About True Wealth

Investing and making provisions has never been so easy.

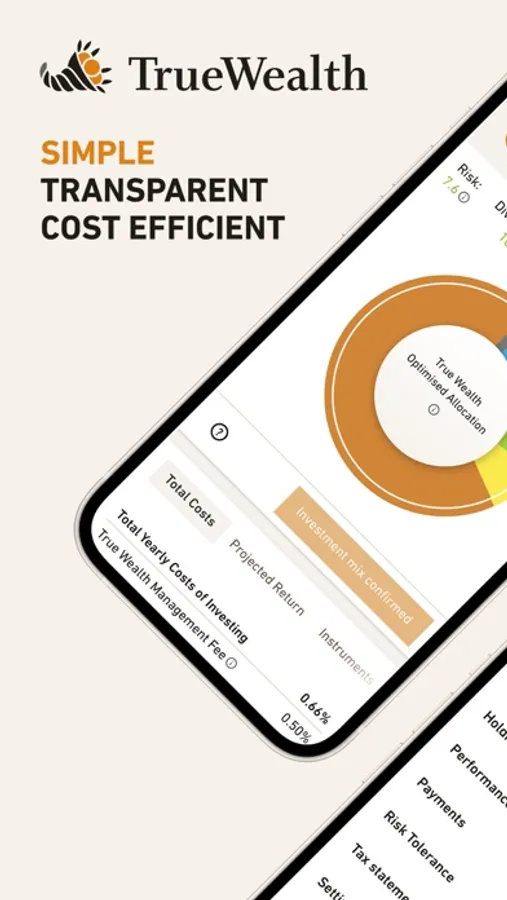

You set the guidelines and retain control of your investment strategy at all times. We take care of the implementation: simple, transparent and cost-efficient.

Professional wealth management doesn't have to be expensive:

High fees are the main enemy of your returns. That's why we do everything we can to keep costs as low as possible. We select the most efficient investment instruments. And everything is already included in our asset management fee of 0.25 to 0.50%:

• Custody fees

• Trading commissions

• Deposits and withdrawals

• Swiss eTax statement

• Risk profiling

• Portfolio rebalancing

The external product costs (TER) are also very competitive. On average, they are only between 0.1% and 0.15% for a global portfolio. The minimum deposit for our wealth management is CHF 8'500. We do not have any kickbacks, retrocessions or hidden fees. We are completely independent in our choice of investment instruments.

What are the benefits of professional wealth management with True Wealth?

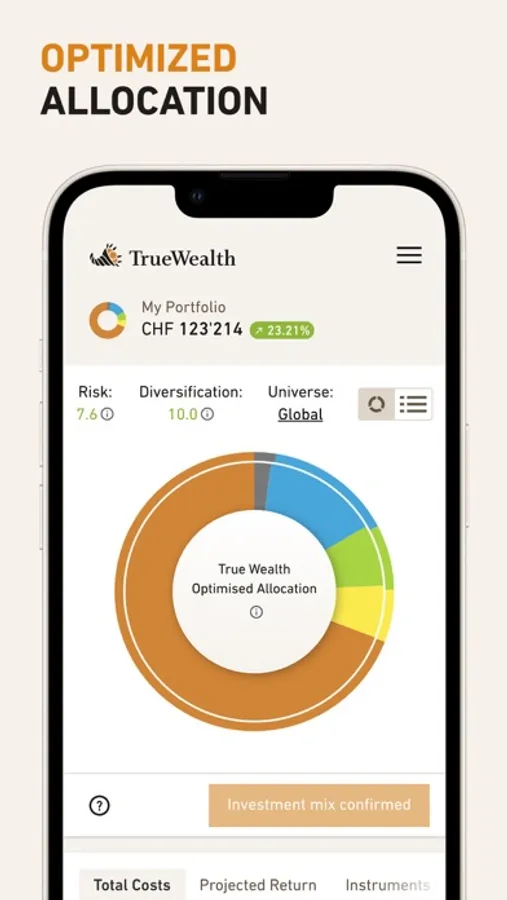

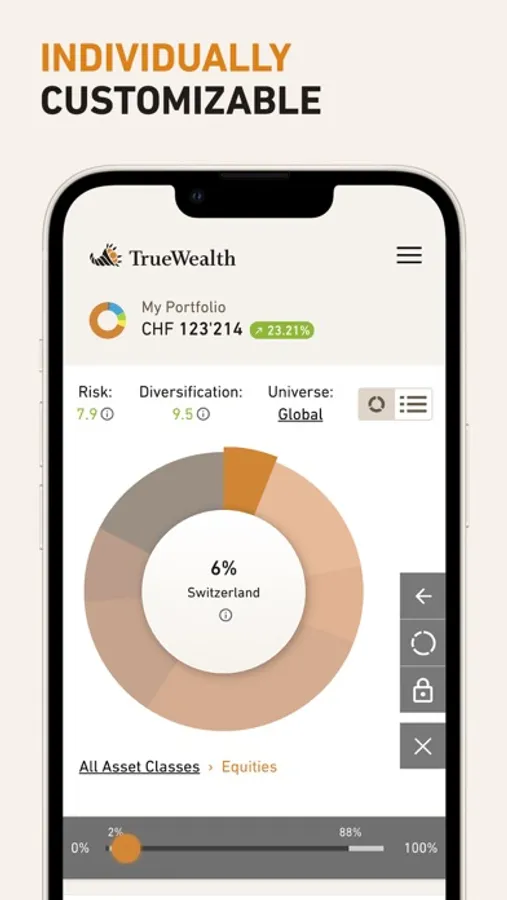

• An investment strategy that suits you. And which you can adjust at any time.

• Reporting that is clear. And that you can understand at a glance.

• Transparency down to the last detail. We show you the total costs at all times.

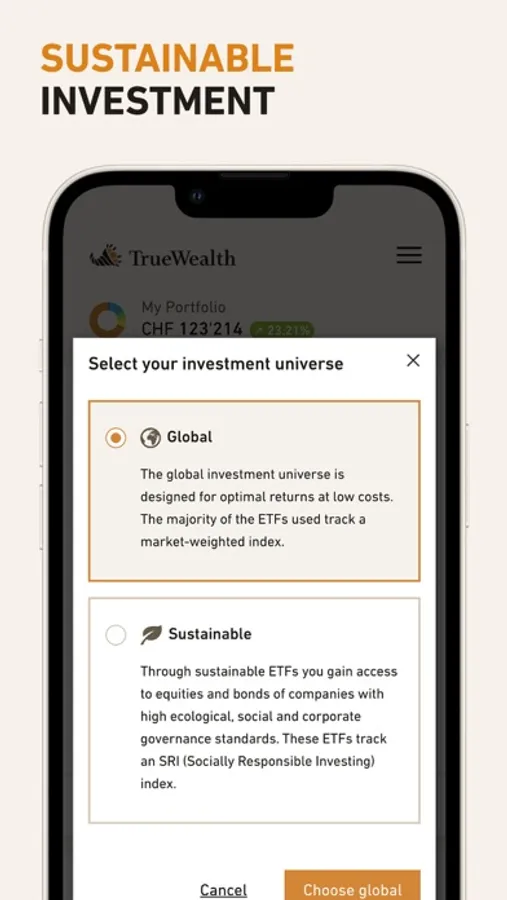

• You can choose between the global and the sustainable investment universe.

• Monitoring and rebalancing: We monitor your portfolio and bring it back on track if necessary.

• Risk management and portfolio construction according to scientific principles.

• High liquidity, no minimum term. Access to your assets at any time.

• Open a custody account and define your investment strategy in less than 15 minutes.

• Test all functions with the virtual account without a penny of real money.

Our Pillar 3a:

The third pillar is seamlessly integrated into our wealth management solution, but can of course also be used as a stand-alone product. And it costs nothing: 0.0% True Wealth fees. And on top of that there is 0.45% interest on cash. Minimum deposit CHF 1'000.

Our solution also offers innovative features: Thanks to automatic account staggering, we open up to five 3a accounts for you over time and with the optional "automatic top up" you will never miss a deposit again.

Portfolios for children and teenagers:

A separate securities portfolio for your child? Check. An account in the child's name? Check. An individual investment strategy that takes your child's long-term investment horizon into account? Check.

We have the solution for young investors. From a minimum deposit of CHF 1'000.

About True Wealth

True Wealth was founded in 2013 by Oliver Herren, co-founder of Digitec Galaxus AG, and Felix Niederer, physicist and portfolio manager, as a Swiss public limited company based in Zurich. Over 35'000 customers are invested via the True Wealth app and platform and have entrusted the company with over 2 billion Swiss francs. True Wealth is an independent wealth manager licensed by FINMA to manage occupational pension schemes and is also subject to its direct supervision.

You set the guidelines and retain control of your investment strategy at all times. We take care of the implementation: simple, transparent and cost-efficient.

Professional wealth management doesn't have to be expensive:

High fees are the main enemy of your returns. That's why we do everything we can to keep costs as low as possible. We select the most efficient investment instruments. And everything is already included in our asset management fee of 0.25 to 0.50%:

• Custody fees

• Trading commissions

• Deposits and withdrawals

• Swiss eTax statement

• Risk profiling

• Portfolio rebalancing

The external product costs (TER) are also very competitive. On average, they are only between 0.1% and 0.15% for a global portfolio. The minimum deposit for our wealth management is CHF 8'500. We do not have any kickbacks, retrocessions or hidden fees. We are completely independent in our choice of investment instruments.

What are the benefits of professional wealth management with True Wealth?

• An investment strategy that suits you. And which you can adjust at any time.

• Reporting that is clear. And that you can understand at a glance.

• Transparency down to the last detail. We show you the total costs at all times.

• You can choose between the global and the sustainable investment universe.

• Monitoring and rebalancing: We monitor your portfolio and bring it back on track if necessary.

• Risk management and portfolio construction according to scientific principles.

• High liquidity, no minimum term. Access to your assets at any time.

• Open a custody account and define your investment strategy in less than 15 minutes.

• Test all functions with the virtual account without a penny of real money.

Our Pillar 3a:

The third pillar is seamlessly integrated into our wealth management solution, but can of course also be used as a stand-alone product. And it costs nothing: 0.0% True Wealth fees. And on top of that there is 0.45% interest on cash. Minimum deposit CHF 1'000.

Our solution also offers innovative features: Thanks to automatic account staggering, we open up to five 3a accounts for you over time and with the optional "automatic top up" you will never miss a deposit again.

Portfolios for children and teenagers:

A separate securities portfolio for your child? Check. An account in the child's name? Check. An individual investment strategy that takes your child's long-term investment horizon into account? Check.

We have the solution for young investors. From a minimum deposit of CHF 1'000.

About True Wealth

True Wealth was founded in 2013 by Oliver Herren, co-founder of Digitec Galaxus AG, and Felix Niederer, physicist and portfolio manager, as a Swiss public limited company based in Zurich. Over 35'000 customers are invested via the True Wealth app and platform and have entrusted the company with over 2 billion Swiss francs. True Wealth is an independent wealth manager licensed by FINMA to manage occupational pension schemes and is also subject to its direct supervision.