AppRecs review analysis

AppRecs rating 1.0. Trustworthiness 65 out of 100. Review manipulation risk 29 out of 100. Based on a review sample analyzed.

★☆☆☆☆

1.0

AppRecs Rating

Ratings breakdown

5 star

0%

4 star

0%

3 star

0%

2 star

11%

1 star

89%

What to know

✓

Low review manipulation risk

29% review manipulation risk

⚠

Mixed user feedback

Average 1.1★ rating suggests room for improvement

About TRI-AD Retirement

TRI-AD’s 50 years of Retirement Plan Expertise at your fingertips, everywhere you go, anytime. Fast, Simple and Easy!

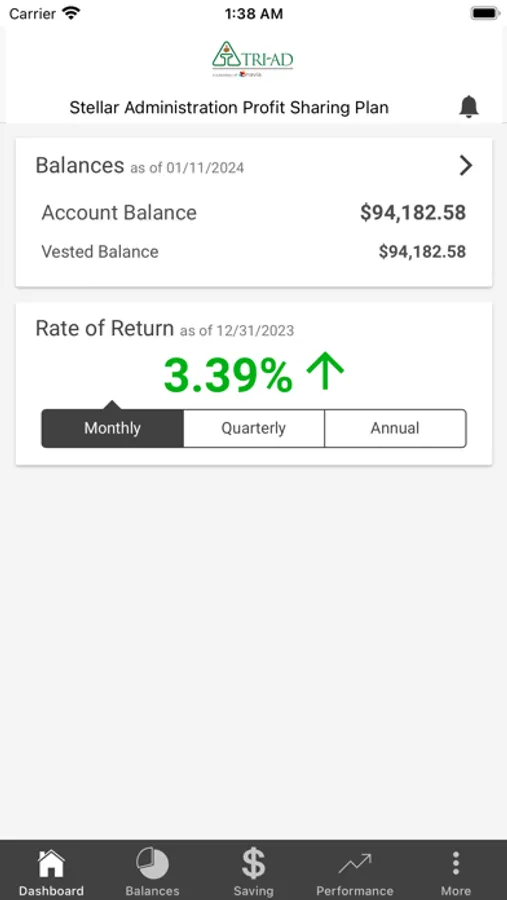

Receive important messages regarding your retirement plan, receive alerts when your participant statement is ready to view, and see reminders of important dates. If you are enrolled in more than one retirement plan you can easily toggle between accounts.

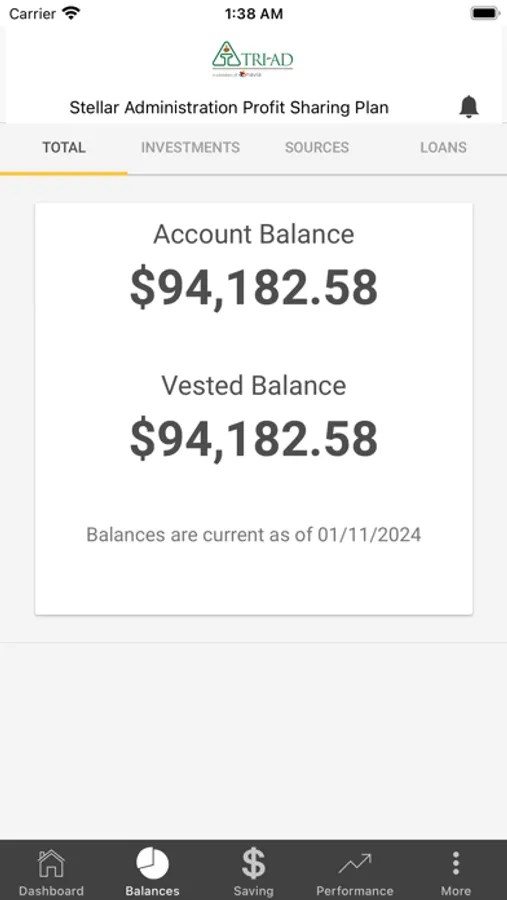

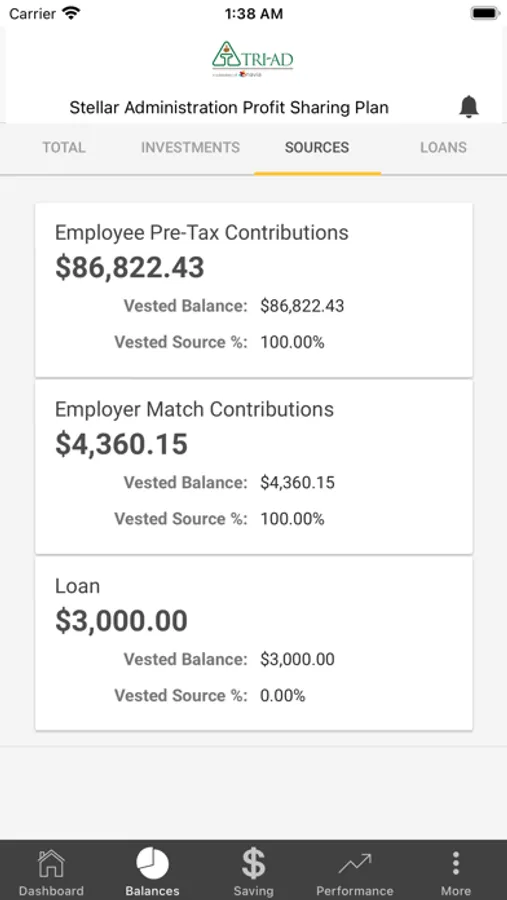

View your full and vested account balance each time you open the App. You can easily view your balance in each plan investment, Roth and Pre-tax balance and balances by source (Deferral, Employer Match, Rollover, etc.). Keep track of your contribution percentages to remind you when to increase them to build your retirement savings.

Watch your account balance grow as you track your individual plan investments, including your personal rate of return over the past month, quarter and year. You can even look up the share price for each contribution made to the plan.

Review your personal information to make sure your address, phone numbers and email addresses are up to date. TRI-AD multifactor authentication is compatible with any device ensuring the security of your retirement information.

Receive important messages regarding your retirement plan, receive alerts when your participant statement is ready to view, and see reminders of important dates. If you are enrolled in more than one retirement plan you can easily toggle between accounts.

View your full and vested account balance each time you open the App. You can easily view your balance in each plan investment, Roth and Pre-tax balance and balances by source (Deferral, Employer Match, Rollover, etc.). Keep track of your contribution percentages to remind you when to increase them to build your retirement savings.

Watch your account balance grow as you track your individual plan investments, including your personal rate of return over the past month, quarter and year. You can even look up the share price for each contribution made to the plan.

Review your personal information to make sure your address, phone numbers and email addresses are up to date. TRI-AD multifactor authentication is compatible with any device ensuring the security of your retirement information.