With this banking app, you can view accounts, transfer funds, pay bills, and deposit checks using your device. Includes account management, transaction monitoring, and fraud prevention tools.

About INTRUST Bank Business

Our history of innovation can be traced back to our founding in 1876. Today that means giving businesses access to manage their accounts in a convenient, secure way through our business banking app.

Here’s what you can do with the app:

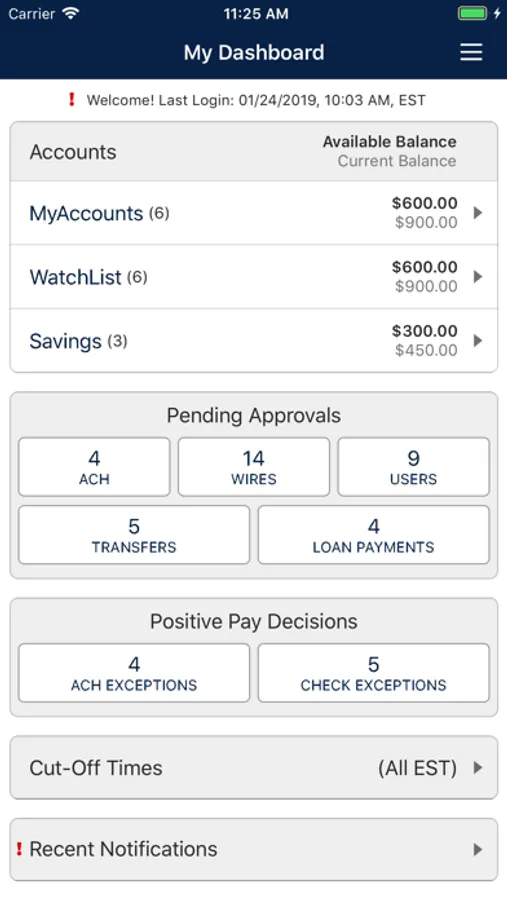

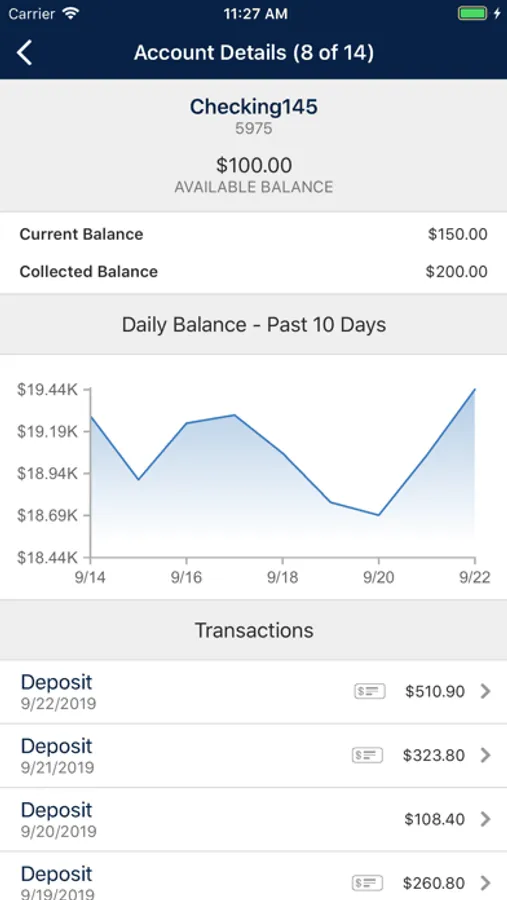

View Accounts – View your INTRUST business checking, savings, time deposit, and loan accounts in one central location. Monitor balances and search recent transactions by date, amount, or check number.

Transfer Funds – Easily move funds between your INTRUST accounts.

Pay Bills – Schedule one-time payments to any individual or business.

Deposit Checks – Deposit paper checks into your accounts using the camera on your smart phone or tablet. No visit to the bank required!

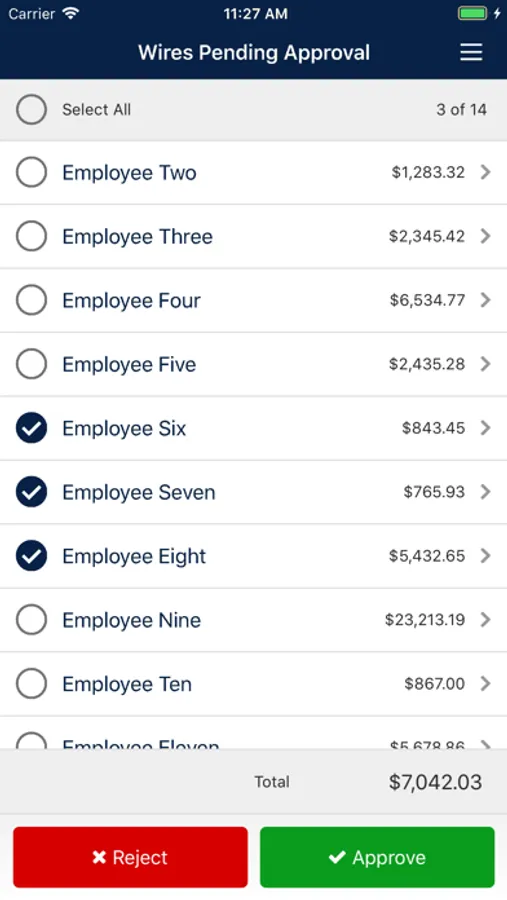

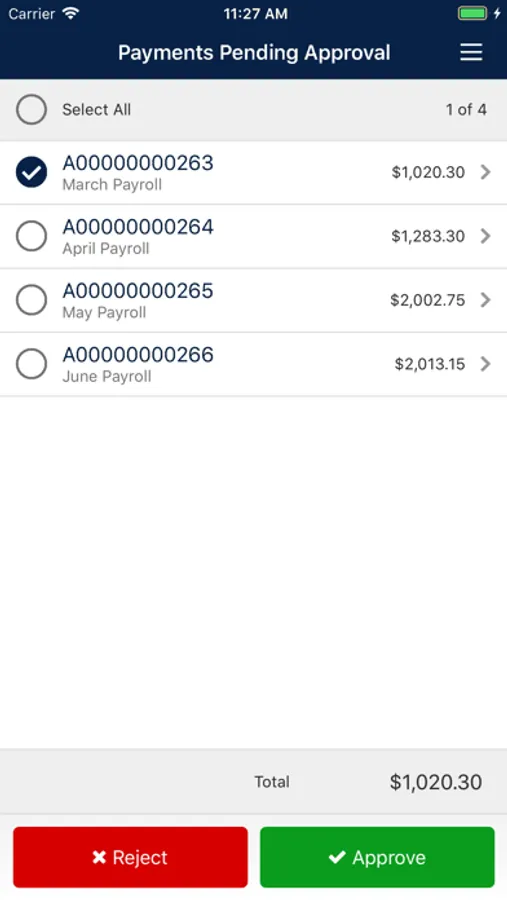

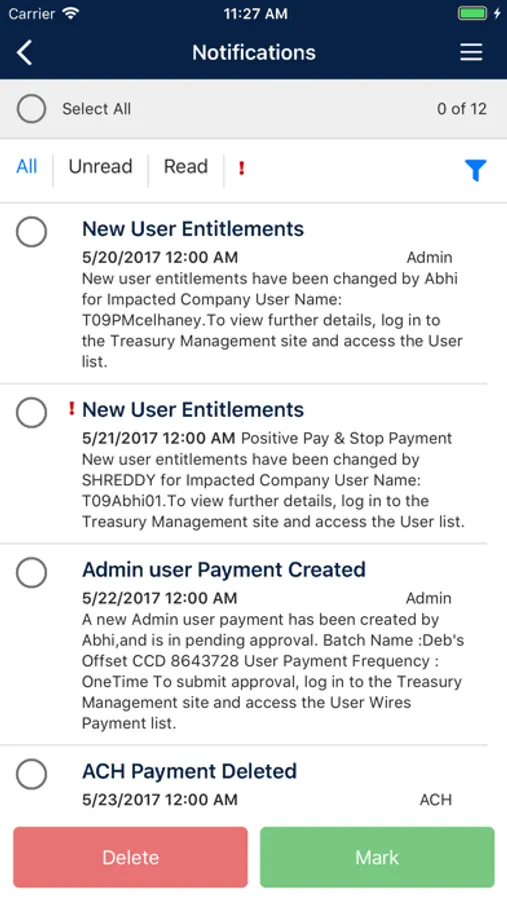

Approve ACH and Wire Transfers – Approve ACH and wire transfers initiated by your other users through Business Online Banking.

Review and Decision Positive Pay Exceptions – If you use our powerful ACH or Check Positive Pay fraud prevention tools, you can review and approve or deny identified exceptions.

Getting started:

In order to take advantage of INTRUST Business Mobile Banking, you must first enroll in Business Online Banking. Enroll your business by visiting intrustbank.com/enroll-business.

If you have questions about the app or need assistance setting up your business with mobile banking, contact our Treasury Services team at 316-383-1494 or 800-905-6630 and we’ll be happy to help.

Member FDIC

Here’s what you can do with the app:

View Accounts – View your INTRUST business checking, savings, time deposit, and loan accounts in one central location. Monitor balances and search recent transactions by date, amount, or check number.

Transfer Funds – Easily move funds between your INTRUST accounts.

Pay Bills – Schedule one-time payments to any individual or business.

Deposit Checks – Deposit paper checks into your accounts using the camera on your smart phone or tablet. No visit to the bank required!

Approve ACH and Wire Transfers – Approve ACH and wire transfers initiated by your other users through Business Online Banking.

Review and Decision Positive Pay Exceptions – If you use our powerful ACH or Check Positive Pay fraud prevention tools, you can review and approve or deny identified exceptions.

Getting started:

In order to take advantage of INTRUST Business Mobile Banking, you must first enroll in Business Online Banking. Enroll your business by visiting intrustbank.com/enroll-business.

If you have questions about the app or need assistance setting up your business with mobile banking, contact our Treasury Services team at 316-383-1494 or 800-905-6630 and we’ll be happy to help.

Member FDIC