About Riskco Crypto

Professional crypto management in real time.

Without comparing the return and risk of your investments with an appropriate index you have no chance. This is essential, all professional investors know this.

Which investors have data on the return and risk of their aggregated portfolio?

Only professionals who have the appropriate software and some non-professionals who trade with a single entity.

Trading with two or more entities you cannot aggregate the portfolios, even trading with one you may only receive the valuation.

Now all investors will know and be able to compare the return and risk of their investments with an appropriate index.

Cryptoriskco is completely free of charge.

The Market Portfolio Index Crypto, a basic monitoring benchmark

The Market Portfolio includes all the cryptos in the world in the exact proportion that at any given moment make up the market. Therefore, all investors, as a group, get the return of the Market Portfolio minus the costs. A basic control reference for global investors.

Things get away from us when we do not have a basic reference to detect what is happening or if it is partial, biased or changes periodically.

Summary and alerts:

Valuation, P&L, return and risk of your aggregated portfolio that you can compare with the benchmark index of your choice.

You will be able to react quickly from risk-return alerts on your aggregated portfolio.

Gotrade:

Monitors the return and risk of the portfolio and the benchmark and indicates WHEN to buy or sell intraday by applying a simple and effective logic.

- If the portfolio return is lower than the benchmark and the risk is higher, the suggestion is to SELL.

- If the portfolio return is higher than the benchmark and the risk lower, the suggestion is BUY.

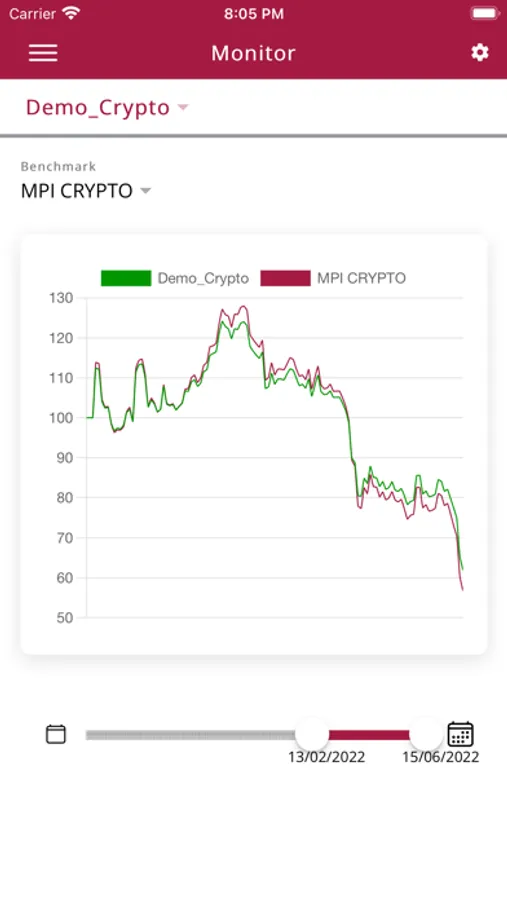

Monitor:

Graphical monitoring of the portfolio return compared to the benchmark.

Portfolio:

Valuation of assets and portfolio at market prices.

Notifications:

You will be able to receive a daily notification with the daily profit/loss.

Without comparing the return and risk of your investments with an appropriate index you have no chance. This is essential, all professional investors know this.

Which investors have data on the return and risk of their aggregated portfolio?

Only professionals who have the appropriate software and some non-professionals who trade with a single entity.

Trading with two or more entities you cannot aggregate the portfolios, even trading with one you may only receive the valuation.

Now all investors will know and be able to compare the return and risk of their investments with an appropriate index.

Cryptoriskco is completely free of charge.

The Market Portfolio Index Crypto, a basic monitoring benchmark

The Market Portfolio includes all the cryptos in the world in the exact proportion that at any given moment make up the market. Therefore, all investors, as a group, get the return of the Market Portfolio minus the costs. A basic control reference for global investors.

Things get away from us when we do not have a basic reference to detect what is happening or if it is partial, biased or changes periodically.

Summary and alerts:

Valuation, P&L, return and risk of your aggregated portfolio that you can compare with the benchmark index of your choice.

You will be able to react quickly from risk-return alerts on your aggregated portfolio.

Gotrade:

Monitors the return and risk of the portfolio and the benchmark and indicates WHEN to buy or sell intraday by applying a simple and effective logic.

- If the portfolio return is lower than the benchmark and the risk is higher, the suggestion is to SELL.

- If the portfolio return is higher than the benchmark and the risk lower, the suggestion is BUY.

Monitor:

Graphical monitoring of the portfolio return compared to the benchmark.

Portfolio:

Valuation of assets and portfolio at market prices.

Notifications:

You will be able to receive a daily notification with the daily profit/loss.