Eximbank EBiz

Vietnam Export Import Commercial Joint Stock Bank

4.6 ★

store rating

Free

AppRecs review analysis

AppRecs rating 4.6. Trustworthiness 0 out of 100. Review manipulation risk 0 out of 100. Based on a review sample analyzed.

★★★★☆

4.6

AppRecs Rating

Ratings breakdown

5 star

86%

4 star

0%

3 star

0%

2 star

14%

1 star

0%

What to know

✓

High user satisfaction

86% of sampled ratings are 5 stars

About Eximbank EBiz

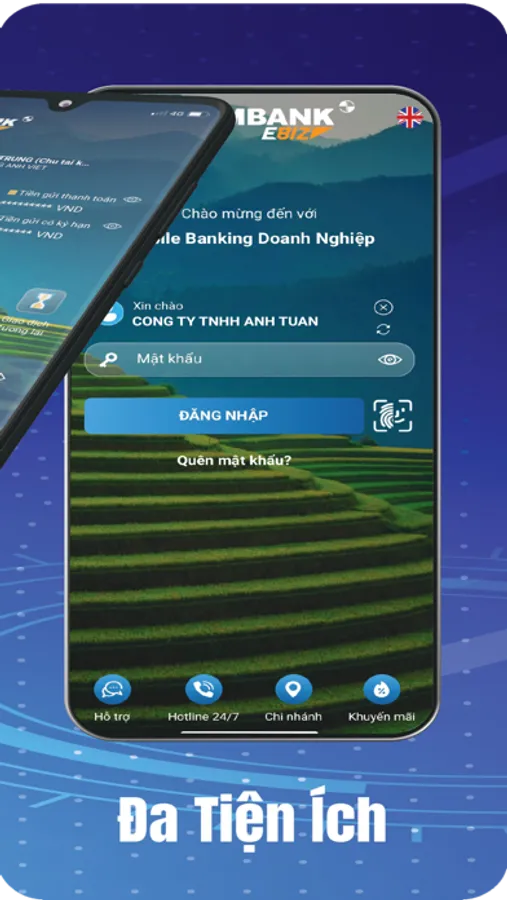

Eximbank EBiz is an online banking application developed by Vietnam Export Import Commercial Joint Stock Bank (Eximbank) for its corporate customers. Eximbank EBiz provides a diverse range of online banking features and cross-platform connectivity, offering a convenient and modern experience for customers.

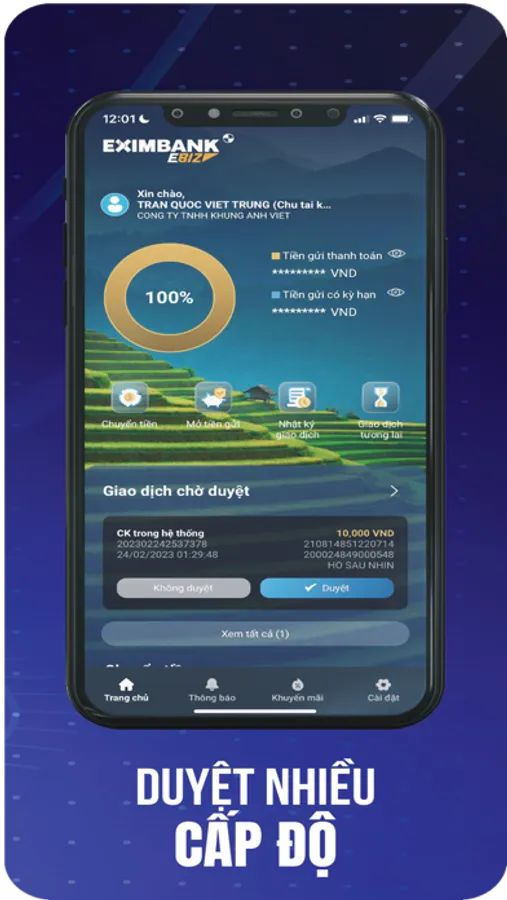

Business operators can track, approve, and manage all company transactions anytime, anywhere on smart devices such as laptops, tablets, smartphones, both through the mobile app and web platform, providing a unified experience.

Features on the Eximbank EBiz application include:

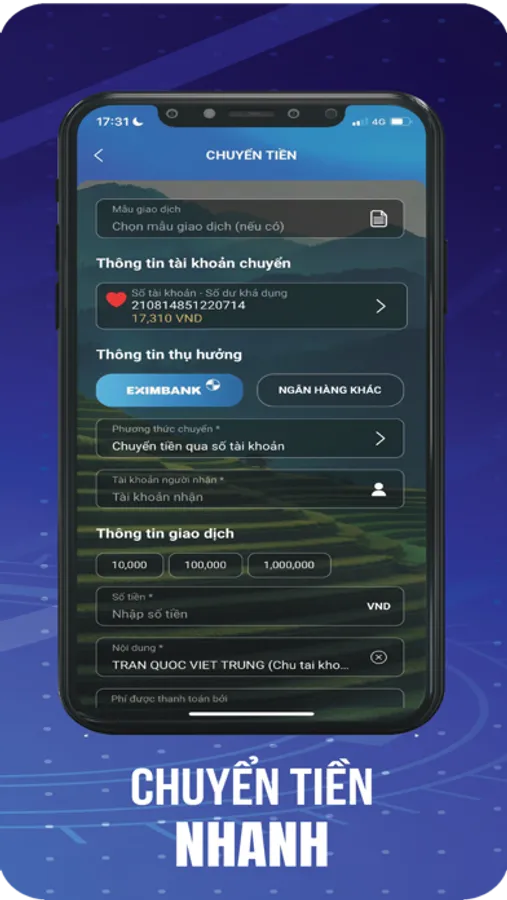

Initiating and approving financial transactions: money transfers, batch transfers, payroll, deposit account opening, deposit account closing, bill payments, domestic tax payments, customs tax payments, securities transfers, international money transfers, automatic bill payment, and more.

Accessing information: payment deposit balances, fixed deposit balances, loan agreements, collateral, guarantees, cards, transaction logs, and more.

Querying utilities: login history, ATM/branch locations, exchange rates, interest rates, promotions, gold prices, and more.

Customizing usage configurations: approval levels, user management, transaction limits, approval processes, and more.

Customizing interface according to user preferences: customers can change the background image, profile picture, prioritize and rearrange functions according to their preferences to meet their personalization needs.

High security with biometric login feature.

Business operators can track, approve, and manage all company transactions anytime, anywhere on smart devices such as laptops, tablets, smartphones, both through the mobile app and web platform, providing a unified experience.

Features on the Eximbank EBiz application include:

Initiating and approving financial transactions: money transfers, batch transfers, payroll, deposit account opening, deposit account closing, bill payments, domestic tax payments, customs tax payments, securities transfers, international money transfers, automatic bill payment, and more.

Accessing information: payment deposit balances, fixed deposit balances, loan agreements, collateral, guarantees, cards, transaction logs, and more.

Querying utilities: login history, ATM/branch locations, exchange rates, interest rates, promotions, gold prices, and more.

Customizing usage configurations: approval levels, user management, transaction limits, approval processes, and more.

Customizing interface according to user preferences: customers can change the background image, profile picture, prioritize and rearrange functions according to their preferences to meet their personalization needs.

High security with biometric login feature.