AppRecs review analysis

AppRecs rating 4.5. Trustworthiness 65 out of 100. Review manipulation risk 29 out of 100. Based on a review sample analyzed.

★★★★☆

4.5

AppRecs Rating

Ratings breakdown

5 star

100%

4 star

0%

3 star

0%

2 star

0%

1 star

0%

What to know

✓

Low review manipulation risk

29% review manipulation risk

✓

High user satisfaction

100% of sampled ratings are 5 stars

About dtaxback

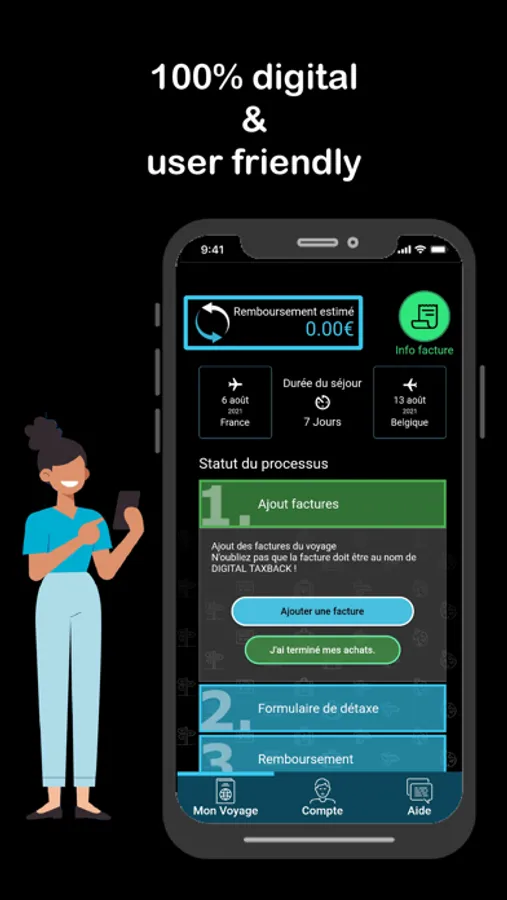

As non-EU residents, you can get your tax refund from your smartphone in just a few steps:

1. Shop everywhere in France and ask for invoices from retailers?

2. Take pictures of invoices and upload them in the app.

3. Scan barcode at customs reader and get an electronic validation.

4. Get your refund within 24 hours.

Advantages of using dtaxback app :

1. Available in 100% of the shops registered in France

2. VAT refund in 24H at a rate of 85%

3. Real time customer support

Which products are eligible for VAT refund ?

All tourist goods sold for transport outside the European Union (EU) in the purchaser's personal luggage are concerned.

Examples :

Perfumes, chocolates, clothes, smartphones, watches, books, medicines…

Purchase must be a retail.. You can buy up to 15 copies of the same article. Thus, a purchase for professional use, corresponding to a commercial wholesale supply, cannot be exempted.

A product purchased for consumption in France cannot benefit from the tax refund.

When leaving the territory, the presentation of the goods is mandatory. Failure to show the goods cancels the tax refund and may result in a fine.

Services are not eligible for tax refund.

Certain goods are also excluded from the tax refund: manufactured tobacco, weapons, ammunition, cultural goods, private vehicles, petroleum products, for example

It is also necessary to be in France for less than 6 months, and be 16 years old at least.

Download now and try your new app !

1. Shop everywhere in France and ask for invoices from retailers?

2. Take pictures of invoices and upload them in the app.

3. Scan barcode at customs reader and get an electronic validation.

4. Get your refund within 24 hours.

Advantages of using dtaxback app :

1. Available in 100% of the shops registered in France

2. VAT refund in 24H at a rate of 85%

3. Real time customer support

Which products are eligible for VAT refund ?

All tourist goods sold for transport outside the European Union (EU) in the purchaser's personal luggage are concerned.

Examples :

Perfumes, chocolates, clothes, smartphones, watches, books, medicines…

Purchase must be a retail.. You can buy up to 15 copies of the same article. Thus, a purchase for professional use, corresponding to a commercial wholesale supply, cannot be exempted.

A product purchased for consumption in France cannot benefit from the tax refund.

When leaving the territory, the presentation of the goods is mandatory. Failure to show the goods cancels the tax refund and may result in a fine.

Services are not eligible for tax refund.

Certain goods are also excluded from the tax refund: manufactured tobacco, weapons, ammunition, cultural goods, private vehicles, petroleum products, for example

It is also necessary to be in France for less than 6 months, and be 16 years old at least.

Download now and try your new app !