ExchangeRateIQ

READY BYTES SOFTWARE LABS PRIVATE LIMITED

5.0 ★

rating

Free

About ExchangeRateIQ

ExchangeRateIQ helps you discover the best way to send money across the globe.

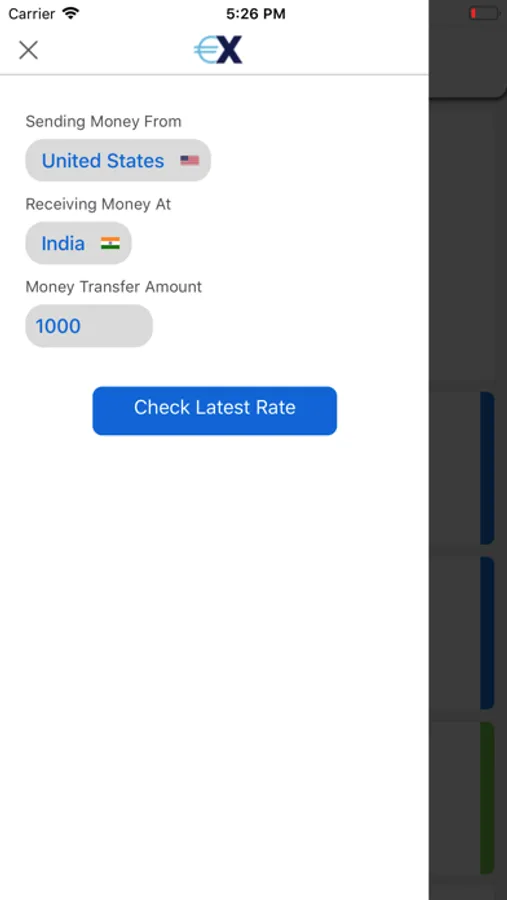

To find the best exchange rates for sending money simply download the app and setup the sending country, the receiving country and the amount you wish to send. Once setup Exchange Rate IQ automatically searches for all available money transfer companies and banks to find out the current exchange rate they are offering. It also checks and update the fees against each remittance provider.

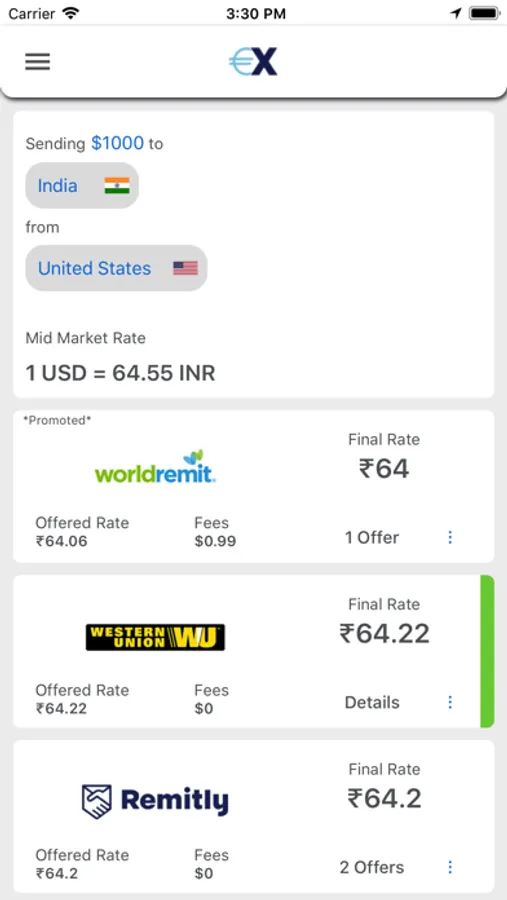

Based on the fees and exchange rates we calculate what we call, a realized exchange rate. A realized exchange rate is calculated after equally distributing the applicable fees on the total amount to discover the actual currency rate you would get after including the fees.

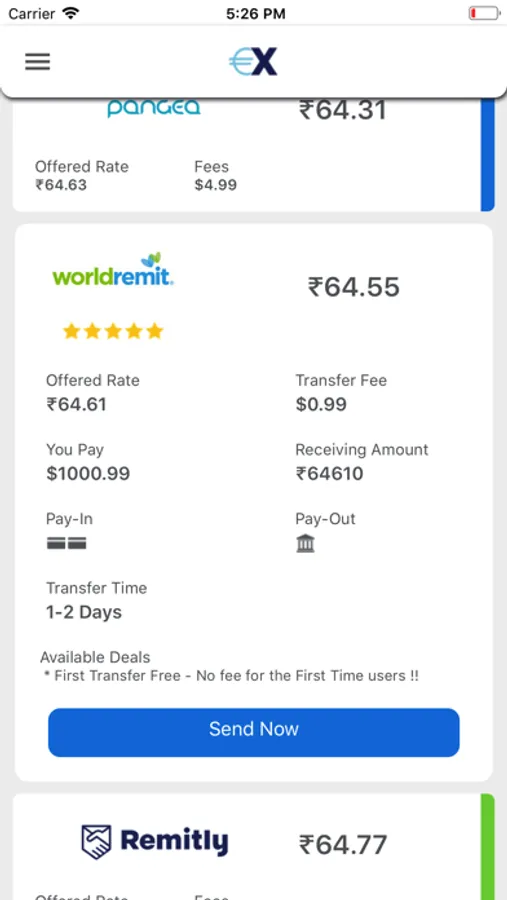

Clicking on details would give you more details about the money transfer company. Considering most suitable option for you may vary depending on following parameters -

- Pay-In Method

- Pay-Out Method

- Transfer Option : Fixed / Indicative

- Transfer Time

Once you have identified the money transfer company you would like to send money with, simply click send now button and the website of the bank or the remittance provider would open right in the app itself. You can safely login your user ID & password to do the transfer.

While sending money abroad, you should be careful about competitive rates and flexible options to suit your financial needs. Same provider will not offer the cheapest rate all the time because fee and exchange rate are dynamic. For an individual, it is not easy to do the complex research, analyzing all money transfer companies and calculating best exchange rates.

ExchangeRateIQ can help you in decision making by using its IQ to solve this repetitive problem. After analyzing raw data, it combines all important information about each transfer service together in a manner that makes comparison easier by getting rid of any deceptive information.

Features -

- Compare live exchange rates & find today’s best exchange rate

- Compare money transfer providers

- Get actual realized exchange rate by individual provider according to their offered

exchange rate and fee

- Get real time mid market rate

- Get money transfer coupons and promotions

We support all major remittance providers including - Xendpay, Western Union, Ria Money Transfer, MoneyGram, TransFast, CurrencyFair, OrbitRemit, RemitGuru, Remitly, Azimo, Remit2India, Indus Fast Remit, State Bank of India, Axis Remit, ICICI Money2India, Lucky Money, Transferwise, Worldremit,Money2anywhere, Wellsfargo, Remitlite, Klinnk, Muncha, Thamelremit, Sonaliexchange, Philippines National Bank, Placid, Zenbanx, Oxigenusa, Pakremit, Gopangea, Kotak Remit, Prabhuonline, Xoom.

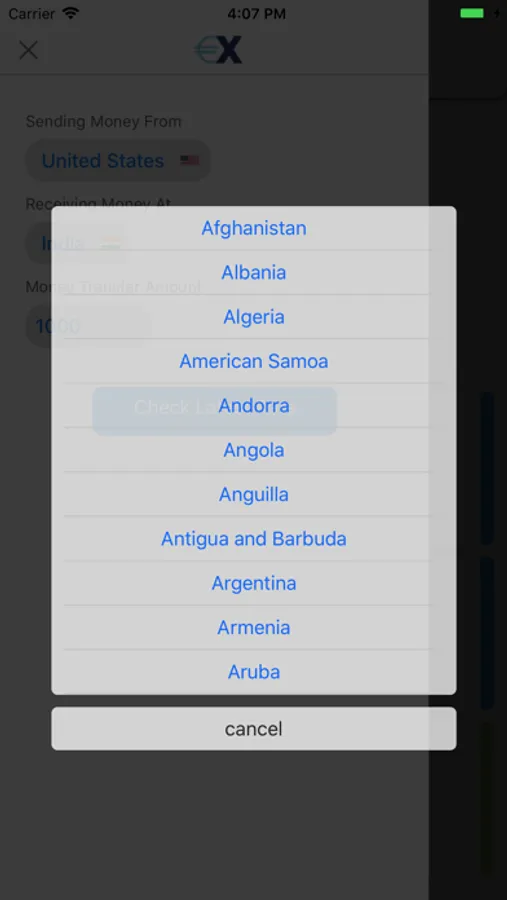

We currently support over 40 countries to send money including the United States, Canada, Australia, United Kingdom, Singapore, UAE & Euro Zone. The total number of receiving countries are over 200 including money transfer to India, Mexico, Philippines, China, Latin America, Africa and Europe.

List of Major Supported Currencies:

U.S. dollar (USD)

European euro (EUR)

UK pound sterling (GBP)

Indian Rupee (INR)

Philippine Peso (PHP)

Swiss franc (CHF)

Australian dollar (AUD)

Canadian dollar (CAD)

Singapore dollar (SGD)

Japanese yen (JPY)

Chinese Renminbi (Yuan) (CNY)

Mexican Peso (MXN)

Saudi Arabian Riyal (SAR)

Qatari Riyal (QAR)

Thai Baht (THB)

UAE Dirham (AED)

Malaysian Ringgit (MYR)

South Korean Won (KPW)

Disclaimer: Details about exchange rates, fees and transfer time provided on our website are generic and high level. While we make every effort to keep the information up to date and correct, we make no warranties of any kind with regards to accuracy or reliability of the data.

To find the best exchange rates for sending money simply download the app and setup the sending country, the receiving country and the amount you wish to send. Once setup Exchange Rate IQ automatically searches for all available money transfer companies and banks to find out the current exchange rate they are offering. It also checks and update the fees against each remittance provider.

Based on the fees and exchange rates we calculate what we call, a realized exchange rate. A realized exchange rate is calculated after equally distributing the applicable fees on the total amount to discover the actual currency rate you would get after including the fees.

Clicking on details would give you more details about the money transfer company. Considering most suitable option for you may vary depending on following parameters -

- Pay-In Method

- Pay-Out Method

- Transfer Option : Fixed / Indicative

- Transfer Time

Once you have identified the money transfer company you would like to send money with, simply click send now button and the website of the bank or the remittance provider would open right in the app itself. You can safely login your user ID & password to do the transfer.

While sending money abroad, you should be careful about competitive rates and flexible options to suit your financial needs. Same provider will not offer the cheapest rate all the time because fee and exchange rate are dynamic. For an individual, it is not easy to do the complex research, analyzing all money transfer companies and calculating best exchange rates.

ExchangeRateIQ can help you in decision making by using its IQ to solve this repetitive problem. After analyzing raw data, it combines all important information about each transfer service together in a manner that makes comparison easier by getting rid of any deceptive information.

Features -

- Compare live exchange rates & find today’s best exchange rate

- Compare money transfer providers

- Get actual realized exchange rate by individual provider according to their offered

exchange rate and fee

- Get real time mid market rate

- Get money transfer coupons and promotions

We support all major remittance providers including - Xendpay, Western Union, Ria Money Transfer, MoneyGram, TransFast, CurrencyFair, OrbitRemit, RemitGuru, Remitly, Azimo, Remit2India, Indus Fast Remit, State Bank of India, Axis Remit, ICICI Money2India, Lucky Money, Transferwise, Worldremit,Money2anywhere, Wellsfargo, Remitlite, Klinnk, Muncha, Thamelremit, Sonaliexchange, Philippines National Bank, Placid, Zenbanx, Oxigenusa, Pakremit, Gopangea, Kotak Remit, Prabhuonline, Xoom.

We currently support over 40 countries to send money including the United States, Canada, Australia, United Kingdom, Singapore, UAE & Euro Zone. The total number of receiving countries are over 200 including money transfer to India, Mexico, Philippines, China, Latin America, Africa and Europe.

List of Major Supported Currencies:

U.S. dollar (USD)

European euro (EUR)

UK pound sterling (GBP)

Indian Rupee (INR)

Philippine Peso (PHP)

Swiss franc (CHF)

Australian dollar (AUD)

Canadian dollar (CAD)

Singapore dollar (SGD)

Japanese yen (JPY)

Chinese Renminbi (Yuan) (CNY)

Mexican Peso (MXN)

Saudi Arabian Riyal (SAR)

Qatari Riyal (QAR)

Thai Baht (THB)

UAE Dirham (AED)

Malaysian Ringgit (MYR)

South Korean Won (KPW)

Disclaimer: Details about exchange rates, fees and transfer time provided on our website are generic and high level. While we make every effort to keep the information up to date and correct, we make no warranties of any kind with regards to accuracy or reliability of the data.