With this financial app, users can view account balances, monitor investment performance, and perform transfers. Includes account alerts, contribution reviews, and secure access to personal details.

AppRecs review analysis

AppRecs rating 4.2. Trustworthiness 0 out of 100. Review manipulation risk 0 out of 100. Based on a review sample analyzed.

★★★★☆

4.2

AppRecs Rating

Ratings breakdown

5 star

69%

4 star

10%

3 star

6%

2 star

5%

1 star

10%

What to know

✓

High user satisfaction

79% of sampled ratings are 4+ stars (4.2★ average)

✓

Authentic reviews

Natural distribution, no red flags

About myMERS

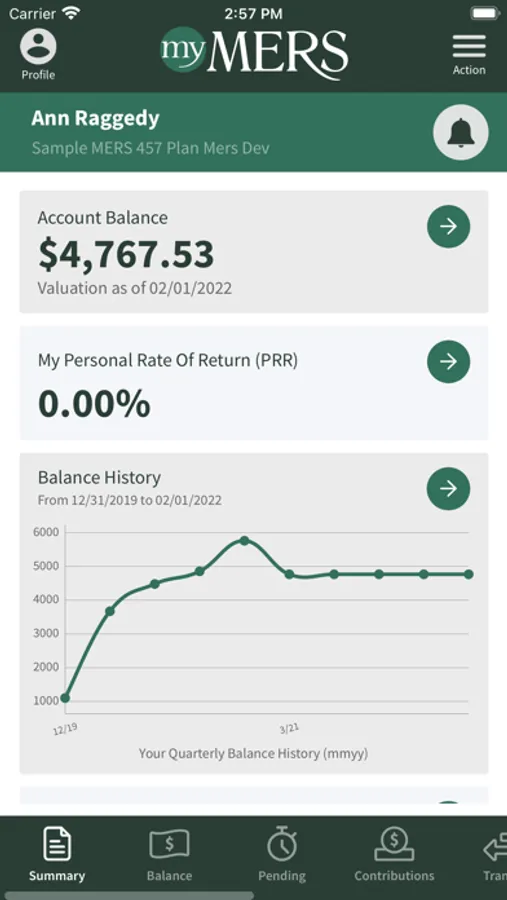

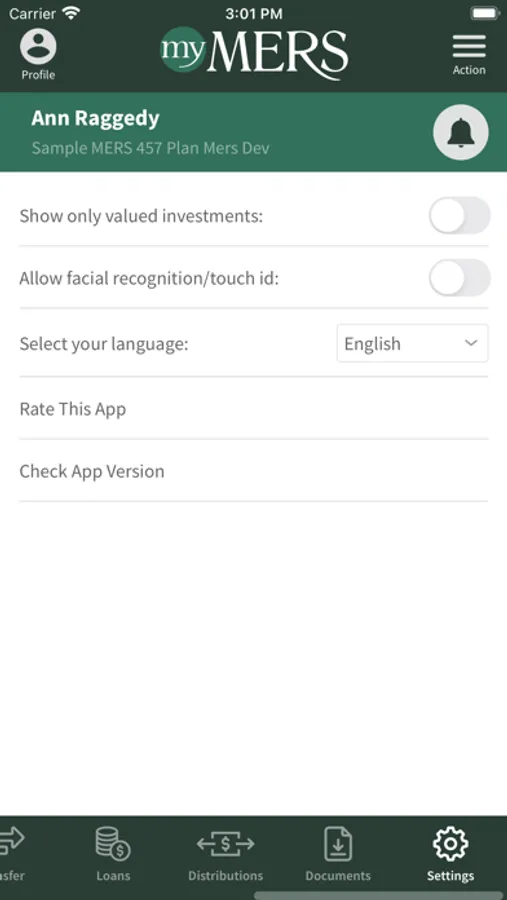

The myMERS mobile app allows MERS plan participants the ability to receive fast, free and secure access to account information using their existing online username and password to log in.

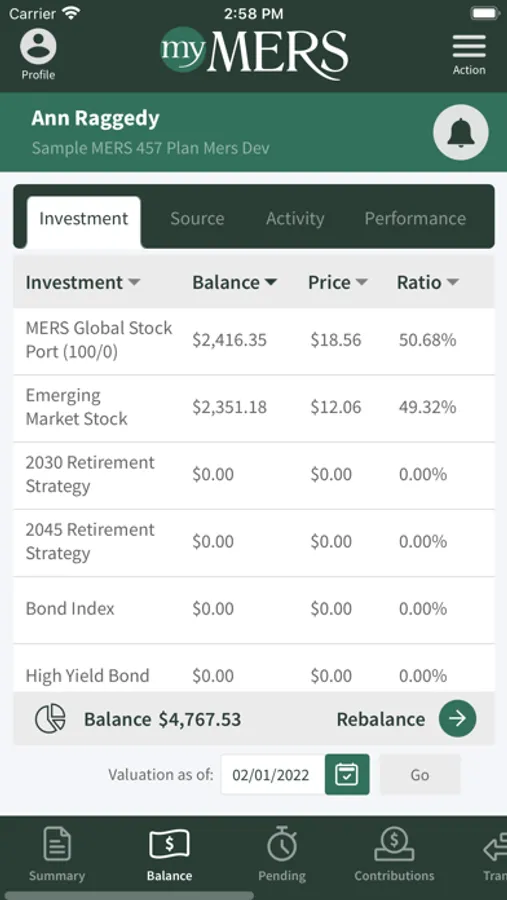

Participants can receive account alerts, check balances, view investment performance graphs, and review contributions.

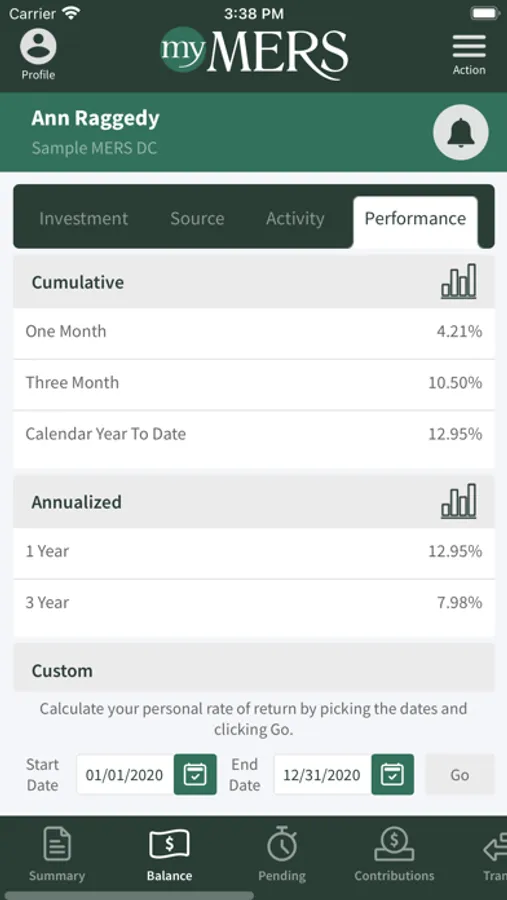

The app also allows for quick access to review investment information, monitor loan data (if applicable), see personal rates of return and download account statements.

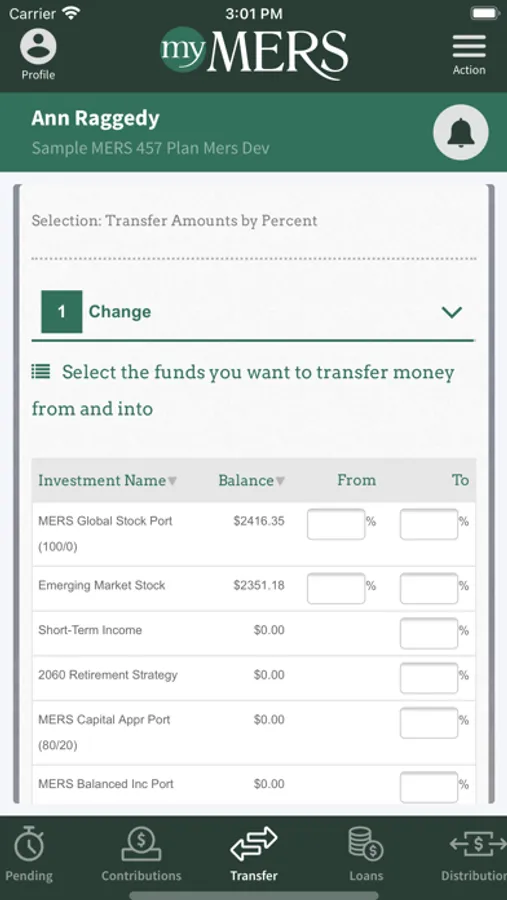

Additionally, the app offers participants easy access to view account activity details, check investment allocation and review contribution totals. When changes are needed, the app provides secure access to perform transfers, make allocation changes and review or change contact and beneficiary details.

Investment products are not FDIC insured, have no bank guarantee, and may lose value.

Participants can receive account alerts, check balances, view investment performance graphs, and review contributions.

The app also allows for quick access to review investment information, monitor loan data (if applicable), see personal rates of return and download account statements.

Additionally, the app offers participants easy access to view account activity details, check investment allocation and review contribution totals. When changes are needed, the app provides secure access to perform transfers, make allocation changes and review or change contact and beneficiary details.

Investment products are not FDIC insured, have no bank guarantee, and may lose value.