In this mortgage industry app, users can access product, pricing, and eligibility data on-the-go and view mortgage market indices. Includes scenario management, real-time updates, and customizable search filters.

AppRecs review analysis

AppRecs rating 4.4. Trustworthiness 69 out of 100. Review manipulation risk 29 out of 100. Based on a review sample analyzed.

★★★★☆

4.4

AppRecs Rating

Ratings breakdown

5 star

90%

4 star

4%

3 star

2%

2 star

0%

1 star

4%

What to know

✓

Low review manipulation risk

29% review manipulation risk

✓

High user satisfaction

90% of sampled ratings are 5 stars

✓

Authentic reviews

No red flags detected

About Optimal Blue - PPE

Access the industry’s most widely used product, pricing and eligibility engine anywhere! Optimal Blue PPE (OB) Mobile provides key functionality to support loan officers and other mortgage industry professionals on-the-go.

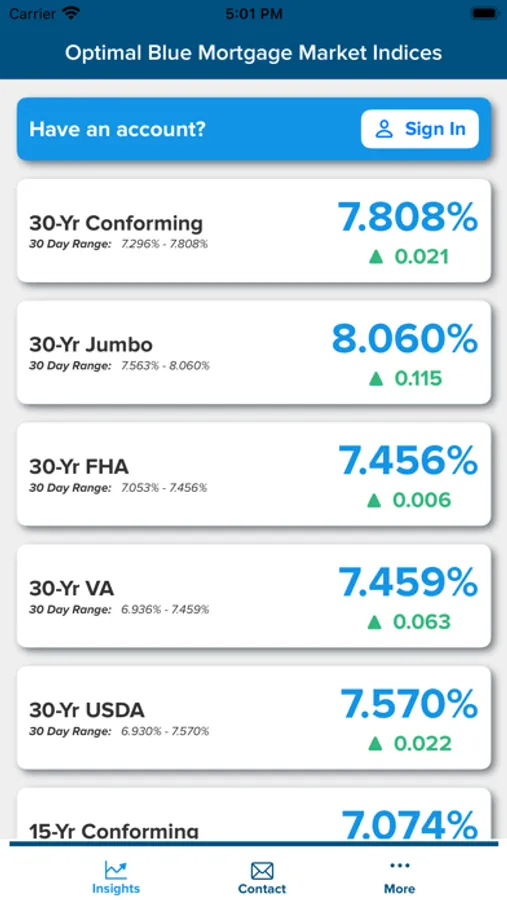

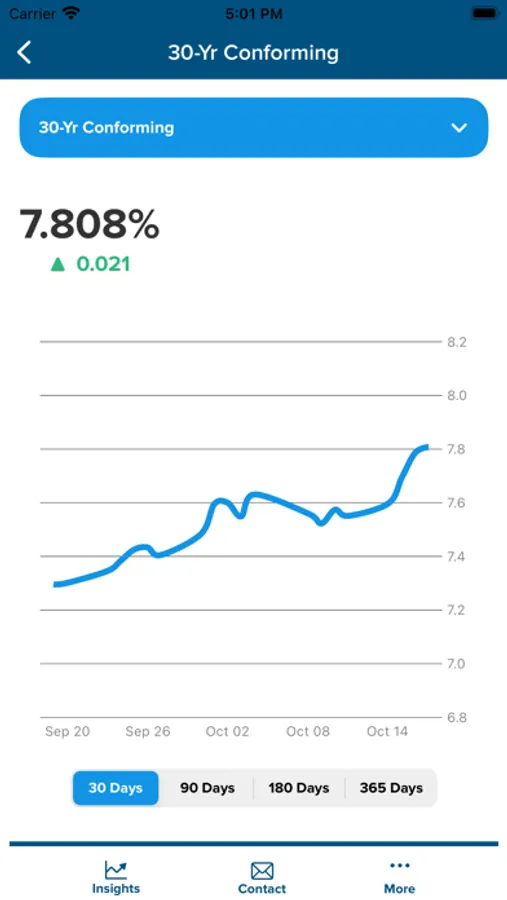

The app allows you to track the Optimal Blue Mortgage Market Indices (OBMMI™) and receive push notifications for updates. OBMMI™ provides the most comprehensive, accurate, timely, and interactive analysis of pricing ever conducted in the mortgage industry. Calculated from actual locked rates with consumers across 42% of all mortgage transactions nationwide, OBMMI includes multiple mortgage pricing indices developed around the most popular mortgage products.

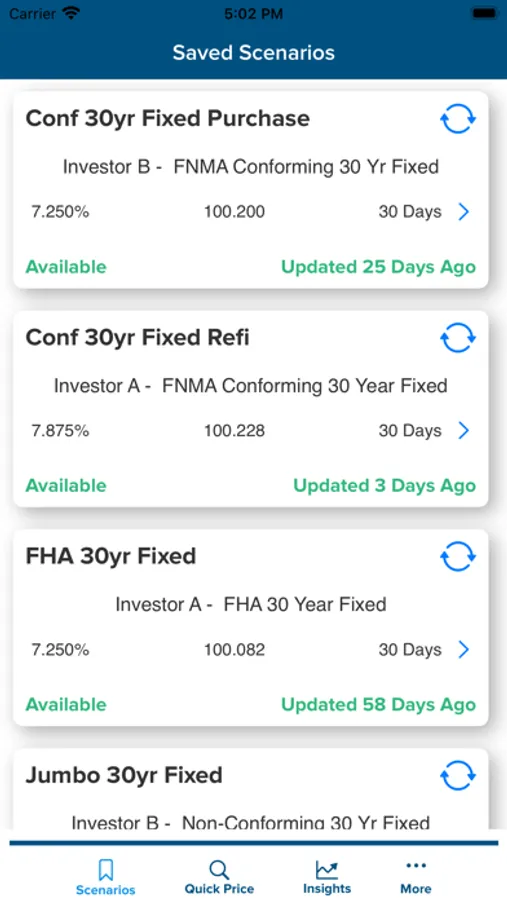

For Optimal Blue customers, you can also log in to price scenarios and save favorites to your dashboard for quick access. Scenarios can be automatically refreshed with a single tap, allowing you to easily see the best product, rate, price and more. This capability helps you understand how interest rates are moving on a given day, directly from your mobile device – no paper rate sheet required! These easily accessible scenarios can assist in conversations with prospective borrowers before an application is taken.

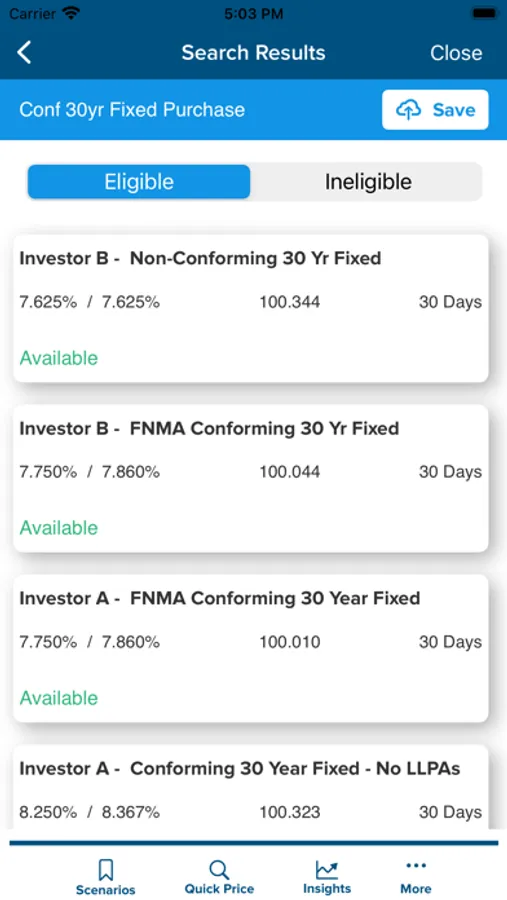

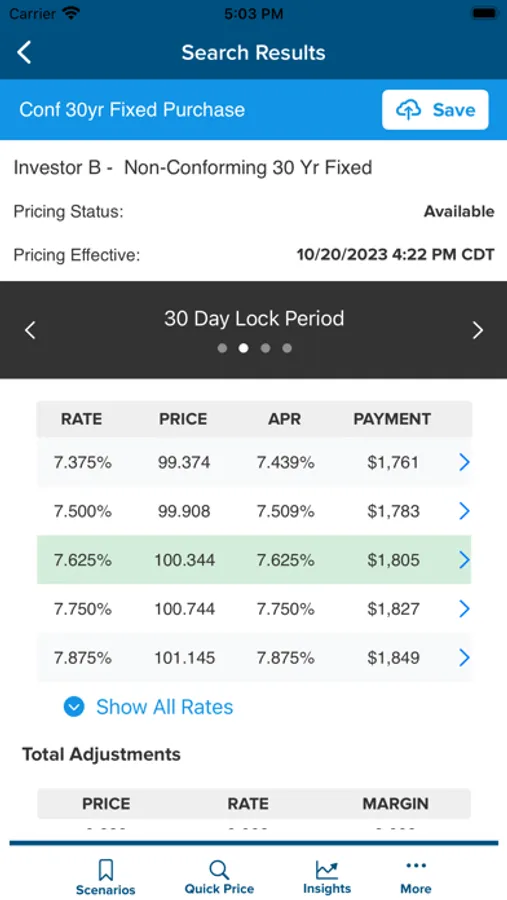

With the app, Optimal Blue customers can access the full array of pricing inputs you’re used to seeing on the web version of the Optimal Blue PPE, including any custom fields. This allows for an instant, accurate quote. Additionally, search results include the full granularity you’re used to accessing on the web. All eligible products and rates are displayed, including any adjustments, notes and advisories. Ineligible products are displayed along with an ineligibility reason.

The app allows you to track the Optimal Blue Mortgage Market Indices (OBMMI™) and receive push notifications for updates. OBMMI™ provides the most comprehensive, accurate, timely, and interactive analysis of pricing ever conducted in the mortgage industry. Calculated from actual locked rates with consumers across 42% of all mortgage transactions nationwide, OBMMI includes multiple mortgage pricing indices developed around the most popular mortgage products.

For Optimal Blue customers, you can also log in to price scenarios and save favorites to your dashboard for quick access. Scenarios can be automatically refreshed with a single tap, allowing you to easily see the best product, rate, price and more. This capability helps you understand how interest rates are moving on a given day, directly from your mobile device – no paper rate sheet required! These easily accessible scenarios can assist in conversations with prospective borrowers before an application is taken.

With the app, Optimal Blue customers can access the full array of pricing inputs you’re used to seeing on the web version of the Optimal Blue PPE, including any custom fields. This allows for an instant, accurate quote. Additionally, search results include the full granularity you’re used to accessing on the web. All eligible products and rates are displayed, including any adjustments, notes and advisories. Ineligible products are displayed along with an ineligibility reason.