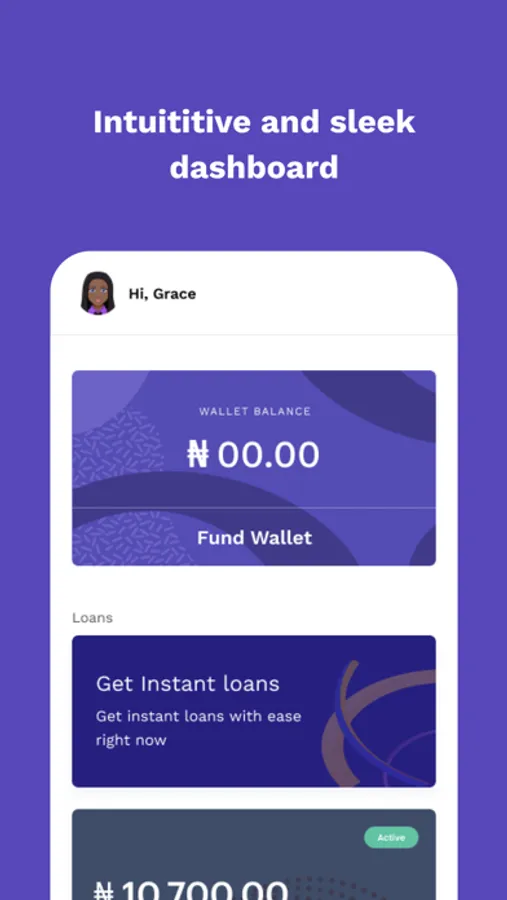

With this financial app, you can apply for personal loans quickly and manage repayments easily. Includes instant loan disbursement and credit scoring features.

About Blocka Cash

Blocka Cash makes access to loans easy and hassle-free, just when you need it. Do away with long queues, paperwork and waiting time. All you need is your smartphone and the Blocka Cash app!

Getting started with Blocka Cash is easy. Just follow the steps below:

- Sign up and set up an account.

- Apply for a loan in seconds.

- Receive your loan instantly and directly into your wallet.

The process is simple and convenient!

OUR LOANS AND REPAYMENT TERMS

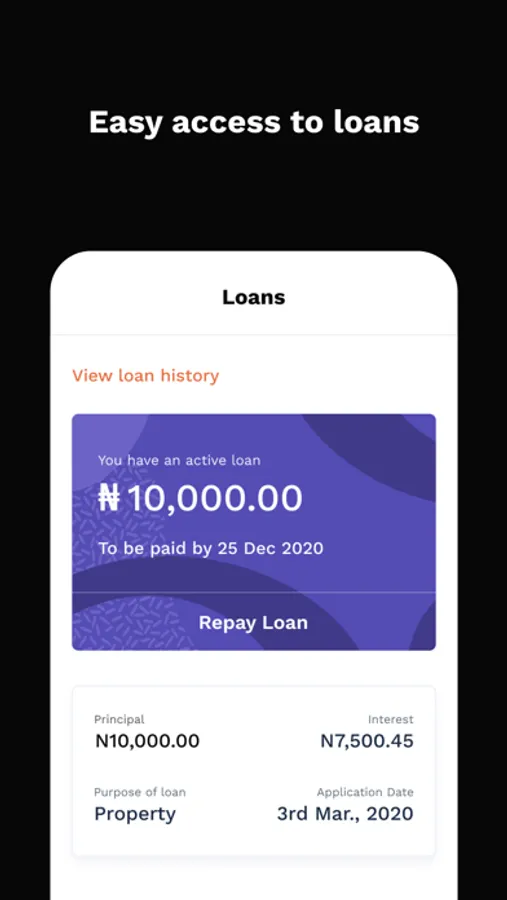

Blocka Cash offers micro-credit and makes provision for short-term personal loans of at least N5,000 and up to N50,000 depending on your credit score.

RATES AND FEES

To access our loans, you must be at least 21 years of age. We may require that you provide a valid Government ID. You can get as little as N5,000 and up to N50,000 and you can pay back between 60 to 180 days. Our usual repayment period is monthly. Our minimum interest rate, which is determined by our credit scoring algorithm, is 3% per month and a maximum of 10% per month. This comes to an Annual Percentage Rate (APR) of 36% to 120%.

EXAMPLE;

If you choose a loan package of N10,000 (Principal) to pay back over a 6-months tenor at an interest rate and fees of 3% per month (36% APR), you will be paying back N1,966.67 monthly for a period of 6 months. At the end of the 6 months, you would’ve paid a total of N11,800.

ADDITIONAL NOTES

When assessing your eligibility for a loan, there are several factors we consider. Some of which are past loan performance, credit score etc.

Ensure that your loan application is correctly filled in as any falsification can lead to consequences ranging from blacklisting your profile to reporting you to the police in clear cases of fraud.

The Blocka Cash app is powered by James Crown Credit Limited. Licensed as a Money Lender by the Ogun State Government of Nigeria.

CONTACT US

Feel free to reach out to us with your feedback, tips, questions and concerns. Let us know how we can make Blocka Cash better for you. Contact us at support@blocka.cash

Getting started with Blocka Cash is easy. Just follow the steps below:

- Sign up and set up an account.

- Apply for a loan in seconds.

- Receive your loan instantly and directly into your wallet.

The process is simple and convenient!

OUR LOANS AND REPAYMENT TERMS

Blocka Cash offers micro-credit and makes provision for short-term personal loans of at least N5,000 and up to N50,000 depending on your credit score.

RATES AND FEES

To access our loans, you must be at least 21 years of age. We may require that you provide a valid Government ID. You can get as little as N5,000 and up to N50,000 and you can pay back between 60 to 180 days. Our usual repayment period is monthly. Our minimum interest rate, which is determined by our credit scoring algorithm, is 3% per month and a maximum of 10% per month. This comes to an Annual Percentage Rate (APR) of 36% to 120%.

EXAMPLE;

If you choose a loan package of N10,000 (Principal) to pay back over a 6-months tenor at an interest rate and fees of 3% per month (36% APR), you will be paying back N1,966.67 monthly for a period of 6 months. At the end of the 6 months, you would’ve paid a total of N11,800.

ADDITIONAL NOTES

When assessing your eligibility for a loan, there are several factors we consider. Some of which are past loan performance, credit score etc.

Ensure that your loan application is correctly filled in as any falsification can lead to consequences ranging from blacklisting your profile to reporting you to the police in clear cases of fraud.

The Blocka Cash app is powered by James Crown Credit Limited. Licensed as a Money Lender by the Ogun State Government of Nigeria.

CONTACT US

Feel free to reach out to us with your feedback, tips, questions and concerns. Let us know how we can make Blocka Cash better for you. Contact us at support@blocka.cash