About Securitize - Alt Investing

EXCLUSIVE ALTERNATIVE INVESTMENT OPPORTUNITIES

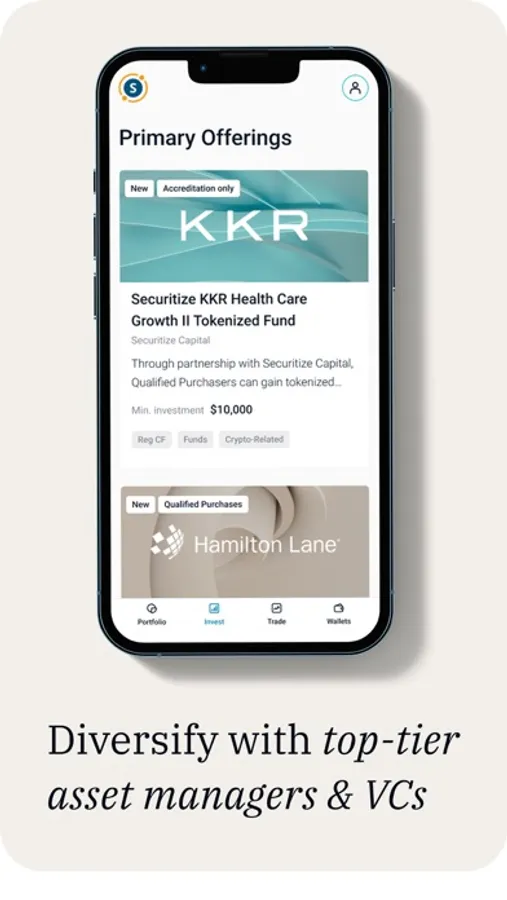

Securitize Markets is a leading platform expanding unique access to real-world, private market asset classes. Individual investors choose from expertly-curated investment offerings to build a private markets portfolio comprised of funds from top-tier asset managers like KKR and Hamilton Lane - without the usual $2M investment minimums and 10+ year lock up periods.

JOIN OUR COMMUNITY OF 510k+ INVESTORS

- $2.7B+ investments pledged

- Investment minimums as low as $5K

- Management fees as little as 0.5% (other fees may apply)

EXPERTLY-VETTED OPPORTUNITIES

Only 3% of investment opportunities pass our extensive due diligence process and are continuously monitored and reported throughout the life of the fund.

LOWER MINIMUMS & FEES, GREATER DIVERSIFICATION

Primary investment offerings come with notably low minimum investment amounts, starting at $5k. Private equity investments start at $10k versus their master fund counterparts that begin at $2M+.

SHORTER LOCKUP PERIODS & FASTER ACCESS TO LIQUIDITY

Find potential liquidity for your shares on our secondary market or engage in redemption events, right from day one (available for select offerings). Our secondary market provides a way to buy and sell shares between funding rounds, from as little as $1. Private equity offerings offer one year lock up periods as opposed to the typical 10+ year lockup of their master fund counterparts.

DEDICATED INVESTMENT SPECIALISTS

Securitize Markets’ investment and support teams are available via email and phone to guide you through the investment process and assist you at anytime with your account.

READY TO INVEST?

Learn more at securitize.io.

QUESTIONS?

Reach out to our investment team anytime here: digitize.securitize.io/bookstrategycall

Disclosures: Securitize, Inc. is a digital asset securities firm with a mission to provide shareholders with access to invest in and trade alternative investments, and for companies to raise capital, manage shareholders, and offer their shareholders potential liquidity. We’re backed by industry leaders, including Morgan Stanley and Blockchain Capital. Securitize has pioneered a fully digital, end-to-end platform for issuing, managing and trading digital asset securities, consistent with the U.S. regulatory framework. Securitize is comprised of Securitize, Inc. and its subsidiaries: Securitize, LLC, an SEC-registered transfer agent; Securitize Markets, LLC, an SEC- registered broker-dealer and member of FINRA and SIPC, that also operates the company’s alternative trading system (ATS); Securitize Capital, LLC, (exempt reporting advisor) the first digital asset management platform of its kind that manages institutional-grade products. Securitize Markets and Securitize Capital are under common ownership. Please refer to the Conflicts of Interest of the offering documents prior to investing. Registration with the SEC does not imply a certain level of skill or training. Investing in securities involves risks, and there is always the potential of losing money when you invest in securities. Before investing, consider your investment objectives and Securitize’s charges and expenses. Nothing in this material should be construed as investment or tax advice, or a solicitation or offer, or recommendation, to buy or sell any security. All images and return and projection figures shown are for illustrative purposes only, may assume additional investments over time, and are not actual Securitize customer or model returns or projections. Visit Securitize.io for any offering documents and other information.

Securitize Markets is a leading platform expanding unique access to real-world, private market asset classes. Individual investors choose from expertly-curated investment offerings to build a private markets portfolio comprised of funds from top-tier asset managers like KKR and Hamilton Lane - without the usual $2M investment minimums and 10+ year lock up periods.

JOIN OUR COMMUNITY OF 510k+ INVESTORS

- $2.7B+ investments pledged

- Investment minimums as low as $5K

- Management fees as little as 0.5% (other fees may apply)

EXPERTLY-VETTED OPPORTUNITIES

Only 3% of investment opportunities pass our extensive due diligence process and are continuously monitored and reported throughout the life of the fund.

LOWER MINIMUMS & FEES, GREATER DIVERSIFICATION

Primary investment offerings come with notably low minimum investment amounts, starting at $5k. Private equity investments start at $10k versus their master fund counterparts that begin at $2M+.

SHORTER LOCKUP PERIODS & FASTER ACCESS TO LIQUIDITY

Find potential liquidity for your shares on our secondary market or engage in redemption events, right from day one (available for select offerings). Our secondary market provides a way to buy and sell shares between funding rounds, from as little as $1. Private equity offerings offer one year lock up periods as opposed to the typical 10+ year lockup of their master fund counterparts.

DEDICATED INVESTMENT SPECIALISTS

Securitize Markets’ investment and support teams are available via email and phone to guide you through the investment process and assist you at anytime with your account.

READY TO INVEST?

Learn more at securitize.io.

QUESTIONS?

Reach out to our investment team anytime here: digitize.securitize.io/bookstrategycall

Disclosures: Securitize, Inc. is a digital asset securities firm with a mission to provide shareholders with access to invest in and trade alternative investments, and for companies to raise capital, manage shareholders, and offer their shareholders potential liquidity. We’re backed by industry leaders, including Morgan Stanley and Blockchain Capital. Securitize has pioneered a fully digital, end-to-end platform for issuing, managing and trading digital asset securities, consistent with the U.S. regulatory framework. Securitize is comprised of Securitize, Inc. and its subsidiaries: Securitize, LLC, an SEC-registered transfer agent; Securitize Markets, LLC, an SEC- registered broker-dealer and member of FINRA and SIPC, that also operates the company’s alternative trading system (ATS); Securitize Capital, LLC, (exempt reporting advisor) the first digital asset management platform of its kind that manages institutional-grade products. Securitize Markets and Securitize Capital are under common ownership. Please refer to the Conflicts of Interest of the offering documents prior to investing. Registration with the SEC does not imply a certain level of skill or training. Investing in securities involves risks, and there is always the potential of losing money when you invest in securities. Before investing, consider your investment objectives and Securitize’s charges and expenses. Nothing in this material should be construed as investment or tax advice, or a solicitation or offer, or recommendation, to buy or sell any security. All images and return and projection figures shown are for illustrative purposes only, may assume additional investments over time, and are not actual Securitize customer or model returns or projections. Visit Securitize.io for any offering documents and other information.