About Fin9nce

One of the best financial planning, expense tracking and personal finance management app!

Money Manager – One of the best financial planning, review, credit card debt management, loan planning, expense tracking and personal asset management app

Money Manager makes managing personal finances as easy as cheesy! Now easily record your personal and business financial transactions, generate spending reports, review your daily, weekly and monthly financial data and manage your cash flow with Money Manager's spending update and budget planner.

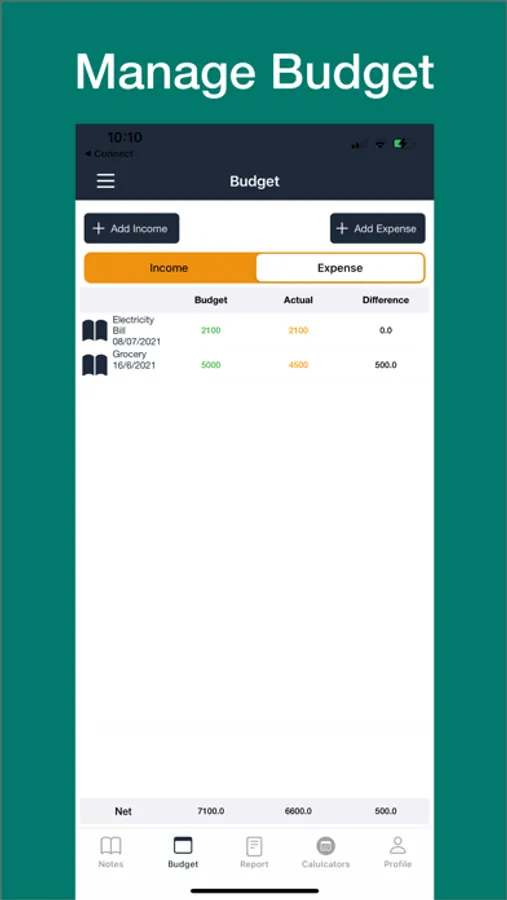

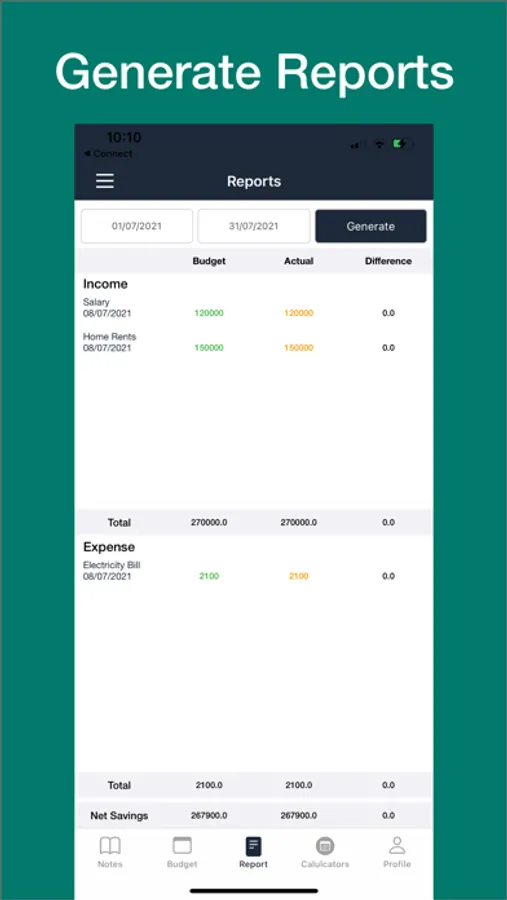

* Budget and expense management function Money Manager shows your budget and expenses by a report so you can see the amount of your expense against your budget quickly and make suitable financial inferences to increase net savings per month. Compare budget with actual and see the difference.

* Credit Card management function Entering a settlement month, you can see the payment amount and outstanding payment in the calculator. You plan what the impact of making minimum payment will yield over a 12-month period. You can see the impact of compounding interest on credit card debt.

* Passcode You can check passcode so you can safely manage your financial review account book within a secured environment.

* Plan Savings -FV

With saving calculator where one can see the product of the compounded interest at work. Plan future saving plans and achieve financial goals.

*Pension Calculator

Plan your pension pot size and monthly payment required to achieve your financial goals. Once you have the rate of return then it easy to calculate with a result of the monthly contribution required to achieve those goals.

*Mortgage/ Personal Loan Calculator

Plan you mortgage payment over the life of the loan and see the impact of interest changes on the loan amount. See monthly payment for personal loans and see total interest paid on loans over the life of the loan.

*Present Value -PV

Find out what the present value is of future sums are of pension, savings, investment or other financial payments. This allows one to use the rate of inflation to check what investment are worth based on your home country.

*Percentage change

This allows one to track price changes, stock price movement, crypto currency movement or any financial investment with price changes.

*Share price

Plan exit strategy of share purchase, by generating scenarios of different share price increase or decrease to plan profit prospect or stop loss containment.

* Instant statistics Based on the data entered, you can instantly see your expense by category and changes between each month. And you can see the change of your assets and income/expense indicated by a looking at figures as well.

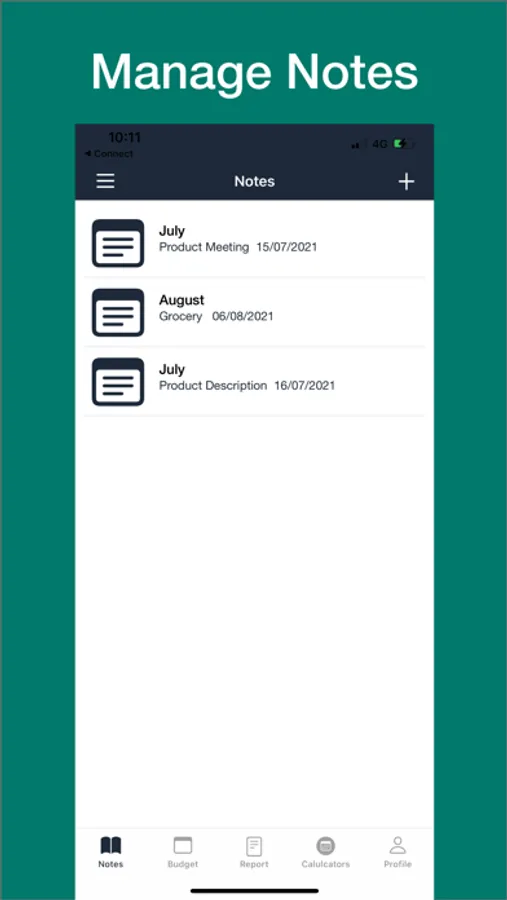

*Notes

Add notes with picture upload for future of receipts or any document from your phone pictures, heading and date organise notes for future reference.

* Other functions - Change of starting date - Calculator function

- Sub Category ON-OFF function

* Paid version * - No Ads.

Money Manager – One of the best financial planning, review, credit card debt management, loan planning, expense tracking and personal asset management app

Money Manager makes managing personal finances as easy as cheesy! Now easily record your personal and business financial transactions, generate spending reports, review your daily, weekly and monthly financial data and manage your cash flow with Money Manager's spending update and budget planner.

* Budget and expense management function Money Manager shows your budget and expenses by a report so you can see the amount of your expense against your budget quickly and make suitable financial inferences to increase net savings per month. Compare budget with actual and see the difference.

* Credit Card management function Entering a settlement month, you can see the payment amount and outstanding payment in the calculator. You plan what the impact of making minimum payment will yield over a 12-month period. You can see the impact of compounding interest on credit card debt.

* Passcode You can check passcode so you can safely manage your financial review account book within a secured environment.

* Plan Savings -FV

With saving calculator where one can see the product of the compounded interest at work. Plan future saving plans and achieve financial goals.

*Pension Calculator

Plan your pension pot size and monthly payment required to achieve your financial goals. Once you have the rate of return then it easy to calculate with a result of the monthly contribution required to achieve those goals.

*Mortgage/ Personal Loan Calculator

Plan you mortgage payment over the life of the loan and see the impact of interest changes on the loan amount. See monthly payment for personal loans and see total interest paid on loans over the life of the loan.

*Present Value -PV

Find out what the present value is of future sums are of pension, savings, investment or other financial payments. This allows one to use the rate of inflation to check what investment are worth based on your home country.

*Percentage change

This allows one to track price changes, stock price movement, crypto currency movement or any financial investment with price changes.

*Share price

Plan exit strategy of share purchase, by generating scenarios of different share price increase or decrease to plan profit prospect or stop loss containment.

* Instant statistics Based on the data entered, you can instantly see your expense by category and changes between each month. And you can see the change of your assets and income/expense indicated by a looking at figures as well.

*Notes

Add notes with picture upload for future of receipts or any document from your phone pictures, heading and date organise notes for future reference.

* Other functions - Change of starting date - Calculator function

- Sub Category ON-OFF function

* Paid version * - No Ads.