About Tu Hipoteca

Do you want to save thousands of euros on your mortgage? Our mortgage amortization simulation app is the key. Discover how additional payments can speed up your financial freedom and reduce your debt faster. Save time and money while you reach your financial goals! Download now to take control of your financial future!

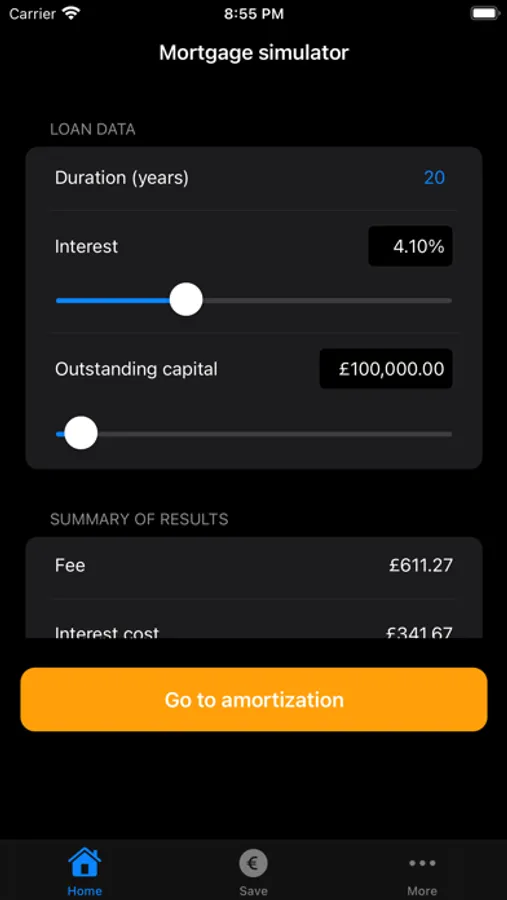

We have created My Mortgage to clearly reflect in a mobile application the interest, installments and total expenses that we will pay when applying for a mortgage. On the main s

creen we will establish the term, the interest rate of the loan and the capital that we will request from the bank as a mortgage.

After establishing these data, we will obtain the following information immediately:

-Cuota mensual que pagaremos.

-Intereses mensuales que pagamos.

-La cantidad total en intereses que pagaremos al final de la hipoteca.

-La cantidad total que pagaremos para la cantidad que pediremos prestado a la entidad bancaria.

De momento no se reflejan los gastos fijos asociados a notarías o comisiones de los bancos. Esperamos incluirlos en próximas versiones.

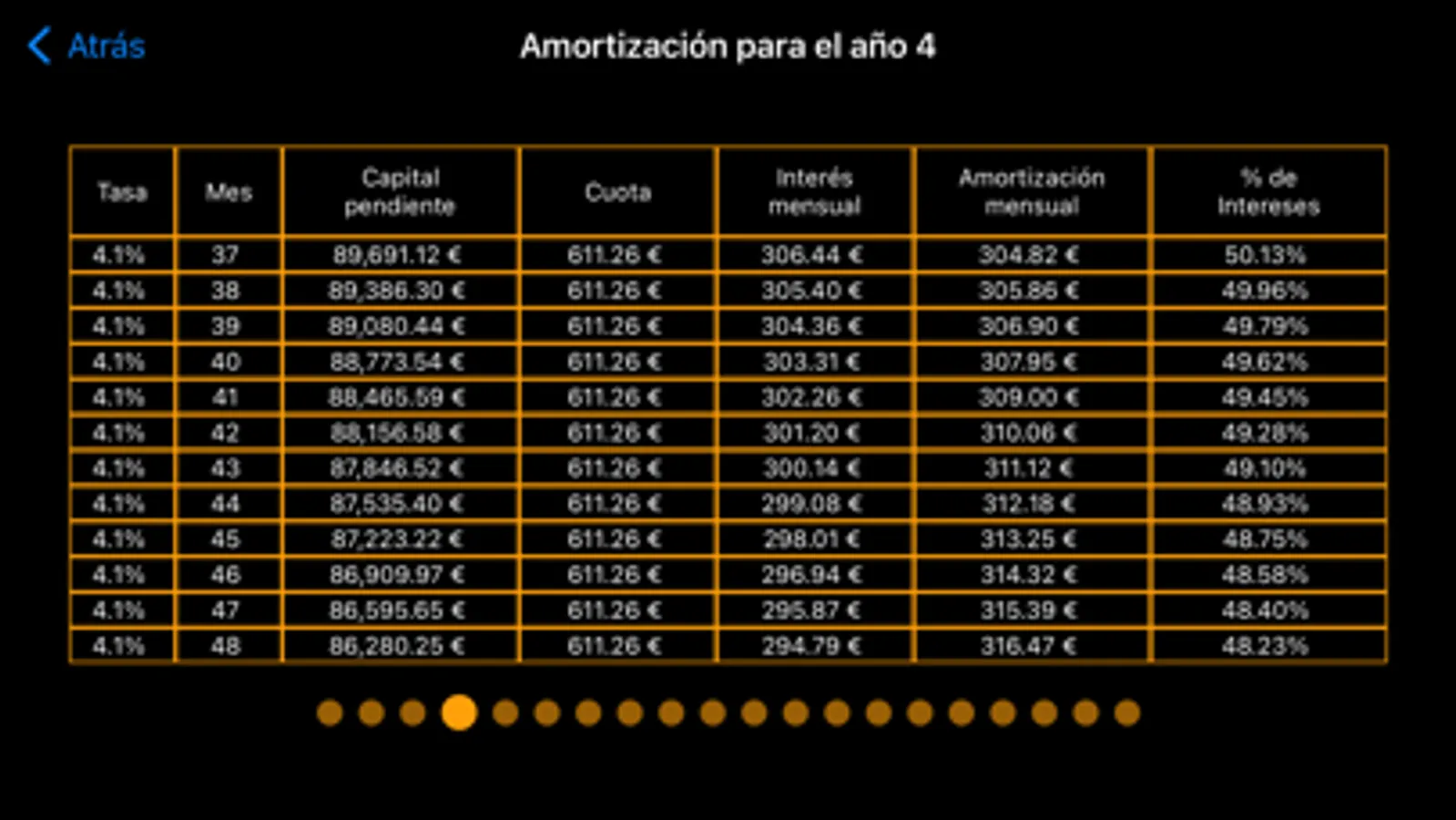

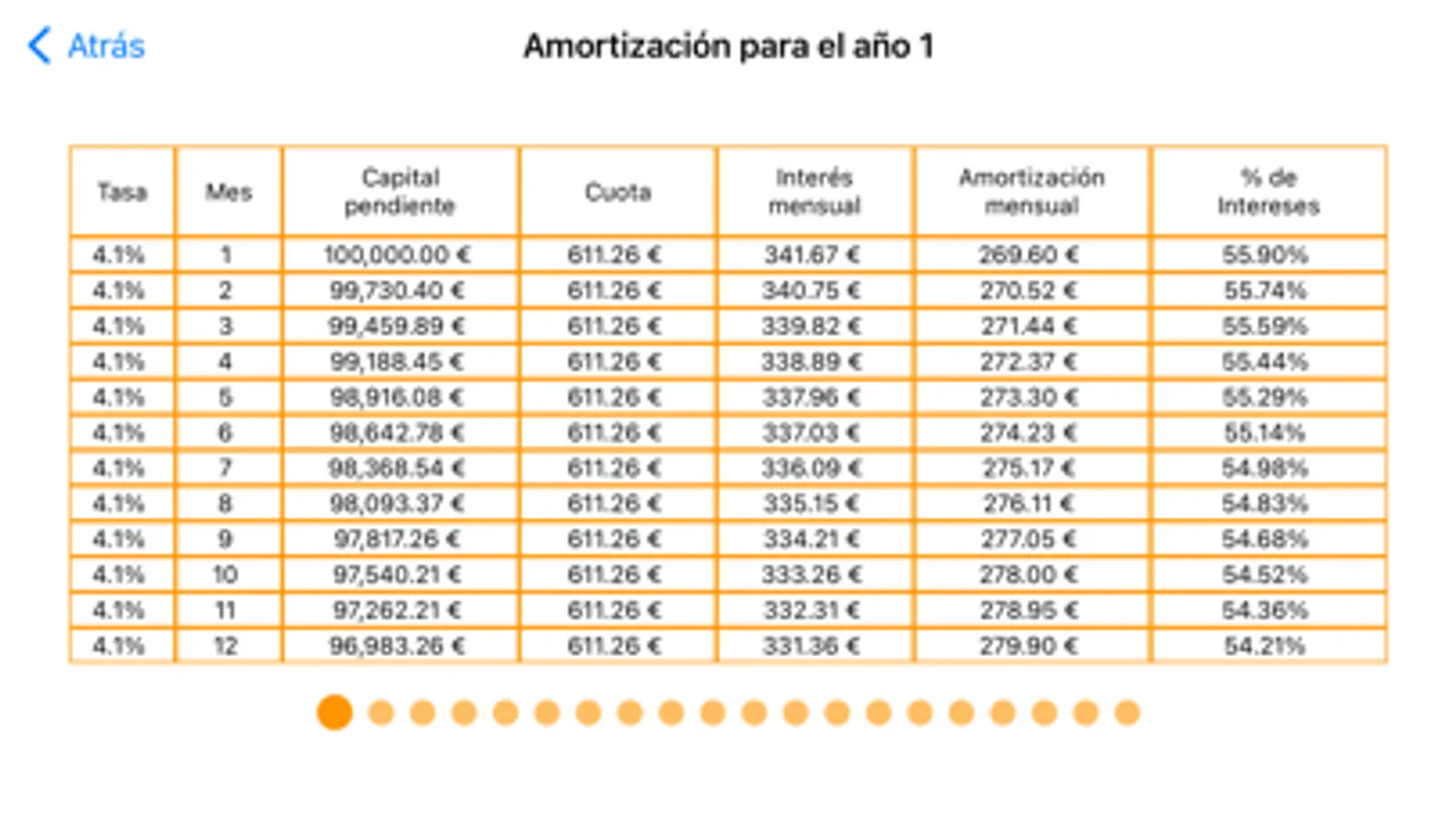

También mostramos la tabla de amortización año a año en la que se ve como va disminuyendo la cantidad de intereses que tenemos que pagar, por lo que se ve que cada vez se amortiza más.

Esta aplicación muestra el sistema de amortización francés.

-Monthly fee that we will pay.

-Monthly interest we pay.

-The total amount of interest that we will pay at the end of the mortgage.

-The total amount that we will pay for the amount that we will borrow from the bank.

At the moment, the fixed expenses associated with notaries or bank commissions are not reflected. We hope to include them in future versions.

We also show the amortization table year by year in which it is seen how the amount of interest that we have to pay decreases, so it is seen that more and more is amortized.

This application shows the French amortization system.

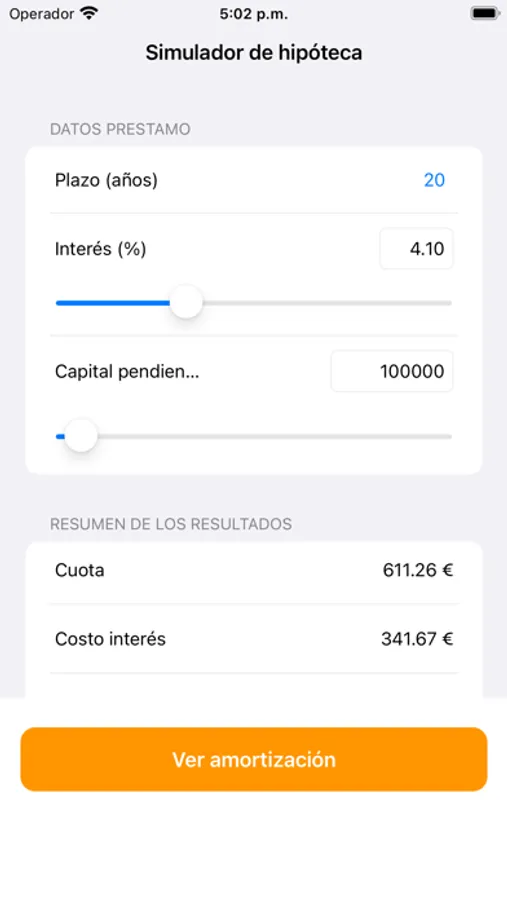

We have created My Mortgage to clearly reflect in a mobile application the interest, installments and total expenses that we will pay when applying for a mortgage. On the main s

creen we will establish the term, the interest rate of the loan and the capital that we will request from the bank as a mortgage.

After establishing these data, we will obtain the following information immediately:

-Cuota mensual que pagaremos.

-Intereses mensuales que pagamos.

-La cantidad total en intereses que pagaremos al final de la hipoteca.

-La cantidad total que pagaremos para la cantidad que pediremos prestado a la entidad bancaria.

De momento no se reflejan los gastos fijos asociados a notarías o comisiones de los bancos. Esperamos incluirlos en próximas versiones.

También mostramos la tabla de amortización año a año en la que se ve como va disminuyendo la cantidad de intereses que tenemos que pagar, por lo que se ve que cada vez se amortiza más.

Esta aplicación muestra el sistema de amortización francés.

-Monthly fee that we will pay.

-Monthly interest we pay.

-The total amount of interest that we will pay at the end of the mortgage.

-The total amount that we will pay for the amount that we will borrow from the bank.

At the moment, the fixed expenses associated with notaries or bank commissions are not reflected. We hope to include them in future versions.

We also show the amortization table year by year in which it is seen how the amount of interest that we have to pay decreases, so it is seen that more and more is amortized.

This application shows the French amortization system.