About CloudReceipts

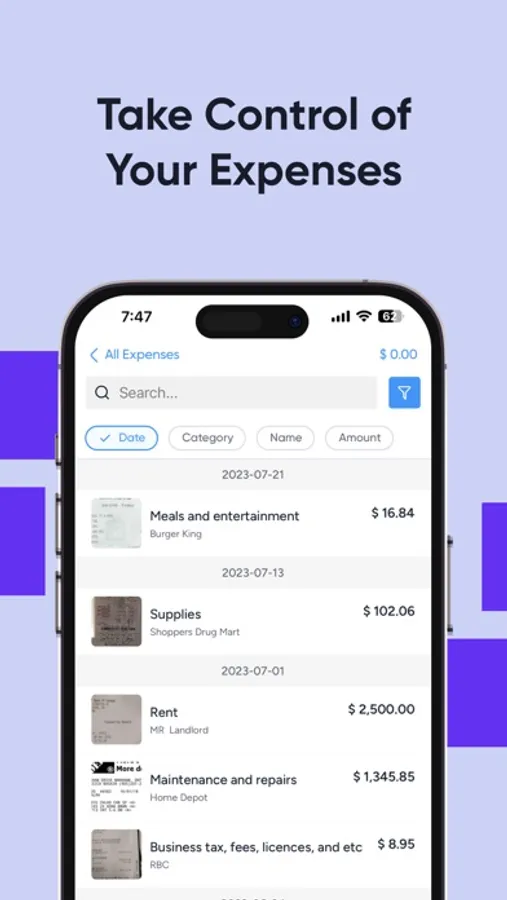

CloudReceipts is an innovative mobile app that allows Canadian taxpayers to simplify and optimize their tax deductions by easily organizing and categorizing their expenses. The app is designed for both personal and business use, making it ideal for individuals, self-employed professionals, and small business owners.

With CloudReceipts, users can simply take a picture of their receipts using their smartphone camera and let the app do the rest. The app automatically categorizes expenses and tracks them over time, making it easy to see where money is being spent and identify areas where tax deductions can be optimized.

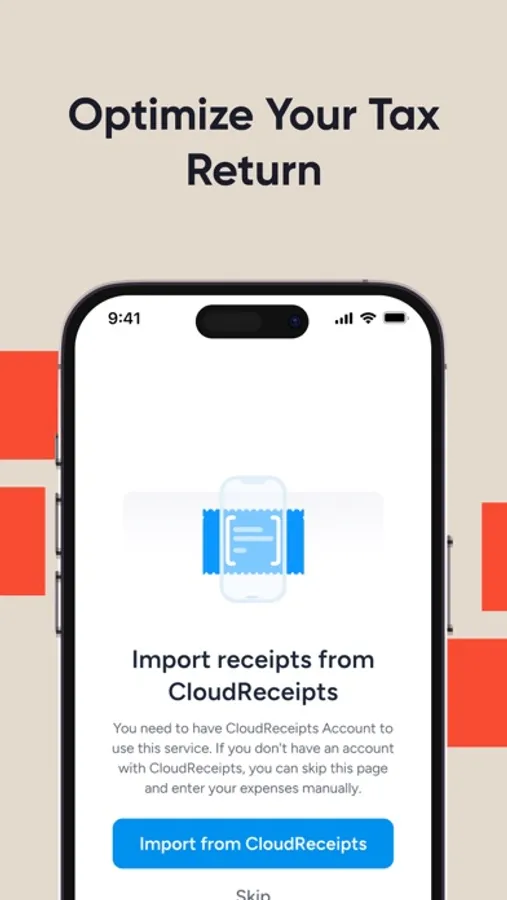

One of the key features of CloudReceipts is its seamless integration with CloudTax, allowing users to automatically import their expenses into their tax returns. This can save time and reduce the risk of errors by eliminating the need for manual data entry.

CloudReceipts also includes advanced OCR technology, which automatically extracts data from receipts and categorizes them accordingly. This feature is available with the paid plan, which costs $9.99/month or $89.99/year and is designed for self-employed professionals, gig workers, and small business owners. The paid plan also includes additional features such as the ability to store unlimited receipts, track mileage, and receive detailed expense reports.

For those who simply want to use the app for personal taxes, such as medical expenses and donations, CloudReceipts is completely free. Users can upload and categorize their receipts for these types of expenses without any cost.

In addition to its powerful expense tracking and tax optimization features, CloudReceipts also provides users with secure storage for their receipts. The app stores receipts for 6 years, as required by the CRA in case of an audit. Users can easily view and download their receipts as PDFs, providing peace of mind and making it easy to share with the CRA if necessary.

CloudTax (Creator of: CloudTax, CloudReceipts) invites you to explore the following links for more information:

• Discover how CloudTax safeguards your privacy by visiting: https://www.cloudtax.ca/privacy-policy.

• Familiarize yourself with the terms of service for CloudTax by reading: https://www.cloudtax.ca/terms-and-conditions.

SUBSCRIPTION INFORMATION

• Your iTunes account will be charged when you confirm the purchase.

• Your subscription will automatically renew unless you turn off auto-renew at least 24 hours before the end of the current period.

• Your iTunes account will be charged for renewal within 24 hours prior to the end of the current period.

• You can manage your subscription and turn off auto-renewal by going to your iTunes account settings after purchase. On your device, go to Settings > iTunes & App Store, tap your Apple ID, and tap Subscriptions.

Overall, CloudReceipts is a powerful and easy-to-use tool that helps Canadians optimize their tax deductions, simplify expense tracking, and stay organized. With its free and paid plans, it's accessible to everyone and offers a wide range of features to meet the needs of personal and business users alike.

With CloudReceipts, users can simply take a picture of their receipts using their smartphone camera and let the app do the rest. The app automatically categorizes expenses and tracks them over time, making it easy to see where money is being spent and identify areas where tax deductions can be optimized.

One of the key features of CloudReceipts is its seamless integration with CloudTax, allowing users to automatically import their expenses into their tax returns. This can save time and reduce the risk of errors by eliminating the need for manual data entry.

CloudReceipts also includes advanced OCR technology, which automatically extracts data from receipts and categorizes them accordingly. This feature is available with the paid plan, which costs $9.99/month or $89.99/year and is designed for self-employed professionals, gig workers, and small business owners. The paid plan also includes additional features such as the ability to store unlimited receipts, track mileage, and receive detailed expense reports.

For those who simply want to use the app for personal taxes, such as medical expenses and donations, CloudReceipts is completely free. Users can upload and categorize their receipts for these types of expenses without any cost.

In addition to its powerful expense tracking and tax optimization features, CloudReceipts also provides users with secure storage for their receipts. The app stores receipts for 6 years, as required by the CRA in case of an audit. Users can easily view and download their receipts as PDFs, providing peace of mind and making it easy to share with the CRA if necessary.

CloudTax (Creator of: CloudTax, CloudReceipts) invites you to explore the following links for more information:

• Discover how CloudTax safeguards your privacy by visiting: https://www.cloudtax.ca/privacy-policy.

• Familiarize yourself with the terms of service for CloudTax by reading: https://www.cloudtax.ca/terms-and-conditions.

SUBSCRIPTION INFORMATION

• Your iTunes account will be charged when you confirm the purchase.

• Your subscription will automatically renew unless you turn off auto-renew at least 24 hours before the end of the current period.

• Your iTunes account will be charged for renewal within 24 hours prior to the end of the current period.

• You can manage your subscription and turn off auto-renewal by going to your iTunes account settings after purchase. On your device, go to Settings > iTunes & App Store, tap your Apple ID, and tap Subscriptions.

Overall, CloudReceipts is a powerful and easy-to-use tool that helps Canadians optimize their tax deductions, simplify expense tracking, and stay organized. With its free and paid plans, it's accessible to everyone and offers a wide range of features to meet the needs of personal and business users alike.