About ScrubMoney App

Our healthcare system is not designed to help doctors thrive. Four years before we start making a paycheck and eight years before we start making a full salary, most medical students are strapped with debt that’s often the equivalent of a mortgage. And most medical schools don’t spend even an afternoon teaching us what to do about that debt.

We’re changing that. We’re here to empower doctors and doctors-in-training to take control of their prospects and lay a path for financial independence.

The ScrubMoney curriculum is based on the most popular elective course at UW School of Medicine and Public Health, where it’s graduating over 60% of each class with raving reviews. ScrubMoney is a mobile, personally tailored, grows-with-you app that provides the same curriculum content when you need it. It serves three main purposes:

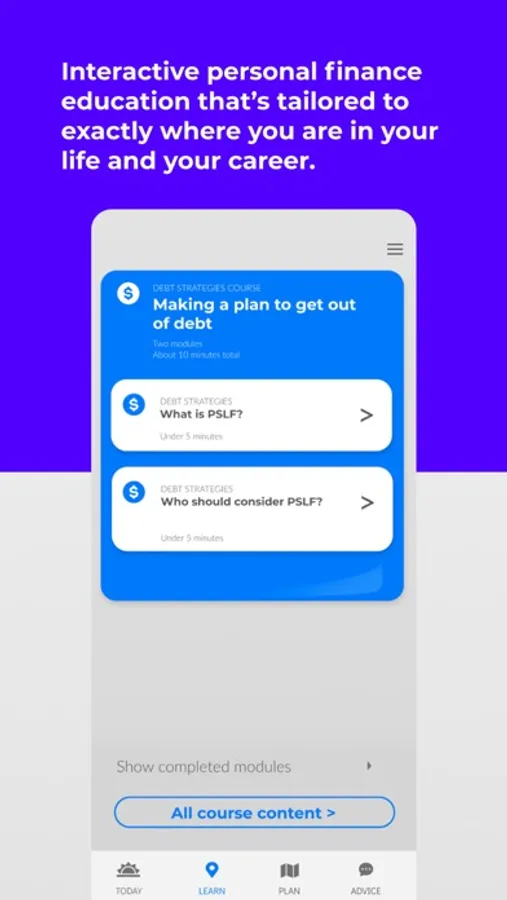

Educate. Do you know if you’re a good candidate for PSLF? Did you get ripped off in your salary negotiations for your first job out of residency? How do you know when it’s time to start investing? How do you even start investing? Answer some basic intro questions about yourself, then head to the Learn screen to watch or read quick modules (most are under 5 minutes) that our algorithm selects for your career stage and life stage.

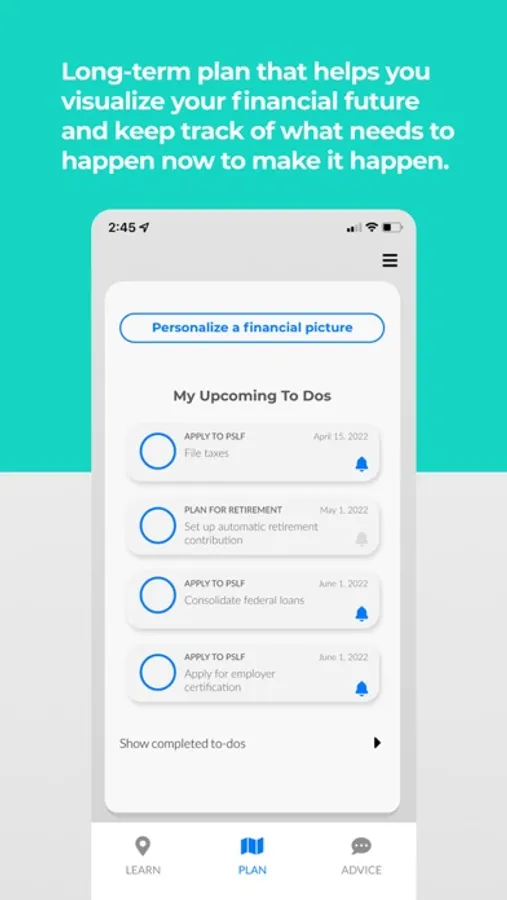

Plan. Your ideal life path looks different from other people’s. As you check off modules on the Learn screen, you’ll answer questions that will trigger notifications and to-dos so you can offload the mental work of remembering what you need to submit and when, for example, when applying for PSLF or consolidating your loans. ScrubMoney will take care of reminding you what you need to do to stay on the path you’ve established as your path to success.

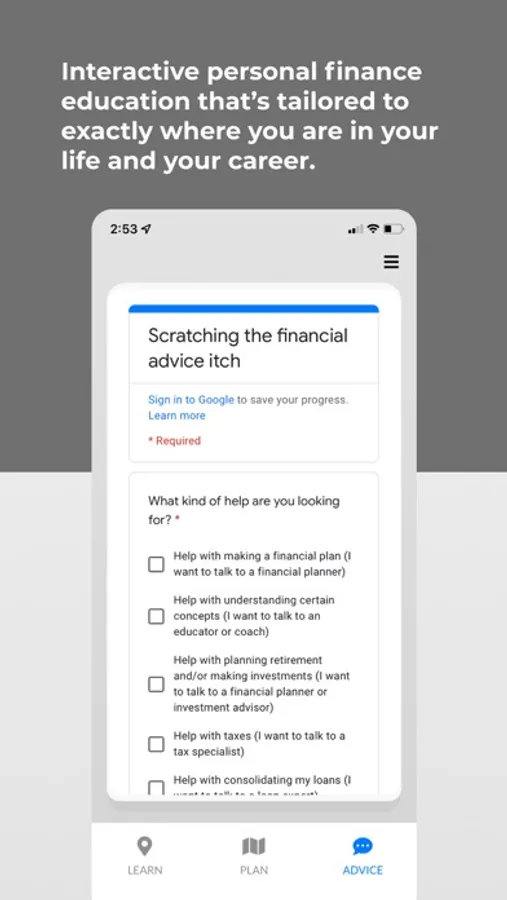

Equip. Learning and planning will be enough for some people. But if you want personalized help — whether you’re looking for investing advice or clarification on compound interest or trying to figure out what you need to do to get a mortgage — you can opt to match with the financial professionals available in Advice.

The truth is, physicians are dealing with burnout at unsustainable rates earlier and earlier in our careers. We’re facing a mental health crisis from being overworked and experiencing less control over our lives and professions than we’d like to have. Having a solid understanding and plan for our personal finances won’t solve everything, but it will go a long way in helping us feel empowered to build the lives that will allow us to focus on what’s most important.

We’re changing that. We’re here to empower doctors and doctors-in-training to take control of their prospects and lay a path for financial independence.

The ScrubMoney curriculum is based on the most popular elective course at UW School of Medicine and Public Health, where it’s graduating over 60% of each class with raving reviews. ScrubMoney is a mobile, personally tailored, grows-with-you app that provides the same curriculum content when you need it. It serves three main purposes:

Educate. Do you know if you’re a good candidate for PSLF? Did you get ripped off in your salary negotiations for your first job out of residency? How do you know when it’s time to start investing? How do you even start investing? Answer some basic intro questions about yourself, then head to the Learn screen to watch or read quick modules (most are under 5 minutes) that our algorithm selects for your career stage and life stage.

Plan. Your ideal life path looks different from other people’s. As you check off modules on the Learn screen, you’ll answer questions that will trigger notifications and to-dos so you can offload the mental work of remembering what you need to submit and when, for example, when applying for PSLF or consolidating your loans. ScrubMoney will take care of reminding you what you need to do to stay on the path you’ve established as your path to success.

Equip. Learning and planning will be enough for some people. But if you want personalized help — whether you’re looking for investing advice or clarification on compound interest or trying to figure out what you need to do to get a mortgage — you can opt to match with the financial professionals available in Advice.

The truth is, physicians are dealing with burnout at unsustainable rates earlier and earlier in our careers. We’re facing a mental health crisis from being overworked and experiencing less control over our lives and professions than we’d like to have. Having a solid understanding and plan for our personal finances won’t solve everything, but it will go a long way in helping us feel empowered to build the lives that will allow us to focus on what’s most important.