NatWest Mobile Banking

National Westminster Bank plc

4.8 ★

5 ratings

Free

In this mobile banking app, you can manage your accounts, set up payments, and monitor transactions. Includes account applications, card controls, and spending analytics features.

AppRecs review analysis

AppRecs rating 4.3. Trustworthiness 0 out of 100. Review manipulation risk 0 out of 100. Based on a review sample analyzed.

★★★★☆

4.3

AppRecs Rating

Ratings breakdown

5 star

90%

4 star

7%

3 star

1%

2 star

0%

1 star

1%

What to know

✓

High user satisfaction

90% of sampled ratings are 5 stars

About NatWest Mobile Banking

Join over 11 million customers and download our NatWest mobile banking app today to make your day-to-day banking easy, quick and secure.

Why the NatWest app?

Manage your money easily and securely:

• Apply for current, savings, child, teen, premier and student accounts quickly. Eligibility criteria apply.

• See all your bank accounts straight from your home screen.

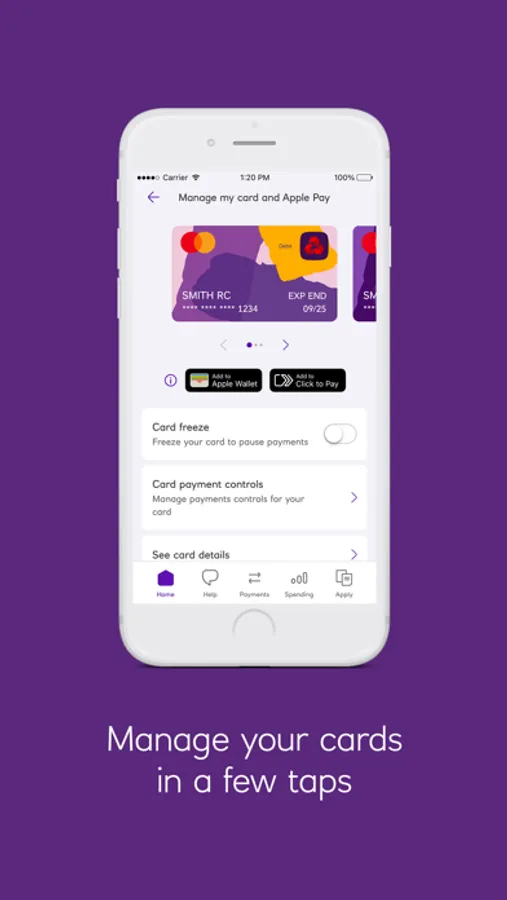

• Freeze and unfreeze your card at any time (Mastercard only).

• Set up touch, voice or face ID for better security and send high value payments in-app, amend payment limits and more. Touch, voice and face ID are only available on selected devices. Optic ID is also available on Apple Vision Pro.

Send, receive and access money quickly:

• Request money via a QR code or link.

• Send money faster with a personalised list of favourite payees.

• Split a bill up to £500 by sharing a payment request link with multiple people at once. (Eligible current accounts only. Payment requests can be sent to anyone with an eligible account with a participating UK bank and uses online or mobile banking. Paying bank criteria and limits may apply.)

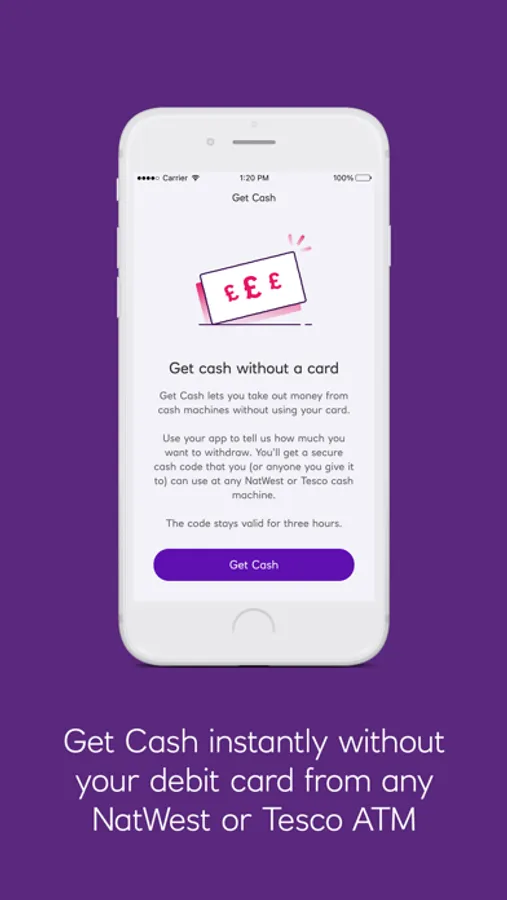

• iPhone only: Get Cash in emergencies with a unique code without using your card. You can withdraw up to £130 every 24 hours at our branded ATMs. You must have a least £10 available in your account and an active debit card (locked or unlocked).

Stay on top of your spending and saving:

• Keep track of payments all in one place.

• Save your spare change with Round Ups if you have an eligible current account and instant access savings account. Round Ups can only be made on debit card and contactless payments in Sterling.

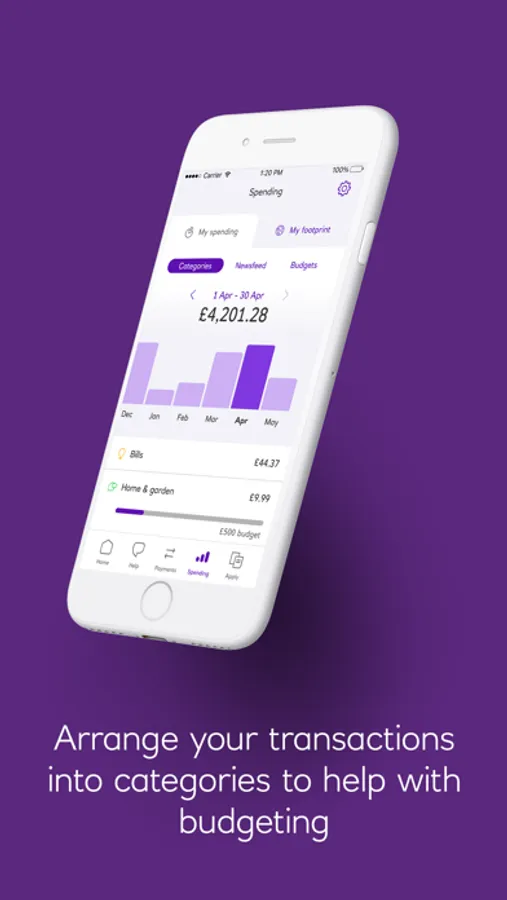

• Budget easily by managing your monthly spending and set categories.

• Turn on push notifications to get alerted when money reaches or leaves your account.

Get support for every life event:

• Spend abroad in Euros and US Dollars without fees or charges by applying for a Travel account. You must have enough money in your travel account. To apply for a Travel account, you need an eligible sole current account and to be over 18. Other terms and fees may apply.

• Get updates on your credit score and insight on how to improve it. Your credit score data is provided by TransUnion and is only available to customers over 18, with a UK address.

• Discover our additional products and services, including mortgages, home and life insurance and loans, in one place.

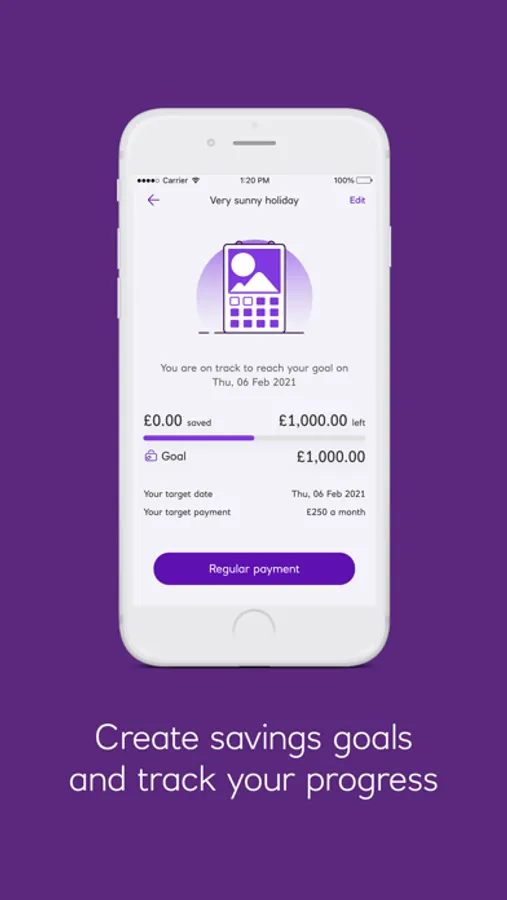

• Fast track your money goals with the help of our handy plans, tools and tips.

Important info

Please note, the app contains images when logging in that may cause a reaction in individuals who are photosensitive. You can switch these off for your device by visiting the settings menu and the accessibility menu where you will be able to find motion and visual control settings within the menu (note this is not within our app, but in the settings of your device itself).

Our app is available to customers aged 11+ with a UK or international mobile number in specific countries. Be aware that some features and products have age restrictions and are only available if you’re over 16 or 18.

By downloading this app, you’re accepting our Terms and Conditions, which can be viewed at natwest.com/mobileterms.

Please save or print a copy along with the Privacy Policy for your record.

Why the NatWest app?

Manage your money easily and securely:

• Apply for current, savings, child, teen, premier and student accounts quickly. Eligibility criteria apply.

• See all your bank accounts straight from your home screen.

• Freeze and unfreeze your card at any time (Mastercard only).

• Set up touch, voice or face ID for better security and send high value payments in-app, amend payment limits and more. Touch, voice and face ID are only available on selected devices. Optic ID is also available on Apple Vision Pro.

Send, receive and access money quickly:

• Request money via a QR code or link.

• Send money faster with a personalised list of favourite payees.

• Split a bill up to £500 by sharing a payment request link with multiple people at once. (Eligible current accounts only. Payment requests can be sent to anyone with an eligible account with a participating UK bank and uses online or mobile banking. Paying bank criteria and limits may apply.)

• iPhone only: Get Cash in emergencies with a unique code without using your card. You can withdraw up to £130 every 24 hours at our branded ATMs. You must have a least £10 available in your account and an active debit card (locked or unlocked).

Stay on top of your spending and saving:

• Keep track of payments all in one place.

• Save your spare change with Round Ups if you have an eligible current account and instant access savings account. Round Ups can only be made on debit card and contactless payments in Sterling.

• Budget easily by managing your monthly spending and set categories.

• Turn on push notifications to get alerted when money reaches or leaves your account.

Get support for every life event:

• Spend abroad in Euros and US Dollars without fees or charges by applying for a Travel account. You must have enough money in your travel account. To apply for a Travel account, you need an eligible sole current account and to be over 18. Other terms and fees may apply.

• Get updates on your credit score and insight on how to improve it. Your credit score data is provided by TransUnion and is only available to customers over 18, with a UK address.

• Discover our additional products and services, including mortgages, home and life insurance and loans, in one place.

• Fast track your money goals with the help of our handy plans, tools and tips.

Important info

Please note, the app contains images when logging in that may cause a reaction in individuals who are photosensitive. You can switch these off for your device by visiting the settings menu and the accessibility menu where you will be able to find motion and visual control settings within the menu (note this is not within our app, but in the settings of your device itself).

Our app is available to customers aged 11+ with a UK or international mobile number in specific countries. Be aware that some features and products have age restrictions and are only available if you’re over 16 or 18.

By downloading this app, you’re accepting our Terms and Conditions, which can be viewed at natwest.com/mobileterms.

Please save or print a copy along with the Privacy Policy for your record.