About Riskco Portfolio

Nonprofessional investors will begin to evaluate the correct way the results of your investments. At any time, you will be able to compare the return and the risk of your aggregate portfolio with the index, simple or compound, that you choose.

Millions of investors need this information: it is not provided by their bank at all or it provides them a comparison index not suitable to their needs. Or maybe, they work with two or more banks at the same time.

If you want to go further, you will have at your disposal more advanced analysis tools.

Nonprofessional investors will enjoy free access to high level tools.

And all the investors, at the end of each month, you will receive a customized rebalancing portfolio advice about increasing or decreasing the equity weights. A touch of financial sophistication applied every month to your portfolio!

To facilitate the learning of the tool you have at your disposal the Demo_RiskcoPortfolio portfolio.

A. What information does RiskcoPortfolio offer for your aggregate investment portfolio?

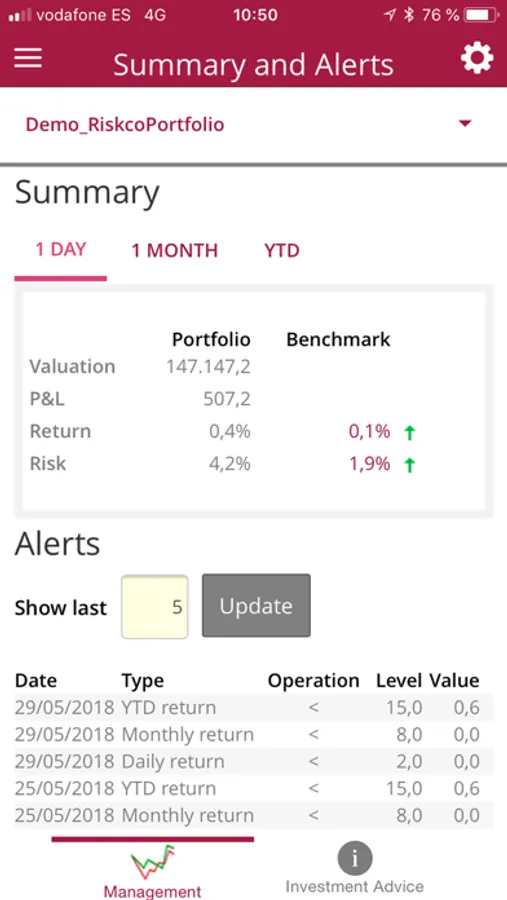

Investments control executive summary

Aggregate portfolio ´valuation, P&L, return and risk compared with a customized multi-asset benchmark.

So that the comparison will be useful, notice that it must be made on homogeneous figures. For example, if your portfolio composition has been 50% eur stocks and 50% eur bonds, a right benchmark is 50% Eurostoxx and 50% a fixed income index like Iboxx.

Customized risk-returns alerts of the overall portfolio – not only regarding individual assets- will be delivered meaning you can react quickly.

Graphical monitoring of the return and risk of your aggregate portfolio with a customized multi-asset benchmark, at all times.

Operational and probabilistic risk limits definition and control

Your Portfolio includes:

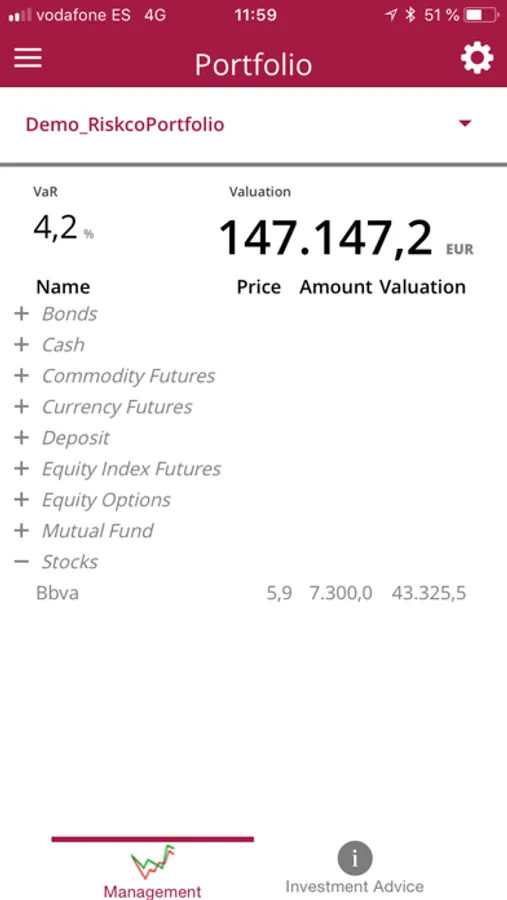

1. Trades, descriptive data and all assets´ fair value.

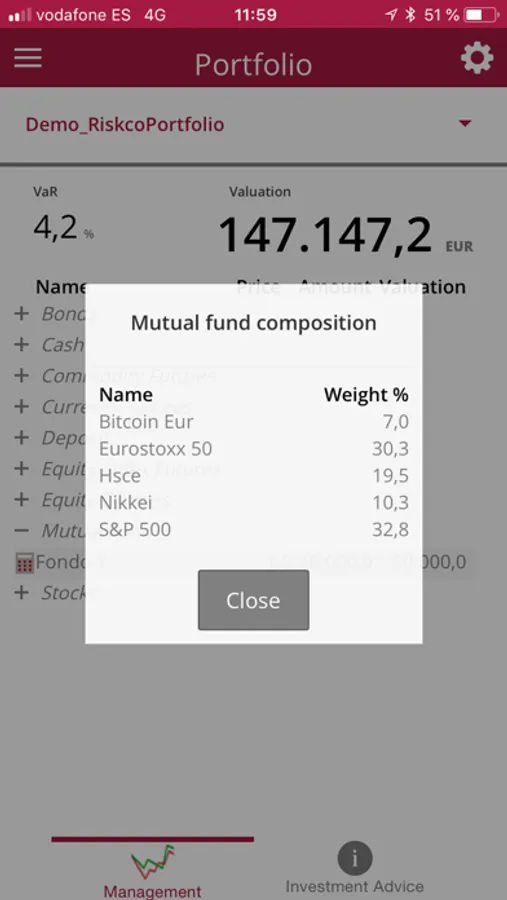

2. Look-through analysis. We do not stay on the surface analysis, we go deeper. We analyse the assets within your mutual funds up to four levels deep.

Top ten (exposition, risk and valuation assets)

Risk interest rate, credit, equity, currency, commodities and real state)

Portfolio composition (asset class, type, currency and country)

B. Automation

You will keep a complete, centralized, well managed, and easily available investments historic file.

Register in the web and, with maximum security, connect with all your Banks and aggregate all your portfolios and trades

C. Monthly rebalancing portfolio advice. Plus passive investing.

There will always be periods with results that are either better or worse than expected. In this situation , there are two possibilities:

1. To decide on a reaction by revising investment expectations

2. Not to revise expectations but rather to apply the mathematical model DoR–Dynamic optimal Risk-, which consists in rebalancing the portfolio weights between bonds and equity, on a monthly basis, to the level of risk that maximizes the terminal wealth.

At the end of each month, you will receive a customized rebalancing portfolio advice increasing or decreasing the equity weights (3% maximum)

In the long run we obtain an additional annual return between 0.25% and 1%, over and above traditional passive investing.

A touch of truly valuable financial sophistication to your portfolio every month!

Millions of investors need this information: it is not provided by their bank at all or it provides them a comparison index not suitable to their needs. Or maybe, they work with two or more banks at the same time.

If you want to go further, you will have at your disposal more advanced analysis tools.

Nonprofessional investors will enjoy free access to high level tools.

And all the investors, at the end of each month, you will receive a customized rebalancing portfolio advice about increasing or decreasing the equity weights. A touch of financial sophistication applied every month to your portfolio!

To facilitate the learning of the tool you have at your disposal the Demo_RiskcoPortfolio portfolio.

A. What information does RiskcoPortfolio offer for your aggregate investment portfolio?

Investments control executive summary

Aggregate portfolio ´valuation, P&L, return and risk compared with a customized multi-asset benchmark.

So that the comparison will be useful, notice that it must be made on homogeneous figures. For example, if your portfolio composition has been 50% eur stocks and 50% eur bonds, a right benchmark is 50% Eurostoxx and 50% a fixed income index like Iboxx.

Customized risk-returns alerts of the overall portfolio – not only regarding individual assets- will be delivered meaning you can react quickly.

Graphical monitoring of the return and risk of your aggregate portfolio with a customized multi-asset benchmark, at all times.

Operational and probabilistic risk limits definition and control

Your Portfolio includes:

1. Trades, descriptive data and all assets´ fair value.

2. Look-through analysis. We do not stay on the surface analysis, we go deeper. We analyse the assets within your mutual funds up to four levels deep.

Top ten (exposition, risk and valuation assets)

Risk interest rate, credit, equity, currency, commodities and real state)

Portfolio composition (asset class, type, currency and country)

B. Automation

You will keep a complete, centralized, well managed, and easily available investments historic file.

Register in the web and, with maximum security, connect with all your Banks and aggregate all your portfolios and trades

C. Monthly rebalancing portfolio advice. Plus passive investing.

There will always be periods with results that are either better or worse than expected. In this situation , there are two possibilities:

1. To decide on a reaction by revising investment expectations

2. Not to revise expectations but rather to apply the mathematical model DoR–Dynamic optimal Risk-, which consists in rebalancing the portfolio weights between bonds and equity, on a monthly basis, to the level of risk that maximizes the terminal wealth.

At the end of each month, you will receive a customized rebalancing portfolio advice increasing or decreasing the equity weights (3% maximum)

In the long run we obtain an additional annual return between 0.25% and 1%, over and above traditional passive investing.

A touch of truly valuable financial sophistication to your portfolio every month!