Standard Life

Standard Life Assets and Employee Services Limited

4.3 ★

24 ratings

Free

AppRecs review analysis

AppRecs rating 4.3. Trustworthiness 0 out of 100. Review manipulation risk 0 out of 100. Based on a review sample analyzed.

★★★★☆

4.3

AppRecs Rating

Ratings breakdown

5 star

71%

4 star

13%

3 star

0%

2 star

4%

1 star

13%

What to know

✓

High user satisfaction

83% of sampled ratings are 4+ stars (4.3★ average)

About Standard Life

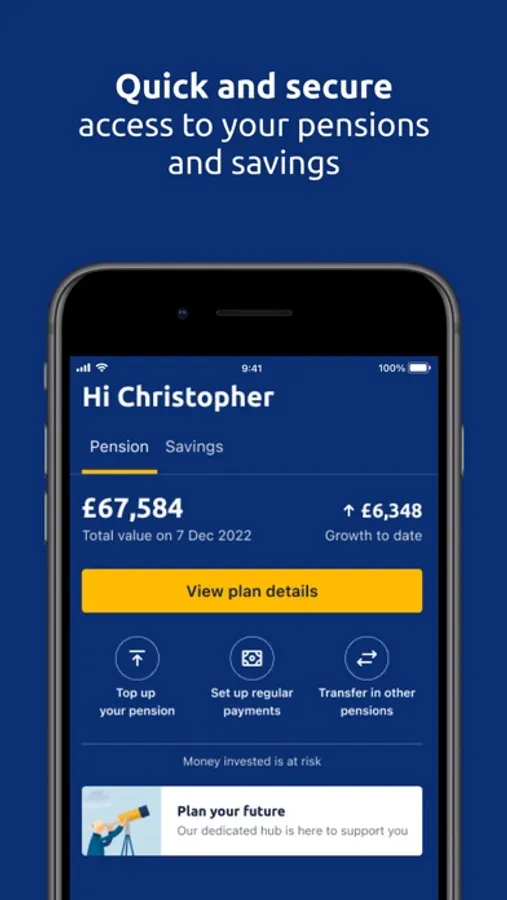

The Standard Life app includes great features which can help you manage your money on the go.

Our App provides the ability to:

- Manage your pension payments: increase, setup, stop & reduce

- Top up your pension

- View recent transactions

- View the value of your plan(s), fund performance and daily fund changes

- Manage your beneficiaries

- Update your retirement date

- Transfer in other pensions

- Change your investments

- Withdraw cash if aged 55 or over

- View charges & discounts on your pension plan

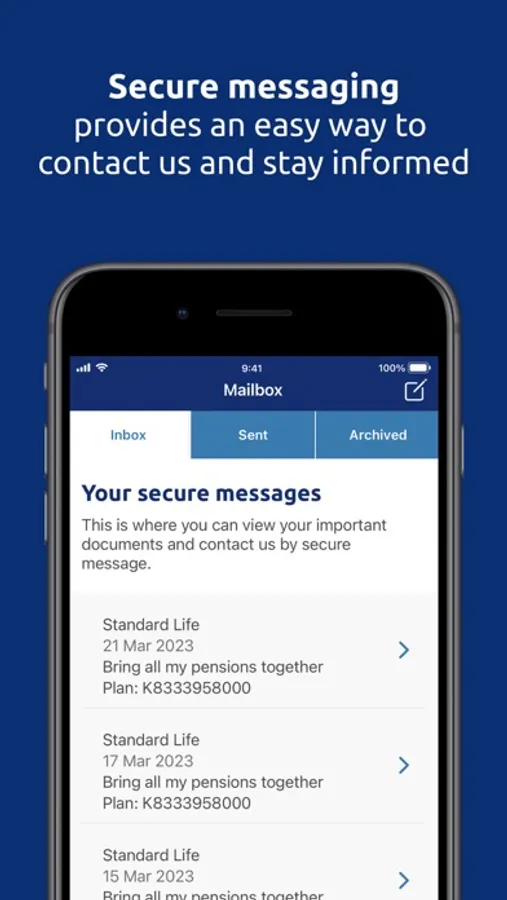

Send and receive secure messages with attachments via the mailbox and there is an option to be notified when you receive a new message.

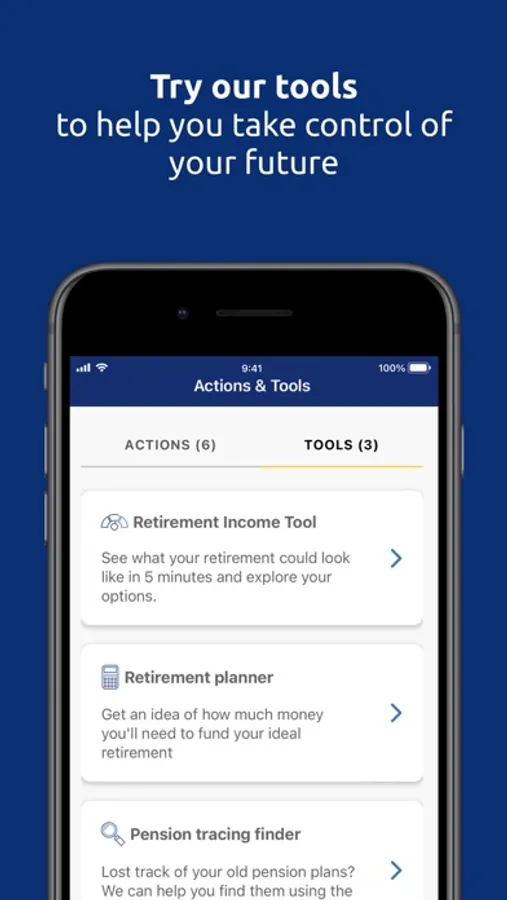

Why not try our retirement income tool to see what your retirement could look like in 5 minutes and explore your options.

We aim to provide access to the features listed wherever possible, but not all products are supported

Help and support

You can access FAQs from our Help page or send us a secure message about your plan from our Mailbox page.

If you run into any issues with the App let us know at: mobile-app@standardlife.com

Feedback

We are always updating the App with new features and tools. We want to hear from you - you can leave us a review or leave feedback in the App within the help section.

Getting started

You must be a customer with us to use the App. If you are not registered for online servicing you can do this on the App. Once you are logged in you can choose to set a passcode, fingerprint or facial recognition if your device allows.

Additional information

The Standard Life app is not available for WRAP products and Aberdeen Standard Capital customers.

Some With Profits Policies, along with some of our Bonds and Investment Fund products cannot be viewed.

Transferring other pensions won’t be right for everyone.

Payments and withdrawals

Not all products support payments through the app and you may be prompted to contact us or your employer if you have a workplace pension. Any changes to regular payments will come from the bank account that you have set up with us.

When making payments, topping up or amending a regular payment it’s important to note that investment returns aren't guaranteed. The value of your investment can go down as well as up and may be worth less than you paid in.

Cookie policy

Cookies do many different jobs like storing your preferences, helping you navigate effectively, and improving your overall experience of a website or app. Cookies make the interaction between you and the app quicker and easier. For example, a cookie might store information so you don't have to keep entering it.

Some cookies are needed to make our app work and keep it secure so they can't be turned off. These are classed as 'essential cookies'. Others are optional and you can change your preferences, these are classed as 'experience and insight cookies'.

Who we are

Phoenix Life Limited, trading name as Standard Life, is registered in England and Wales (1016269) at 10 Brindleyplace, Birmingham, B1 2JB. Phoenix Life Limited is authorised by the Prudential Regulation Authority and regulated by the Financial Conduct Authority and the Prudential Regulation Authority.

Phoenix Life Limited uses the Standard Life brand, name and logo under licence from Phoenix Group Management Services Limited.

©2025 Phoenix Group Management Services Limited. All rights reserved

Our App provides the ability to:

- Manage your pension payments: increase, setup, stop & reduce

- Top up your pension

- View recent transactions

- View the value of your plan(s), fund performance and daily fund changes

- Manage your beneficiaries

- Update your retirement date

- Transfer in other pensions

- Change your investments

- Withdraw cash if aged 55 or over

- View charges & discounts on your pension plan

Send and receive secure messages with attachments via the mailbox and there is an option to be notified when you receive a new message.

Why not try our retirement income tool to see what your retirement could look like in 5 minutes and explore your options.

We aim to provide access to the features listed wherever possible, but not all products are supported

Help and support

You can access FAQs from our Help page or send us a secure message about your plan from our Mailbox page.

If you run into any issues with the App let us know at: mobile-app@standardlife.com

Feedback

We are always updating the App with new features and tools. We want to hear from you - you can leave us a review or leave feedback in the App within the help section.

Getting started

You must be a customer with us to use the App. If you are not registered for online servicing you can do this on the App. Once you are logged in you can choose to set a passcode, fingerprint or facial recognition if your device allows.

Additional information

The Standard Life app is not available for WRAP products and Aberdeen Standard Capital customers.

Some With Profits Policies, along with some of our Bonds and Investment Fund products cannot be viewed.

Transferring other pensions won’t be right for everyone.

Payments and withdrawals

Not all products support payments through the app and you may be prompted to contact us or your employer if you have a workplace pension. Any changes to regular payments will come from the bank account that you have set up with us.

When making payments, topping up or amending a regular payment it’s important to note that investment returns aren't guaranteed. The value of your investment can go down as well as up and may be worth less than you paid in.

Cookie policy

Cookies do many different jobs like storing your preferences, helping you navigate effectively, and improving your overall experience of a website or app. Cookies make the interaction between you and the app quicker and easier. For example, a cookie might store information so you don't have to keep entering it.

Some cookies are needed to make our app work and keep it secure so they can't be turned off. These are classed as 'essential cookies'. Others are optional and you can change your preferences, these are classed as 'experience and insight cookies'.

Who we are

Phoenix Life Limited, trading name as Standard Life, is registered in England and Wales (1016269) at 10 Brindleyplace, Birmingham, B1 2JB. Phoenix Life Limited is authorised by the Prudential Regulation Authority and regulated by the Financial Conduct Authority and the Prudential Regulation Authority.

Phoenix Life Limited uses the Standard Life brand, name and logo under licence from Phoenix Group Management Services Limited.

©2025 Phoenix Group Management Services Limited. All rights reserved