In this mobile banking app, users can manage accounts, make payments, and apply for loans or credit cards. Includes account management, payment options, and security features.

AppRecs review analysis

AppRecs rating 4.3. Trustworthiness 0 out of 100. Review manipulation risk 0 out of 100. Based on a review sample analyzed.

★★★★☆

4.3

AppRecs Rating

Ratings breakdown

5 star

80%

4 star

6%

3 star

2%

2 star

1%

1 star

11%

What to know

✓

High user satisfaction

86% of sampled ratings are 4+ stars (4.4★ average)

About AIB Mobile

What's banking without a mobile app?

With the AIB Mobile Banking app you can manage your everyday banking anywhere and anytime, from your phone. Freedom and flexibility to do whatever you need, whenever you want.

Meeting your needs:

- If you want to become an AIB customer and need a current account, you can open an AIB account on the AIB app if you're aged 16 and over, live in the Republic of Ireland and have a valid passport or other acceptable Photographic ID.

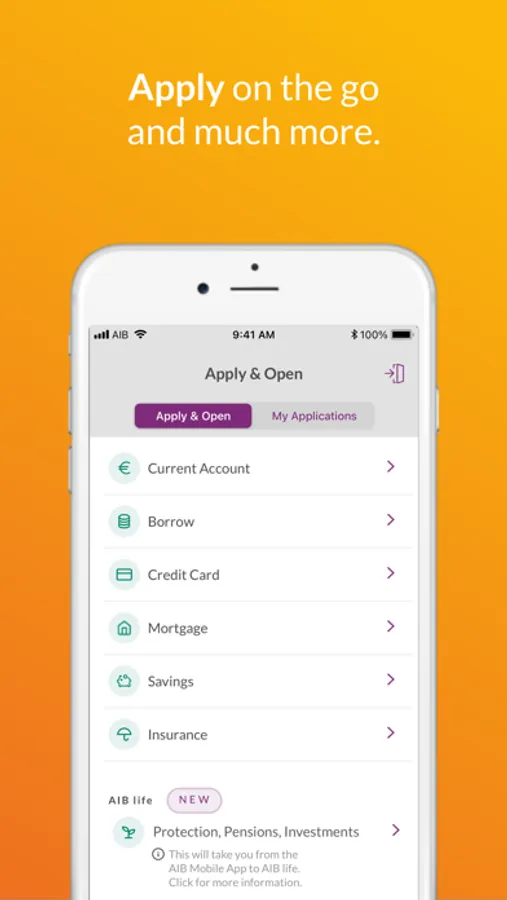

- Personal Loan: Use the app to apply for a personal loan or loan top-up, up to €30,000.

- Overdraft: Apply for an overdraft in your app in minutes.

- Credit card: Apply in your app in minutes.

Making and managing payments has never been easier:

- Pay another AIB customer with Pay a contact using just their phone number. Maximum transfer is €1,000

- Simply pay another Irish bank account with a one-off payment up to €1,000

- Avail of Apple Pay, & Fitbit Pay.

- Quickly manage standing orders & debit debits

- View, print, save & share up to seven years of statements.

Safeguarding your banking:

- Strong Customer Authentication (SCA) adds an extra layer of security to your online shopping.

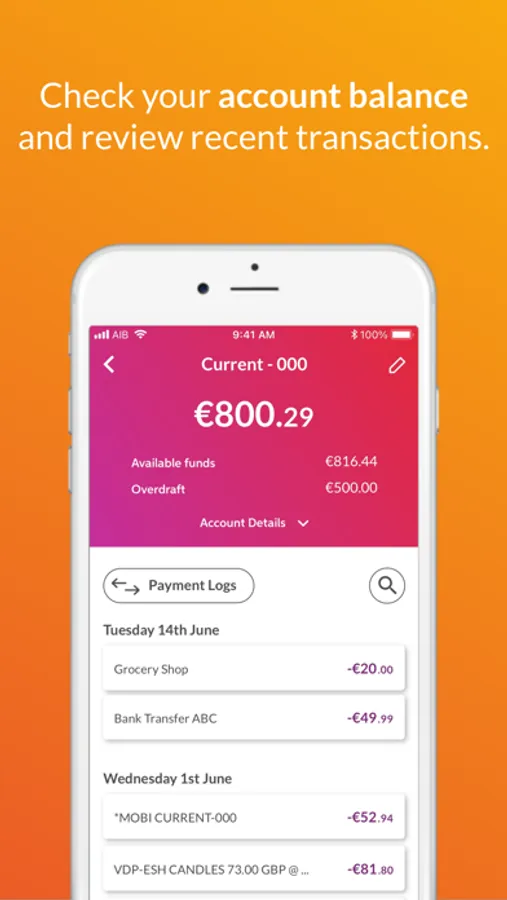

- Tap your transactions to see more information like the time, date and type of transaction made.

- Freeze your lost card to keep your money safe – and it's just as easy to unfreeze the card if you find it.

- Need a replacement card? Use the app to cancel your old one and have a new one posted to you.

- Secure Login - Use a compatible smartphone to login securely with FaceID or TouchID.

You can also use the AIB Mobile app to:

- Quick balance: Check up to two balances without logging in.

- Change your address: If you have a sole account, you can change your address on the AIB app.

- See your PIN: If you forget a Debit card PIN you can see it in the app.

- Open a Savings or Current account: You can open an account in minutes

And much much more…

To use the app you need to be registered for AIB Phone and Internet Banking.

For AIB Mobile information and FAQ's visit: https://aib.ie/ways-to-bank/mobile-banking

For information about our Loan products visit: https://aib.ie/our-products/loans

AIB Mobile is available 20 hours a day, subject to our terms and conditions – we have some nightly maintenance needs.

Transaction fees and charges, and transaction limits may apply.

Allied Irish Banks, p.l.c. is regulated by the Central Bank of Ireland

With the AIB Mobile Banking app you can manage your everyday banking anywhere and anytime, from your phone. Freedom and flexibility to do whatever you need, whenever you want.

Meeting your needs:

- If you want to become an AIB customer and need a current account, you can open an AIB account on the AIB app if you're aged 16 and over, live in the Republic of Ireland and have a valid passport or other acceptable Photographic ID.

- Personal Loan: Use the app to apply for a personal loan or loan top-up, up to €30,000.

- Overdraft: Apply for an overdraft in your app in minutes.

- Credit card: Apply in your app in minutes.

Making and managing payments has never been easier:

- Pay another AIB customer with Pay a contact using just their phone number. Maximum transfer is €1,000

- Simply pay another Irish bank account with a one-off payment up to €1,000

- Avail of Apple Pay, & Fitbit Pay.

- Quickly manage standing orders & debit debits

- View, print, save & share up to seven years of statements.

Safeguarding your banking:

- Strong Customer Authentication (SCA) adds an extra layer of security to your online shopping.

- Tap your transactions to see more information like the time, date and type of transaction made.

- Freeze your lost card to keep your money safe – and it's just as easy to unfreeze the card if you find it.

- Need a replacement card? Use the app to cancel your old one and have a new one posted to you.

- Secure Login - Use a compatible smartphone to login securely with FaceID or TouchID.

You can also use the AIB Mobile app to:

- Quick balance: Check up to two balances without logging in.

- Change your address: If you have a sole account, you can change your address on the AIB app.

- See your PIN: If you forget a Debit card PIN you can see it in the app.

- Open a Savings or Current account: You can open an account in minutes

And much much more…

To use the app you need to be registered for AIB Phone and Internet Banking.

For AIB Mobile information and FAQ's visit: https://aib.ie/ways-to-bank/mobile-banking

For information about our Loan products visit: https://aib.ie/our-products/loans

AIB Mobile is available 20 hours a day, subject to our terms and conditions – we have some nightly maintenance needs.

Transaction fees and charges, and transaction limits may apply.

Allied Irish Banks, p.l.c. is regulated by the Central Bank of Ireland