About Bank Like a Bank

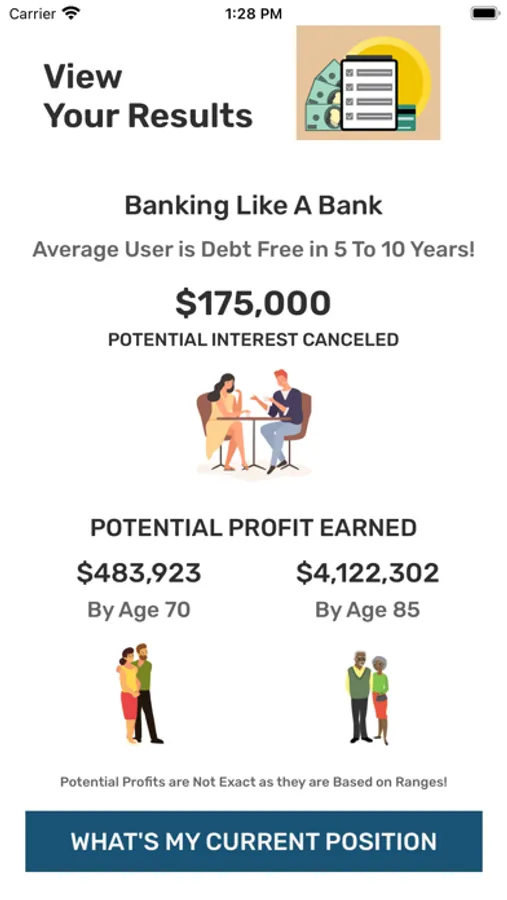

This free app is based on a proprietary formula that calculates how much interest the average adult can cancel by paying debt early. The app also calculates what the average adult can earn tax free by collateralizing their debt. Unlike BYOB or Infinite Banking, with banking like a bank, people can borrow against their debt, earn interest on that debt, during & after the debt is paid, without tax & without paying back the loan.

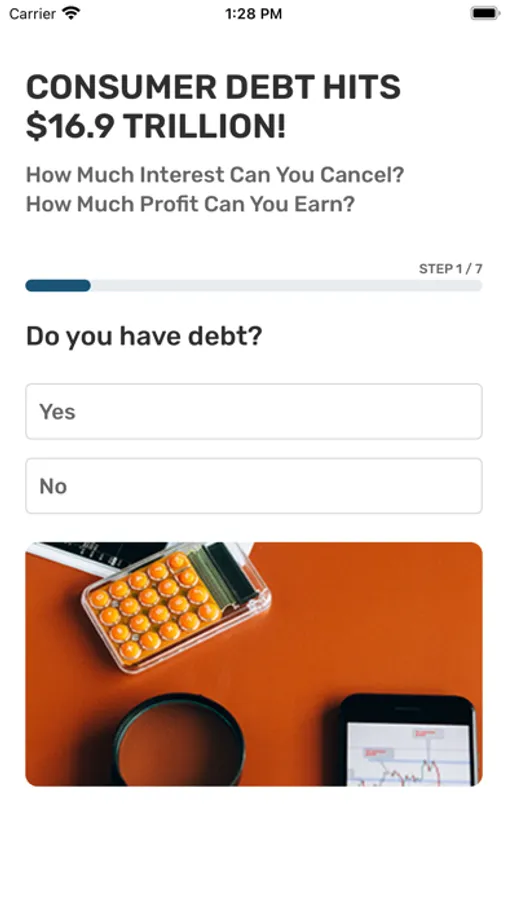

After seeing the results of banking like a bank, the user can engage in a logic based personal finance survey that tells them their current financial position. Based on these results, the user receives a report that tells them what they can do to start banking like a bank. Resources include coaching, eBooks, online financial literacy courses & financial wellness programs that can be accessed through the app at any time.

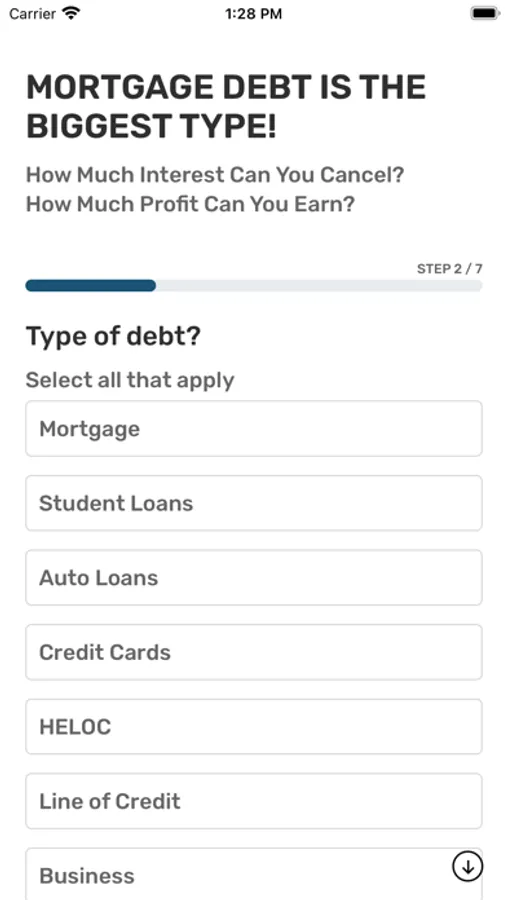

Banking like a Bank is a type of Hybrid Arbitrage that deals with any kind of debt including credit cards, residential & commercial mortgages, auto, equity, personal, student, equipment & business loans.

Banking like a Bank is a unique combination of GPS debt technology & a special kind of liquid index universal life insurance, POLI (Private Owned Life Insurance), a type of BOLI for any middle class adult, family or business. The app is about early debt payoff, interest elimination & turning liabilities into income & generational wealth.

The goal of Banking like a Bank is not to use a whole life insurance policy, the goal is to strategically optimize your debt pay off using technology, eliminating up to 75% of the interest, while paying off your debt or mortgage in less than half the time. Rather than using a HELOC or a Savings Account, using the Index Universal Life Insurance policy allows the user to make tax free money on their early mortgage or debt pay off. Users' money never leaves the IUL, they earn tax free interest on their liabilities for the rest of their lives, they have no risk, they also become their own bank. Homeowners or debtors make the interest on their own future loans & never pay them back. Banking like a bank, equalizes the financial playing field & closes the wealth gap forever.

How do banks, credit unions, & other organizations in the finance industry use tax-advantaged products to offset costs? Bank Owned Life Insurance (BOLI) is a great way for banks to save money on their employee benefit costs, without adding expenses on a monthly basis that take away from bottom line profits & mask bank performance in their financial statements.

Equity is real money, the app demonstrates how banking like a bank really works, with amortization a 6% APR on a mortgage, equals more interest than the cost of the house.

The IRS codes 7702 & 101a passed by congress in the Cares Act 2020, changed everything for whole life insurance, the app demonstrates taking advantage of these changes.

There are a lot of influencers online & on social media talking about the benefits of life insurance, mostly Whole Life vs IULs.

They speak about borrowing money, buying consumer products & in most cases, paying back the insurance loan. When it comes to IULs, they speak about the fees, cost, the 0% floor, the volatility & the compounded interest.

They don't talk about surrender charges, caps & that you can overfund the policy with your debt, which then becomes your collateral.

Why? Because surrender charges could be 10 years away. They consider debt another subject & overfunding means having to put more money in the policy. Overfunding the policy with your debt, liabilities or mortgage, is actually less money than the user would spend because of the reduced interest, the debt technology delivers. The IUL used in this app is POLI, it has no surrender charges, no caps & no fees.

Users don't pay back the loan? They are borrowing against their own money, which was originally their debt, liabilities are the collateral, not the death benefit.

After seeing the results of banking like a bank, the user can engage in a logic based personal finance survey that tells them their current financial position. Based on these results, the user receives a report that tells them what they can do to start banking like a bank. Resources include coaching, eBooks, online financial literacy courses & financial wellness programs that can be accessed through the app at any time.

Banking like a Bank is a type of Hybrid Arbitrage that deals with any kind of debt including credit cards, residential & commercial mortgages, auto, equity, personal, student, equipment & business loans.

Banking like a Bank is a unique combination of GPS debt technology & a special kind of liquid index universal life insurance, POLI (Private Owned Life Insurance), a type of BOLI for any middle class adult, family or business. The app is about early debt payoff, interest elimination & turning liabilities into income & generational wealth.

The goal of Banking like a Bank is not to use a whole life insurance policy, the goal is to strategically optimize your debt pay off using technology, eliminating up to 75% of the interest, while paying off your debt or mortgage in less than half the time. Rather than using a HELOC or a Savings Account, using the Index Universal Life Insurance policy allows the user to make tax free money on their early mortgage or debt pay off. Users' money never leaves the IUL, they earn tax free interest on their liabilities for the rest of their lives, they have no risk, they also become their own bank. Homeowners or debtors make the interest on their own future loans & never pay them back. Banking like a bank, equalizes the financial playing field & closes the wealth gap forever.

How do banks, credit unions, & other organizations in the finance industry use tax-advantaged products to offset costs? Bank Owned Life Insurance (BOLI) is a great way for banks to save money on their employee benefit costs, without adding expenses on a monthly basis that take away from bottom line profits & mask bank performance in their financial statements.

Equity is real money, the app demonstrates how banking like a bank really works, with amortization a 6% APR on a mortgage, equals more interest than the cost of the house.

The IRS codes 7702 & 101a passed by congress in the Cares Act 2020, changed everything for whole life insurance, the app demonstrates taking advantage of these changes.

There are a lot of influencers online & on social media talking about the benefits of life insurance, mostly Whole Life vs IULs.

They speak about borrowing money, buying consumer products & in most cases, paying back the insurance loan. When it comes to IULs, they speak about the fees, cost, the 0% floor, the volatility & the compounded interest.

They don't talk about surrender charges, caps & that you can overfund the policy with your debt, which then becomes your collateral.

Why? Because surrender charges could be 10 years away. They consider debt another subject & overfunding means having to put more money in the policy. Overfunding the policy with your debt, liabilities or mortgage, is actually less money than the user would spend because of the reduced interest, the debt technology delivers. The IUL used in this app is POLI, it has no surrender charges, no caps & no fees.

Users don't pay back the loan? They are borrowing against their own money, which was originally their debt, liabilities are the collateral, not the death benefit.