About HKSMN

Company Background

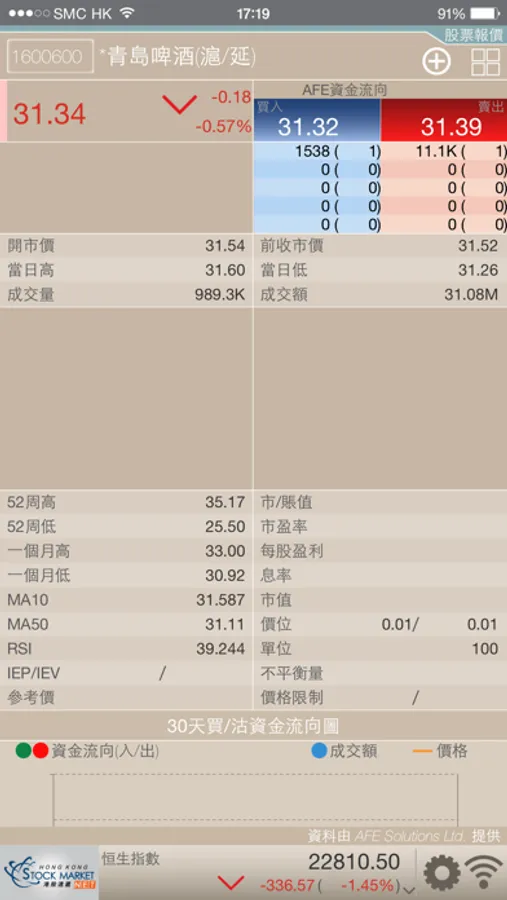

HKSMN is a new generation stock information system jointly developed by PCCW and AFE Solutions Limited. AFE Solutions Limited is the leading information provider for real-time prices, news and analytics in Hong Kong financial market. Established since 1983, AFE has been serving major brokerage firms and banks in HK with its high quality stocks market information terminals and trading systems. Among AFE self-developed exclusive AFE Real Time Bought/Sold Fund Flow that has become an indispensable and crucial reference for professional investors and traders.

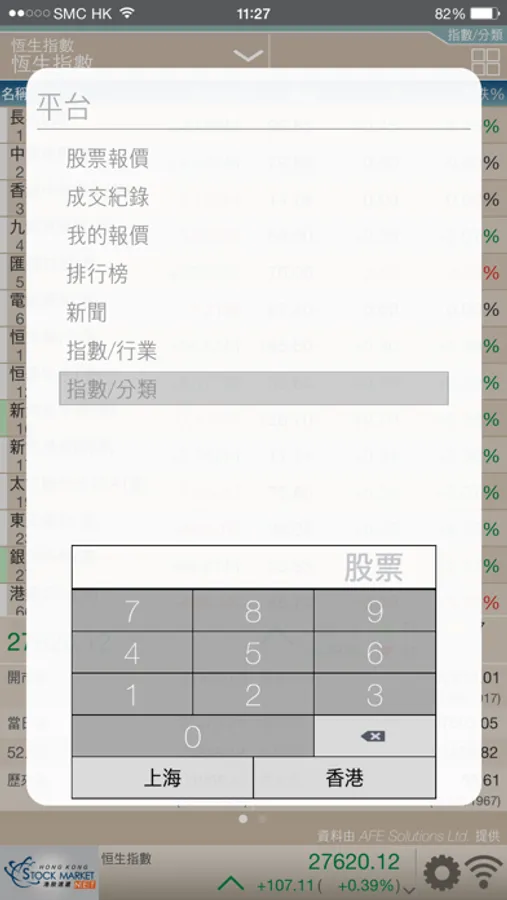

You are invited to experience this rich and powerful HKSMN information through your handheld device.The main features / information are as below:

- Cover all stocks and derivatives instruments - warrants and CBBC.

- Exclusive AFE Bought/Sold Fund Flow & daily chart, Order & Broker Queue etc

- Real-time exclusive AFE Bought/Sold Fund Flow, TOP 20 Warrants/CBBC ranking feature (by turnover) the most active Warrants/CBBC in the market.

Transaction Log

- provide full transaction log for all stocks.

My Quote:

- A simply touch in each stock code to add into your "My Quote" page.

World / Local Indexes and Industry Performance:

- Hang Seng Index (HSI), Hang Seng China Enterprise Index (HSCEI) and Hang Seng China-Affiliated Corporations Index (HSCCI).

- Equip yourself with unique exclusive AFE Bought/Sold Fund Flow analysis of major Indexes with industry categorization.

Index Constituents:

- Provide Index Constituents for major Indexes.

Charting Analysis:

- Choose from a wide range of historical chart (from 30days to 12months)

- View it in your preferred format (Bar, Line Chart, Candlestick).

AFE Alert:

- Comprehensive self-monitoring system for about 90 Constituent Stocks of Hang Seng Index, China Enterprise Index & China-Aff Corp Index.

- AFE Alert provides auto news for these stocks which triggers either of 24 pre-set technical breakthroughs or popular analytical indicators.

Top 20 Ranking:

- Full choices of Top 20 Rankings with AFE bought / sold fund flow.

HKSMN is a new generation stock information system jointly developed by PCCW and AFE Solutions Limited. AFE Solutions Limited is the leading information provider for real-time prices, news and analytics in Hong Kong financial market. Established since 1983, AFE has been serving major brokerage firms and banks in HK with its high quality stocks market information terminals and trading systems. Among AFE self-developed exclusive AFE Real Time Bought/Sold Fund Flow that has become an indispensable and crucial reference for professional investors and traders.

You are invited to experience this rich and powerful HKSMN information through your handheld device.The main features / information are as below:

- Cover all stocks and derivatives instruments - warrants and CBBC.

- Exclusive AFE Bought/Sold Fund Flow & daily chart, Order & Broker Queue etc

- Real-time exclusive AFE Bought/Sold Fund Flow, TOP 20 Warrants/CBBC ranking feature (by turnover) the most active Warrants/CBBC in the market.

Transaction Log

- provide full transaction log for all stocks.

My Quote:

- A simply touch in each stock code to add into your "My Quote" page.

World / Local Indexes and Industry Performance:

- Hang Seng Index (HSI), Hang Seng China Enterprise Index (HSCEI) and Hang Seng China-Affiliated Corporations Index (HSCCI).

- Equip yourself with unique exclusive AFE Bought/Sold Fund Flow analysis of major Indexes with industry categorization.

Index Constituents:

- Provide Index Constituents for major Indexes.

Charting Analysis:

- Choose from a wide range of historical chart (from 30days to 12months)

- View it in your preferred format (Bar, Line Chart, Candlestick).

AFE Alert:

- Comprehensive self-monitoring system for about 90 Constituent Stocks of Hang Seng Index, China Enterprise Index & China-Aff Corp Index.

- AFE Alert provides auto news for these stocks which triggers either of 24 pre-set technical breakthroughs or popular analytical indicators.

Top 20 Ranking:

- Full choices of Top 20 Rankings with AFE bought / sold fund flow.