About Futurelock

Futurelock is a secure personal financial management app made available to you through an invitation from your trusted loan officer and Amerifirst Home Mortgage.

Here’s how Futurelock can help you manage your finances:

Get Organized:

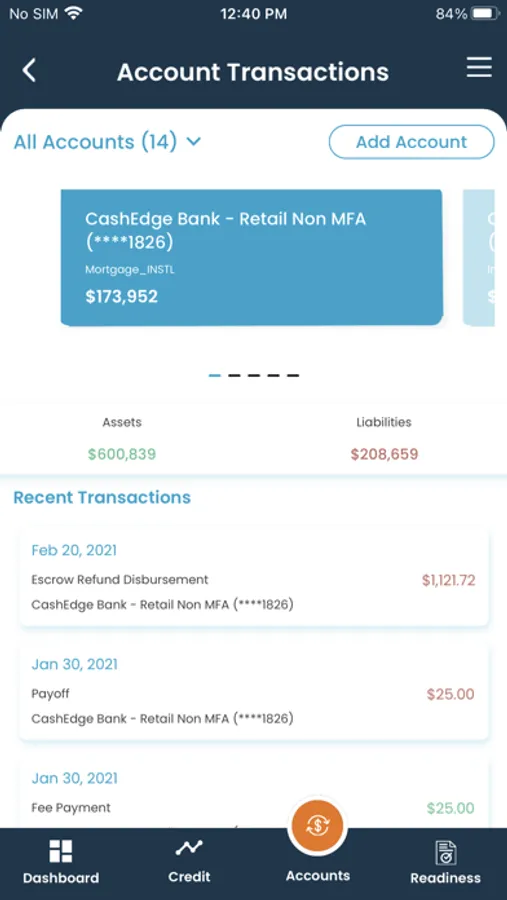

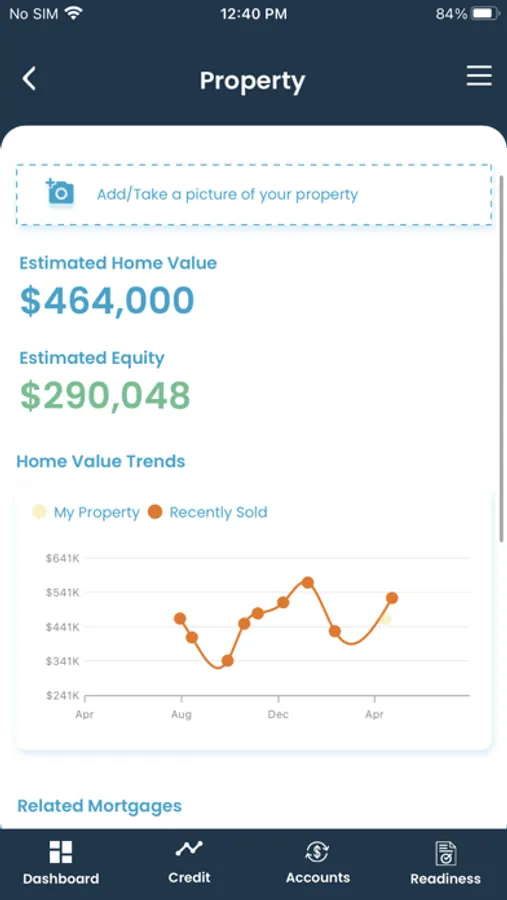

Your Futurelock dashboard summarizes important financial information such as account balances, transactions, net worth, budgeting, credit score, cash flow, estimated home value, and spending.

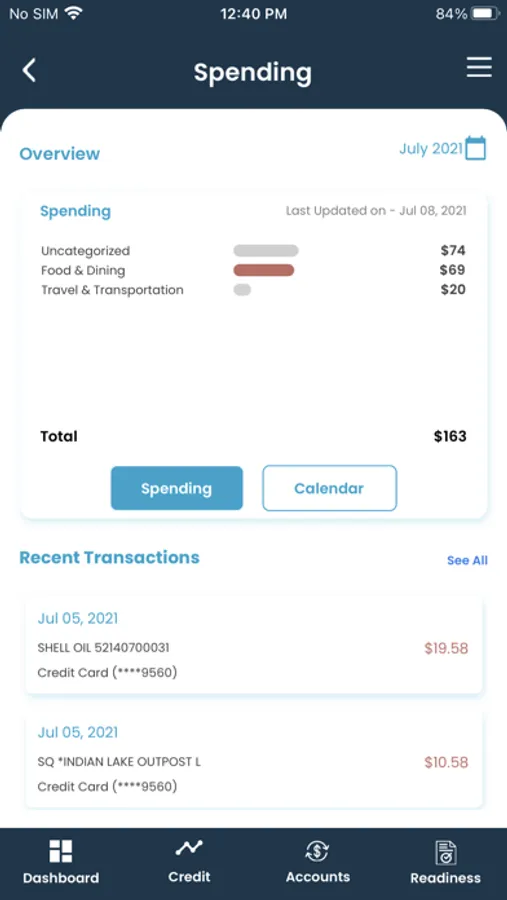

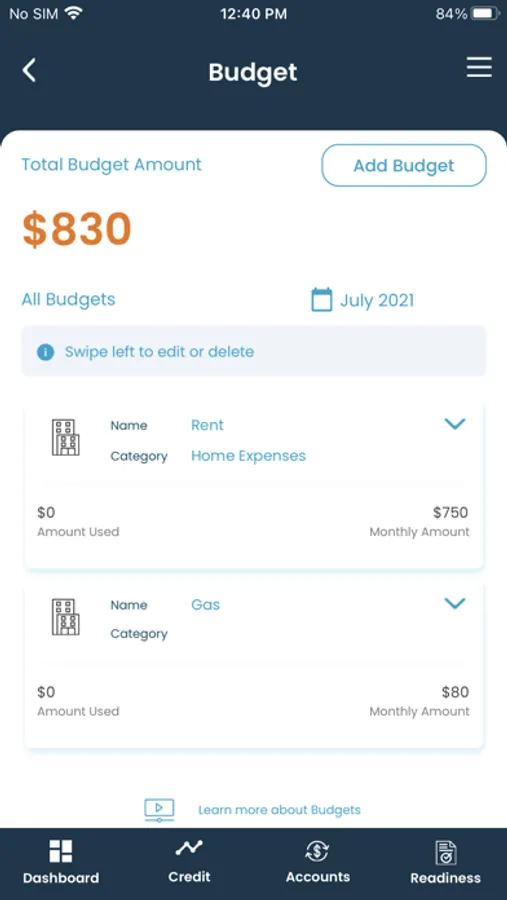

Create Budgets:

Establish savings goals and track your progress with real-time budgets and spending analysis tools. Track your spending by categories and set up alerts so you know when you’re off track and when you’re spending wisely.

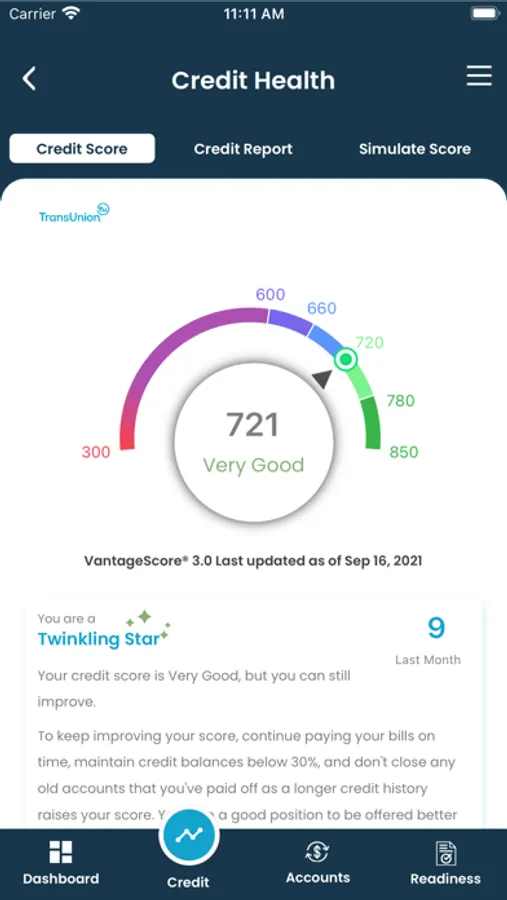

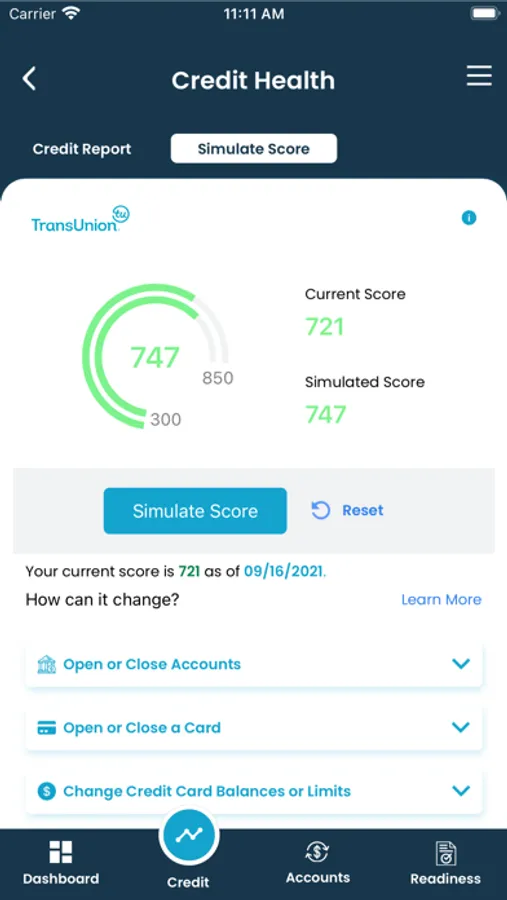

Monitor your Credit Score and Report:

Your credit score is prominently displayed in your dashboard - and it doesn't cost you anything. Track changes month to month and learn the key factors that make up your score like length of credit, timely payment history, utilization of credit, total accounts opened, and inquiries.

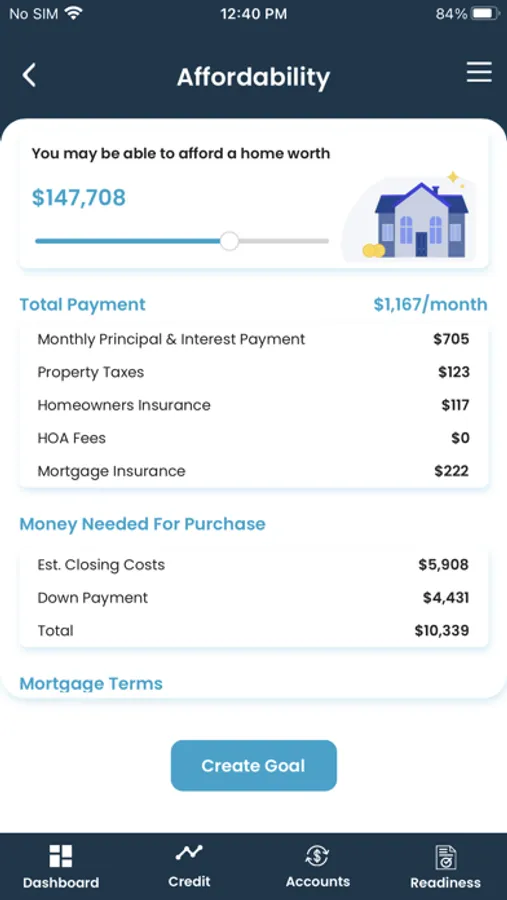

Prepare for homeownership:

Get ready to buy by planning for your down payment, establishing reserves, improving or maintaining your credit, running loan scenarios through our calculators, establishing your projected loan-to-value, and more. Take a readiness assessment to see if you need to improve your credit score, continue saving, or reduce your debt before you apply for a home loan or refinance your current mortgage.

Search Properties:

Looking for your first home? Want to move up or downsize? Use Futurelock to search local and nationwide real estate listings to find homes that match what you can afford. Customize your searches, locate open houses, and save your favorite properties.

Share:

When you’re ready to move forward with a financial transaction, you choose what accounts and documents to share with Amerifirst. Having your financial information at your fingertips will save you time and speed up the loan application process. Your data is always encrypted.

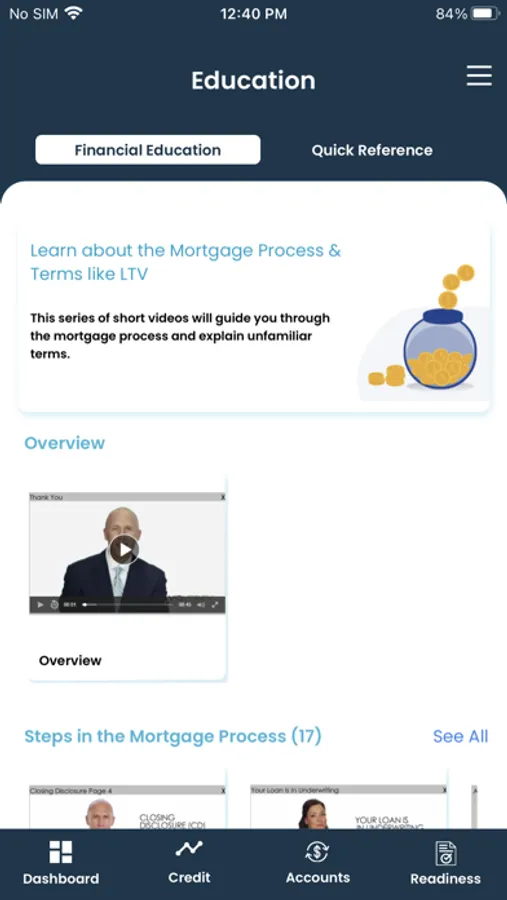

Learn:

Visit our information center to access our large selection of personal finance articles and videos.

Security:

Security is our #1 priority so you can feel confident that the financial accounts you’ve connected and documents you’ve uploaded are secure. See more here: https://www.finlocker.com/security/

Privacy:

Your privacy is important to us. To learn how we protect your privacy, visit: https://www.finlocker.com/privacy-policy/

Here’s how Futurelock can help you manage your finances:

Get Organized:

Your Futurelock dashboard summarizes important financial information such as account balances, transactions, net worth, budgeting, credit score, cash flow, estimated home value, and spending.

Create Budgets:

Establish savings goals and track your progress with real-time budgets and spending analysis tools. Track your spending by categories and set up alerts so you know when you’re off track and when you’re spending wisely.

Monitor your Credit Score and Report:

Your credit score is prominently displayed in your dashboard - and it doesn't cost you anything. Track changes month to month and learn the key factors that make up your score like length of credit, timely payment history, utilization of credit, total accounts opened, and inquiries.

Prepare for homeownership:

Get ready to buy by planning for your down payment, establishing reserves, improving or maintaining your credit, running loan scenarios through our calculators, establishing your projected loan-to-value, and more. Take a readiness assessment to see if you need to improve your credit score, continue saving, or reduce your debt before you apply for a home loan or refinance your current mortgage.

Search Properties:

Looking for your first home? Want to move up or downsize? Use Futurelock to search local and nationwide real estate listings to find homes that match what you can afford. Customize your searches, locate open houses, and save your favorite properties.

Share:

When you’re ready to move forward with a financial transaction, you choose what accounts and documents to share with Amerifirst. Having your financial information at your fingertips will save you time and speed up the loan application process. Your data is always encrypted.

Learn:

Visit our information center to access our large selection of personal finance articles and videos.

Security:

Security is our #1 priority so you can feel confident that the financial accounts you’ve connected and documents you’ve uploaded are secure. See more here: https://www.finlocker.com/security/

Privacy:

Your privacy is important to us. To learn how we protect your privacy, visit: https://www.finlocker.com/privacy-policy/