AppRecs review analysis

AppRecs rating 4.3. Trustworthiness 79 out of 100. Review manipulation risk 25 out of 100. Based on a review sample analyzed.

★★★★☆

4.3

AppRecs Rating

Ratings breakdown

5 star

90%

4 star

0%

3 star

0%

2 star

5%

1 star

5%

What to know

✓

Low review manipulation risk

25% review manipulation risk

✓

Credible reviews

79% trustworthiness score from analyzed reviews

✓

High user satisfaction

90% of sampled ratings are 5 stars

About Club Money: Simple Budget

Free trial for new users! All features included.

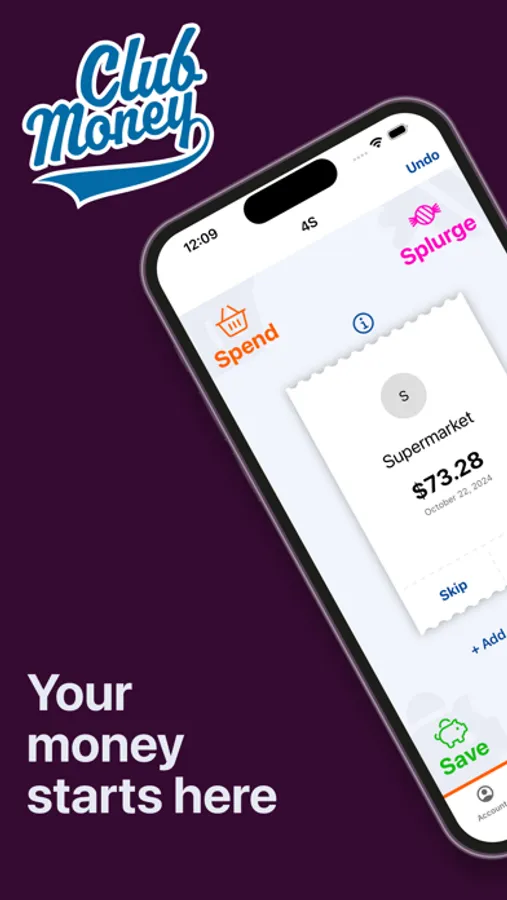

There's no need to be afraid of your own money. Getting started is simple and fast. Here's how it works step by step:

1. Swipe receipts (easy and fun)

2. Discover your true monthly expenses (without judgment)

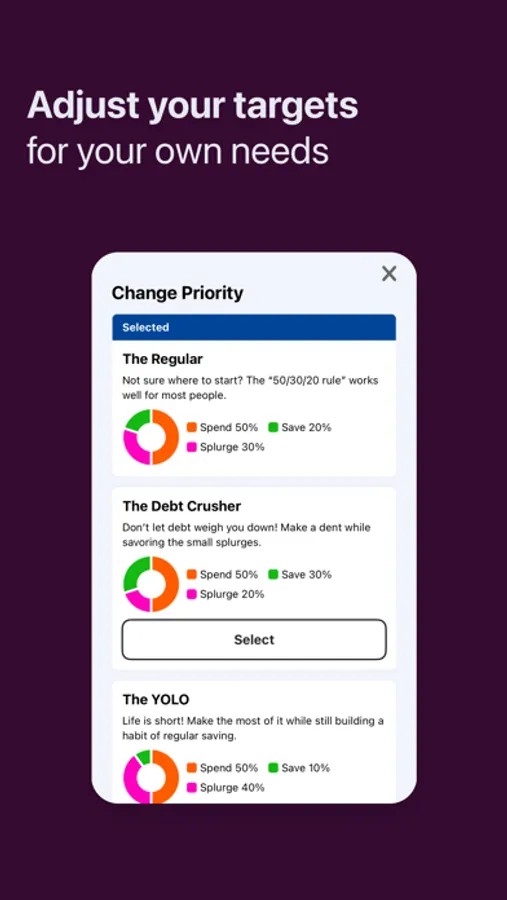

3. Adjust your target percentages for your own life (pick one and go)

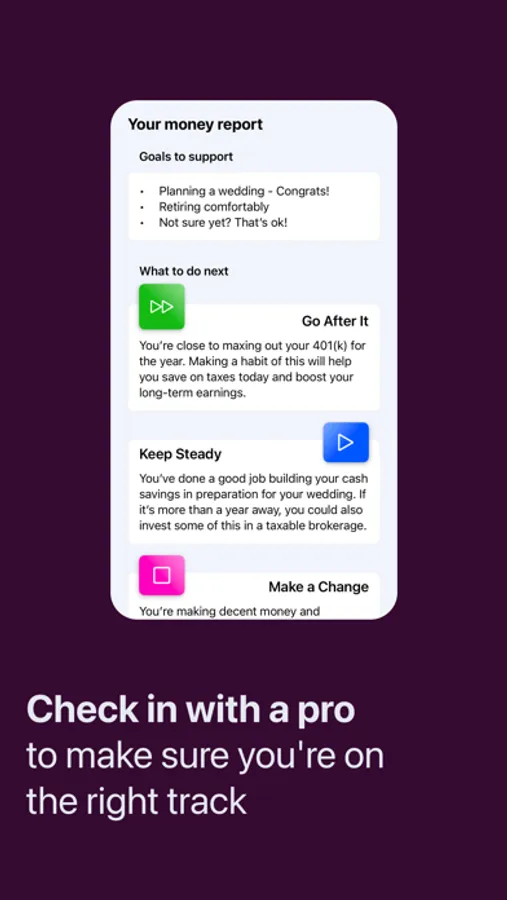

4. Check in with a Certified Financial Planner® professional and get advice on where to focus next (live in beta)

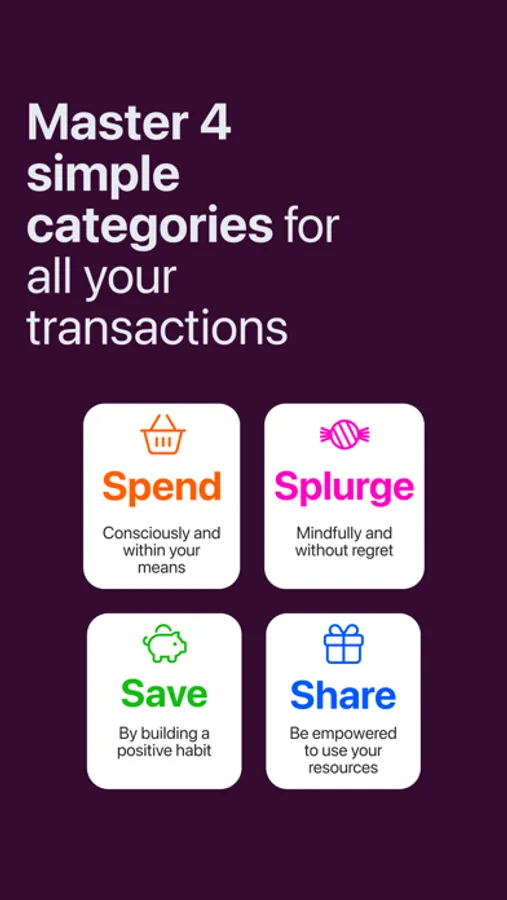

To categorize, swipe each transaction to one of just four categories.

*Spend* on your needs, consciously and within your means

*Splurge* on your wants, mindfully and without regret

*Save* by building a positive habit

*Share* gifts with those you love, and donations with those in need

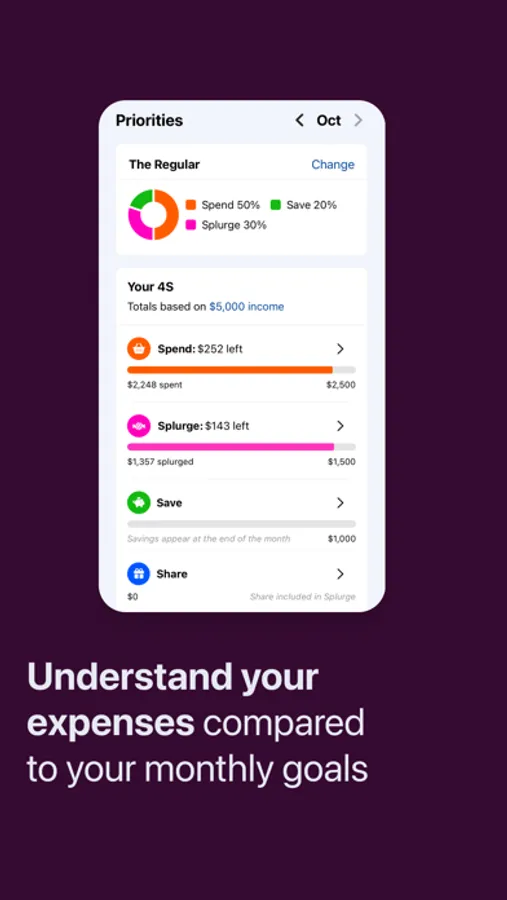

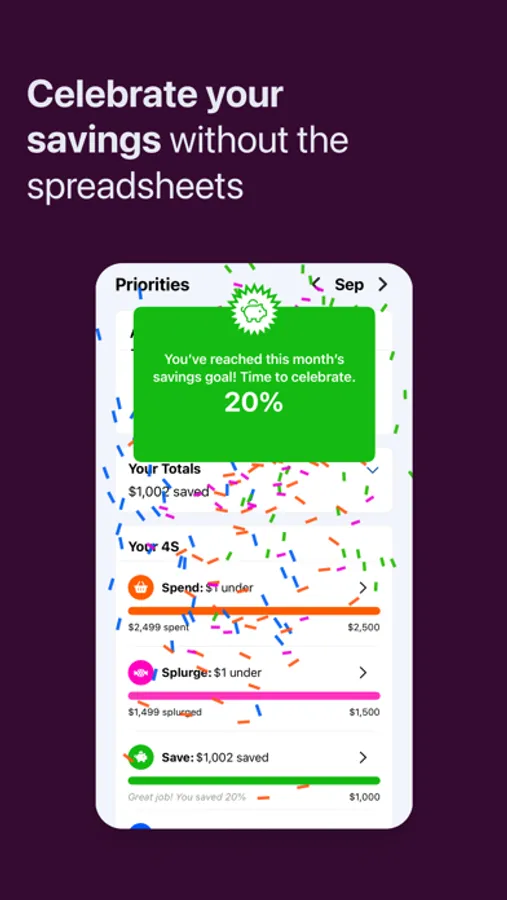

Club Money keeps track of all the calculations for you. At any time, see how you’re doing compared to your targets in the current month. At the end of the month, your total percentages will be revealed. Find out if you achieved 20% savings!

One size doesn’t fit all. Choose target percentages for Spend / Splurge / Save based on your own Priorities. (Share is included in Splurge.)

• The Regular: 50/30/20

• The Debt Crusher: 50/20/30

• The YOLO: 50/40/10

• The Wealth Builder: 40/20/40

• In this economy?: 60/30/10

• The FIRE: 20/20/60

Club Money is the first of its kind, a community finance app bringing people together to make money less stressful. It starts with group advice based on spending patterns, delivered by our (fully human) Certified Financial Planner® professionals. Many more community features to come! Let's figure this out together.

Account connections are powered by the same secure service trusted by more than 4,000 banks and financial apps. When you connect an account with Club Money, that service sends the information you provide to your financial institution. Balances and transactions are returned for you to see in the Club Money app. Club Money has no access to your login credentials.

Our Data Promise

We won’t ask for any piece of data that doesn’t have a benefit to you.

We will manage your data with the highest level of security.

We won’t sell your data.

https://brightfin.io/terms-of-use

https://brightfin.io/privacy-policy

There's no need to be afraid of your own money. Getting started is simple and fast. Here's how it works step by step:

1. Swipe receipts (easy and fun)

2. Discover your true monthly expenses (without judgment)

3. Adjust your target percentages for your own life (pick one and go)

4. Check in with a Certified Financial Planner® professional and get advice on where to focus next (live in beta)

To categorize, swipe each transaction to one of just four categories.

*Spend* on your needs, consciously and within your means

*Splurge* on your wants, mindfully and without regret

*Save* by building a positive habit

*Share* gifts with those you love, and donations with those in need

Club Money keeps track of all the calculations for you. At any time, see how you’re doing compared to your targets in the current month. At the end of the month, your total percentages will be revealed. Find out if you achieved 20% savings!

One size doesn’t fit all. Choose target percentages for Spend / Splurge / Save based on your own Priorities. (Share is included in Splurge.)

• The Regular: 50/30/20

• The Debt Crusher: 50/20/30

• The YOLO: 50/40/10

• The Wealth Builder: 40/20/40

• In this economy?: 60/30/10

• The FIRE: 20/20/60

Club Money is the first of its kind, a community finance app bringing people together to make money less stressful. It starts with group advice based on spending patterns, delivered by our (fully human) Certified Financial Planner® professionals. Many more community features to come! Let's figure this out together.

Account connections are powered by the same secure service trusted by more than 4,000 banks and financial apps. When you connect an account with Club Money, that service sends the information you provide to your financial institution. Balances and transactions are returned for you to see in the Club Money app. Club Money has no access to your login credentials.

Our Data Promise

We won’t ask for any piece of data that doesn’t have a benefit to you.

We will manage your data with the highest level of security.

We won’t sell your data.

https://brightfin.io/terms-of-use

https://brightfin.io/privacy-policy