With this business banking app, you can create accounts, accept payments, and manage finances easily. Includes features for bill payments, expense tracking, and card management.

AppRecs review analysis

AppRecs rating 4.4. Trustworthiness 0 out of 100. Review manipulation risk 0 out of 100. Based on a review sample analyzed.

★★★★☆

4.4

AppRecs Rating

Ratings breakdown

5 star

82%

4 star

7%

3 star

4%

2 star

3%

1 star

4%

What to know

✓

High user satisfaction

82% of sampled ratings are 5 stars

About Moniepoint Business Banking

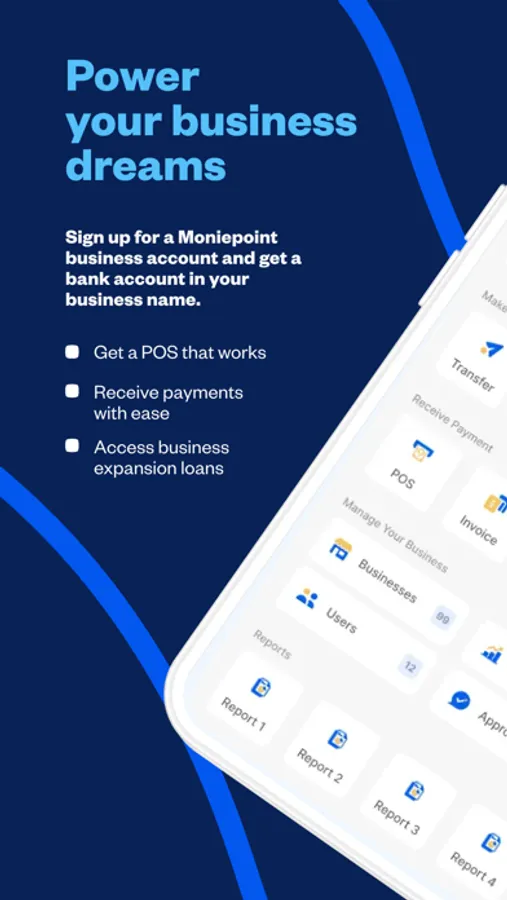

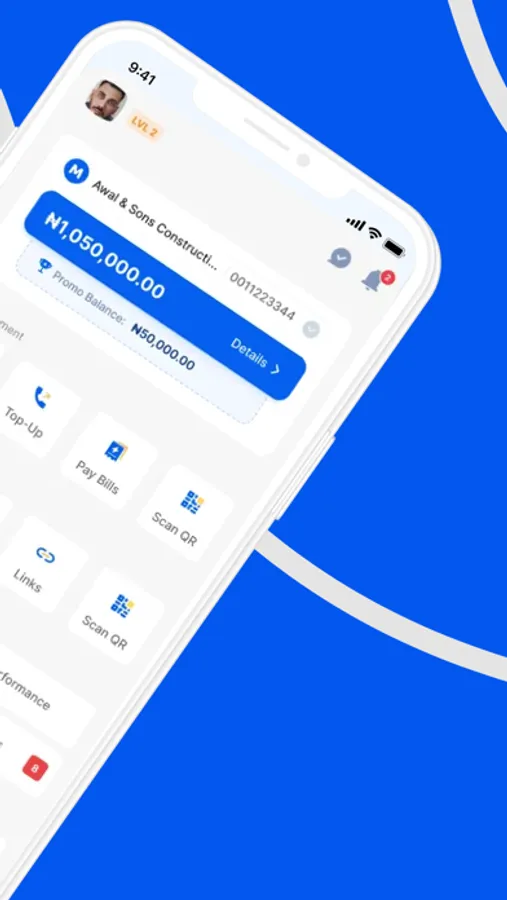

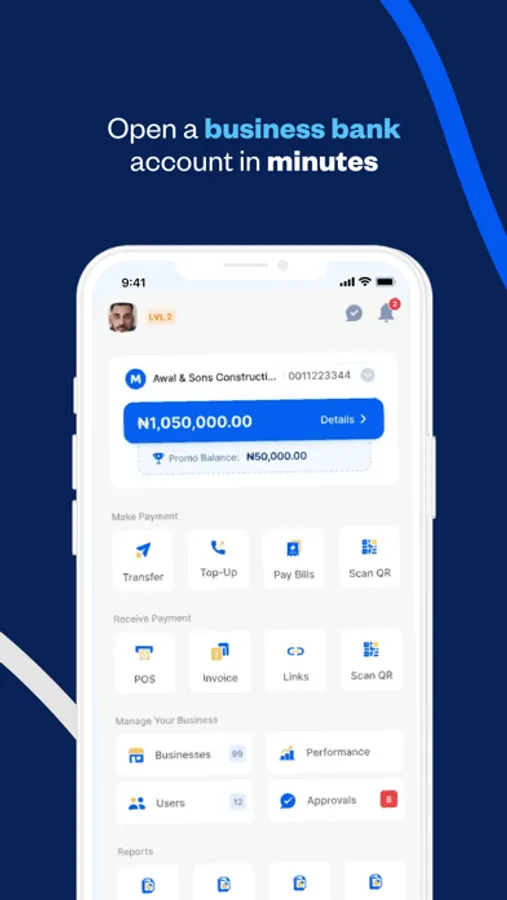

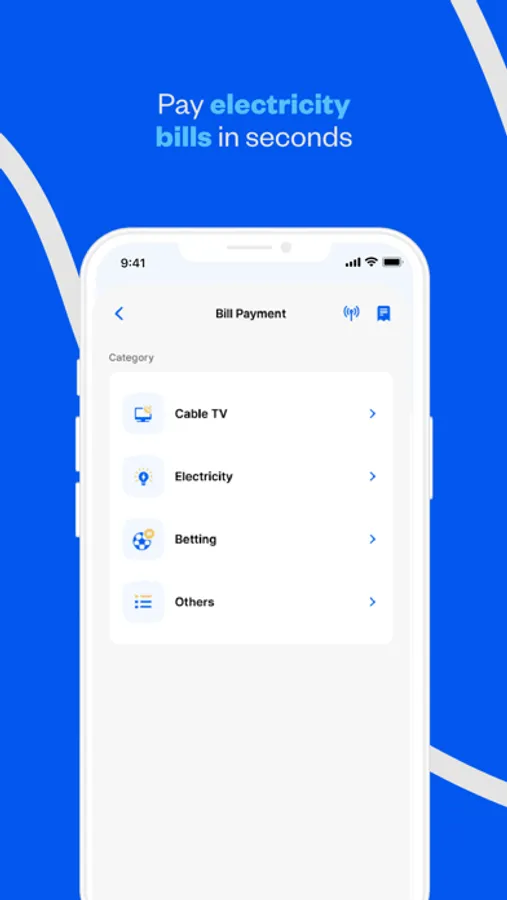

Moniepoint Business Bank provides businesses with access to mobile business banking solutions that enable them to create their own business bank account, accept online and offline payments, purchase airtime, pay utility bills, request expense cards, and manage their business finances with ease.

More than 2 million business customers trust Moniepoint to help them achieve their business goals.

◉ BUSINESS BANKING SOLUTIONS FOR EVERY BUSINESS

Moniepoint Business Bank provides simple yet effective solutions for your business, so you can manage bills, control expenses, handle business money transfers, and grow without limits:

Business Bank Account: Open a business bank account in your business name right from your phone — fast, secure, and hassle-free.

Saving Plans: Save a predetermined amount from transactions made through your POS system and grow your business reserves automatically.

Send and Receive Money: Send funds to any business or individual account effortlessly with no hidden charges. Enjoy fast, reliable transfers that ensure your money reaches its destination securely.

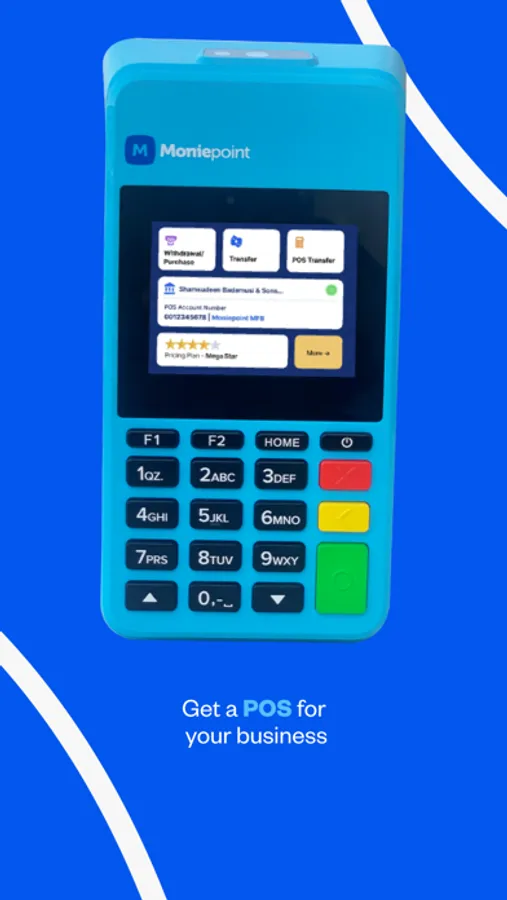

POS Terminals: Receive card and bank transfer payments easily with the Moniepoint POS. Request one right from the app and have it delivered to your doorstep within 48 hours.

Business Expense Cards: Manage your business spending efficiently. Track your expenses in real time, set spending limits, and create budgets that help your business stay on track. Each card costs only ₦1,000 and can be delivered to your doorstep for just ₦1,000.

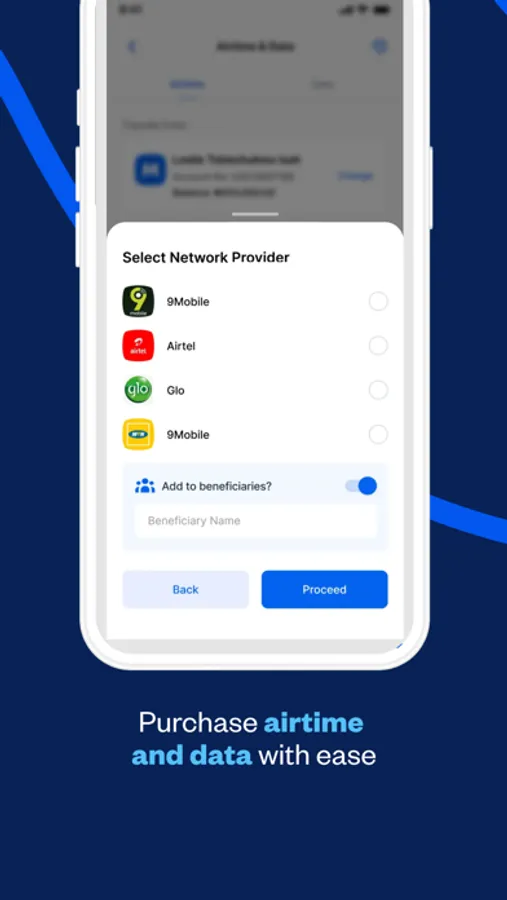

Airtime & Data Purchase with Cashback: Buy airtime and data directly from the app and enjoy 2% cashback on every purchase.

◉ THE BEST BUSINESS BANKING APP TO MANAGE YOUR BUSINESS

Experience a smarter way to manage your business with Moniepoint Business Banking.

Our intuitive mobile app gives you everything you need — from business accounts and expense management tools to bill payments and POS requests — all in one place.

Moniepoint started as an agent banking network and has now evolved into a trusted provider of personal and business banking services.

Moniepoint Microfinance Bank is the definitive bank for small and medium-sized businesses in Nigeria, regulated by the Central Bank of Nigeria (CBN).

Create your business bank account now, send and receive money instantly, buy airtime, pay bills, and request business expense cards or POS terminals delivered to you in less than 48 hours. Join over 2,000,000 satisfied businesses and experience seamless business banking today.

Contact us

Our committed support team is always ready to assist.

Helpline: 01 888 9990

Website: www.moniepoint.com

WhatsApp: +234 908 843 0803

Facebook: @moniepointng

Twitter: @moniepointng

Instagram: @moniepointng

YouTube: @moniepointng

LinkedIn: Moniepoint Nigeria

Address: Plot 7A, Block 4, Admiralty Road, Lekki Phase 1, Lagos State

More than 2 million business customers trust Moniepoint to help them achieve their business goals.

◉ BUSINESS BANKING SOLUTIONS FOR EVERY BUSINESS

Moniepoint Business Bank provides simple yet effective solutions for your business, so you can manage bills, control expenses, handle business money transfers, and grow without limits:

Business Bank Account: Open a business bank account in your business name right from your phone — fast, secure, and hassle-free.

Saving Plans: Save a predetermined amount from transactions made through your POS system and grow your business reserves automatically.

Send and Receive Money: Send funds to any business or individual account effortlessly with no hidden charges. Enjoy fast, reliable transfers that ensure your money reaches its destination securely.

POS Terminals: Receive card and bank transfer payments easily with the Moniepoint POS. Request one right from the app and have it delivered to your doorstep within 48 hours.

Business Expense Cards: Manage your business spending efficiently. Track your expenses in real time, set spending limits, and create budgets that help your business stay on track. Each card costs only ₦1,000 and can be delivered to your doorstep for just ₦1,000.

Airtime & Data Purchase with Cashback: Buy airtime and data directly from the app and enjoy 2% cashback on every purchase.

◉ THE BEST BUSINESS BANKING APP TO MANAGE YOUR BUSINESS

Experience a smarter way to manage your business with Moniepoint Business Banking.

Our intuitive mobile app gives you everything you need — from business accounts and expense management tools to bill payments and POS requests — all in one place.

Moniepoint started as an agent banking network and has now evolved into a trusted provider of personal and business banking services.

Moniepoint Microfinance Bank is the definitive bank for small and medium-sized businesses in Nigeria, regulated by the Central Bank of Nigeria (CBN).

Create your business bank account now, send and receive money instantly, buy airtime, pay bills, and request business expense cards or POS terminals delivered to you in less than 48 hours. Join over 2,000,000 satisfied businesses and experience seamless business banking today.

Contact us

Our committed support team is always ready to assist.

Helpline: 01 888 9990

Website: www.moniepoint.com

WhatsApp: +234 908 843 0803

Facebook: @moniepointng

Twitter: @moniepointng

Instagram: @moniepointng

YouTube: @moniepointng

LinkedIn: Moniepoint Nigeria

Address: Plot 7A, Block 4, Admiralty Road, Lekki Phase 1, Lagos State