AppRecs review analysis

AppRecs rating 3.7. Trustworthiness 0 out of 100. Review manipulation risk 0 out of 100. Based on a review sample analyzed.

★★★☆☆

3.7

AppRecs Rating

Ratings breakdown

5 star

62%

4 star

0%

3 star

10%

2 star

5%

1 star

24%

What to know

✓

Good user ratings

62% positive sampled reviews

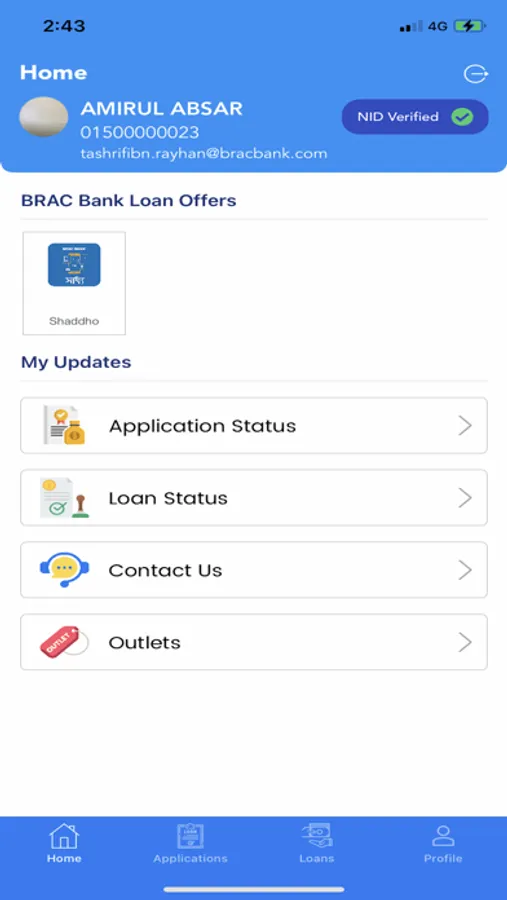

About BBL Shubidha

BRAC Bank (BBL) 'Shubidha' is a mobile-based app through which selective customers can avail of retail loan products digitally. The app performs end-to-end digital loan processing, including loan application, assessment, and disbursement. You can now enjoy a digital borrowing experience in a fast, secure, and convenient way using the BBL Shubidha app.

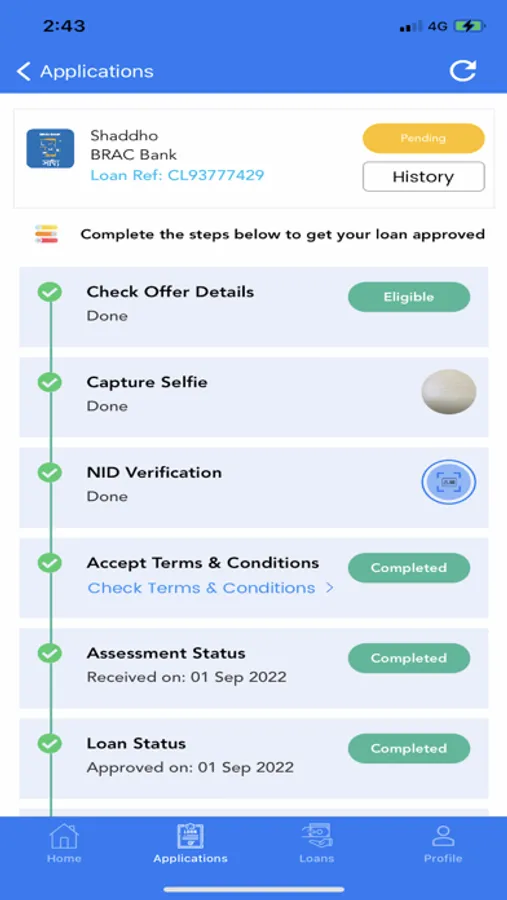

After installing the app, you can:

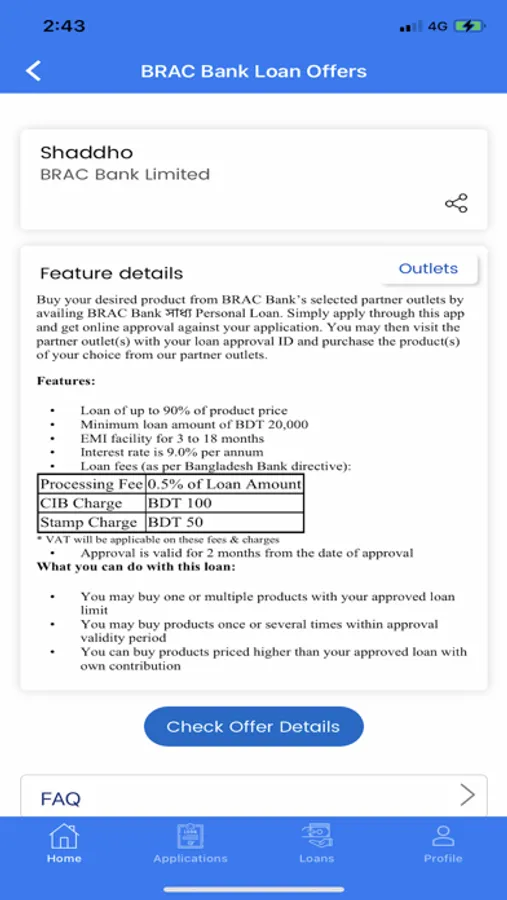

1. Know about the digital loan products of BRAC Bank:

· See product features and benefits;

· View a list of merchants from where you can purchase your desired product(s) with a digital loan.

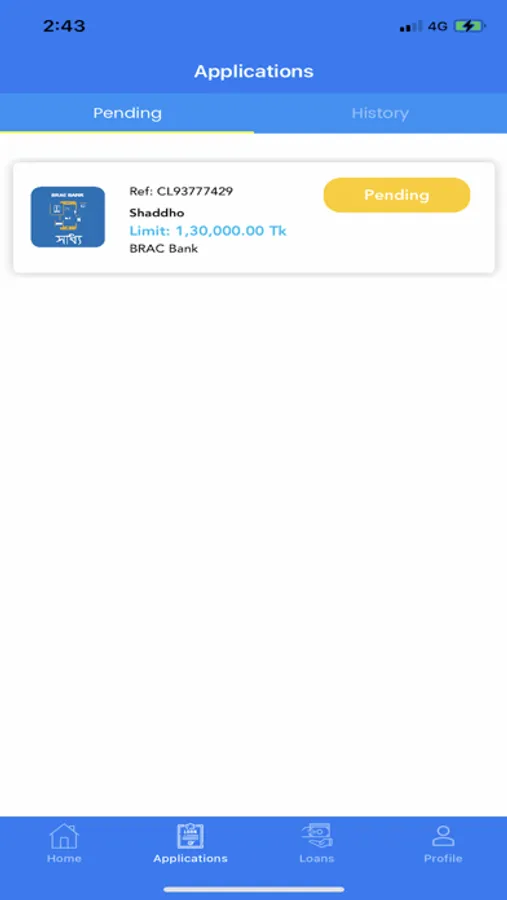

2. Check your eligibility & apply for a digital loan:

· Check the loan offer in-store for you;

· Capture your selfie;

· Accept terms & conditions of the digital loan;

· Submit loan application by 8 pm of the working day.

3. Get your loan decision:

· Wait for a few minutes for a decision on your applied loan;

· Get Loan Reference Number if the loan is approved.

4. Pay loan processing fee:

· Visit the merchant outlet & select your desired product;

· Inform the merchant to assist you to buy the product with a digital loan;

· Pay a loan processing fee from your BRAC Bank account through the app.

5. Get product delivery:

· Inform merchant about the product delivery code sent in your app;

· Get delivery of your product.

6. View anytime:

· Status of your ongoing application and loans;

· Your short profile.

7. Pre-login features:

· Registration for New User;

· Password creation.

Loan features:

· Interest rate of 9% per annum;

· Tenure of 3 to 18 months;

· Sample Loan Repayment Schedule:

If you have availed loan of BDT 100,000 @ 9% interest per annum and tenure of 12 months, your Equal Monthly Instalment (EMI) will be approximately BDT 8,745. Therefore, the total cost of the loan (principal + interest) will be BDT 104,942. In addition to interest, you have to pay loan processing fee before availing the loan as follows:

Processing fee: 0.5% of loan amount + 15% VAT

CIB & Stamp Charge: At actual.

All you need:

• An active account and a debit card with BRAC Bank;

• A smartphone with an iOS operating system;

• Internet connectivity through mobile internet or Wi-Fi.

We welcome your feedback and suggestions; please call us at 16221.

After installing the app, you can:

1. Know about the digital loan products of BRAC Bank:

· See product features and benefits;

· View a list of merchants from where you can purchase your desired product(s) with a digital loan.

2. Check your eligibility & apply for a digital loan:

· Check the loan offer in-store for you;

· Capture your selfie;

· Accept terms & conditions of the digital loan;

· Submit loan application by 8 pm of the working day.

3. Get your loan decision:

· Wait for a few minutes for a decision on your applied loan;

· Get Loan Reference Number if the loan is approved.

4. Pay loan processing fee:

· Visit the merchant outlet & select your desired product;

· Inform the merchant to assist you to buy the product with a digital loan;

· Pay a loan processing fee from your BRAC Bank account through the app.

5. Get product delivery:

· Inform merchant about the product delivery code sent in your app;

· Get delivery of your product.

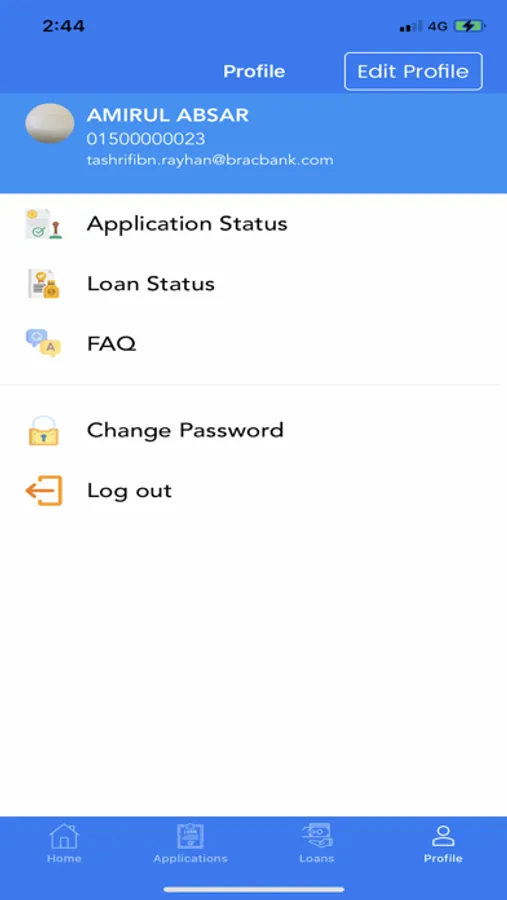

6. View anytime:

· Status of your ongoing application and loans;

· Your short profile.

7. Pre-login features:

· Registration for New User;

· Password creation.

Loan features:

· Interest rate of 9% per annum;

· Tenure of 3 to 18 months;

· Sample Loan Repayment Schedule:

If you have availed loan of BDT 100,000 @ 9% interest per annum and tenure of 12 months, your Equal Monthly Instalment (EMI) will be approximately BDT 8,745. Therefore, the total cost of the loan (principal + interest) will be BDT 104,942. In addition to interest, you have to pay loan processing fee before availing the loan as follows:

Processing fee: 0.5% of loan amount + 15% VAT

CIB & Stamp Charge: At actual.

All you need:

• An active account and a debit card with BRAC Bank;

• A smartphone with an iOS operating system;

• Internet connectivity through mobile internet or Wi-Fi.

We welcome your feedback and suggestions; please call us at 16221.