AppRecs review analysis

AppRecs rating 4.5. Trustworthiness 45 out of 100. Review manipulation risk 28 out of 100. Based on a review sample analyzed.

★★★★☆

4.5

AppRecs Rating

Ratings breakdown

5 star

100%

4 star

0%

3 star

0%

2 star

0%

1 star

0%

What to know

⚠

Unusually uniform ratings

100% of sampled ratings are 5 stars with very little variation

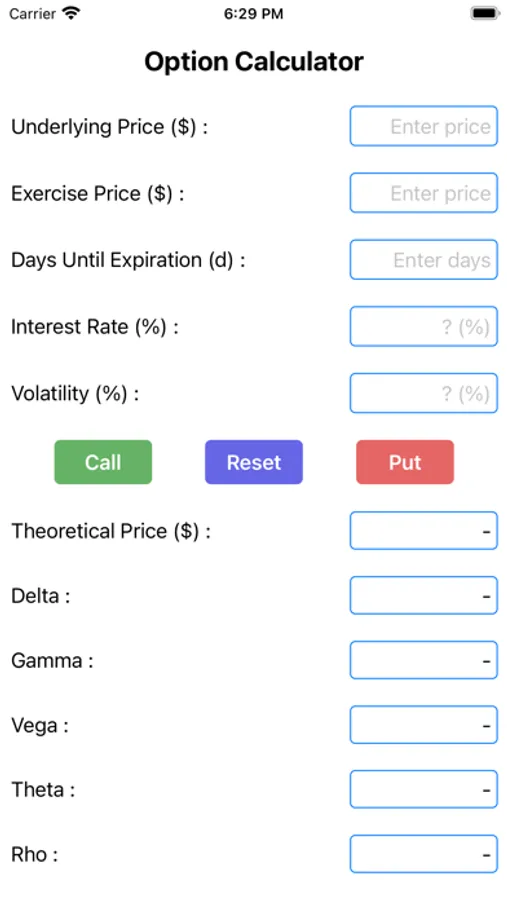

About Easy Option Calculator

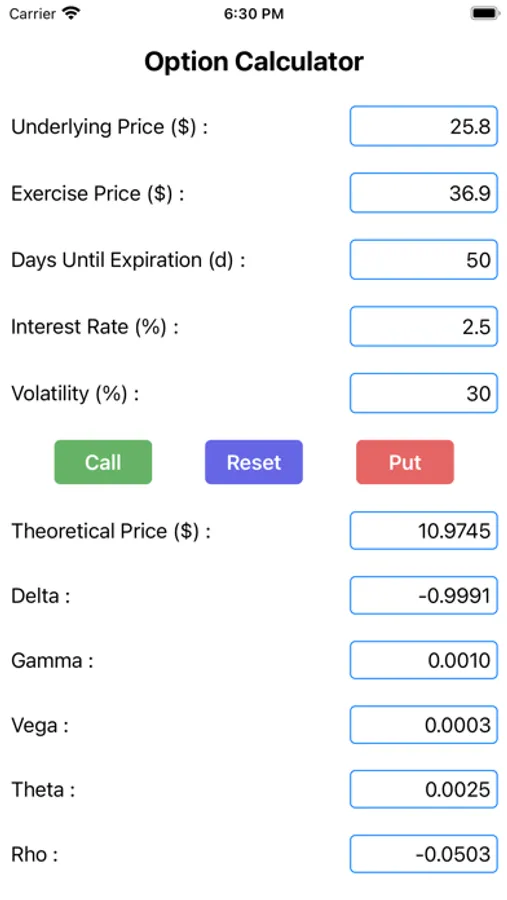

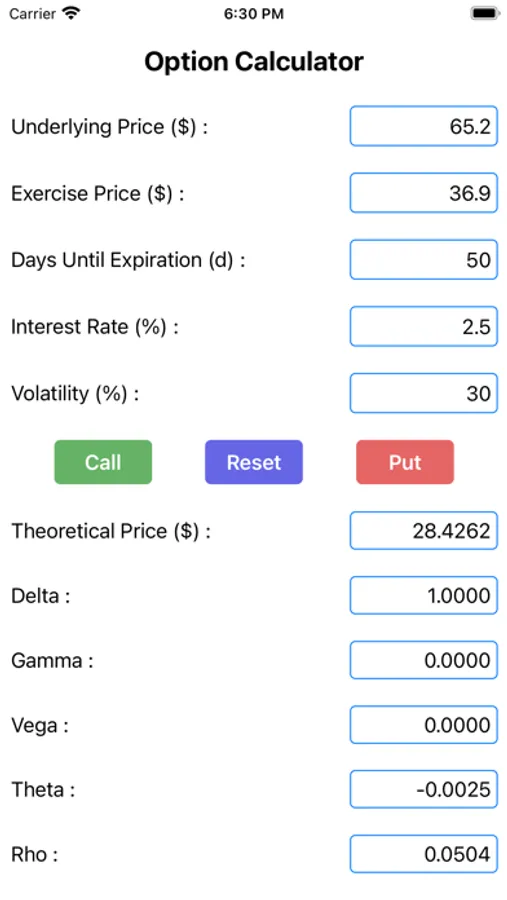

Easy Option Calculator is very easy to use, enter following values, and click button “Call”, or “Put” to get option prices and option Greeks:

Underlying price ($), exercise price ($), days until expiration (days), interest rate (%), and volatility (%).

click "Reset" button to reset values.

The Black–Scholes model is a mathematical model of a financial market containing certain derivative investment instruments. From the model, one can deduce the Black–Scholes formula, which gives the price of options. It is widely used by options market participants. Many empirical tests have shown the Black-Scholes price is “fairly close” to the observed prices.

Underlying price ($), exercise price ($), days until expiration (days), interest rate (%), and volatility (%).

click "Reset" button to reset values.

The Black–Scholes model is a mathematical model of a financial market containing certain derivative investment instruments. From the model, one can deduce the Black–Scholes formula, which gives the price of options. It is widely used by options market participants. Many empirical tests have shown the Black-Scholes price is “fairly close” to the observed prices.