In this banking app, users can view accounts, transfer funds, and pay bills through self-service features. Includes account management, fund transfers, bill payments, and support options.

AppRecs review analysis

AppRecs rating 4.3. Trustworthiness 0 out of 100. Review manipulation risk 0 out of 100. Based on a review sample analyzed.

★★★★☆

4.3

AppRecs Rating

Ratings breakdown

5 star

76%

4 star

11%

3 star

5%

2 star

3%

1 star

6%

What to know

✓

High user satisfaction

86% of sampled ratings are 4+ stars (4.5★ average)

✓

Authentic reviews

Natural distribution, no red flags

⚠

Pricing complaints

Many low ratings mention paywalls or pricing

About eNMB

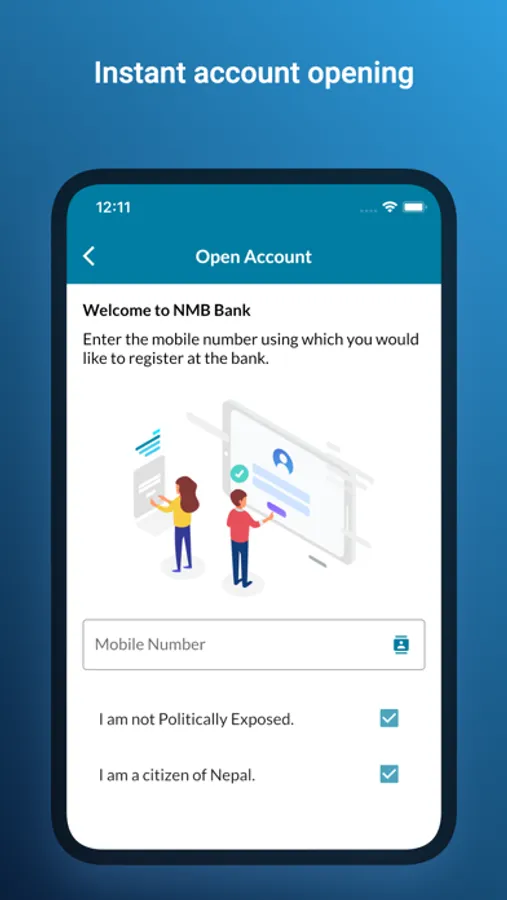

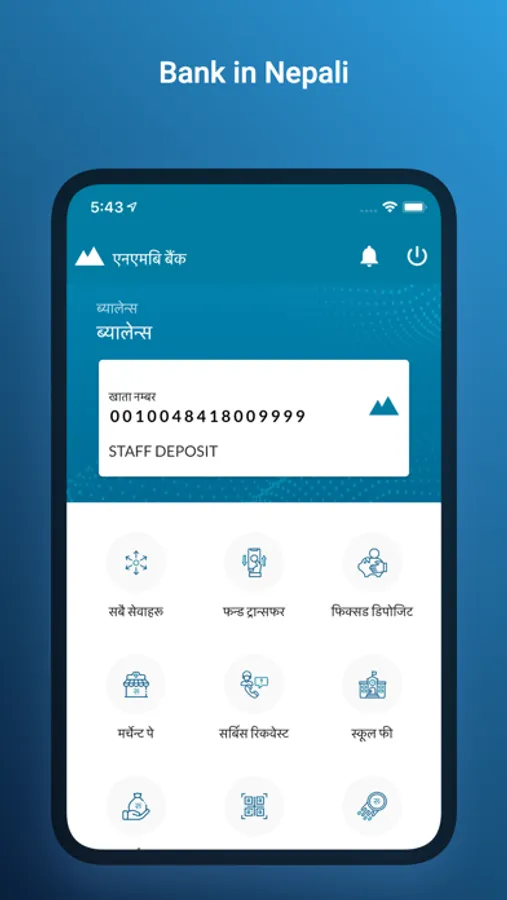

NMB Bank’s new Mobile Banking App is called eNMB, it provides banking on the go for all existing retail banking customers.

If you are not an existing NMB Bank customer, you can open a savings account by visiting your nearest branch and then experience banking through our new application.

If you are an existing NMB bank customer, you can download the application follow the simple one-time activation process, and experience the new digital experience.

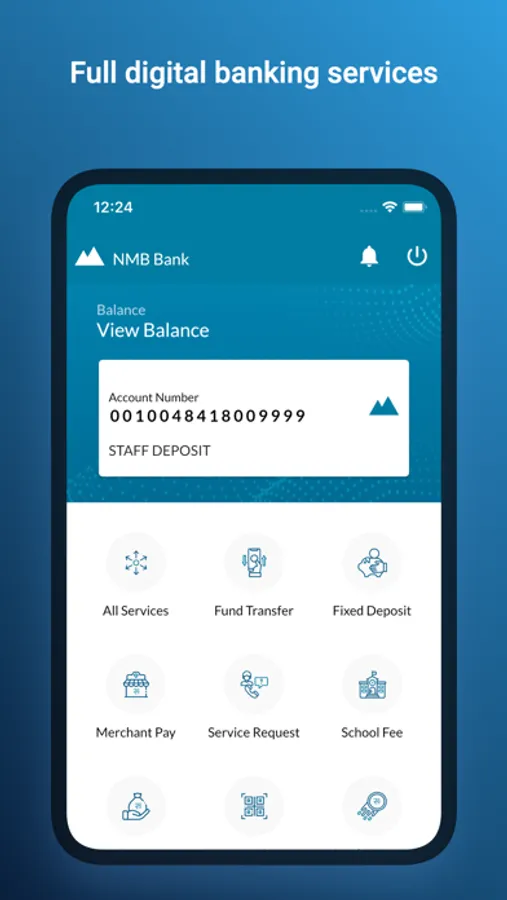

The new application is the first step towards the digital journey started by NMB Bank, the users can experience

• Self services:

- Self application activation for NMB Bank retail banking customers.

- PIN reset.

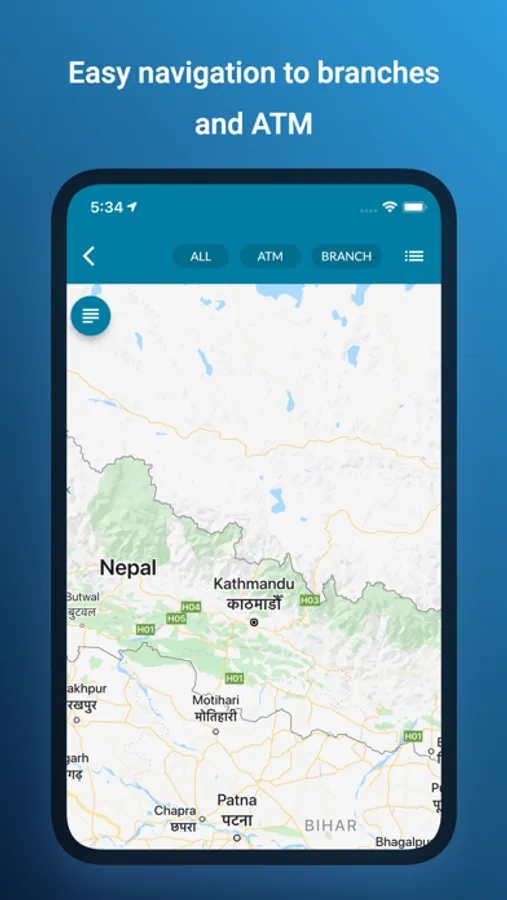

- Navigate to branches.

- Navigate to ATM.

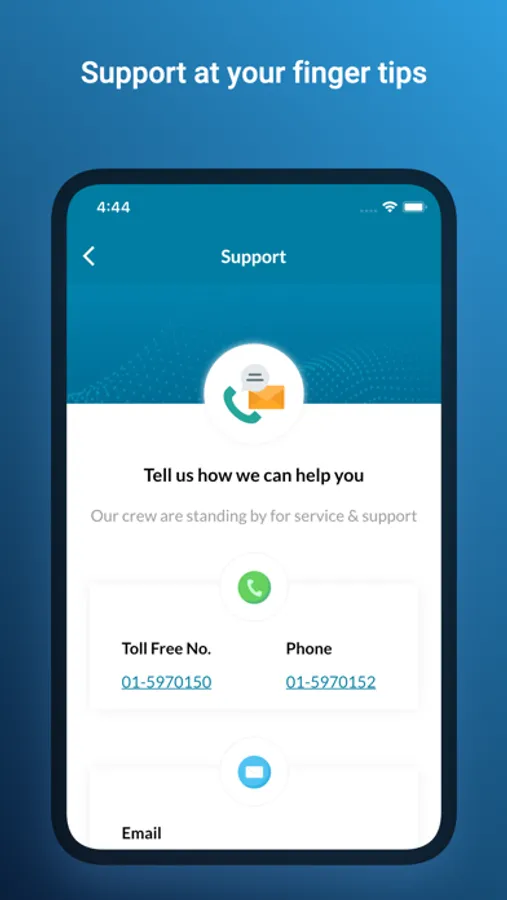

- Contact support.

- Change PIN.

- FAQ

• Banking on the go services:

- View Accounts.

- View FD.

- View Loans.

- Inter Bank Fund Transfer.

- Intra Bank Fund Transfer.

- Schedule Transfer.

- Add Payee

- Direct Transfer to Payee.

- Create FD.

- Email TDS.

- Download & Email Statement

• Services:

- Stop check.

- Occupation change.

- Update marital status.

- Update VAT/PAN.

- Update the purpose of A/C.

- Update the source of funds for A/C.

- Update change in anticipated transactions to A/C.

- Update number per year for the A/C.

- Update temporary address

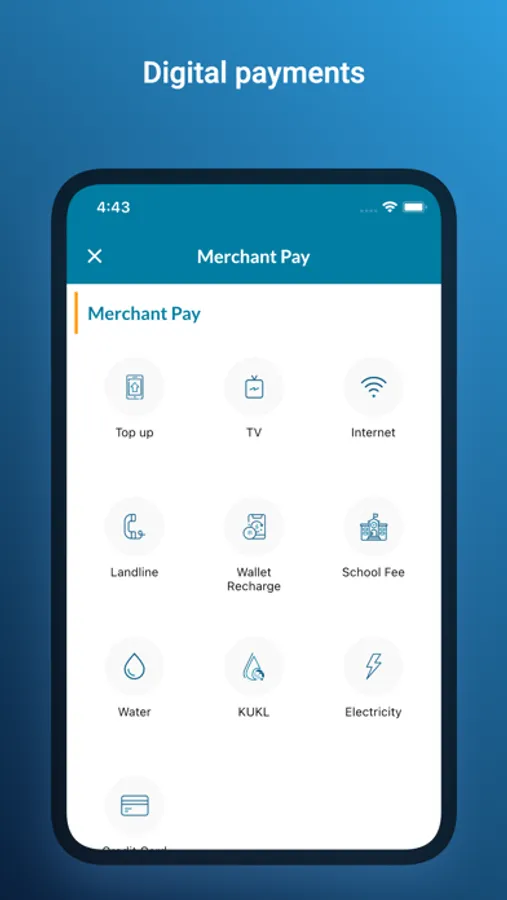

• Pay Your Bills:

- Pay school fees.

- Pay water bill.

- Pay electricity bill.

- Topup

Get started:

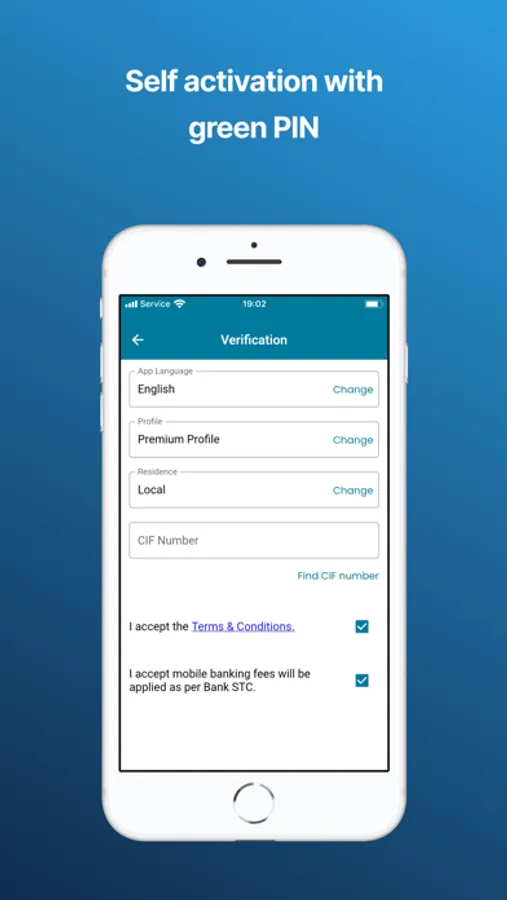

To get started with eNMB, you just need your Customer Information File Number (CIF), In case you do not know your CIF number the application provides the option to fetch this number, you can follow the instructions.

The app will take you through a one-time activation process when you download the mobile application and start the activation.

eNMB App requires the following permissions:

- Location: This is required for locating and navigating to the branches and ATM.

- Photos / Media / Files / Camera: This is required to let you access the gallery / click an image to set a profile picture.

Please note that your data is safe with NMB Bank. We do not share any information with the third party without your initiation.

We never call you asking for your PIN, CIF, or Account numbers, please avoid giving such information to callers on the phone, email, or any other media for the security of your account.

If you are not an existing NMB Bank customer, you can open a savings account by visiting your nearest branch and then experience banking through our new application.

If you are an existing NMB bank customer, you can download the application follow the simple one-time activation process, and experience the new digital experience.

The new application is the first step towards the digital journey started by NMB Bank, the users can experience

• Self services:

- Self application activation for NMB Bank retail banking customers.

- PIN reset.

- Navigate to branches.

- Navigate to ATM.

- Contact support.

- Change PIN.

- FAQ

• Banking on the go services:

- View Accounts.

- View FD.

- View Loans.

- Inter Bank Fund Transfer.

- Intra Bank Fund Transfer.

- Schedule Transfer.

- Add Payee

- Direct Transfer to Payee.

- Create FD.

- Email TDS.

- Download & Email Statement

• Services:

- Stop check.

- Occupation change.

- Update marital status.

- Update VAT/PAN.

- Update the purpose of A/C.

- Update the source of funds for A/C.

- Update change in anticipated transactions to A/C.

- Update number per year for the A/C.

- Update temporary address

• Pay Your Bills:

- Pay school fees.

- Pay water bill.

- Pay electricity bill.

- Topup

Get started:

To get started with eNMB, you just need your Customer Information File Number (CIF), In case you do not know your CIF number the application provides the option to fetch this number, you can follow the instructions.

The app will take you through a one-time activation process when you download the mobile application and start the activation.

eNMB App requires the following permissions:

- Location: This is required for locating and navigating to the branches and ATM.

- Photos / Media / Files / Camera: This is required to let you access the gallery / click an image to set a profile picture.

Please note that your data is safe with NMB Bank. We do not share any information with the third party without your initiation.

We never call you asking for your PIN, CIF, or Account numbers, please avoid giving such information to callers on the phone, email, or any other media for the security of your account.