About FinQuest

FinQuest is a free educational app that teaches youth how to own their financial future. Through mini-games and Quests, youth make smart financial decisions and learn how to earn, save, and spend wisely.

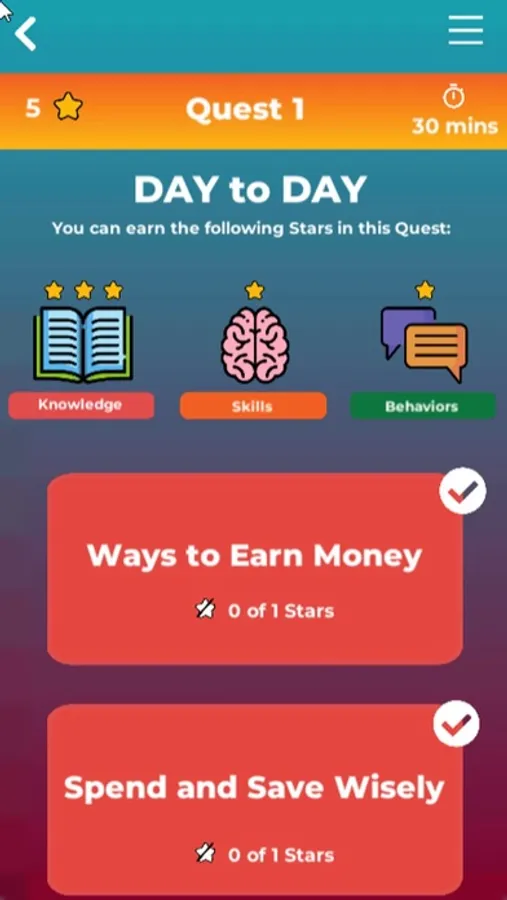

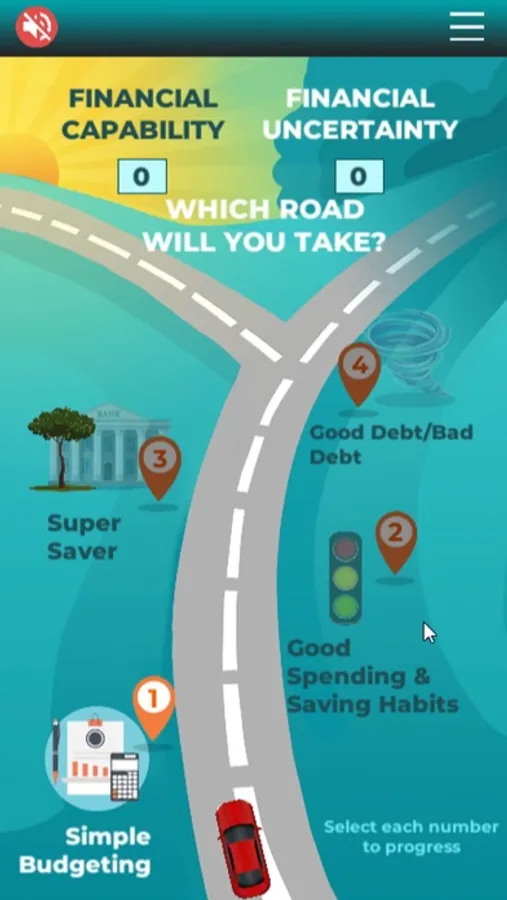

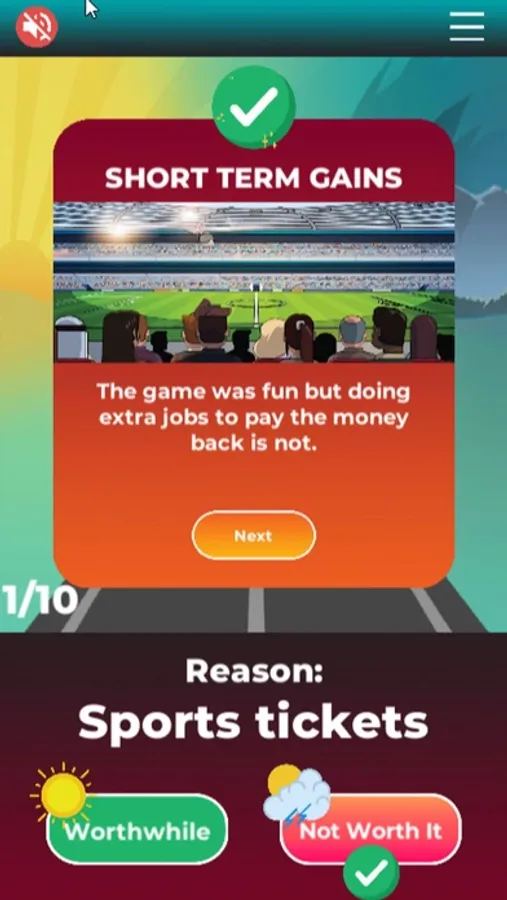

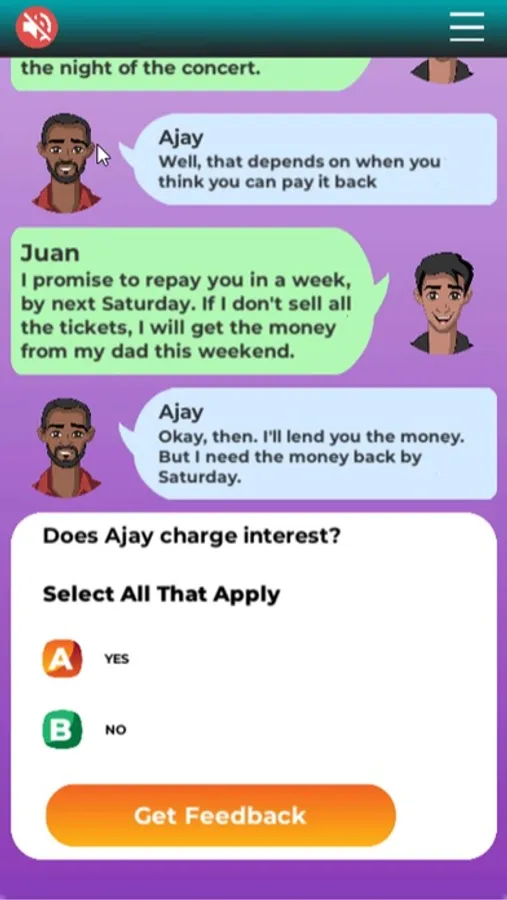

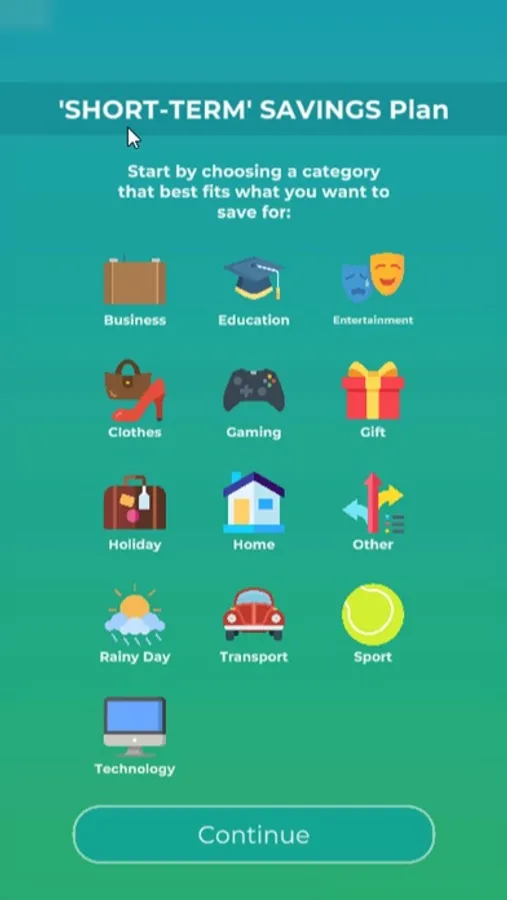

Activities: FinQuest includes four Quests. Each Quest contains a series of fun activities, mini-games, challenges, and quizzes. Quests teach youth how to manage money day to day, the skills and attitudes needed for lifelong financial health, and how to navigate life’s financial ups and downs. Together, the Quests deliver approximately 240 minutes of game-based learning. FinQuest introduces youth to a wide range of financial concepts, including: 50-30-20 budgeting, borrowing, debt management, financial negotiation, financial planning, managing cash flow, managing risk, money talk, resiliency, rules of saving, and tracking spending.

Features: FinQuest uses elements of gamification and simulation learning to create a game-based learning experience.

- Youth users can create avatars.

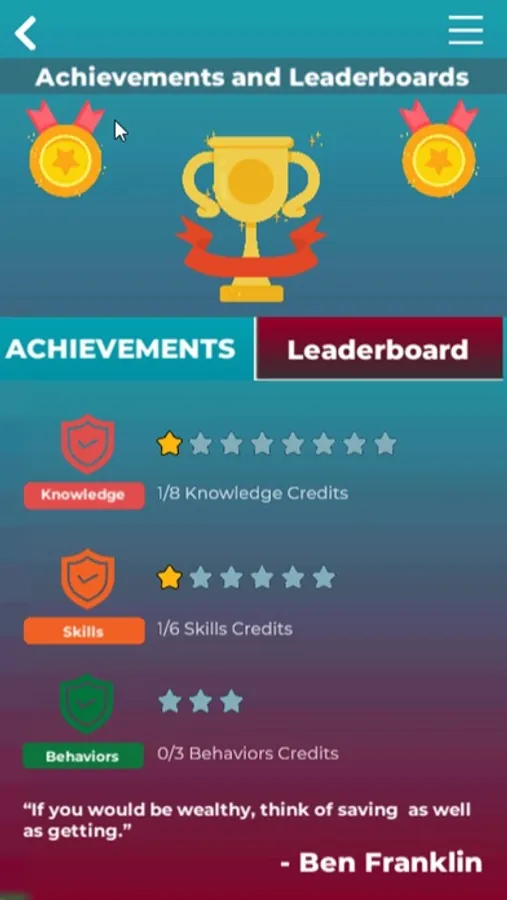

- Youth users collect points and badges and compete for leaderboard rankings as they navigate four self-directed Quests.

- Youth users access a basic budget tracker tool to manage their money day to day.

- Quest Leaders (other youth, volunteers, parents, educators) can track user progress and performance.

About JA Worldwide: As one of the world’s largest and most-impactful youth-serving NGOs, JA (Junior Achievement) Worldwide delivers hands-on, immersive learning in work readiness, financial health, entrepreneurship, sustainability, STEM, economics, citizenship, ethics, and more. Reaching more than 12 million young people each year through nearly half a million teachers and business volunteers, JA Worldwide is one of few organizations with the scale, experience, and passion to build a brighter future for the next generation of innovators, entrepreneurs, and leaders.

About JA Building a Financially Capable Generation: JA Worldwide created the FinQuest app as part of its JA Building a Financially Capable Generation initiative, supported by HSBC.

Activities: FinQuest includes four Quests. Each Quest contains a series of fun activities, mini-games, challenges, and quizzes. Quests teach youth how to manage money day to day, the skills and attitudes needed for lifelong financial health, and how to navigate life’s financial ups and downs. Together, the Quests deliver approximately 240 minutes of game-based learning. FinQuest introduces youth to a wide range of financial concepts, including: 50-30-20 budgeting, borrowing, debt management, financial negotiation, financial planning, managing cash flow, managing risk, money talk, resiliency, rules of saving, and tracking spending.

Features: FinQuest uses elements of gamification and simulation learning to create a game-based learning experience.

- Youth users can create avatars.

- Youth users collect points and badges and compete for leaderboard rankings as they navigate four self-directed Quests.

- Youth users access a basic budget tracker tool to manage their money day to day.

- Quest Leaders (other youth, volunteers, parents, educators) can track user progress and performance.

About JA Worldwide: As one of the world’s largest and most-impactful youth-serving NGOs, JA (Junior Achievement) Worldwide delivers hands-on, immersive learning in work readiness, financial health, entrepreneurship, sustainability, STEM, economics, citizenship, ethics, and more. Reaching more than 12 million young people each year through nearly half a million teachers and business volunteers, JA Worldwide is one of few organizations with the scale, experience, and passion to build a brighter future for the next generation of innovators, entrepreneurs, and leaders.

About JA Building a Financially Capable Generation: JA Worldwide created the FinQuest app as part of its JA Building a Financially Capable Generation initiative, supported by HSBC.