Options Pricing Monte Carlo

Tenacious App Production, LLC

5.0 ★

rating

Free

About Options Pricing Monte Carlo

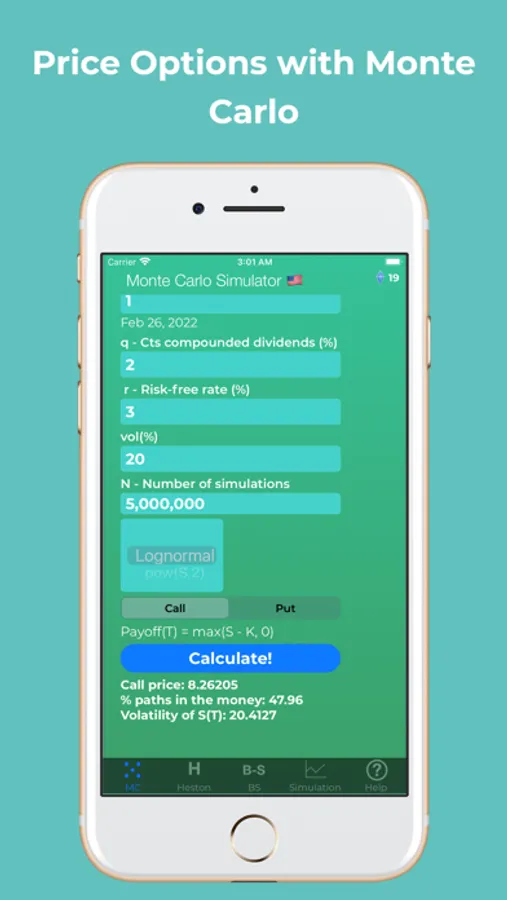

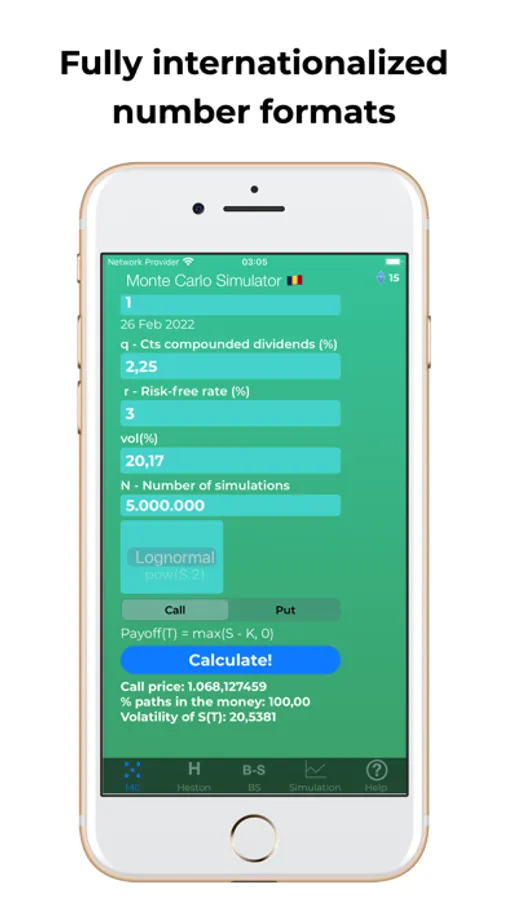

The Options Pricing Monte Carlo app prices power options: max(S^i -K,0) or max(K-S^i,0). It also shows the % of paths with positive payoffs. The normal inverse is calculated with Beasley-Springer-Moro method.

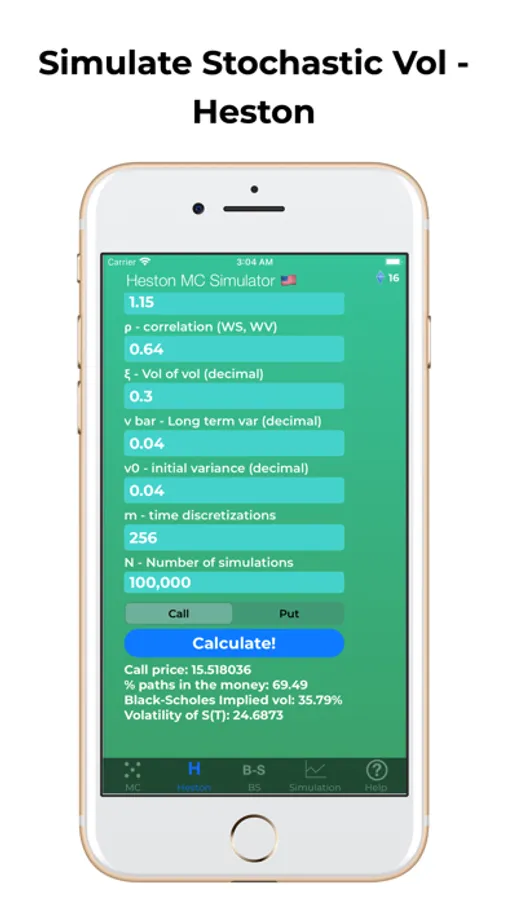

The Heston tab is used to price options under stochastic volatility using Monte Carlo.

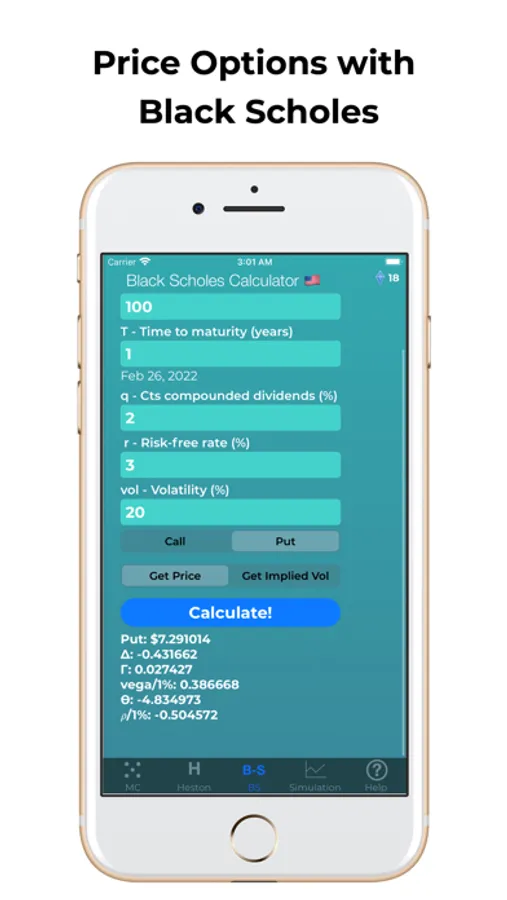

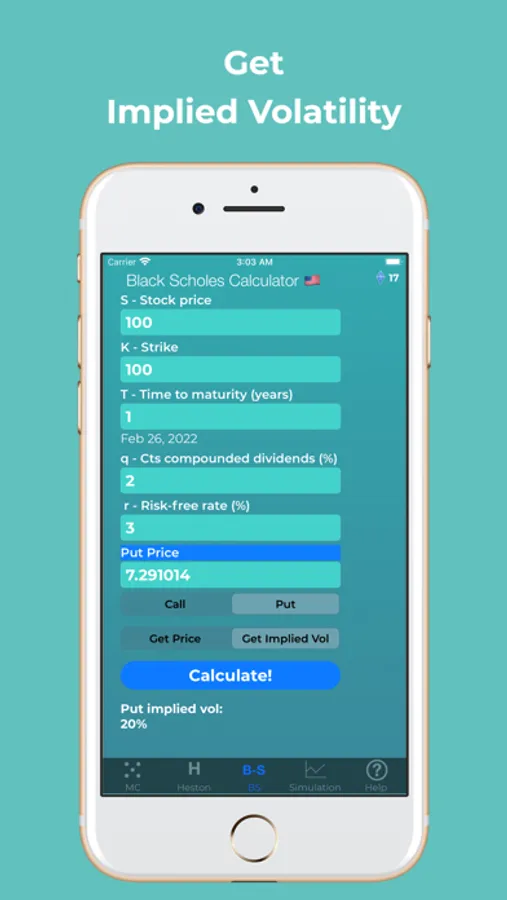

It also prices European options using Black-Scholes and can also calculate Implied Vol. Normal is calculated by direct integration using Simpson method with a low tolerance.

So 4 calculators in one:

- Monte Carlo simulator for regular European and Power options.

- Monte Carlo simulator for European options with stochastic vol (Heston model).

- Black Scholes calculator for price and greeks and implied vol.

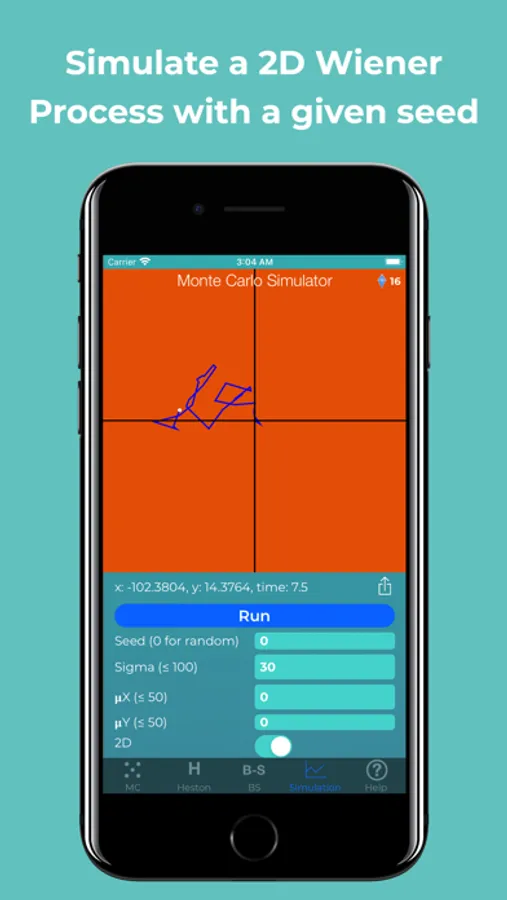

- Simulation tab lets you visualize Brownian Motion with drift. (2D or vs time).

The Heston tab is used to price options under stochastic volatility using Monte Carlo.

It also prices European options using Black-Scholes and can also calculate Implied Vol. Normal is calculated by direct integration using Simpson method with a low tolerance.

So 4 calculators in one:

- Monte Carlo simulator for regular European and Power options.

- Monte Carlo simulator for European options with stochastic vol (Heston model).

- Black Scholes calculator for price and greeks and implied vol.

- Simulation tab lets you visualize Brownian Motion with drift. (2D or vs time).