 100. Review manipulation risk 0 out of 100. Based on a review sample analyzed.

★★★☆☆

3.9

AppRecs Rating

Ratings breakdown

5 star

67%

4 star

7%

3 star

1%

2 star

3%

1 star

22%

What to know

✓

Good user ratings

74% positive sampled reviews

✓

Authentic reviews

No red flags detected

About Sense SuperApp: online bank UA

Sense SuperApp is a reliable digital bank that offers fast and convenient financial management. Open your bank account in 5 minutes, pay utility bills, send and receive money, apply for credit and installments, control your expenses, and manage your individual entrepreneurship.

OPEN A CARD IN MINUTES

Choose the easiest way to become a customer:

1. 15 minutes via video chat or 5 minutes with the help of the Diia app.

2. In just 1 minute, you can use your digital card.

3. If you need a plastic card, delivery is free of charge.

Sense Bank is a state-owned Ukrainian bank and one of the largest banks in Ukraine.

Sense Online Banking:

CREDIT AND INSTALLMENTS

• Online credit — choose the amount and period of the credit, and get money on your card

• Instant installment plan: max. loan amount - up to UAH 200,000 for a period of up to 24 months. The actual annual interest rate ranges from 1.8% for up to 6 months to 2.9% for up to 24 months, subject to the conditions of the "Instant Installment Plan" program.

• Easy installment plan — purchase goods and services from our partner network. Max. loan amount - up to UAH 200,000 for a period of up to 24 months. The actual annual interest rate, subject to the conditions of the "Easy Installment Plan" program, is 0.01% (for 3–24 months).

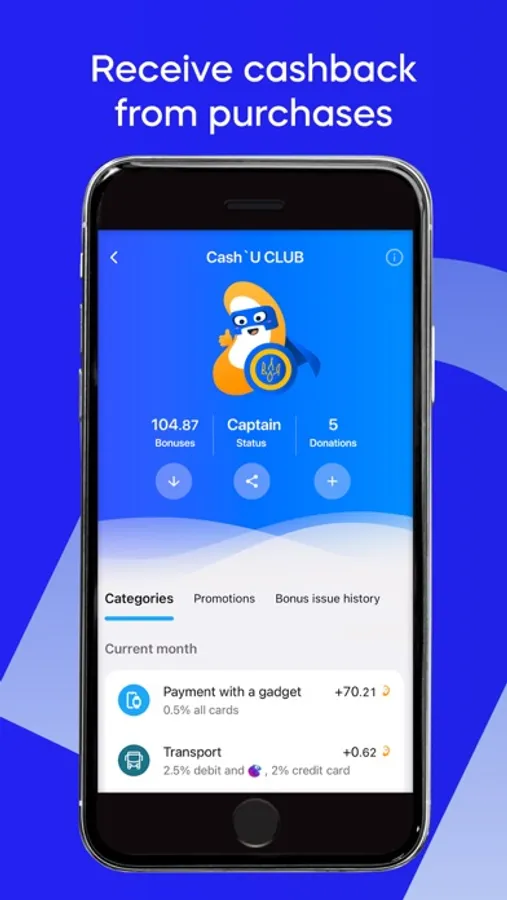

CASHBACK

• Cash ’u Club bonus program, advanced cashback, and special cashback from our partners

• Withdraw bonuses as real money (1 bonus = 1 UAH)

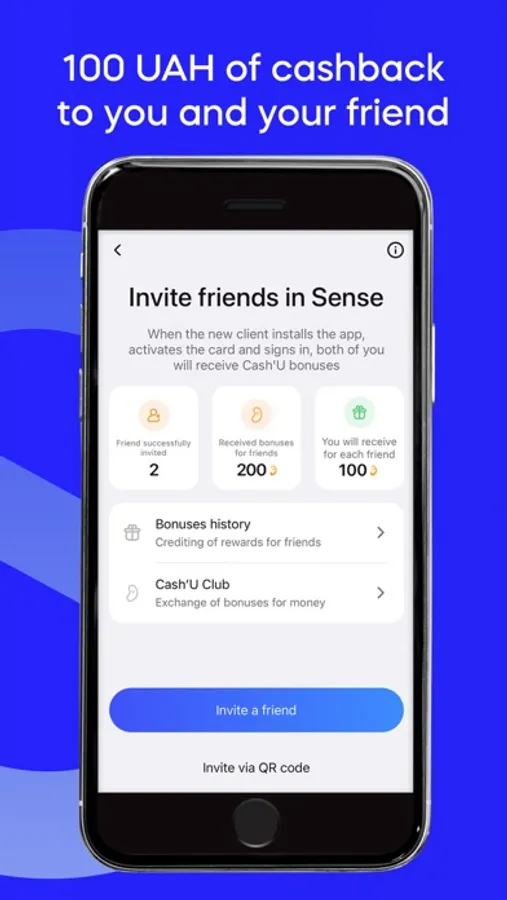

• Invite a friend to Sense SuperApp — you and the new client both get 100 UAH cash back directly to your accounts.

BANKING SERVICES

Sense SuperApp — banking and finance with comfort:

• Swift payments, money transfers, utility payments, and mobile balance top-ups with no additional charge, plus QR code payments

• Choose your card — debit, credit, premium, and business cards are available, as well as branded cards "ВИГОДА" (Epicenter) and ATB

• Payment systems — Mastercard and Visa

• Top up your card — easily, with no fees, via Sense Bank ATMs and terminals, or through EasyPay and City24 terminals

• Ability to create templates for payments and money transfers

• Unique “Drag’n’Drop” function — make payments even faster

• “Raise money” service — split the bill in a cafe or chip in for a birthday present

• Token and subscription management

• Your financial assistant — track expenses by category, choose a spending plan, and more

• Account statements and receipts — get in a few taps

• Google Pay and Apple Pay support — add your card to your digital wallet and pay with your smartphone (incl. Face ID and Touch ID)

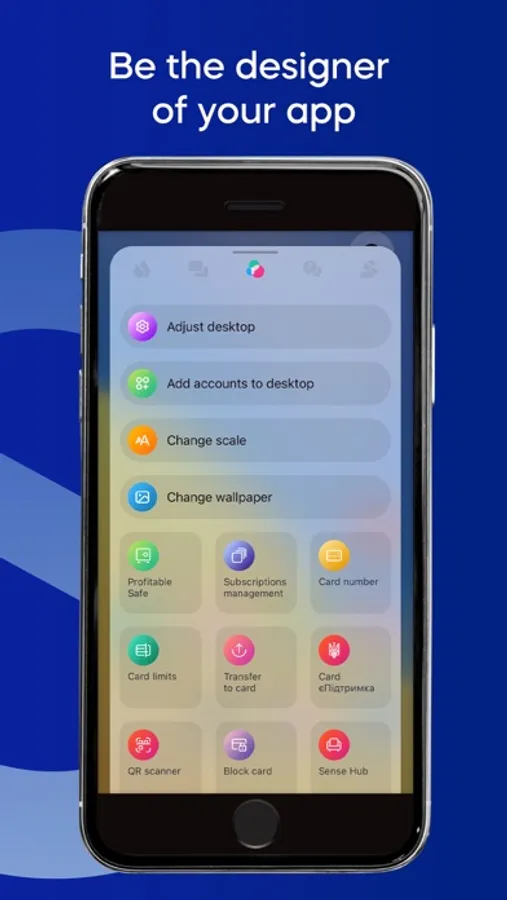

• Intuitive interface — enjoy a unique, personalized banking experience

• 24/7 support — our online support team is available 24/7.

Also:

• International transfers and currency exchange

• Investments in Domestic Government Bonds of UA.

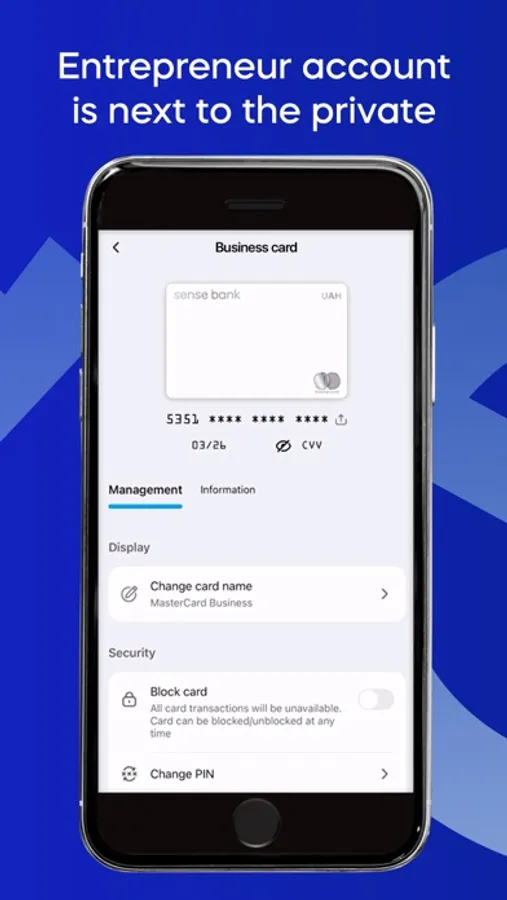

INDIVIDUAL ENTREPRENEURSHIP

Open and manage simply and efficiently:

• Business account for an individual entrepreneur: tax payments, money withdrawal to a personal card, sale of currency, opening of accounts in foreign currencies, and more.

Sense SuperApp - an online bank that simplifies business and finance management.

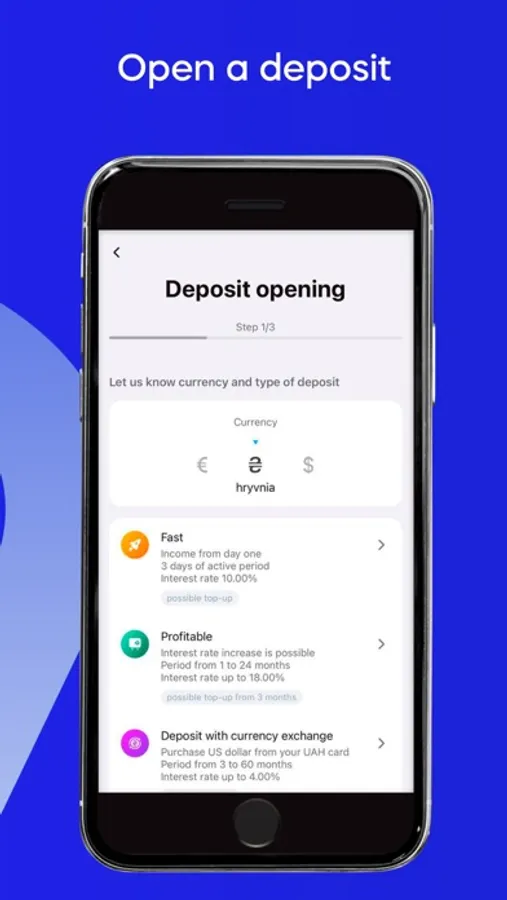

DEPOSITS

Invest directly from your phone:

• Deposits: "Quick" — income for each day; “Profitable” with the bonus for prolongation; "Saving" for any period you wish

• Mortgage.

SENSE FAMILY

Open cards for your family and children — manage your family budget, share credit limits, and earn more bonuses.

• Family Card — an additional card for shared use

• Kids Card — for children aged 6-14, with a loyalty program and parental controls.

WHY SENSE SUPERAPP?

• All finances in one app: personal finances, business accounts, and investments.

• Rewarding purchases: credit, installment purchases, cashback, and bonuses.

• Fast and convenient: intuitive interface, instant payments, wallet, and 24/7 online support.

Join 1 million+ satisfied customers today!

JSC «Sense Bank» License NBU №61 dated 05.10.2011, in a banking state register №158, Ukraine, Kyiv

OPEN A CARD IN MINUTES

Choose the easiest way to become a customer:

1. 15 minutes via video chat or 5 minutes with the help of the Diia app.

2. In just 1 minute, you can use your digital card.

3. If you need a plastic card, delivery is free of charge.

Sense Bank is a state-owned Ukrainian bank and one of the largest banks in Ukraine.

Sense Online Banking:

CREDIT AND INSTALLMENTS

• Online credit — choose the amount and period of the credit, and get money on your card

• Instant installment plan: max. loan amount - up to UAH 200,000 for a period of up to 24 months. The actual annual interest rate ranges from 1.8% for up to 6 months to 2.9% for up to 24 months, subject to the conditions of the "Instant Installment Plan" program.

• Easy installment plan — purchase goods and services from our partner network. Max. loan amount - up to UAH 200,000 for a period of up to 24 months. The actual annual interest rate, subject to the conditions of the "Easy Installment Plan" program, is 0.01% (for 3–24 months).

CASHBACK

• Cash ’u Club bonus program, advanced cashback, and special cashback from our partners

• Withdraw bonuses as real money (1 bonus = 1 UAH)

• Invite a friend to Sense SuperApp — you and the new client both get 100 UAH cash back directly to your accounts.

BANKING SERVICES

Sense SuperApp — banking and finance with comfort:

• Swift payments, money transfers, utility payments, and mobile balance top-ups with no additional charge, plus QR code payments

• Choose your card — debit, credit, premium, and business cards are available, as well as branded cards "ВИГОДА" (Epicenter) and ATB

• Payment systems — Mastercard and Visa

• Top up your card — easily, with no fees, via Sense Bank ATMs and terminals, or through EasyPay and City24 terminals

• Ability to create templates for payments and money transfers

• Unique “Drag’n’Drop” function — make payments even faster

• “Raise money” service — split the bill in a cafe or chip in for a birthday present

• Token and subscription management

• Your financial assistant — track expenses by category, choose a spending plan, and more

• Account statements and receipts — get in a few taps

• Google Pay and Apple Pay support — add your card to your digital wallet and pay with your smartphone (incl. Face ID and Touch ID)

• Intuitive interface — enjoy a unique, personalized banking experience

• 24/7 support — our online support team is available 24/7.

Also:

• International transfers and currency exchange

• Investments in Domestic Government Bonds of UA.

INDIVIDUAL ENTREPRENEURSHIP

Open and manage simply and efficiently:

• Business account for an individual entrepreneur: tax payments, money withdrawal to a personal card, sale of currency, opening of accounts in foreign currencies, and more.

Sense SuperApp - an online bank that simplifies business and finance management.

DEPOSITS

Invest directly from your phone:

• Deposits: "Quick" — income for each day; “Profitable” with the bonus for prolongation; "Saving" for any period you wish

• Mortgage.

SENSE FAMILY

Open cards for your family and children — manage your family budget, share credit limits, and earn more bonuses.

• Family Card — an additional card for shared use

• Kids Card — for children aged 6-14, with a loyalty program and parental controls.

WHY SENSE SUPERAPP?

• All finances in one app: personal finances, business accounts, and investments.

• Rewarding purchases: credit, installment purchases, cashback, and bonuses.

• Fast and convenient: intuitive interface, instant payments, wallet, and 24/7 online support.

Join 1 million+ satisfied customers today!

JSC «Sense Bank» License NBU №61 dated 05.10.2011, in a banking state register №158, Ukraine, Kyiv