About Pliit

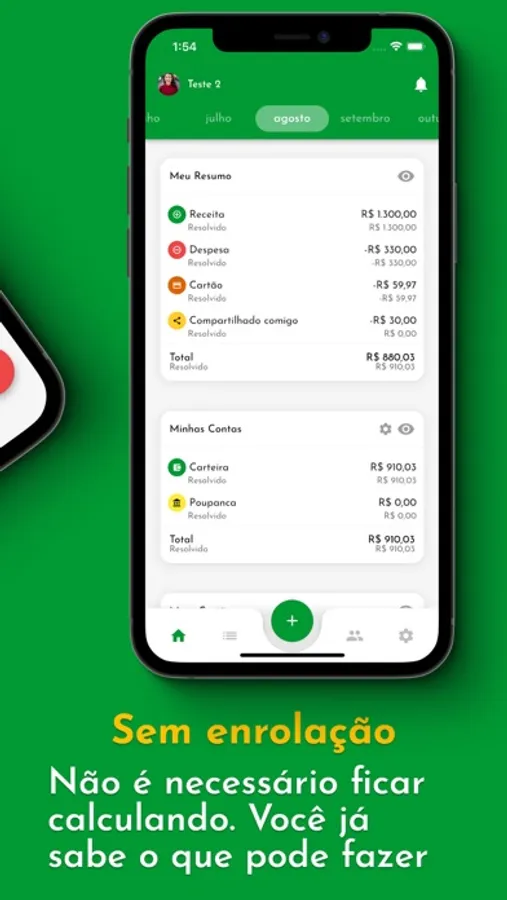

Organize your financial life now by controlling your entire budget in a single app, in an easy and personalized way!

Have you noticed that knowing only one point of view can harm our decision-making? For example, the person watching a scene from a specific angle may fail to notice important details that would be easily seen from a different angle. And this same situation can happen with our finances.

With that in mind, Pliit offers you all the “angles” of your financial life, making every important detail of your budget available in a CLEAR, SIMPLE and ORGANIZED way, in a single place.

Discover the advantages of using Pliit:

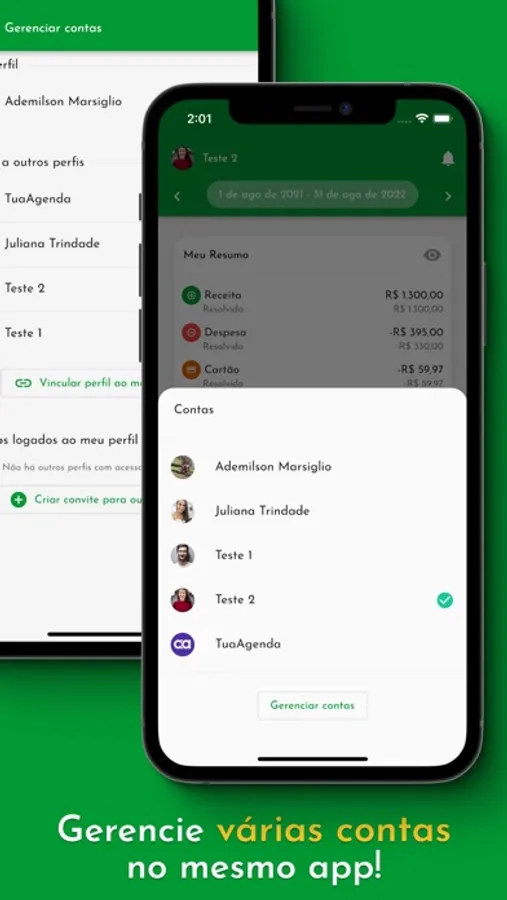

MISCELLANEOUS ACCOUNTS / BANK ACCOUNTS / MULTIPLE ACCOUNTS / YOUR ACCOUNTS:

In Pliit you have control over everything! Based on this principle, it is possible to include all your accounts by entering the movements of each one of them. This feature allows you to track the income and expenses of each account, and, at the same time, have an overview of the use of your money.

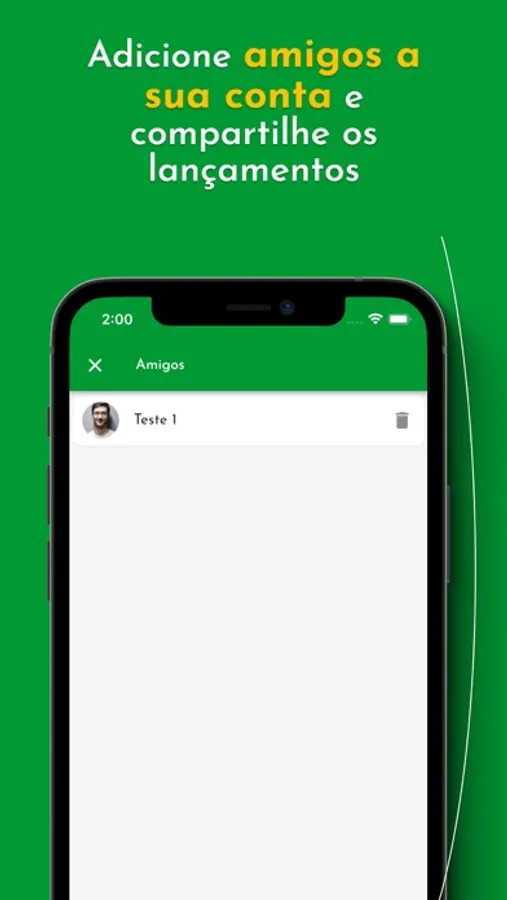

You can also assign and configure ACCESS PERMISSIONS, a very useful feature in the case of business or joint accounts. With this tool, you can define which information or actions will be available to the person you have given access to.

EASY TO USE:

Pliit was developed to organize and simplify people's financial lives, and this objective is reflected in the layout of the app. Every piece of information or feature in Pliit is presented very clearly and intuitively, so entering or finding information in this app is easy and uncomplicated. For example, you know exactly how much of your money is being spent for each purpose (eg Market, Fuel, Leisure).

SECURITY:

At Pliit you have a safe environment to better understand your finances, all of this, without requiring or exposing passwords or sensitive data from your bank accounts. Your personal information is not shared with third parties, in addition, you have peace of mind in knowing that no financial transactions can be made through the app.

RECEIVE NOTIFICATIONS:

With Pliit you receive daily notifications about the movements in your accounts, that is, YOU INSIDE EVERYTHING THAT HAPPENS WITH YOUR MONEY.

CUSTOMIZE THE PLiiT:

At Pliit you customize financial control according to your reality. Add income and expense categories by naming them as you like, including due dates and other information as you wish. Add bills and cards at will and customize the app's dashboard so that information is displayed the way you like it, combining Pliit's look with your style!

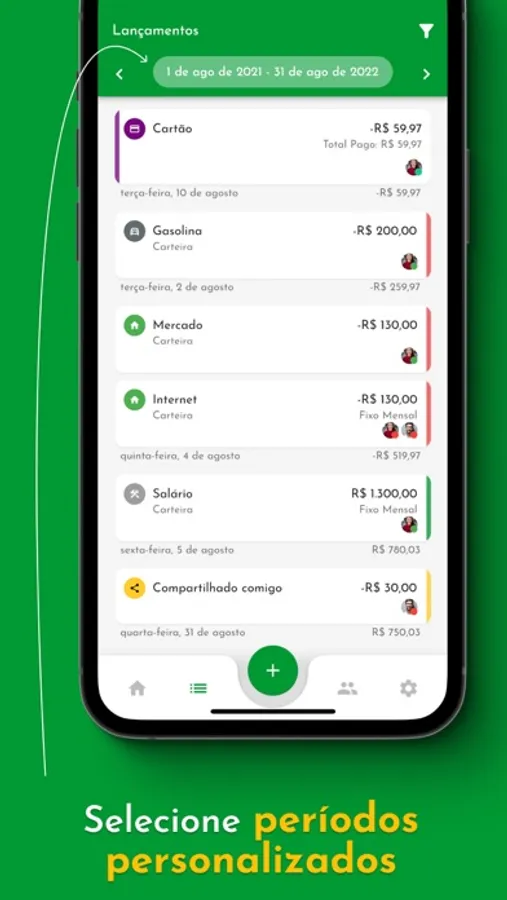

INSTALLMENTS RELEASES:

In a simple way, you can enter recurring income and expenses and even installment releases. This function makes your life easier, allows you to enter the amount and value of each installment and receive an accurate report of your financial life.

SHARED EXPENSES:

Do you share the rent or water/electricity/internet bill with someone in the household? Did you lend your credit card to that friend and are you going to split the bill? Then you will like this function. By identifying a release as a shared expense, you can inform how much of that expense will come out of your pocket, and at the end of the month, you will have an even more accurate view of all your income and expenses.

Terms of use: https://pliit.app/termos-de-uso

Privacy Policy: https://pliit.app/politica-de-privacidade

Have you noticed that knowing only one point of view can harm our decision-making? For example, the person watching a scene from a specific angle may fail to notice important details that would be easily seen from a different angle. And this same situation can happen with our finances.

With that in mind, Pliit offers you all the “angles” of your financial life, making every important detail of your budget available in a CLEAR, SIMPLE and ORGANIZED way, in a single place.

Discover the advantages of using Pliit:

MISCELLANEOUS ACCOUNTS / BANK ACCOUNTS / MULTIPLE ACCOUNTS / YOUR ACCOUNTS:

In Pliit you have control over everything! Based on this principle, it is possible to include all your accounts by entering the movements of each one of them. This feature allows you to track the income and expenses of each account, and, at the same time, have an overview of the use of your money.

You can also assign and configure ACCESS PERMISSIONS, a very useful feature in the case of business or joint accounts. With this tool, you can define which information or actions will be available to the person you have given access to.

EASY TO USE:

Pliit was developed to organize and simplify people's financial lives, and this objective is reflected in the layout of the app. Every piece of information or feature in Pliit is presented very clearly and intuitively, so entering or finding information in this app is easy and uncomplicated. For example, you know exactly how much of your money is being spent for each purpose (eg Market, Fuel, Leisure).

SECURITY:

At Pliit you have a safe environment to better understand your finances, all of this, without requiring or exposing passwords or sensitive data from your bank accounts. Your personal information is not shared with third parties, in addition, you have peace of mind in knowing that no financial transactions can be made through the app.

RECEIVE NOTIFICATIONS:

With Pliit you receive daily notifications about the movements in your accounts, that is, YOU INSIDE EVERYTHING THAT HAPPENS WITH YOUR MONEY.

CUSTOMIZE THE PLiiT:

At Pliit you customize financial control according to your reality. Add income and expense categories by naming them as you like, including due dates and other information as you wish. Add bills and cards at will and customize the app's dashboard so that information is displayed the way you like it, combining Pliit's look with your style!

INSTALLMENTS RELEASES:

In a simple way, you can enter recurring income and expenses and even installment releases. This function makes your life easier, allows you to enter the amount and value of each installment and receive an accurate report of your financial life.

SHARED EXPENSES:

Do you share the rent or water/electricity/internet bill with someone in the household? Did you lend your credit card to that friend and are you going to split the bill? Then you will like this function. By identifying a release as a shared expense, you can inform how much of that expense will come out of your pocket, and at the end of the month, you will have an even more accurate view of all your income and expenses.

Terms of use: https://pliit.app/termos-de-uso

Privacy Policy: https://pliit.app/politica-de-privacidade