In this personal finance app, users can analyze various financial scenarios and compare different options. Includes features like financial profile creation, scenario analysis, and detailed reports for retirement, disability, and estate planning.

AppRecs review analysis

AppRecs rating 4.3. Trustworthiness 0 out of 100. Review manipulation risk 0 out of 100. Based on a review sample analyzed.

★★★★☆

4.3

AppRecs Rating

Ratings breakdown

5 star

70%

4 star

12%

3 star

6%

2 star

3%

1 star

10%

What to know

✓

High user satisfaction

82% of sampled ratings are 4+ stars (4.3★ average)

✓

Authentic reviews

Natural distribution, no red flags

About PlanMode Financial Planning

COMPREHENSIVE FINANCIAL PLANNING

This app is for use by individuals for personal financial planning. It provides you with a powerful planning tool for answers to questions like-

• Should I convert my IRA to Roth IRA?

• Should I start taking Social Security benefits at age 66 or wait for larger payments at age 70?

• When will I have enough to retire on my terms?

• What will be the bottom line impact of a owning a second home?

• Is buying a house is better for me than continuing to rent?

• Is my family protected for their needs if I am disabled or die?

PlanMode can help you analyze these and other situations. It is easy to use and its usage is limitless; you could use it to analyze almost any financial scenario which impacts just in the current year or many years to come.

KEY FEATURES

This app can-

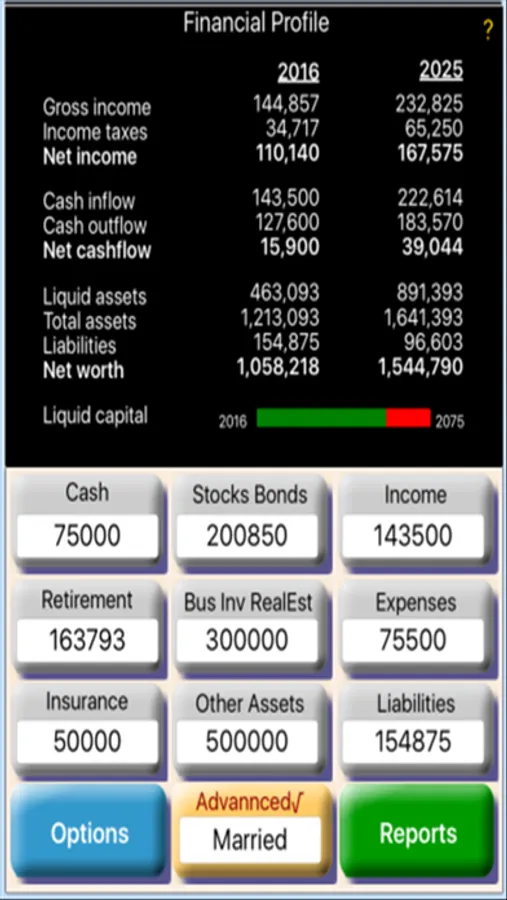

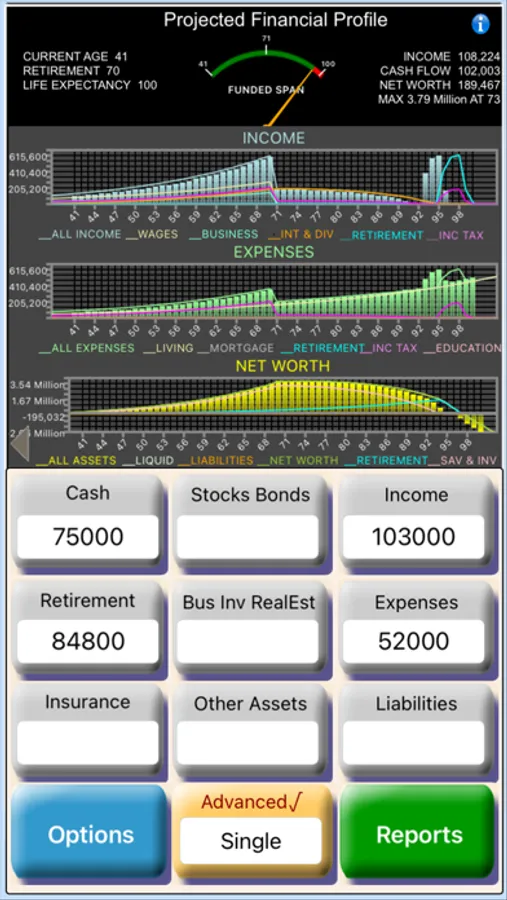

• Prepare complete financial profiles, including-

- Current & projected income and expenses

- Bank accounts

- Retirement accounts

- Business & Investments

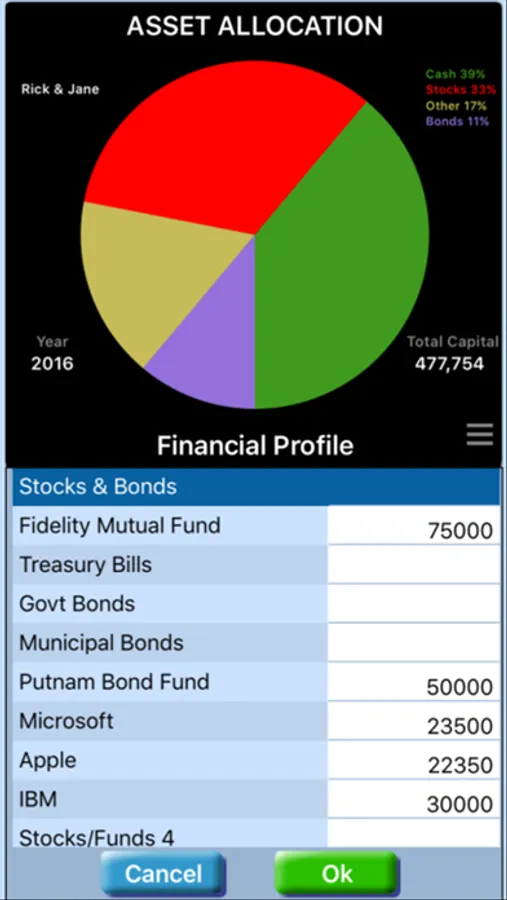

- Stocks & Bonds

- Insurance policies

- Real estate

- Mortgages & loans

- Cash management simulation

- Social security

- Income taxes

• Compare financial alternatives

- Unlimited what-if scenarios

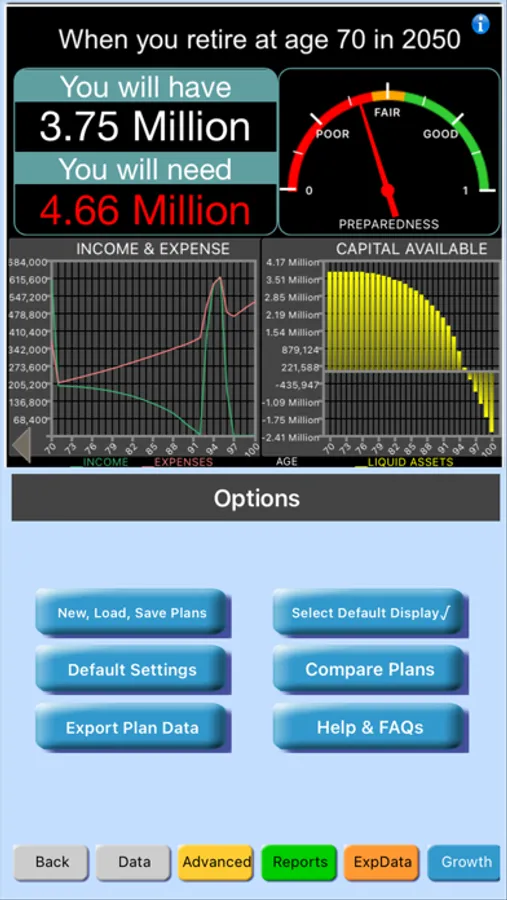

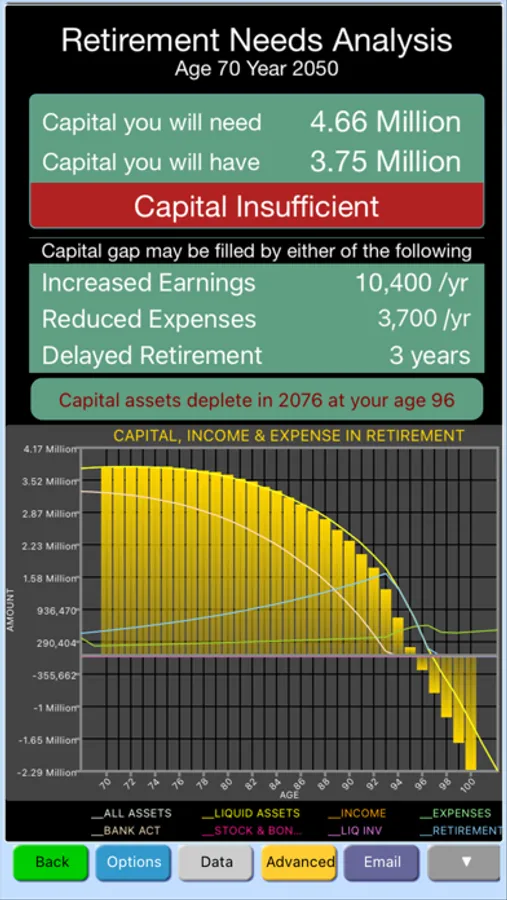

• Prepare retirement profile automatically

- Evaluate if a Roth conversion is good for you

- Determine lifelong capital needs

- Analyze liquid capital sufficiency

- Alternatives to fill capital shortfall

• Prepare disability profiles automatically

- Analyze cash flow sufficiency

- Alternatives to fill cash shortfall

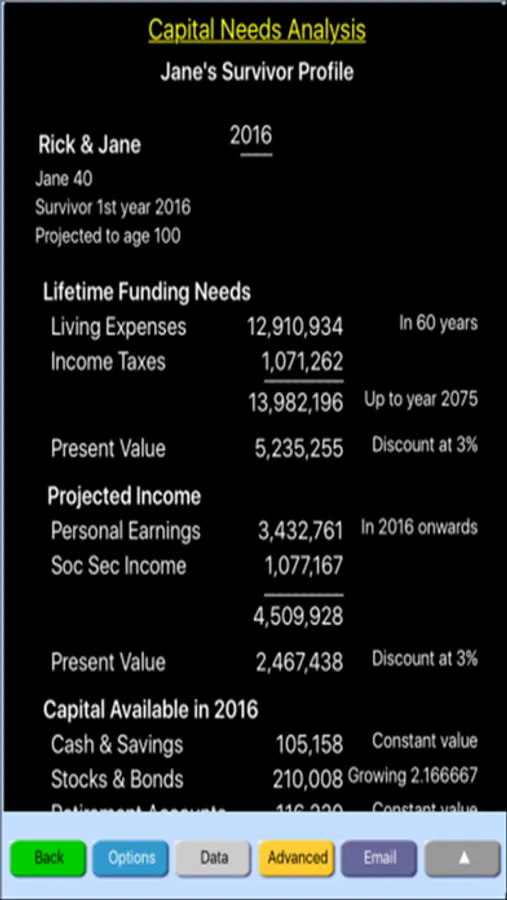

• Prepare death profiles automatically

- Determine survivor’s capital needs

- Analyze income sufficiency

- Alternatives to fill capital gap

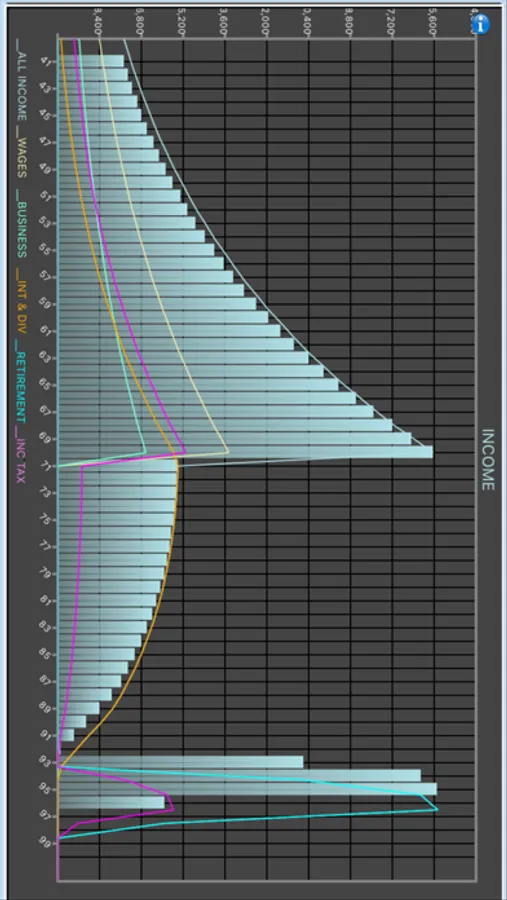

REPORTS & CHARTS

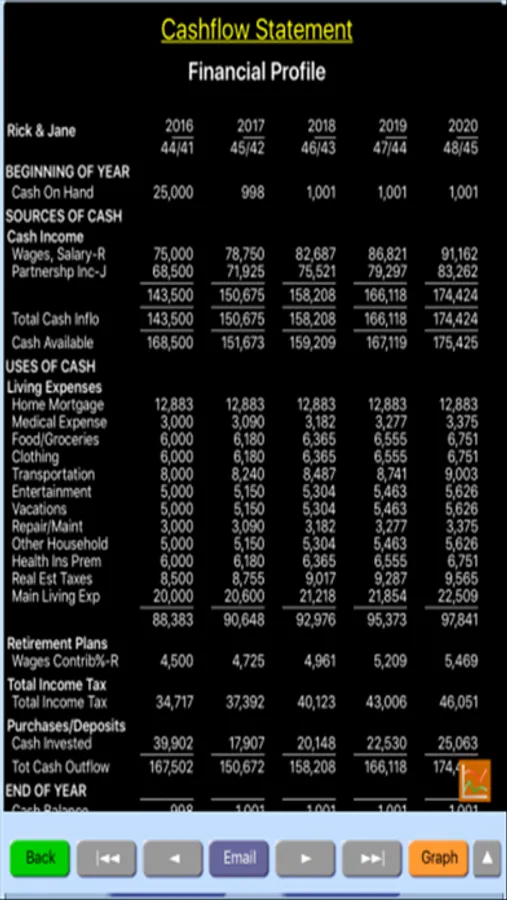

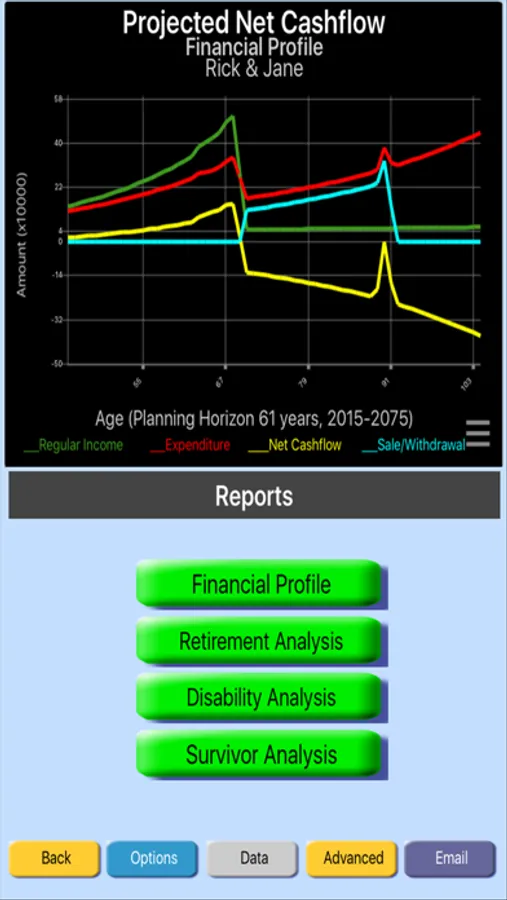

A complete set of financial statements is available for each scenario. PlanMode provides you with comprehensive analysis of retirement and other scenarios for lifetime capital needs and the capital available for its fulfillment. When capital resources are not sufficient PlanMode provides suggestive courses of action that may fill the shortcoming. The following reports are available for each profile scenario-

• Income Statement

• Balance Sheet

• Cashflow Statement

• Supporting Information

• Capital Needs Analysis

• 8 pie charts providing profile snapshots in any year

• 8 line graphs providing overall snapshot of the profile

All charts and graphs dynamically respond to your data.

COMPREHENSIVE

PlanMode includes a number of features that can be found in high-end financial planning systems, such as-

• Profiles for singles and married spouses

• Planning span of up to 100 years

• Retirement profile and analysis

• Comparing your choices of age to retire

• Quick bottom-line analysis of a Roth conversion

• Quick comparison of taking Social Security at different ages

• Disability profile and analysis

• Survivor’s profile and analysis

• Automatic cash management simulation

• Detailed annual cash flow analysis

• Personalized data input items

• Customizable financial statements

• Ample graphs & charts for quick overview

• Automated scenario comparison for what-if analysis

• Definable national & local income taxes

• Built-in USA income taxes

• Predefined product structures for-

• Individual Retirement Accounts

• Company Retirement Plans (401k)

• Self-employed Retirement Plans

• Mortgages

• Life Insurance

• Fixed & Variable Annuities

• Charitable Annuities

• Reverse Mortgages

• Custom Planning Tools for automated comparisons

WORLDWIDE INCOME TAXES

USA

US individual income tax computations are built-in and applied as applicable. State and local taxes can also be defined via built-in templates.

NON-USA

Non-USA individuals can turn the USA option off and activate a generalized version that allows you to define how income tax should be computed for national & local levels.

This app is for use by individuals for personal financial planning. It provides you with a powerful planning tool for answers to questions like-

• Should I convert my IRA to Roth IRA?

• Should I start taking Social Security benefits at age 66 or wait for larger payments at age 70?

• When will I have enough to retire on my terms?

• What will be the bottom line impact of a owning a second home?

• Is buying a house is better for me than continuing to rent?

• Is my family protected for their needs if I am disabled or die?

PlanMode can help you analyze these and other situations. It is easy to use and its usage is limitless; you could use it to analyze almost any financial scenario which impacts just in the current year or many years to come.

KEY FEATURES

This app can-

• Prepare complete financial profiles, including-

- Current & projected income and expenses

- Bank accounts

- Retirement accounts

- Business & Investments

- Stocks & Bonds

- Insurance policies

- Real estate

- Mortgages & loans

- Cash management simulation

- Social security

- Income taxes

• Compare financial alternatives

- Unlimited what-if scenarios

• Prepare retirement profile automatically

- Evaluate if a Roth conversion is good for you

- Determine lifelong capital needs

- Analyze liquid capital sufficiency

- Alternatives to fill capital shortfall

• Prepare disability profiles automatically

- Analyze cash flow sufficiency

- Alternatives to fill cash shortfall

• Prepare death profiles automatically

- Determine survivor’s capital needs

- Analyze income sufficiency

- Alternatives to fill capital gap

REPORTS & CHARTS

A complete set of financial statements is available for each scenario. PlanMode provides you with comprehensive analysis of retirement and other scenarios for lifetime capital needs and the capital available for its fulfillment. When capital resources are not sufficient PlanMode provides suggestive courses of action that may fill the shortcoming. The following reports are available for each profile scenario-

• Income Statement

• Balance Sheet

• Cashflow Statement

• Supporting Information

• Capital Needs Analysis

• 8 pie charts providing profile snapshots in any year

• 8 line graphs providing overall snapshot of the profile

All charts and graphs dynamically respond to your data.

COMPREHENSIVE

PlanMode includes a number of features that can be found in high-end financial planning systems, such as-

• Profiles for singles and married spouses

• Planning span of up to 100 years

• Retirement profile and analysis

• Comparing your choices of age to retire

• Quick bottom-line analysis of a Roth conversion

• Quick comparison of taking Social Security at different ages

• Disability profile and analysis

• Survivor’s profile and analysis

• Automatic cash management simulation

• Detailed annual cash flow analysis

• Personalized data input items

• Customizable financial statements

• Ample graphs & charts for quick overview

• Automated scenario comparison for what-if analysis

• Definable national & local income taxes

• Built-in USA income taxes

• Predefined product structures for-

• Individual Retirement Accounts

• Company Retirement Plans (401k)

• Self-employed Retirement Plans

• Mortgages

• Life Insurance

• Fixed & Variable Annuities

• Charitable Annuities

• Reverse Mortgages

• Custom Planning Tools for automated comparisons

WORLDWIDE INCOME TAXES

USA

US individual income tax computations are built-in and applied as applicable. State and local taxes can also be defined via built-in templates.

NON-USA

Non-USA individuals can turn the USA option off and activate a generalized version that allows you to define how income tax should be computed for national & local levels.