With this app, you can assess your financial health, track improvements, and access tools or seminars. Includes a wellness assessment, goal setting, educational content, and access to coaching sessions.

AppRecs review analysis

AppRecs rating 3.9. Trustworthiness 80 out of 100. Review manipulation risk 21 out of 100. Based on a review sample analyzed.

★★★☆☆

3.9

AppRecs Rating

Ratings breakdown

5 star

63%

4 star

7%

3 star

3%

2 star

10%

1 star

17%

What to know

✓

Low review manipulation risk

21% review manipulation risk

✓

Credible reviews

80% trustworthiness score from analyzed reviews

✓

Good user ratings

69% positive sampled reviews

About Goldman Sachs Wellness

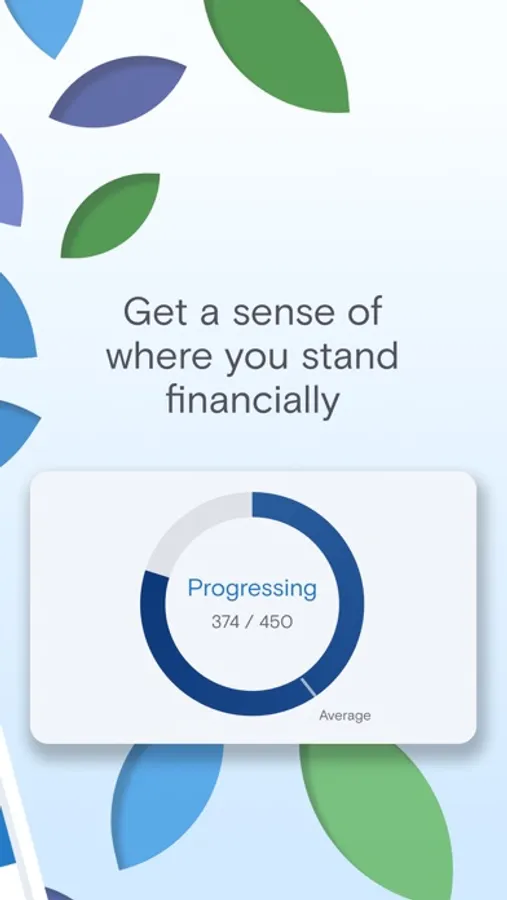

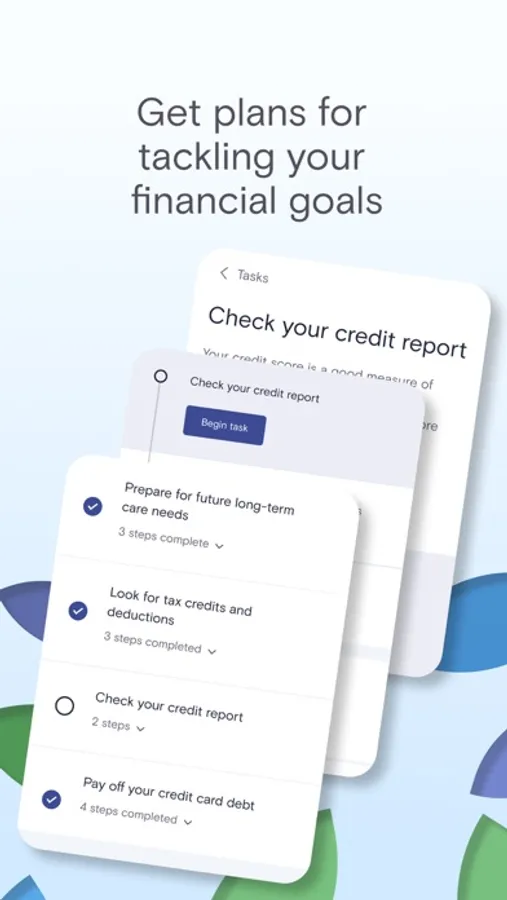

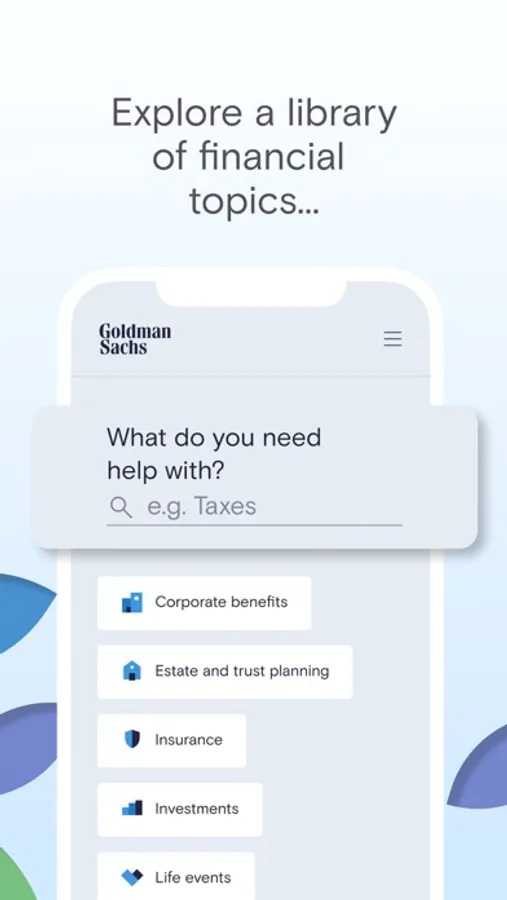

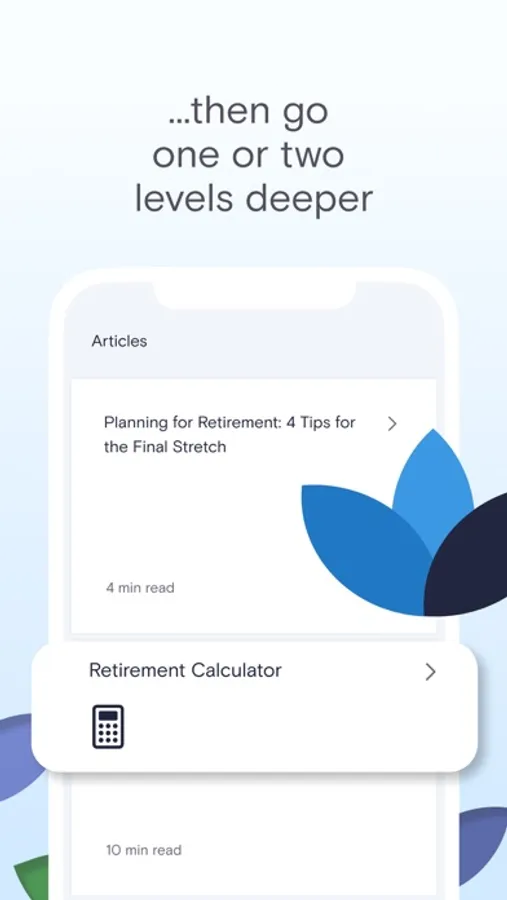

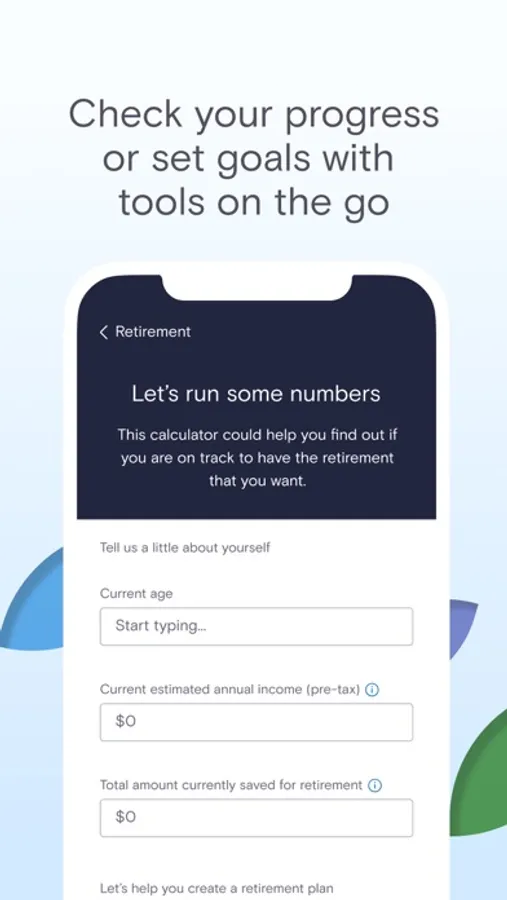

Your benefits are so much more than vacation days. They also include personal financial guidance. There’s no charge to you – your employer picks up the bill – and it takes just minutes to get started. Register in just a few steps and then take your financial wellness assessment. We’ll uncover some areas of improvement and provide a score that you can track and improve over time. Select your focus and start working on the area of your finances that matters most to you, such as saving for an emergency or paying off your high-interest debt. Then, take action - use our tools or watch a seminar to move your financial plan forward. You can also schedule a call with a coach for guidance. All at your fingertips with the GS Wellness app.

Goldman Sachs Wellness is honored to receive Aite-Novarica Group’s 2022 Impact Award, which recognizes the innovative ways we're leveraging technology to deliver personalized guidance to support employees’ full financial lives. Nominees in the Financial Wellness category were assessed on the capacity of their digital tools to deliver financial coaching and connectivity to financial services to help individuals feel better about their finances today and more prepared to meet future needs and goals.

Goldman Sachs Wellness is honored to receive Aite-Novarica Group’s 2022 Impact Award, which recognizes the innovative ways we're leveraging technology to deliver personalized guidance to support employees’ full financial lives. Nominees in the Financial Wellness category were assessed on the capacity of their digital tools to deliver financial coaching and connectivity to financial services to help individuals feel better about their finances today and more prepared to meet future needs and goals.