LoanTap

Loantap Financial Technologies Pvt. Ltd.

5.0 ★

store rating

Free

About LoanTap

Fast, Flexible, Friendly Loans for Salaried Professionals!

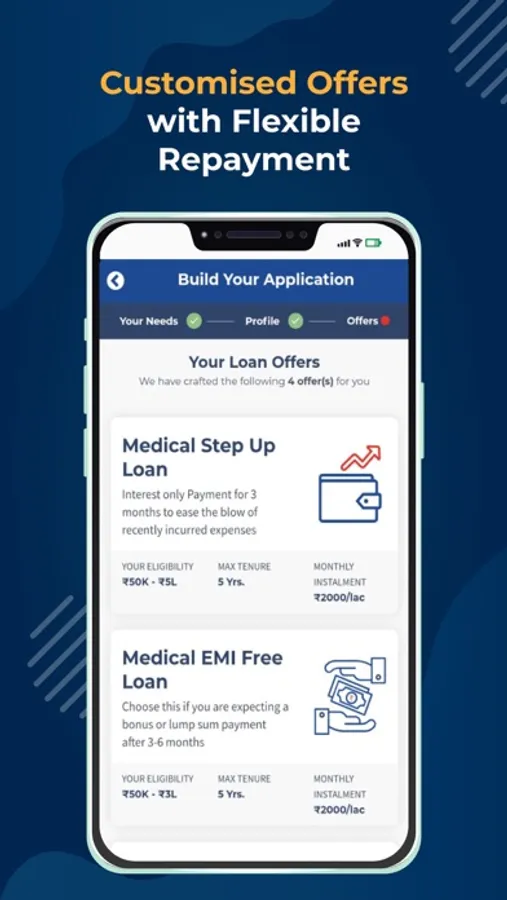

Avail LoanTap’s customized personal loans in 24 hours*. You can enjoy flexible repayment plans that are best suited to lower your monthly EMIs

Minimum Salary Required = Rs. 30,000/month

LoanTap offers personal loans for tenures between 3 months to 60 months. Our loans are both short term and long term with a minimum repayment period of 6 months (for long term loans) post which loan can be closed without any charges!

At LoanTap, we give loans between INR 25,000 to INR 10,00,000. Our Interest Rates start from 18% and go up to 30% per annum depending upon products, personal circumstances, credit assessment procedures and other related factors. We charge processing fees at 2%+ applicable taxes; on the gross loan amount sanctioned.

Repayment Plans offered by LoanTap -

One can avail loans for various purposes like travel, wedding, medical emergency, business expansion, home renovations, purchasing a vehicle or any other financial need. Choose from a variety of personal loans and avail the benefits of Flexible repayment plans such as -

Step Up -

Interest only payment option for the initial 3 months, followed by fixed EMIs for the remaining tenure.

EMI Free -

Interest only payment every month coupled with bullet payment towards the Principal every 3/6 months. Reduces your monthly instalment by 40%

Term -

Repayment done via Fixed equated monthly installments. Each installment reduces both interest and principal amount.

Overdraft -

Interest only payments on the amount you withdraw from your sanctioned credit limit. Credit Card like facility with No restriction on withdrawals and usage.

Note: Final instalment options for a loan will be decided based on your profile and inputs

Reasons to download the LoanTap App:

8 reasons why should you choose LoanTap over any other lending app:

1. Lower instalments

2. Fastest turnaround time

3. Flexible repayment plan

4. No foreclosure charges #

5. Higher Loan amount

6. Higher Loan Tenure

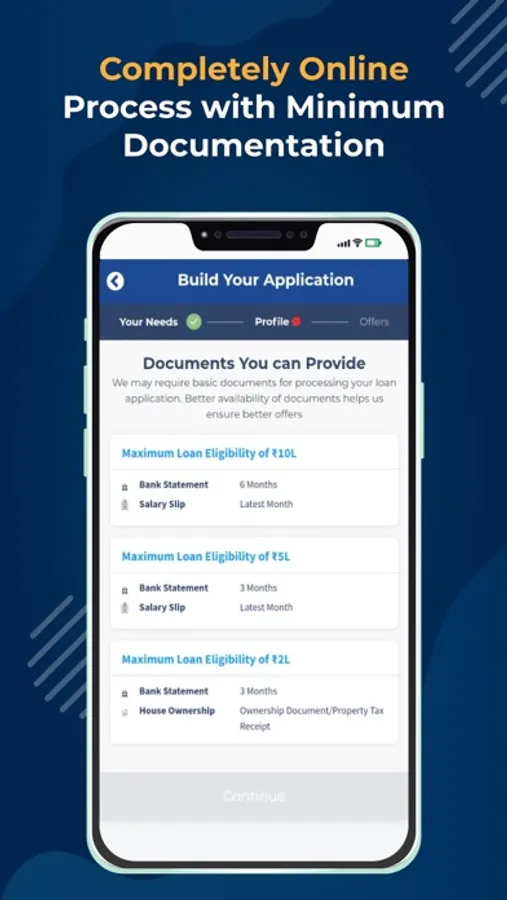

7. Minimum documentation

8. One app for all kinds of personal loans

What makes LoanTap App the best online personal loan app?

1. Easy registration

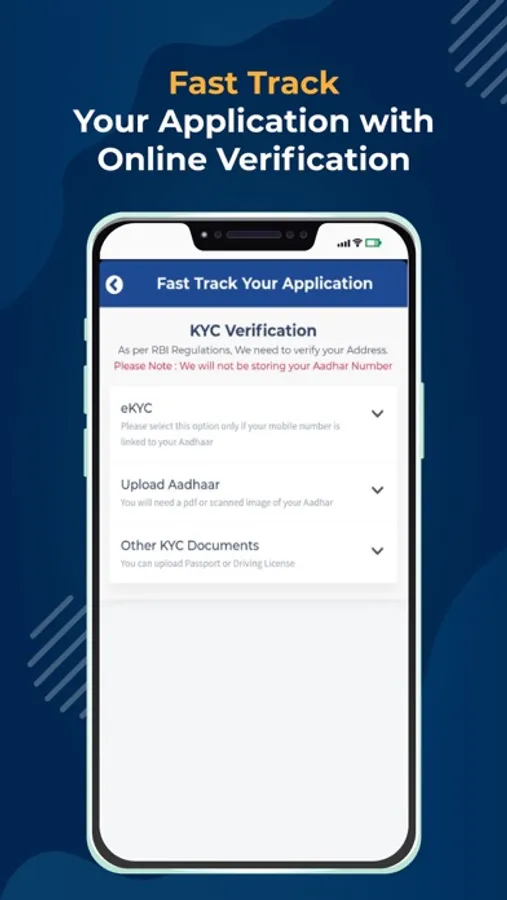

2. Easy upload of documents and eKYC

3. eAgreement and Disbursal

4. Trusted customer support

Avail a contactless, completely digital personal loan with LoanTap. We simplify the loan process right from registration to disbursal. You can now avail a personal loan from the comfort of your home with the help of the Best Instant loan App.

Eligibility Criteria for Loan Application:

1. Individuals with a minimum income of INR 30,000

2. Indian Citizens/Residents who are 21 years & above

One App – Multiple Loan Solutions:

LoanTap offers unique/flexible Credit products such as EMI Free Loan, Personal Overdraft Loan, Advance Salary Loan, Personal Loan, Wedding Loan, Holiday Loan, Credit Card Takeover Loan, Premium Bike Loan, Rental Deposit Loan, House Owner Loan, Medical loan, Vehicle loan and Short term Credit line.

LoanTap’s EMI Free Loan has won “ET Now presents BFSI Most Innovative FinTech product” for the Year, 2019

Cities of Operation:

• Ahmedabad

• Bangalore

• Bhopal

• Chandigarh

• Chennai

• Coimbatore

• Delhi NCR

• Hyderabad

• Indore

• Jaipur

• Mumbai

• Pune

• Raipur

• Vadodara

To apply for a Loan via website – http://loantap.in/apply

Security and Privacy Policy:

We have a highly secured & encrypted system to ensure safety of information shared by our customers. To read our privacy policy click here: https://loantap.in/privacy-security/

Terms and Conditions:

LoanTap offers loans from its in-house RBI registered NBFC, LoanTap Credit Products Private Limited. For more terms and conditions, click at https://loantap.in/terms-of-use/

Please do reach out/write to us on info@loantap.in or call at +91 788 804 0000 for any other information.

*: subject to credit checks

#: subject to conditions

Avail LoanTap’s customized personal loans in 24 hours*. You can enjoy flexible repayment plans that are best suited to lower your monthly EMIs

Minimum Salary Required = Rs. 30,000/month

LoanTap offers personal loans for tenures between 3 months to 60 months. Our loans are both short term and long term with a minimum repayment period of 6 months (for long term loans) post which loan can be closed without any charges!

At LoanTap, we give loans between INR 25,000 to INR 10,00,000. Our Interest Rates start from 18% and go up to 30% per annum depending upon products, personal circumstances, credit assessment procedures and other related factors. We charge processing fees at 2%+ applicable taxes; on the gross loan amount sanctioned.

Repayment Plans offered by LoanTap -

One can avail loans for various purposes like travel, wedding, medical emergency, business expansion, home renovations, purchasing a vehicle or any other financial need. Choose from a variety of personal loans and avail the benefits of Flexible repayment plans such as -

Step Up -

Interest only payment option for the initial 3 months, followed by fixed EMIs for the remaining tenure.

EMI Free -

Interest only payment every month coupled with bullet payment towards the Principal every 3/6 months. Reduces your monthly instalment by 40%

Term -

Repayment done via Fixed equated monthly installments. Each installment reduces both interest and principal amount.

Overdraft -

Interest only payments on the amount you withdraw from your sanctioned credit limit. Credit Card like facility with No restriction on withdrawals and usage.

Note: Final instalment options for a loan will be decided based on your profile and inputs

Reasons to download the LoanTap App:

8 reasons why should you choose LoanTap over any other lending app:

1. Lower instalments

2. Fastest turnaround time

3. Flexible repayment plan

4. No foreclosure charges #

5. Higher Loan amount

6. Higher Loan Tenure

7. Minimum documentation

8. One app for all kinds of personal loans

What makes LoanTap App the best online personal loan app?

1. Easy registration

2. Easy upload of documents and eKYC

3. eAgreement and Disbursal

4. Trusted customer support

Avail a contactless, completely digital personal loan with LoanTap. We simplify the loan process right from registration to disbursal. You can now avail a personal loan from the comfort of your home with the help of the Best Instant loan App.

Eligibility Criteria for Loan Application:

1. Individuals with a minimum income of INR 30,000

2. Indian Citizens/Residents who are 21 years & above

One App – Multiple Loan Solutions:

LoanTap offers unique/flexible Credit products such as EMI Free Loan, Personal Overdraft Loan, Advance Salary Loan, Personal Loan, Wedding Loan, Holiday Loan, Credit Card Takeover Loan, Premium Bike Loan, Rental Deposit Loan, House Owner Loan, Medical loan, Vehicle loan and Short term Credit line.

LoanTap’s EMI Free Loan has won “ET Now presents BFSI Most Innovative FinTech product” for the Year, 2019

Cities of Operation:

• Ahmedabad

• Bangalore

• Bhopal

• Chandigarh

• Chennai

• Coimbatore

• Delhi NCR

• Hyderabad

• Indore

• Jaipur

• Mumbai

• Pune

• Raipur

• Vadodara

To apply for a Loan via website – http://loantap.in/apply

Security and Privacy Policy:

We have a highly secured & encrypted system to ensure safety of information shared by our customers. To read our privacy policy click here: https://loantap.in/privacy-security/

Terms and Conditions:

LoanTap offers loans from its in-house RBI registered NBFC, LoanTap Credit Products Private Limited. For more terms and conditions, click at https://loantap.in/terms-of-use/

Please do reach out/write to us on info@loantap.in or call at +91 788 804 0000 for any other information.

*: subject to credit checks

#: subject to conditions