With this mobile banking app, users can manage accounts, make payments, and apply for loans. Includes services like card issuance, fund transfers, and expense analytics.

AppRecs review analysis

AppRecs rating 4.4. Trustworthiness 0 out of 100. Review manipulation risk 0 out of 100. Based on a review sample analyzed.

★★★★☆

4.4

AppRecs Rating

Ratings breakdown

5 star

94%

4 star

4%

3 star

1%

2 star

0%

1 star

2%

What to know

✓

High user satisfaction

94% of sampled ratings are 5 stars

About Privat24 – mobile bank

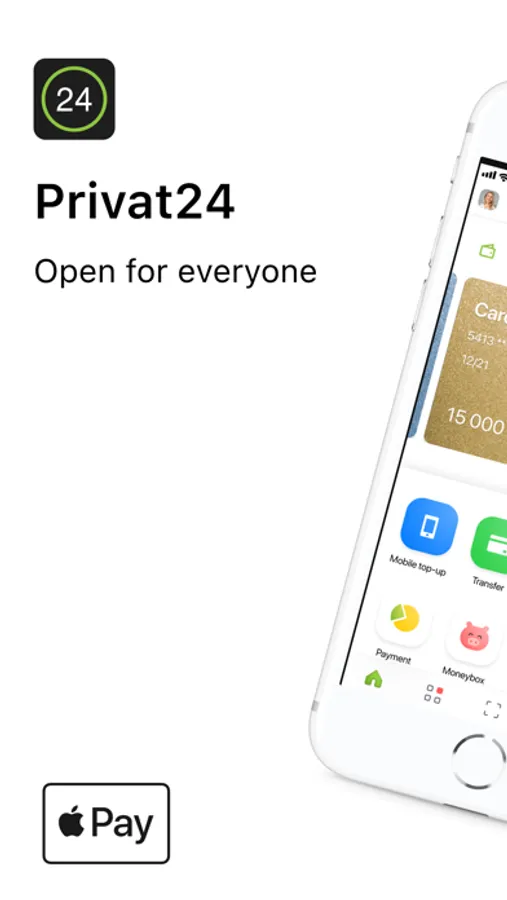

Your mobile bank Privat24. Payments and money transfers, loans, utilities and mobile top-ups – all online in the app!

Cashback, deposits and savings:

• “Pryvit” loyalty program: personalized cashback offers and discounts just for you;

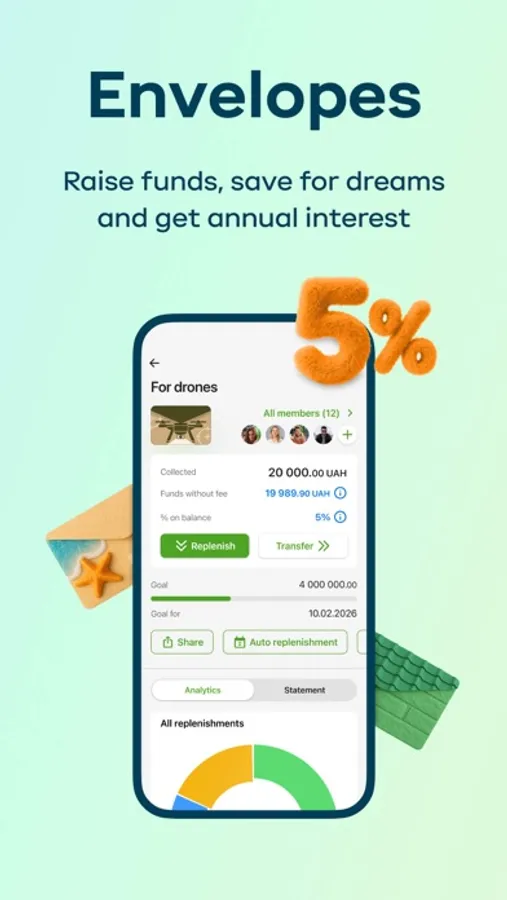

• “Envelopes” service: set and achieve your financial goals for donations, saving money and managing your own expenses;

• cashback accumulation with the “National Cashback” card;

• deposits in various currencies online: UAH, USD, EUR.

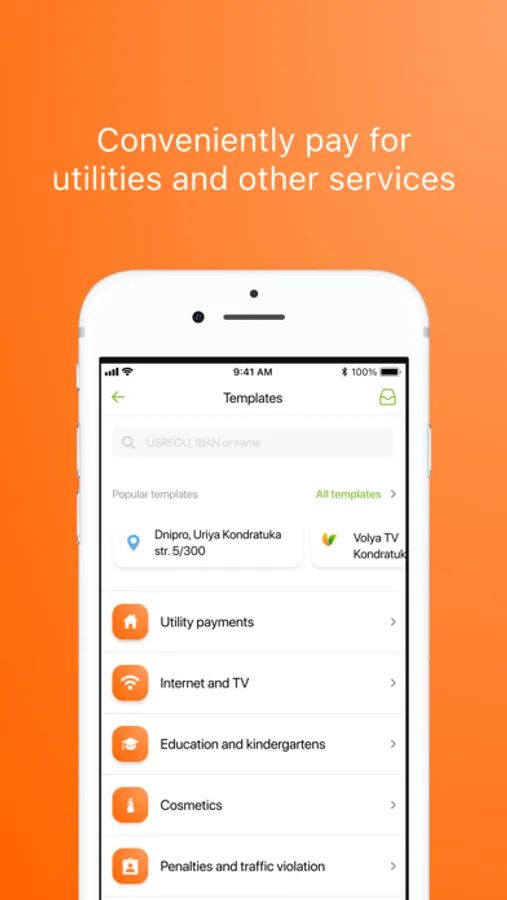

Payments and transfers in the mobile app:

• account replenishment: via Apple Pay, from your own card, from another bank's card, by IBAN account number;

• transfers to IBAN account number and by card number to Visa and Mastercard;

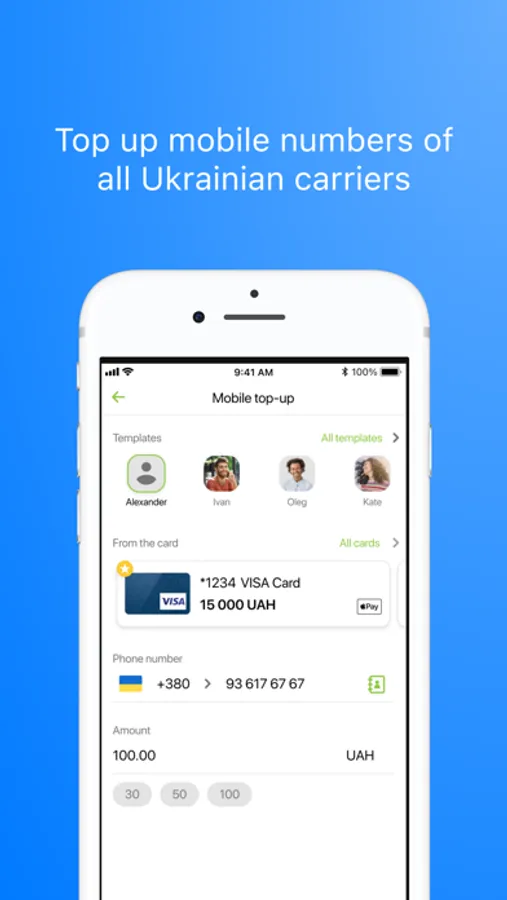

• replenishment of the mobile number of any Ukrainian telecom operators;

• payments: utilities, internet services, TV, education, traffic fines, etc.;

• Request to pay: split payment amount for a company;

• in-app online currency exchange;

• sending and receiving instant transfers and non-cash payments;

• SWIFT international transfers.

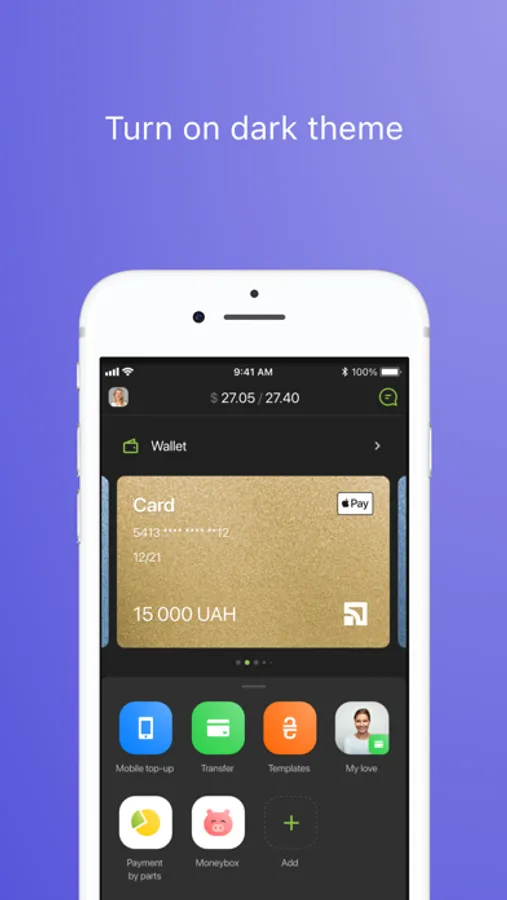

Managing cards and accounts:

• setting limits – for online payments and cash withdrawals;

• withdrawing and ordering cash;

• opening and reissuing a card online;

• adding a card for payments via Apple Pay;

• selecting a virtual design (skin) for the card.

Loans:

• managing and changing the credit limit;

• making payments under the “Payment by parts”;

• applying for a cash loan, a mortgage, and a car loan.

Controlling and planning expenses:

• income and spending statistics with the “Analytics” service;

• auto payments: mobile top-ups, transfers to a card, utilities and other payments.

More services:

• "Charity" service to support the initiatives;

• "Parking" service to pay for parking in your city;

• order cash at branches and at an ATM;

• certificates: standard, for state institutions, for obtaining subsidies;

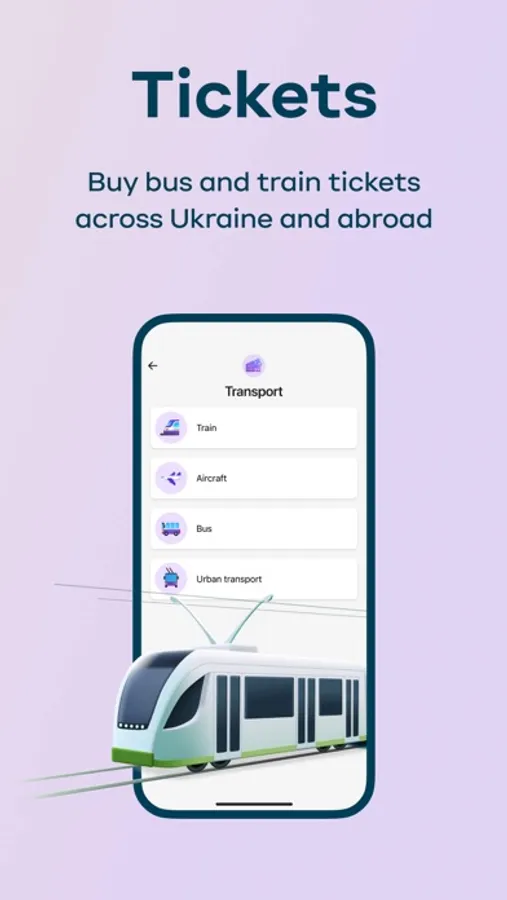

• purchasing train and bus tickets online;

• public transport fare payments;

• insurance (motor third-party liability insurance (MTPL), green card, health insurance, travel insurance).

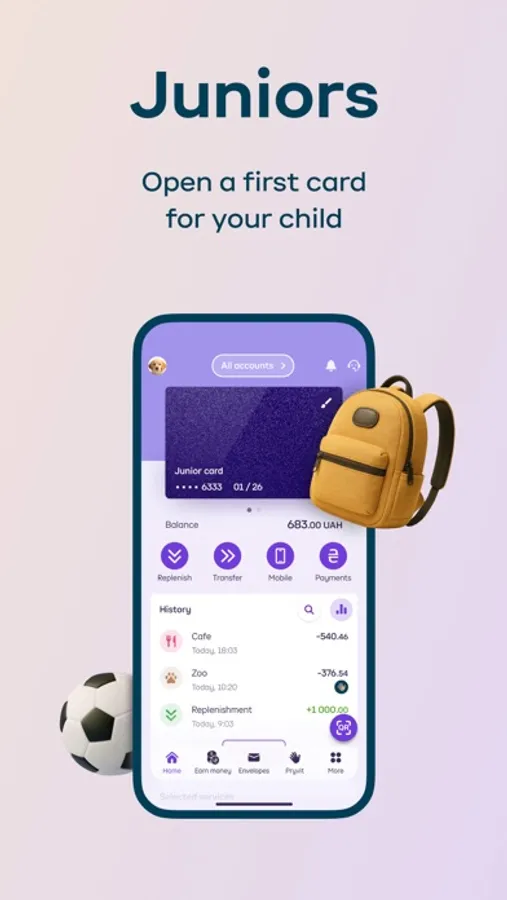

Junior Card (from 6 years old):

• the child's first bank card;

• card replenishment in the app;

• ability to pay and withdraw cash;

• fund transfers and mobile top-up;

• safety of payments and setting payment limits;

• parent control of child's expenses.

Interesting for Juniors:

• original card skins;

• app theme change;

• rewards from parents for completing tasks in the "Task completed – Money earned" service.

For Premium clients:

• personal banker;

• Concierge service;

• list of available benefits:

• availability of services and features check.

Available possibilities for entrepreneurs:

• transferring funds from account of an individual entrepreneur;

• viewing the balance and statement for the account;

• sending account details to counterparties.

We work every day to improve the accessibility and usability of the app.

We get things done!

© 2025 PrivatBank NBU license № 22, 05.10.2011

Cashback, deposits and savings:

• “Pryvit” loyalty program: personalized cashback offers and discounts just for you;

• “Envelopes” service: set and achieve your financial goals for donations, saving money and managing your own expenses;

• cashback accumulation with the “National Cashback” card;

• deposits in various currencies online: UAH, USD, EUR.

Payments and transfers in the mobile app:

• account replenishment: via Apple Pay, from your own card, from another bank's card, by IBAN account number;

• transfers to IBAN account number and by card number to Visa and Mastercard;

• replenishment of the mobile number of any Ukrainian telecom operators;

• payments: utilities, internet services, TV, education, traffic fines, etc.;

• Request to pay: split payment amount for a company;

• in-app online currency exchange;

• sending and receiving instant transfers and non-cash payments;

• SWIFT international transfers.

Managing cards and accounts:

• setting limits – for online payments and cash withdrawals;

• withdrawing and ordering cash;

• opening and reissuing a card online;

• adding a card for payments via Apple Pay;

• selecting a virtual design (skin) for the card.

Loans:

• managing and changing the credit limit;

• making payments under the “Payment by parts”;

• applying for a cash loan, a mortgage, and a car loan.

Controlling and planning expenses:

• income and spending statistics with the “Analytics” service;

• auto payments: mobile top-ups, transfers to a card, utilities and other payments.

More services:

• "Charity" service to support the initiatives;

• "Parking" service to pay for parking in your city;

• order cash at branches and at an ATM;

• certificates: standard, for state institutions, for obtaining subsidies;

• purchasing train and bus tickets online;

• public transport fare payments;

• insurance (motor third-party liability insurance (MTPL), green card, health insurance, travel insurance).

Junior Card (from 6 years old):

• the child's first bank card;

• card replenishment in the app;

• ability to pay and withdraw cash;

• fund transfers and mobile top-up;

• safety of payments and setting payment limits;

• parent control of child's expenses.

Interesting for Juniors:

• original card skins;

• app theme change;

• rewards from parents for completing tasks in the "Task completed – Money earned" service.

For Premium clients:

• personal banker;

• Concierge service;

• list of available benefits:

• availability of services and features check.

Available possibilities for entrepreneurs:

• transferring funds from account of an individual entrepreneur;

• viewing the balance and statement for the account;

• sending account details to counterparties.

We work every day to improve the accessibility and usability of the app.

We get things done!

© 2025 PrivatBank NBU license № 22, 05.10.2011