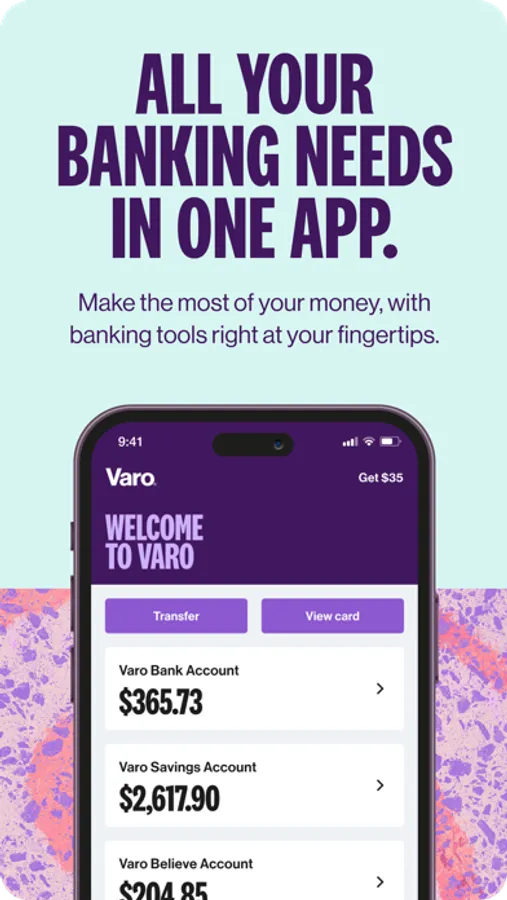

With this banking app, you can manage accounts, make transfers, and access savings tools. Includes early payday options, fee-free ATMs, and loan services.

AppRecs review analysis

AppRecs rating 4.3. Trustworthiness 0 out of 100. Review manipulation risk 0 out of 100. Based on a review sample analyzed.

★★★★☆

4.3

AppRecs Rating

Ratings breakdown

5 star

92%

4 star

5%

3 star

1%

2 star

0%

1 star

1%

What to know

✓

High user satisfaction

92% of sampled ratings are 5 stars

About Varo Bank: Online Banking

We are a real bank, built for the digital age.

Member FDIC, backed by the full faith and credit of the U.S. Government.

ONLINE BANKING

• Early payday³

• No monthly, minimum balance, or overdraft fees¹

• 40k+ fee-free Allpoint® ATMs⁴

• Up to 5.00% annual percentage yield on first $5,000, quals apply⁷

• 2.50% APY on additional balances

• Auto-saving tools

• Unlike many money apps, we’re a real bank

INSTANT CASH ADVANCES

• Borrow up to $250 today by linking a qualifying account²

• Work up to $500 cash advances over time with direct deposit²

• Flat fee per cash advance

• 30 days to repay

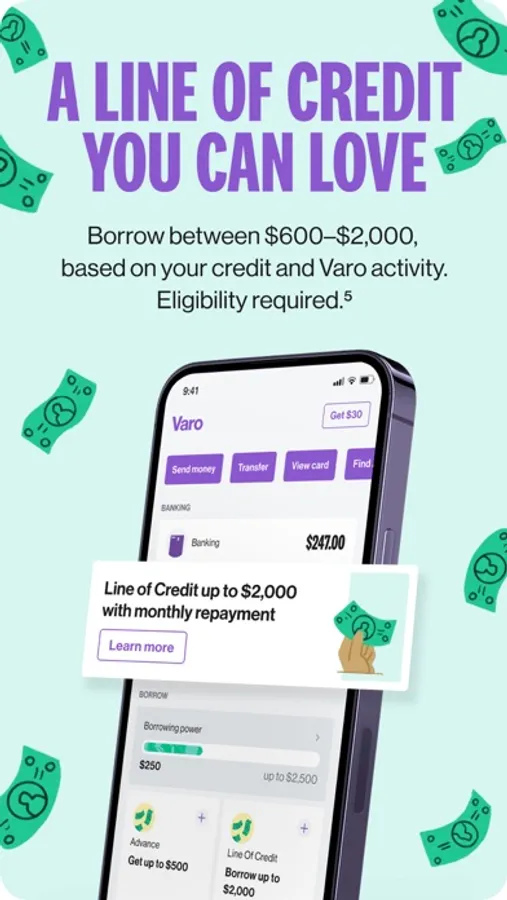

LINE OF CREDIT

• From $600 to $2,000, quals apply⁵

• No interest, late fees, or penalties

• Simple flat fee

• Payment periods between 3 and 12 months

FREE SECURED CREDIT CARD⁶

• No credit check, interest, annual fees, or min security deposit

• Reported to Equifax, Experian, & TransUnion

• Quals: Must have an active Varo Bank Account in good standing & incoming deposits of $200 or more in the past 31 days

SEND MONEY

• Use recipient’s phone number or email address, even if they aren’t a Varo customer

• Fast, secure, and free!

DOWNLOAD NOW!

• Signup in less than two minutes with no impact on your credit

Member FDIC, backed by the full faith and credit of the U.S. Government.

ONLINE BANKING

• Early payday³

• No monthly, minimum balance, or overdraft fees¹

• 40k+ fee-free Allpoint® ATMs⁴

• Up to 5.00% annual percentage yield on first $5,000, quals apply⁷

• 2.50% APY on additional balances

• Auto-saving tools

• Unlike many money apps, we’re a real bank

INSTANT CASH ADVANCES

• Borrow up to $250 today by linking a qualifying account²

• Work up to $500 cash advances over time with direct deposit²

• Flat fee per cash advance

• 30 days to repay

LINE OF CREDIT

• From $600 to $2,000, quals apply⁵

• No interest, late fees, or penalties

• Simple flat fee

• Payment periods between 3 and 12 months

FREE SECURED CREDIT CARD⁶

• No credit check, interest, annual fees, or min security deposit

• Reported to Equifax, Experian, & TransUnion

• Quals: Must have an active Varo Bank Account in good standing & incoming deposits of $200 or more in the past 31 days

SEND MONEY

• Use recipient’s phone number or email address, even if they aren’t a Varo customer

• Fast, secure, and free!

DOWNLOAD NOW!

• Signup in less than two minutes with no impact on your credit