AppRecs review analysis

AppRecs rating . Trustworthiness 0 out of 100. Review manipulation risk 0 out of 100. Based on a review sample analyzed.

★

AppRecs Rating

Ratings breakdown

5 star

0%

4 star

0%

3 star

0%

2 star

0%

1 star

100%

What to know

⚠

Mixed user feedback

Average 1.0★ rating suggests room for improvement

About TrackCoin

What is TrackCoin?

TrackCoin is a behavioral algorithm applied to cryptocurrencies. The method is inspired by Endel Tulving’s research on emotional memory and its requirement in making decisions. The algorithm translates historical coin price trajectory and volatility into the probable mental states of market participants.

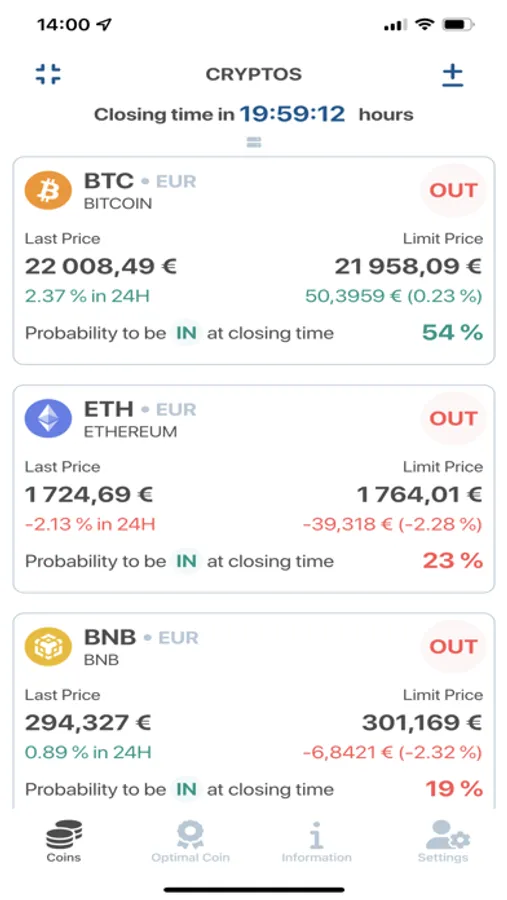

Each day it estimates, at the close of the market, the degree of satisfaction and the degree of frustration in the market for each coin. It then provides a limit price, that tells you at what point the market will turn from being frustrated to satisfied (or vice versa).

Since cryptocurrency markets trade 24 hours a day, the user chooses their own closing time, for example, every day at 7pm.

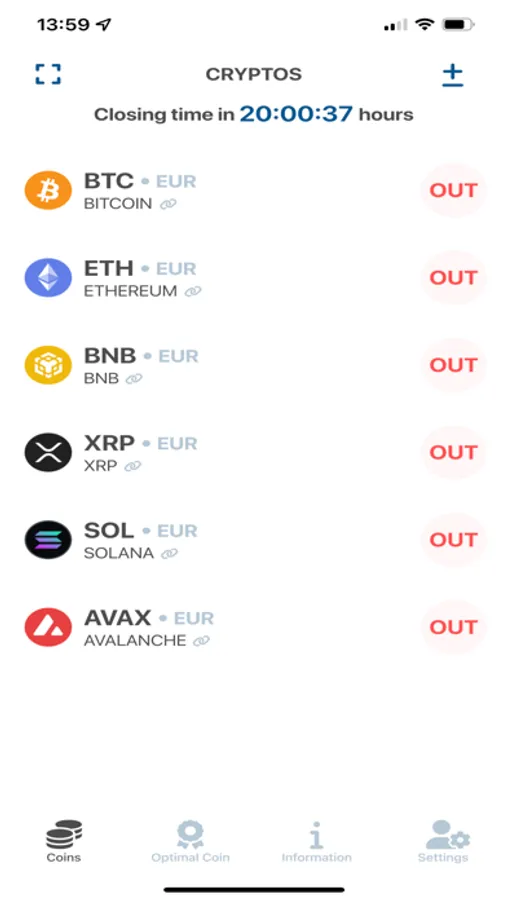

When satisfaction prevails at the close, TrackCoin provides a “safety” signal (IN), and when frustration prevails, it provides a “caution” signal (OUT).

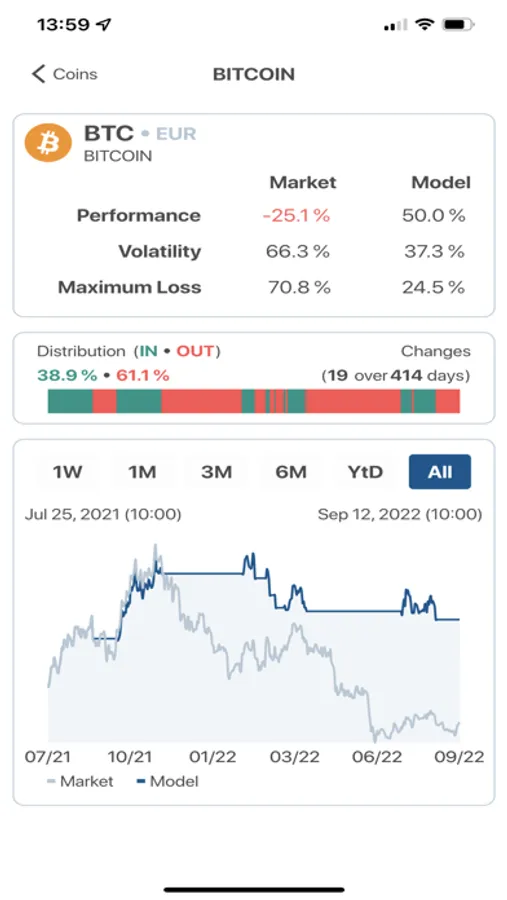

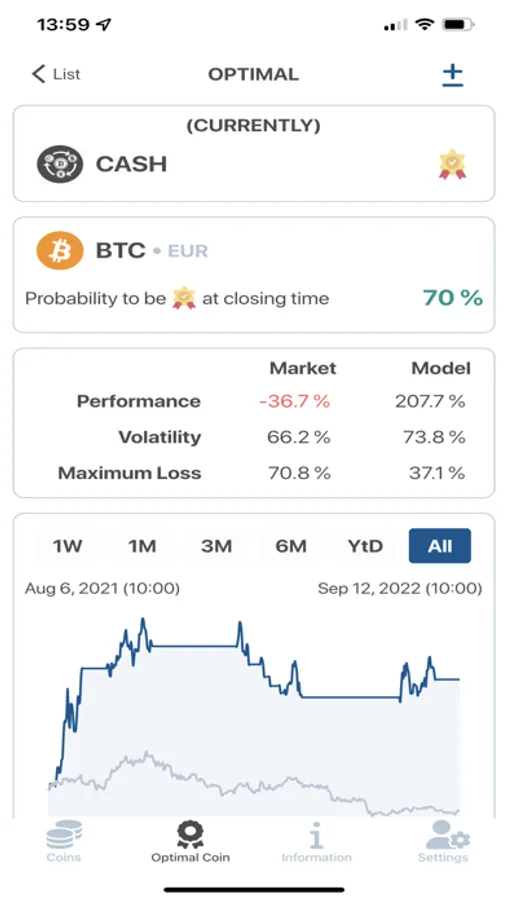

Thus, TrackCoin simulates a cryptocurrency investor who is either a buyer of a cryptocurrency (IN) at the close, or a buyer of a stable coin (OUT). TrackCoin is not a short seller. The model performance is measured and displayed day after day.

TrackCoin also provides continuous statistical information, namely the probability of being IN or OUT at closing.

TrackCoin also offers a so-called "optimal" solution inspired by traditional asset management techniques. This involves taking more risks when the market is safe, and less risk when the market is unstable.

If the dominant cryptocurrency, i.e., bitcoin, is OUT, then the strategy is cautious (OUT). Alternatively, if bitcoin is IN, then the strategy selects the coin with the highest upside potential, be it bitcoin or another coin.

TrackCoin is a behavioral algorithm applied to cryptocurrencies. The method is inspired by Endel Tulving’s research on emotional memory and its requirement in making decisions. The algorithm translates historical coin price trajectory and volatility into the probable mental states of market participants.

Each day it estimates, at the close of the market, the degree of satisfaction and the degree of frustration in the market for each coin. It then provides a limit price, that tells you at what point the market will turn from being frustrated to satisfied (or vice versa).

Since cryptocurrency markets trade 24 hours a day, the user chooses their own closing time, for example, every day at 7pm.

When satisfaction prevails at the close, TrackCoin provides a “safety” signal (IN), and when frustration prevails, it provides a “caution” signal (OUT).

Thus, TrackCoin simulates a cryptocurrency investor who is either a buyer of a cryptocurrency (IN) at the close, or a buyer of a stable coin (OUT). TrackCoin is not a short seller. The model performance is measured and displayed day after day.

TrackCoin also provides continuous statistical information, namely the probability of being IN or OUT at closing.

TrackCoin also offers a so-called "optimal" solution inspired by traditional asset management techniques. This involves taking more risks when the market is safe, and less risk when the market is unstable.

If the dominant cryptocurrency, i.e., bitcoin, is OUT, then the strategy is cautious (OUT). Alternatively, if bitcoin is IN, then the strategy selects the coin with the highest upside potential, be it bitcoin or another coin.