About Elan Easy Pay™

Instantly extend your organization’s purchasing power to anyone who needs it to make business purchases with Elan Easy Pay™.

With just a few simple steps, you can easily create and send an Easy Pay card to anyone in your organization who needs it. It eliminates the need for your employees and contingent workers (e.g., freelancers, independent contractors, consultants), to pay for business expenses with a personal credit card and seek reimbursement.

Easy Pay combines the capabilities of an Elan One Card with the power of a mobile device to create a completely digital payment experience.

FEATURES:

• Send cards to employees and contractors from a web portal or mobile app in real time

• Set the card activation period to the exact time needed

• Set the card limit to desired amount (based on available credit limit)

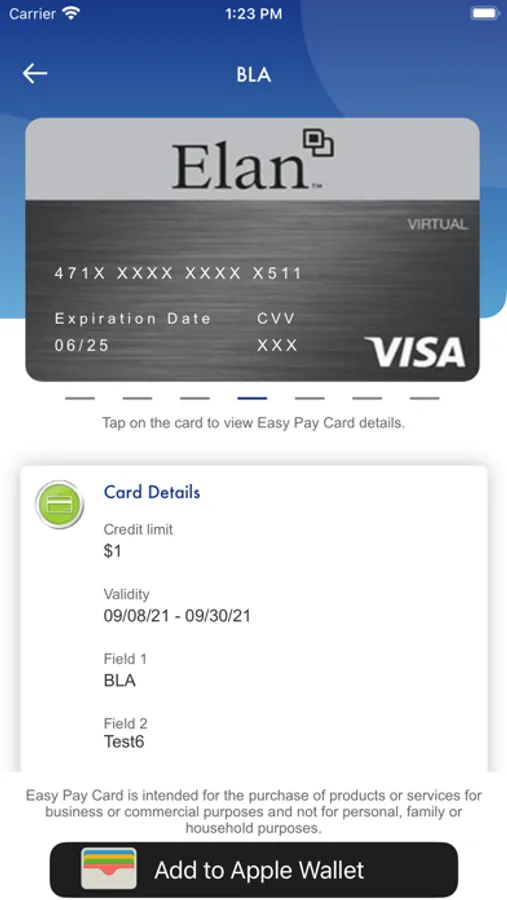

• Push the virtual card to Apple Wallet with a single click

• View the full card number and CVV code securely

• Integrated with Access® Online for reporting

• Send multiple cards to a single user

• Deactivate cards immediately when no longer needed

HOW IT WORKS:

An authorized provisioner for your organization will receive an email invitation from Elan Financial Services with all the information to download the app and register. Once registered, the provisioner creates a virtual Easy Pay card by:

1. Setting the credit limit and expiration date.

2. Entering basic recipient details.

3. Pushing the virtual credit card to the recipient through the Easy Pay app.

The recipient will receive an email notification with instructions to download the app and register. Once the recipient registers, the virtual Easy Pay card is active and can be added directly to their Apple Wallet.

REQUIREMENTS:

Organizations must be a Elan Easy Pay customer and you must be either entitled by the organization as an authorized provisioner or sent a mobile card by a provisioner. Interested in becoming Easy Pay customer? Please contact us.

With just a few simple steps, you can easily create and send an Easy Pay card to anyone in your organization who needs it. It eliminates the need for your employees and contingent workers (e.g., freelancers, independent contractors, consultants), to pay for business expenses with a personal credit card and seek reimbursement.

Easy Pay combines the capabilities of an Elan One Card with the power of a mobile device to create a completely digital payment experience.

FEATURES:

• Send cards to employees and contractors from a web portal or mobile app in real time

• Set the card activation period to the exact time needed

• Set the card limit to desired amount (based on available credit limit)

• Push the virtual card to Apple Wallet with a single click

• View the full card number and CVV code securely

• Integrated with Access® Online for reporting

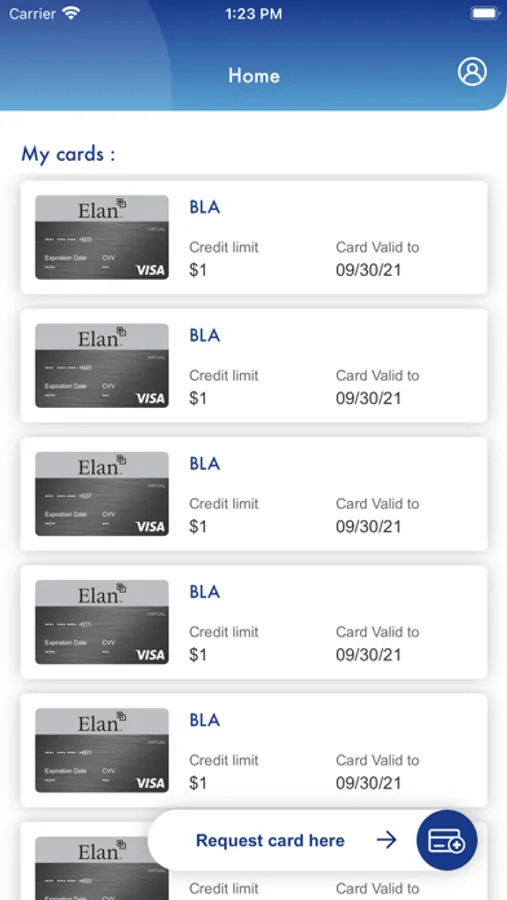

• Send multiple cards to a single user

• Deactivate cards immediately when no longer needed

HOW IT WORKS:

An authorized provisioner for your organization will receive an email invitation from Elan Financial Services with all the information to download the app and register. Once registered, the provisioner creates a virtual Easy Pay card by:

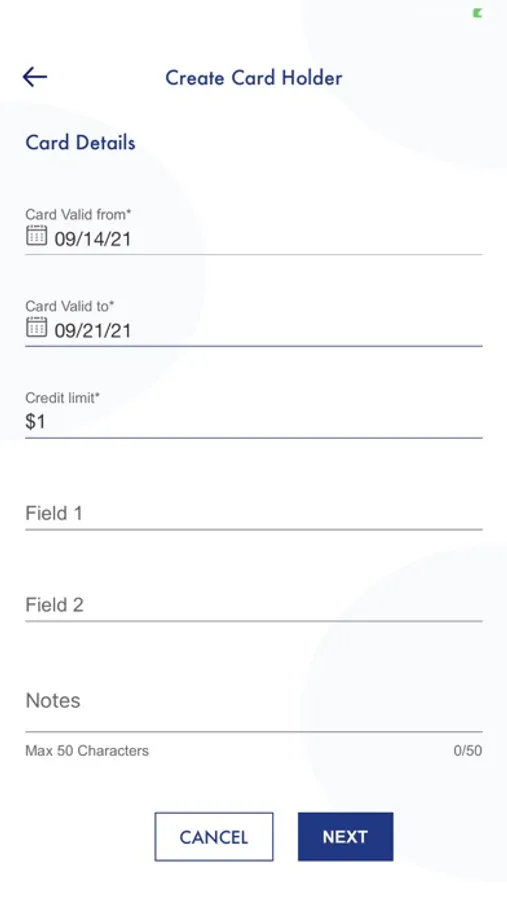

1. Setting the credit limit and expiration date.

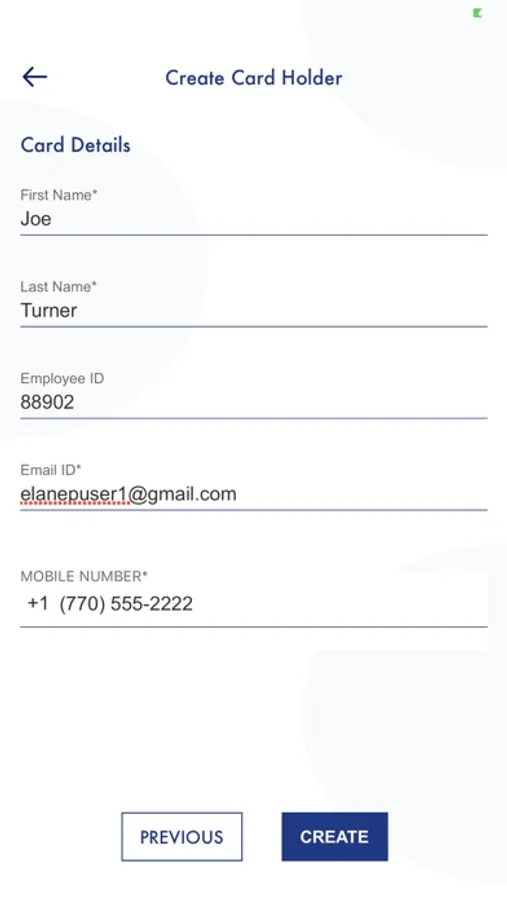

2. Entering basic recipient details.

3. Pushing the virtual credit card to the recipient through the Easy Pay app.

The recipient will receive an email notification with instructions to download the app and register. Once the recipient registers, the virtual Easy Pay card is active and can be added directly to their Apple Wallet.

REQUIREMENTS:

Organizations must be a Elan Easy Pay customer and you must be either entitled by the organization as an authorized provisioner or sent a mobile card by a provisioner. Interested in becoming Easy Pay customer? Please contact us.