About MyVanDyk

VanDyk Mortgage Corporation is making mortgage loans easier. Introducing: “MyVanDyk.”

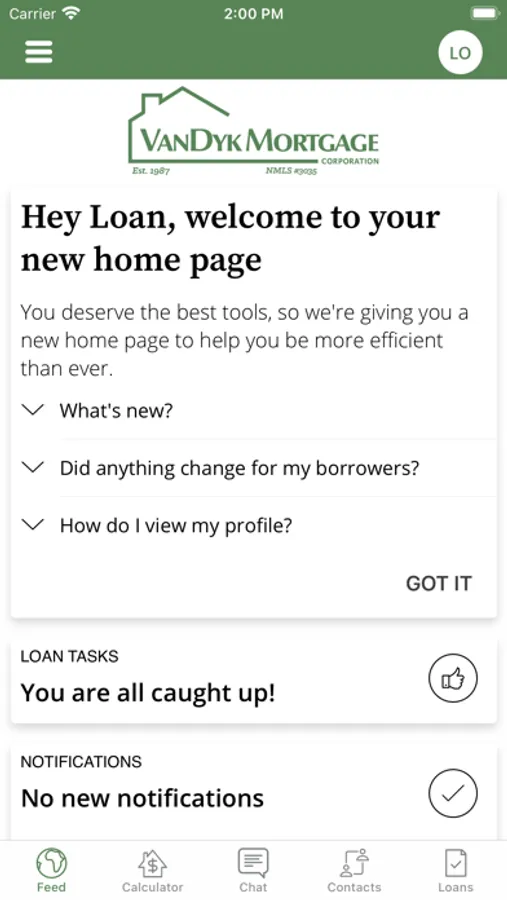

A communication platform built for borrowers, loan officers, and real estate professionals, “insert chosen name” securely automates and streamlines the mortgage loan process to provide a seamless experience – from application to closing.

By allowing users to upload and view loan documents within a secure portal, stay up-to-date with automated updates, alerts, and text/SMS notifications, and track every step of the loan process, “insert chosen name” makes obtaining a mortgage loan easier than ever before.

Key Features:

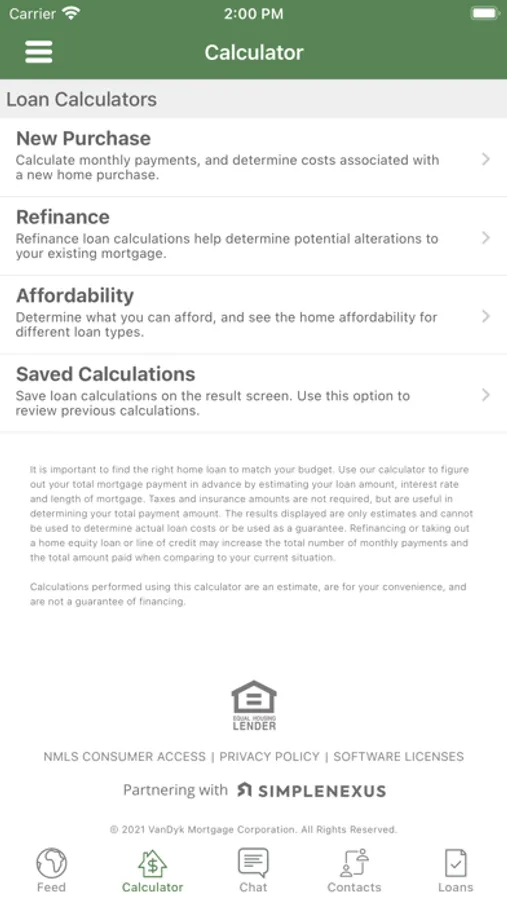

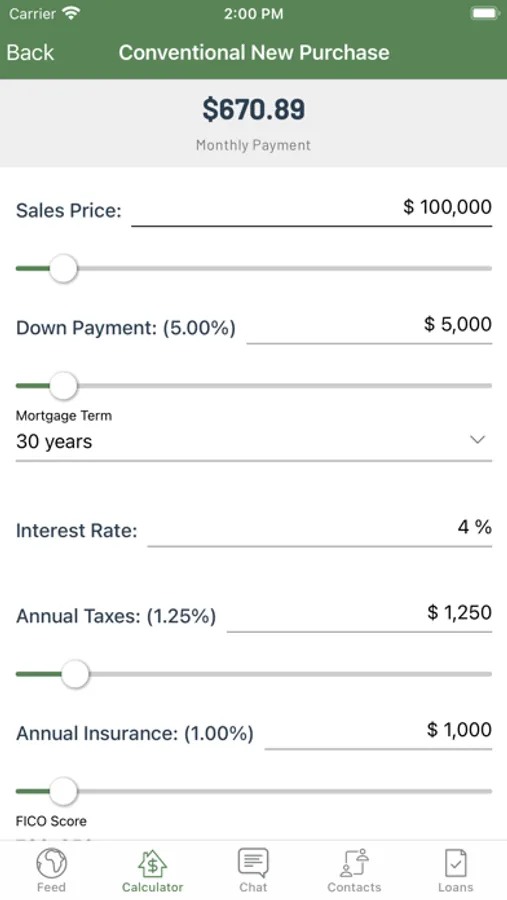

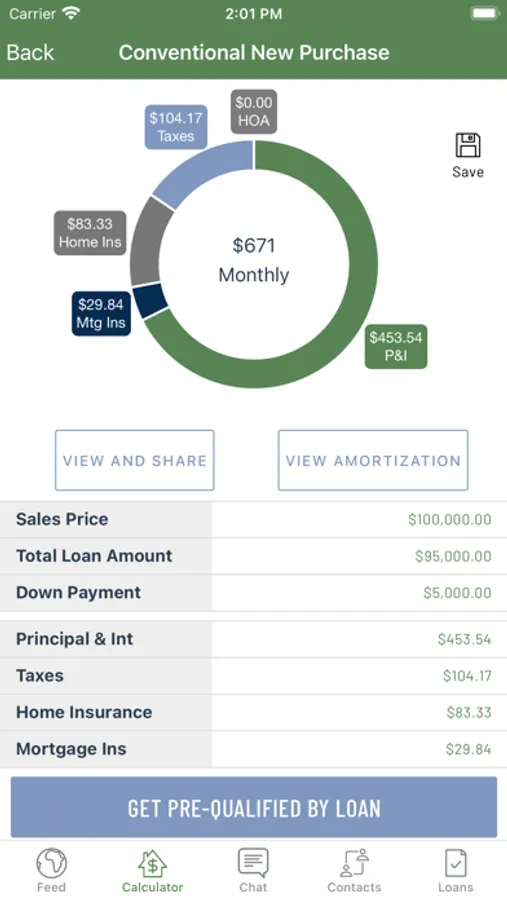

• Compare different lending scenarios using various loan programs to help determine which product is the best for you.

• Calculate the possible savings (or cost) of refinancing your mortgage.

• Determine if homeownership is an affordable option for you based on your current income and monthly expenses.

• Scan in required documents on your phone and upload them quickly to expedite the loan approval process.

• Easily access contact information for your Academy Loan Officer and real estate agent and share this information with your family and friends.

• Stay up-to-date on industry news and happenings that may impact your loan, like a change in mortgage interest rates.

Whether you are looking to purchase a new home or refinance your current mortgage loan, “MyVanDyk” can help. To learn more, contact a VanDyk Mortgage Loan Officer today and let us help you secure the right mortgage loan for you.

A communication platform built for borrowers, loan officers, and real estate professionals, “insert chosen name” securely automates and streamlines the mortgage loan process to provide a seamless experience – from application to closing.

By allowing users to upload and view loan documents within a secure portal, stay up-to-date with automated updates, alerts, and text/SMS notifications, and track every step of the loan process, “insert chosen name” makes obtaining a mortgage loan easier than ever before.

Key Features:

• Compare different lending scenarios using various loan programs to help determine which product is the best for you.

• Calculate the possible savings (or cost) of refinancing your mortgage.

• Determine if homeownership is an affordable option for you based on your current income and monthly expenses.

• Scan in required documents on your phone and upload them quickly to expedite the loan approval process.

• Easily access contact information for your Academy Loan Officer and real estate agent and share this information with your family and friends.

• Stay up-to-date on industry news and happenings that may impact your loan, like a change in mortgage interest rates.

Whether you are looking to purchase a new home or refinance your current mortgage loan, “MyVanDyk” can help. To learn more, contact a VanDyk Mortgage Loan Officer today and let us help you secure the right mortgage loan for you.