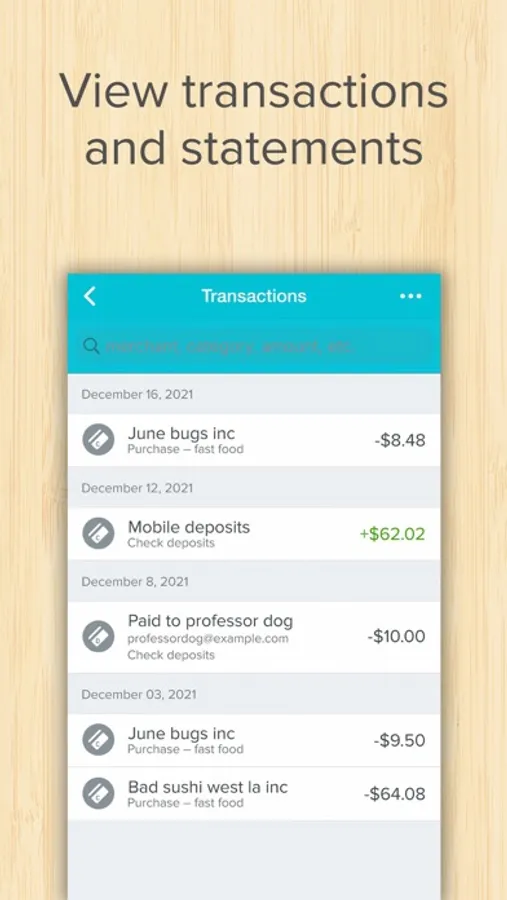

In this mobile banking app, you can check your balance, transfer funds, and pay bills. Includes free ATM access, mobile deposits, and bill payment features.

AppRecs review analysis

AppRecs rating 3.7. Trustworthiness 0 out of 100. Review manipulation risk 0 out of 100. Based on a review sample analyzed.

★★★☆☆

3.7

AppRecs Rating

Ratings breakdown

5 star

72%

4 star

6%

3 star

3%

2 star

3%

1 star

16%

What to know

✓

High user satisfaction

78% of sampled ratings are 4+ stars (4.1★ average)

⚠

Pricing complaints

Many low ratings mention paywalls or pricing

About GoBank - Mobile Banking

Free ATM network. Limits apply*. No surprise fees. No worries. Try GoBank’s award-winning mobile app now!

GoBank is a checking account made for people who are fed up with big banks and their big fees, and designed to be accessed on a mobile phone. It’s fast (works like your other favorite apps), fair (no surprise fees) and feature-rich (keep reading for a sneak peek).

WHY GOBANK?

NO SURPRISE FEES

Seriously. GoBank has no surprise fees. Check out GoBank.com/NoWorries to see what we mean.

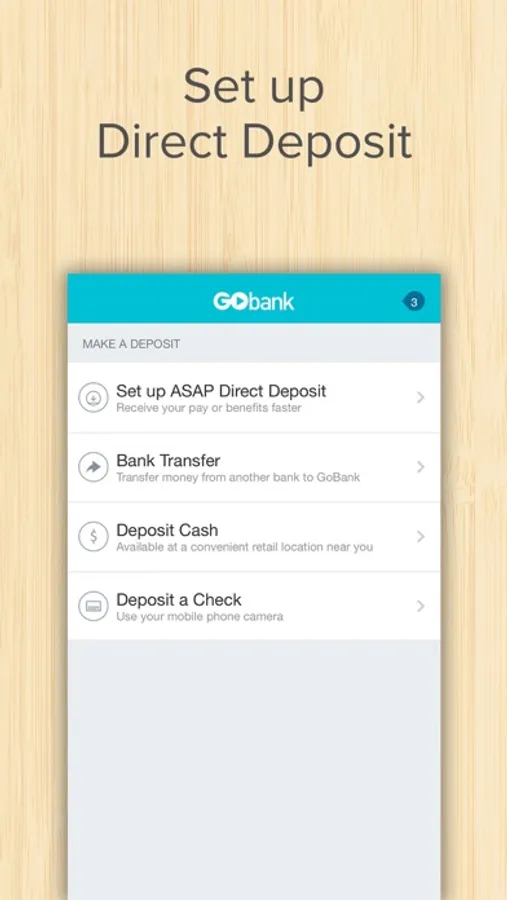

GET YOUR PAY UP TO 2 DAYS FASTER WITH ASAP DIRECT DEPOSIT™

Direct Deposit early availability depends on timing of payor’s payment instructions and fraud prevention restrictions may apply. As such, the availability or timing of early direct deposit may vary from pay period to pay period. Make sure the name and social security number on file with your employer or benefits provider matches what’s on your GoBank account exactly. We will not be able to deposit your payment if we are unable to match recipients.

SIGN UP FOR DIRECT DEPOSIT

If you’re not eligible for the above, you can still sign up for direct deposit to get your pay faster than a paper check!

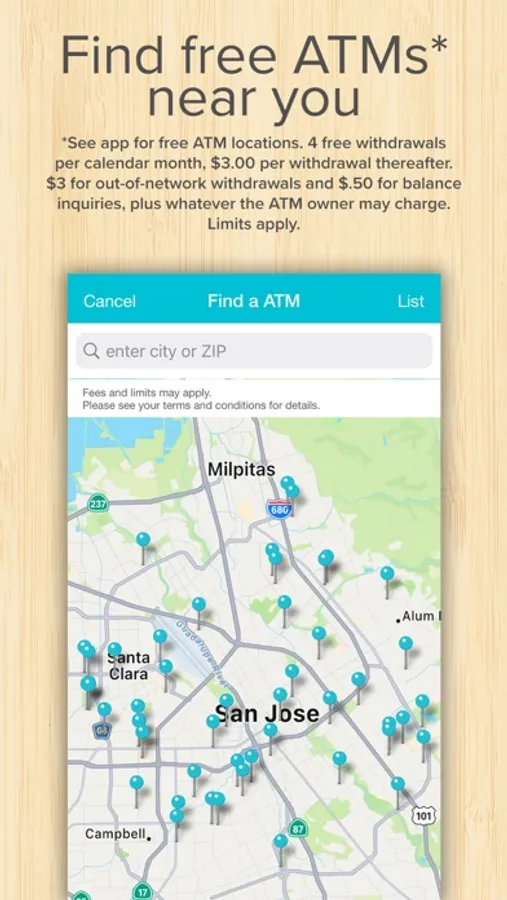

FREE ATMS*.

* See app for free ATM locations. 4 free withdrawals per calendar month, $3.00 per withdrawal thereafter. $3 for out-of-network withdrawals and $.50 for balance inquiries, plus any fee the ATM owner may charge. Limits apply.

PAY BILLS

Pay rent, or any bill with the GoBank app or website. Need to send a check to your landlord (or anyone else)? No problem. We’ll mail the check for free.

SEND MONEY FAST

Quickly send money to friends, family and even the dog groomer who have GoBank accounts. We notify them via email or text message.

DEPOSIT CASH

Just take your GoBank debit card and cash to any participating retail location. Swipe your card or hand it to the cashier, and the cash will be deposited to your account automatically. Fees may apply.

MOBILE DEPOSITS

Our nearest bank branch is in your pocket. Use your phone to scan a check and deposit it into your account. You may be asked to upload your ID.

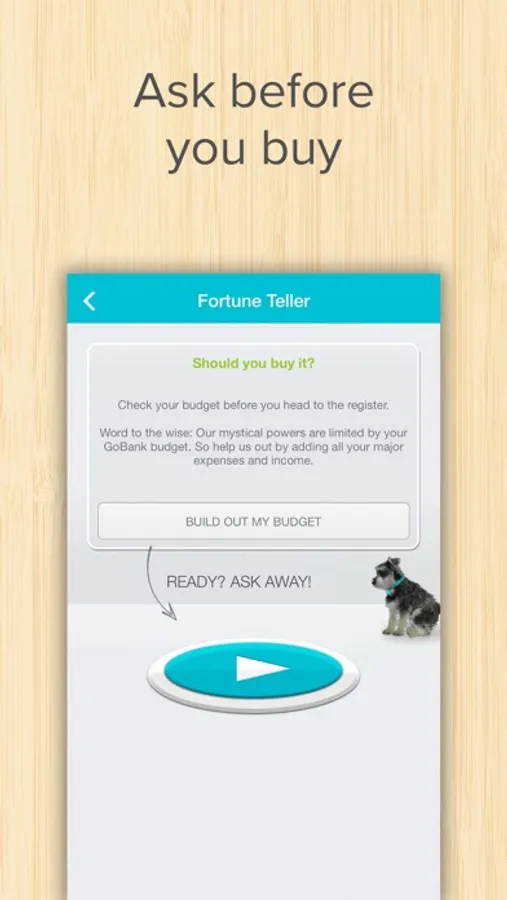

FREE ADVICE: FORTUNE TELLER™

Use the Fortune Teller to double-check your budget before you spend. Just tell us how much it costs, and we’ll give you a quick yay or nay based on the budget you’ve created.

FYI: We'll need to successfully verify your ID before you can use all of GoBank's award-winning features.

Questions about your GoBank account?

Call us at the number on the back of your card (24/7 support).

Or log in to gobank.com & email us through the Contact Us page.

Stay in touch with us!

Follow us on Twitter @GoBank and on Instagram @GoBankOfficial. While you’re at it, like us on Facebook.com/GoBank. We’d love to meet you and answer any questions you may have.

* See app for free ATM locations. 4 free withdrawals per calendar month, $3.00 per withdrawal thereafter. $3 for out-of-network withdrawals and $.50 for balance inquiries, plus any fee the ATM owner may charge. Limits apply.

GoBank is a brand of Green Dot Bank, Member FDIC, which also operates under the brands Green Dot Bank and Bonneville Bank. Deposits under any of these trade names are deposits with a single FDIC-insured bank, Green Dot Bank, and are aggregated for deposit insurance coverage.

©2013-2022 Green Dot Bank. All rights reserved.

Terms of Use: https://m.gobank.com/static/other/GoBank_Mobile_App_EULA_Android_version.pdf

Privacy Policy: https://m.gobank.com/privacy-policy

Technology Privacy Statement: https://m.gobank.com/banking-agreement

GoBank is a checking account made for people who are fed up with big banks and their big fees, and designed to be accessed on a mobile phone. It’s fast (works like your other favorite apps), fair (no surprise fees) and feature-rich (keep reading for a sneak peek).

WHY GOBANK?

NO SURPRISE FEES

Seriously. GoBank has no surprise fees. Check out GoBank.com/NoWorries to see what we mean.

GET YOUR PAY UP TO 2 DAYS FASTER WITH ASAP DIRECT DEPOSIT™

Direct Deposit early availability depends on timing of payor’s payment instructions and fraud prevention restrictions may apply. As such, the availability or timing of early direct deposit may vary from pay period to pay period. Make sure the name and social security number on file with your employer or benefits provider matches what’s on your GoBank account exactly. We will not be able to deposit your payment if we are unable to match recipients.

SIGN UP FOR DIRECT DEPOSIT

If you’re not eligible for the above, you can still sign up for direct deposit to get your pay faster than a paper check!

FREE ATMS*.

* See app for free ATM locations. 4 free withdrawals per calendar month, $3.00 per withdrawal thereafter. $3 for out-of-network withdrawals and $.50 for balance inquiries, plus any fee the ATM owner may charge. Limits apply.

PAY BILLS

Pay rent, or any bill with the GoBank app or website. Need to send a check to your landlord (or anyone else)? No problem. We’ll mail the check for free.

SEND MONEY FAST

Quickly send money to friends, family and even the dog groomer who have GoBank accounts. We notify them via email or text message.

DEPOSIT CASH

Just take your GoBank debit card and cash to any participating retail location. Swipe your card or hand it to the cashier, and the cash will be deposited to your account automatically. Fees may apply.

MOBILE DEPOSITS

Our nearest bank branch is in your pocket. Use your phone to scan a check and deposit it into your account. You may be asked to upload your ID.

FREE ADVICE: FORTUNE TELLER™

Use the Fortune Teller to double-check your budget before you spend. Just tell us how much it costs, and we’ll give you a quick yay or nay based on the budget you’ve created.

FYI: We'll need to successfully verify your ID before you can use all of GoBank's award-winning features.

Questions about your GoBank account?

Call us at the number on the back of your card (24/7 support).

Or log in to gobank.com & email us through the Contact Us page.

Stay in touch with us!

Follow us on Twitter @GoBank and on Instagram @GoBankOfficial. While you’re at it, like us on Facebook.com/GoBank. We’d love to meet you and answer any questions you may have.

* See app for free ATM locations. 4 free withdrawals per calendar month, $3.00 per withdrawal thereafter. $3 for out-of-network withdrawals and $.50 for balance inquiries, plus any fee the ATM owner may charge. Limits apply.

GoBank is a brand of Green Dot Bank, Member FDIC, which also operates under the brands Green Dot Bank and Bonneville Bank. Deposits under any of these trade names are deposits with a single FDIC-insured bank, Green Dot Bank, and are aggregated for deposit insurance coverage.

©2013-2022 Green Dot Bank. All rights reserved.

Terms of Use: https://m.gobank.com/static/other/GoBank_Mobile_App_EULA_Android_version.pdf

Privacy Policy: https://m.gobank.com/privacy-policy

Technology Privacy Statement: https://m.gobank.com/banking-agreement