Finispia

Finispia Investment Inc.

Free

rated 3.0 stars

About Finispia

OVERVIEW

Finsipia is a stock screening tool designed for making Islamic investment easier. Now you can know which stock is halal and which one is not. Whether you are looking to invest halal for yourself or for someone else, Finsipia is here to help.

WHAT MAKES FINISPIA DIFFERENT?

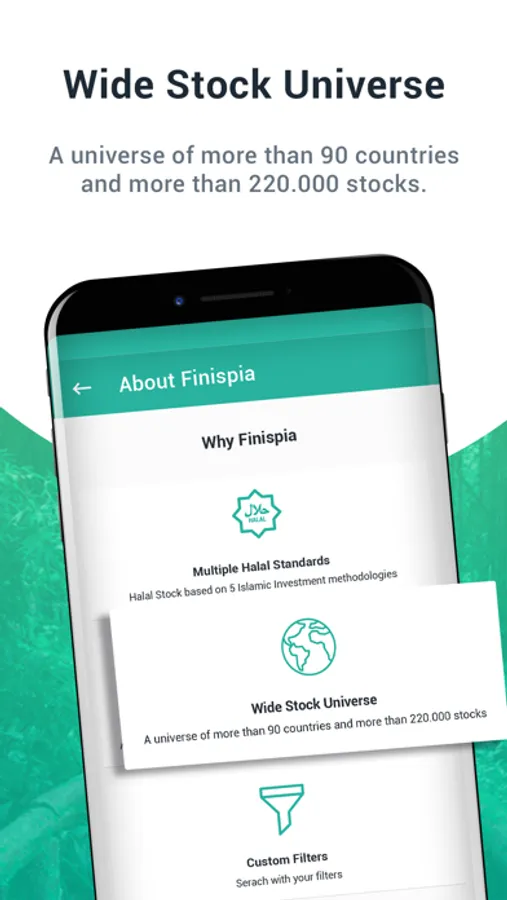

* Multiple Halal Standards: Halal stock results based on 5 Islamic investment methodologies.

* Wide Stock Universe: More than 90 countries and more than 220.000 stocks.

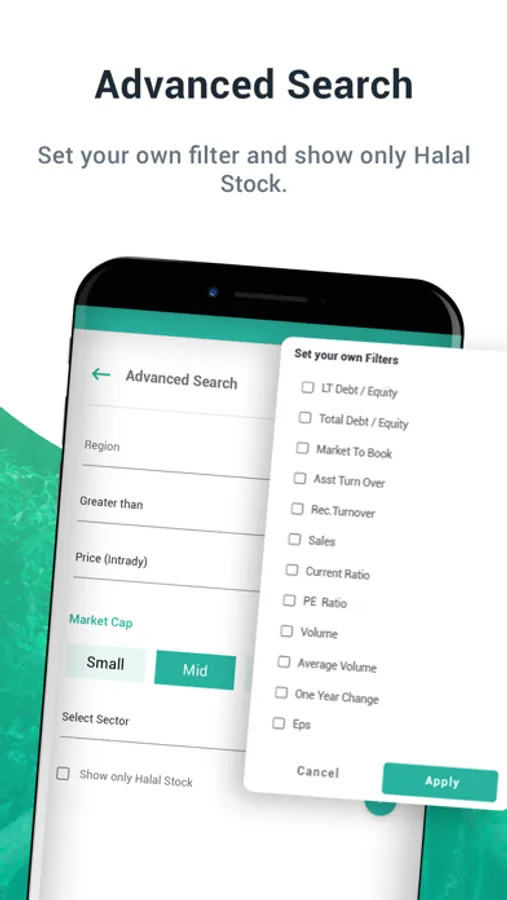

* Advanced Filtering: Filter by country, by sector, by ratios, by only halal stocks, etc.

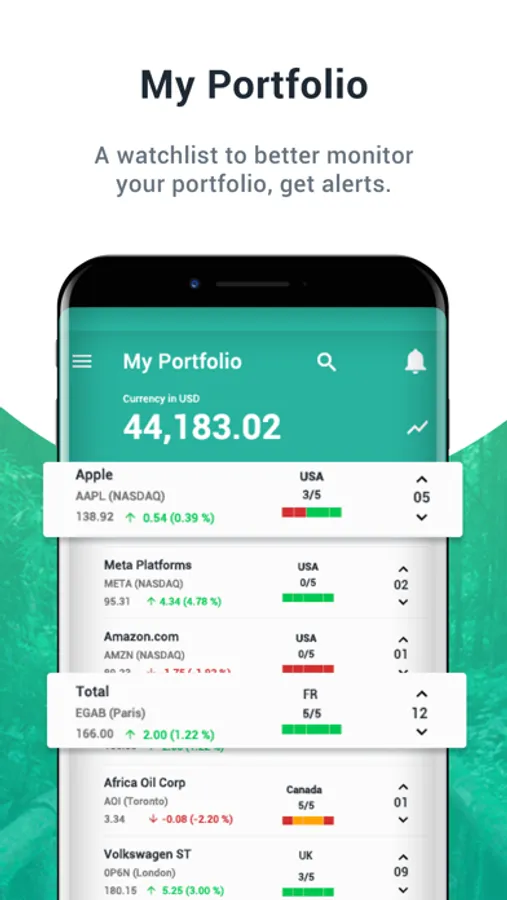

* Monitor Portfolio: Add stock to your watch list.

* Stay Vigilant: Get alert if stock turn out of halal universe.

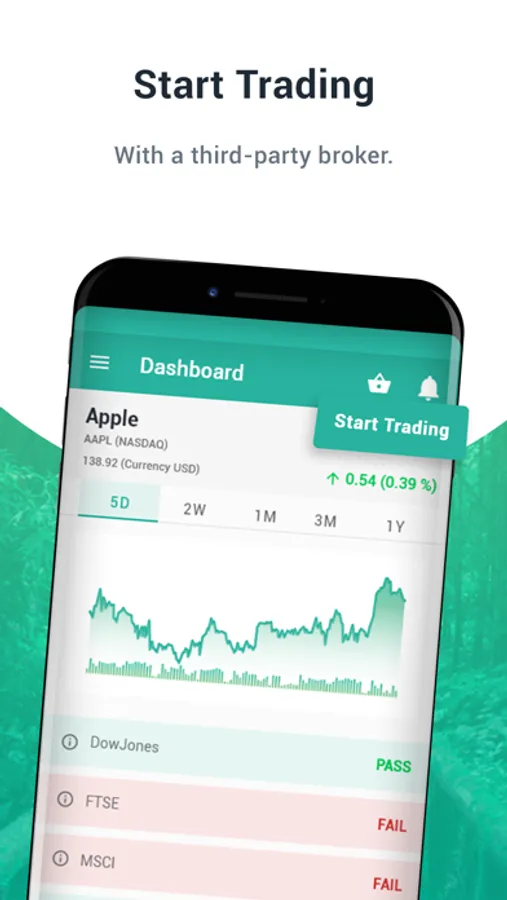

* Trade Easily: Trade-in feature with third party broker of your choice.

FREQUENTLY ASKED QUESTIONS

- What is Stock Screening?

Stock screening is the process of filtering the investment universe (the list of available stocks) to a small list of equities that passes specific characteristics that investors are looking for.

- How a stock is considered as Halal? What is Halal Stock Screening?

Every investment methodology is backed by a trustworthy Sharia advisory board. Overall, the eligibility criteria are two-fold: sector-based criteria and ratio based criteria.

Under sector-based test, business related to some activities are excluded such as: Alcohol, Tobacco, Pork, Adult Entertainment, Conventional Financials, Gambling / Casinos, Weapons, etc. After removing companies with non-compliant business activities, the rest of the companies are examined for compliance in financial ratios, such as debt level, liquidity, etc.

- What are the different Islamic investment standards?

Finispia provides results based upon five mainstream Islamic investment methodologies including: DowJones, Standard & Poors, FTSE, MSCI and AAOIFI.

Why Finispia is offering more than one answer for the shariah compliance of a Stock?

The notion of “Halal” in stock investment is not a black or white answer. It depends on the scholars behind it. This is like any other legal opinion where scholars do not converge toward one answer. So, in our case, if there is one Pass (1/5), that means at least there is one group of scholars that would approve the stock as Halal. If there is two Pass (2/5), that’s even better, so you can be more comfortable. If you got five Pass (5/5), then that’s the best answer your can get from a Shariah compliance perspective. Accordingly, with Finispia you can invest the way you want based on your own preference and your own tolerance to halal/ not halal.

How often data are updated?

We use intraday data, which is considered as the optimal frequency in the Halal stock screening.

- Is there a FREE Plan?

Yes, our free plan includes the search of 3 stocks from all over the world. So, you can get Halal test results for 3 stocks of your choice.

Can I cancel my plan?

Yes, anytime by switching to the Free Plan on your user Dashboard.

- Can I get refund?

Customers have 14 days for total or partial refund. Finispia will refund to customer any prepaid, but unused fees, on search number for Basic and Premium plan and on a straight-line, pro-rata basis, based on a 365-day year and 30 days for Unlimited plan.

- Can I start trading using Finispia

To make your life easier, you can connect with one of our third-party brokers, depending on your country, and you can start trading right away.

Finsipia is a stock screening tool designed for making Islamic investment easier. Now you can know which stock is halal and which one is not. Whether you are looking to invest halal for yourself or for someone else, Finsipia is here to help.

WHAT MAKES FINISPIA DIFFERENT?

* Multiple Halal Standards: Halal stock results based on 5 Islamic investment methodologies.

* Wide Stock Universe: More than 90 countries and more than 220.000 stocks.

* Advanced Filtering: Filter by country, by sector, by ratios, by only halal stocks, etc.

* Monitor Portfolio: Add stock to your watch list.

* Stay Vigilant: Get alert if stock turn out of halal universe.

* Trade Easily: Trade-in feature with third party broker of your choice.

FREQUENTLY ASKED QUESTIONS

- What is Stock Screening?

Stock screening is the process of filtering the investment universe (the list of available stocks) to a small list of equities that passes specific characteristics that investors are looking for.

- How a stock is considered as Halal? What is Halal Stock Screening?

Every investment methodology is backed by a trustworthy Sharia advisory board. Overall, the eligibility criteria are two-fold: sector-based criteria and ratio based criteria.

Under sector-based test, business related to some activities are excluded such as: Alcohol, Tobacco, Pork, Adult Entertainment, Conventional Financials, Gambling / Casinos, Weapons, etc. After removing companies with non-compliant business activities, the rest of the companies are examined for compliance in financial ratios, such as debt level, liquidity, etc.

- What are the different Islamic investment standards?

Finispia provides results based upon five mainstream Islamic investment methodologies including: DowJones, Standard & Poors, FTSE, MSCI and AAOIFI.

Why Finispia is offering more than one answer for the shariah compliance of a Stock?

The notion of “Halal” in stock investment is not a black or white answer. It depends on the scholars behind it. This is like any other legal opinion where scholars do not converge toward one answer. So, in our case, if there is one Pass (1/5), that means at least there is one group of scholars that would approve the stock as Halal. If there is two Pass (2/5), that’s even better, so you can be more comfortable. If you got five Pass (5/5), then that’s the best answer your can get from a Shariah compliance perspective. Accordingly, with Finispia you can invest the way you want based on your own preference and your own tolerance to halal/ not halal.

How often data are updated?

We use intraday data, which is considered as the optimal frequency in the Halal stock screening.

- Is there a FREE Plan?

Yes, our free plan includes the search of 3 stocks from all over the world. So, you can get Halal test results for 3 stocks of your choice.

Can I cancel my plan?

Yes, anytime by switching to the Free Plan on your user Dashboard.

- Can I get refund?

Customers have 14 days for total or partial refund. Finispia will refund to customer any prepaid, but unused fees, on search number for Basic and Premium plan and on a straight-line, pro-rata basis, based on a 365-day year and 30 days for Unlimited plan.

- Can I start trading using Finispia

To make your life easier, you can connect with one of our third-party brokers, depending on your country, and you can start trading right away.