About Bitango

Bitcoin futures contracts often trade at a premium price over physical (spot) markets. This premium is called contango and it allows for arbitrage trading strategies that yield fixed USD profits regardless of changes in the price of bitcoin. Such strategies are called market neutral.

Construction of these trades requires precise planning and execution and so far only trading professionals have been able easily execute such trades. This is where Bitango comes in: it allows you to monitor, analyse and get alerts in real time about market conditions and profitability of contango arbitrage trades on supported Bitcoin exchanges.

If you have an account on supported exchanges, you can link it to your Bitango app using your API keys (for your security they never leave your device). Bitango can then help you to identify and execute perfect market neutral trades by:

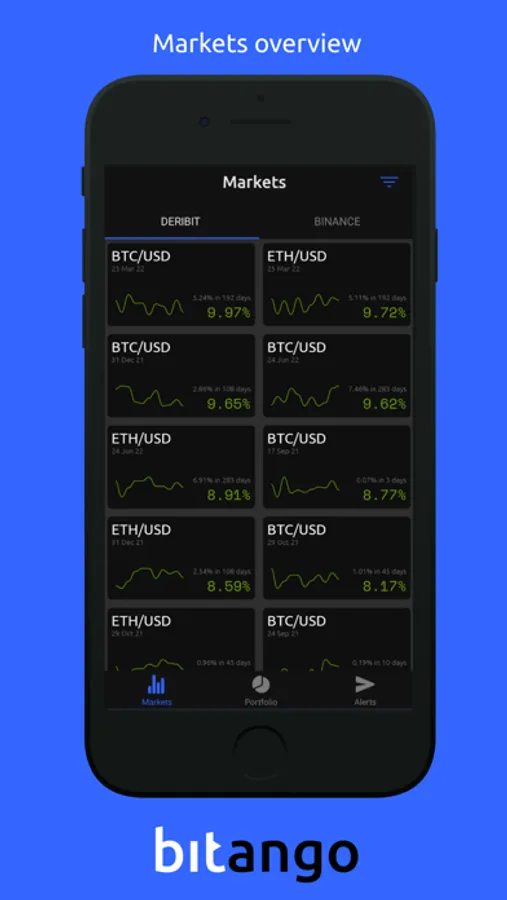

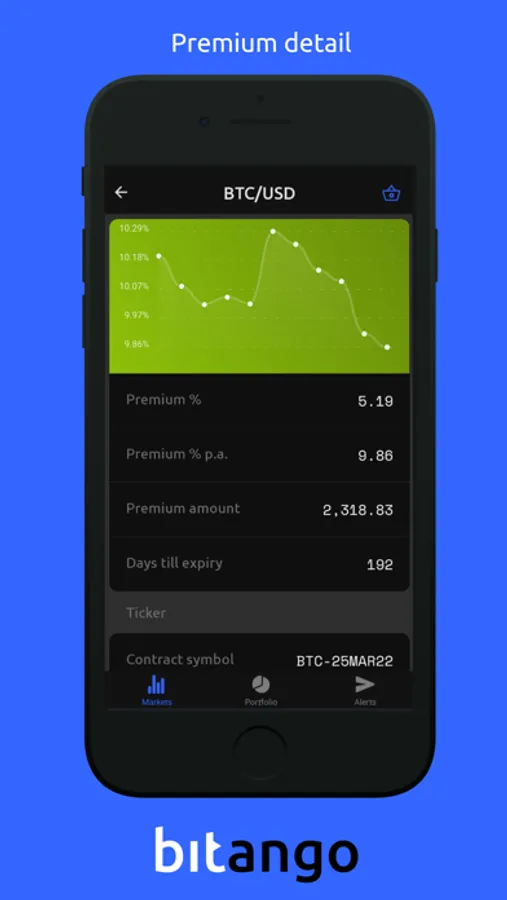

- calculating annualized premium yields existing between spot market and futures contracts (supported on Deribit, Binance and OKX)

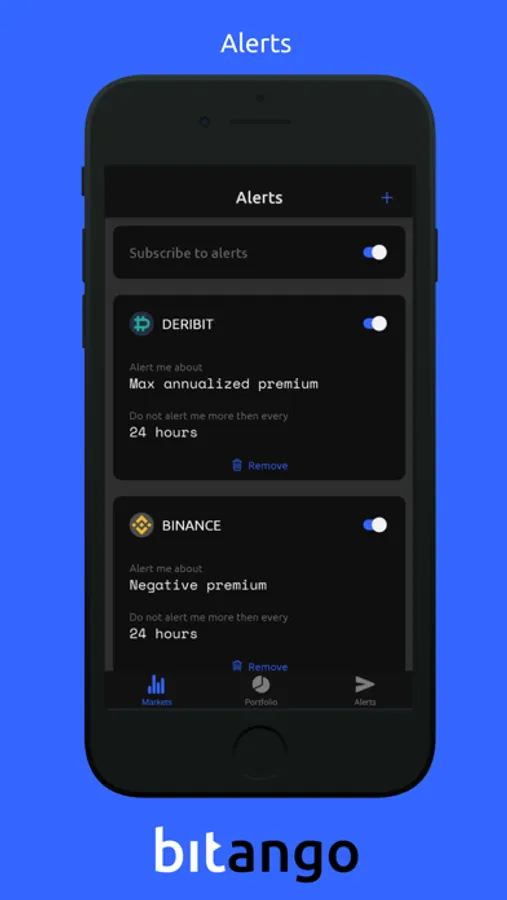

- providing alerts regarding real time market conditions based on multiple strategies (Deribit, Binance, OKX)

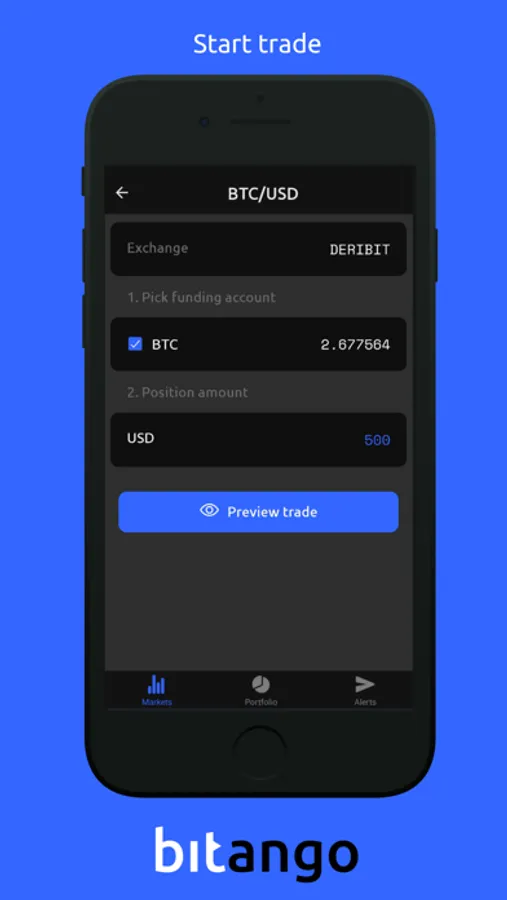

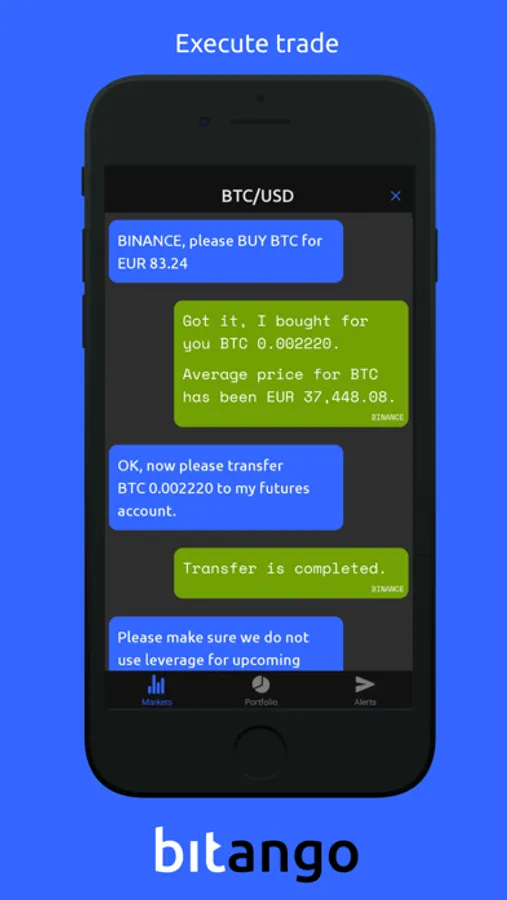

- optimizing your spot buy size to futures contract sizes and executing buy order of spot bitcoin (Binance, OKX)

- allowing for transfer between spot and futures account, so you can use purchased bitcoin as a collateral for futures short position (Binance)

- switch-off leverage for the trade so you do not enter leveraged futures position by mistake (Binance, OKX)

- sell futures matching your spot buy trade (Deribit, Binance, OKX)

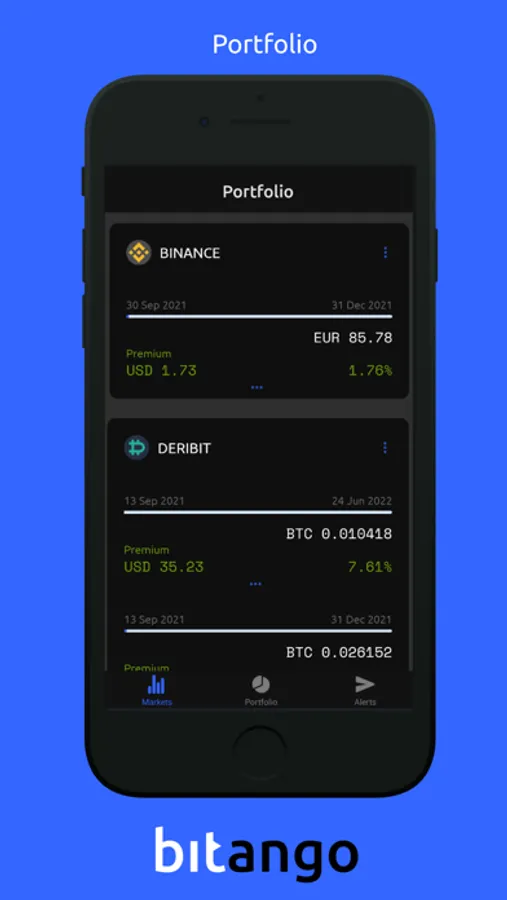

- monitoring trades executed through the Bitango app, calculating achieved yield in % and absolute terms and keep an eye on expiry of the trade (Deribit, Binance, OKX)

All of this functionality is available in a transparent and easy to use way so you do not need to master complex trading environments of supported exchanges.

Is this app for hard Bitcoin hodlers?

We believe everybody should own some bitcoin in their own wallets, without relying on the custody service by third parties. However, we all need some cash flows for our daily lives and earning fixed USD or other fiat currency yield on your fiat savings is a great option. In the current monetary environment, fixed yields in fiat currency are either too small to bother about or bear substantial risks for investors. In a kind of a paradox, bitcoin spot and futures markets help to bridge this gap by allowing you to execute low-risk, market neutral fixed yield trade denominated in USD.

Can I trade in other crypto currencies then bitcoin?

Exchanges may provide futures contracts for cryptocurrencies other than bitcoin and Bitango supports them. However we have crated Bitango mainly with bitcoin in mind as we feel its robust market and liquidity make it particularly suitable for contango trading strategies.

What are the risks of market neutral contango arbitrage trades?

Please be aware that no trade is without some risks. Market neutral trade strategies are constructed to protect you from volatility in prices of underlying assets, e.g. bitcoin. However, you still bear all other risks of trading, including but not limited to the counterparty risks of exchanges you use, or risks related to the execution of trade. There might be other risks. Please make sure you fully understand the construction and limitations of contango arbitrage trades as well as risks associated with them. Bitango provides you with structured information and help automate the execution of trades on supported exchanges, however Bitango does not identify or recommend trades suitable for you, does not guarantee successful execution of trades, does not guarantee any yields or profits and does not provide protection from loss.

Can I try trade automation without risking any of my funds?

Yes! Bitango app provides test mode in which you execute your trade against the testing environment of supported exchanges. You do not need to link your real exchange account to the app to try this.

Construction of these trades requires precise planning and execution and so far only trading professionals have been able easily execute such trades. This is where Bitango comes in: it allows you to monitor, analyse and get alerts in real time about market conditions and profitability of contango arbitrage trades on supported Bitcoin exchanges.

If you have an account on supported exchanges, you can link it to your Bitango app using your API keys (for your security they never leave your device). Bitango can then help you to identify and execute perfect market neutral trades by:

- calculating annualized premium yields existing between spot market and futures contracts (supported on Deribit, Binance and OKX)

- providing alerts regarding real time market conditions based on multiple strategies (Deribit, Binance, OKX)

- optimizing your spot buy size to futures contract sizes and executing buy order of spot bitcoin (Binance, OKX)

- allowing for transfer between spot and futures account, so you can use purchased bitcoin as a collateral for futures short position (Binance)

- switch-off leverage for the trade so you do not enter leveraged futures position by mistake (Binance, OKX)

- sell futures matching your spot buy trade (Deribit, Binance, OKX)

- monitoring trades executed through the Bitango app, calculating achieved yield in % and absolute terms and keep an eye on expiry of the trade (Deribit, Binance, OKX)

All of this functionality is available in a transparent and easy to use way so you do not need to master complex trading environments of supported exchanges.

Is this app for hard Bitcoin hodlers?

We believe everybody should own some bitcoin in their own wallets, without relying on the custody service by third parties. However, we all need some cash flows for our daily lives and earning fixed USD or other fiat currency yield on your fiat savings is a great option. In the current monetary environment, fixed yields in fiat currency are either too small to bother about or bear substantial risks for investors. In a kind of a paradox, bitcoin spot and futures markets help to bridge this gap by allowing you to execute low-risk, market neutral fixed yield trade denominated in USD.

Can I trade in other crypto currencies then bitcoin?

Exchanges may provide futures contracts for cryptocurrencies other than bitcoin and Bitango supports them. However we have crated Bitango mainly with bitcoin in mind as we feel its robust market and liquidity make it particularly suitable for contango trading strategies.

What are the risks of market neutral contango arbitrage trades?

Please be aware that no trade is without some risks. Market neutral trade strategies are constructed to protect you from volatility in prices of underlying assets, e.g. bitcoin. However, you still bear all other risks of trading, including but not limited to the counterparty risks of exchanges you use, or risks related to the execution of trade. There might be other risks. Please make sure you fully understand the construction and limitations of contango arbitrage trades as well as risks associated with them. Bitango provides you with structured information and help automate the execution of trades on supported exchanges, however Bitango does not identify or recommend trades suitable for you, does not guarantee successful execution of trades, does not guarantee any yields or profits and does not provide protection from loss.

Can I try trade automation without risking any of my funds?

Yes! Bitango app provides test mode in which you execute your trade against the testing environment of supported exchanges. You do not need to link your real exchange account to the app to try this.