With this financial app, you can make investments in mutual funds, fixed deposits, and manage your portfolio. Includes personalized recommendations, systematic investment plans, and portfolio rebalancing options.

AppRecs review analysis

AppRecs rating 4.3. Trustworthiness 0 out of 100. Review manipulation risk 0 out of 100. Based on a review sample analyzed.

★★★★☆

4.3

AppRecs Rating

Ratings breakdown

5 star

96%

4 star

0%

3 star

0%

2 star

4%

1 star

0%

What to know

✓

High user satisfaction

96% of sampled ratings are 5 stars

About HDFC Bank SmartWealth

Access a wide range of financial solutions with the SmartWealth app. SmartWealth is an all-in-one investment app from HDFC Bank. With the SmartWealth app’s intuitive interface complex investments are now easy. Diversify your financial portfolio by investing in Fixed Deposits and market-linked Mutual Funds. Take charge of your financial future with the SmartWealth App!

Why SmartWealth

Here’s how SmartWealth can help you make sound financial decisions:

*Simplified onboarding

Start investing immediately with a completely digital onboarding and Know Your Client (KYC) process. Sign up on the SmartWealth app and get investment-ready in under three minutes.

*Minimal initial investments

Start investing via the SmartWealth app, with amounts as low as ₹100.

*Personalised recommendations

Explore portfolio recommendations based on your risk appetite, investment profile and financial dreams. These recommendations are curated by Bank MF Research team and can help you construct your portfolio and make informed investment decisions.

*Flexible Systematic Investment Plans

You can invest in Mutual Funds with smaller amounts at fixed intervals through Systematic Investment Plans (SIPs). You can select a preferred SIP payment date, amount, etc. Besides using the investment app to invest in SIP, you can also use it to pause, stop or redeem your SIP instantly.

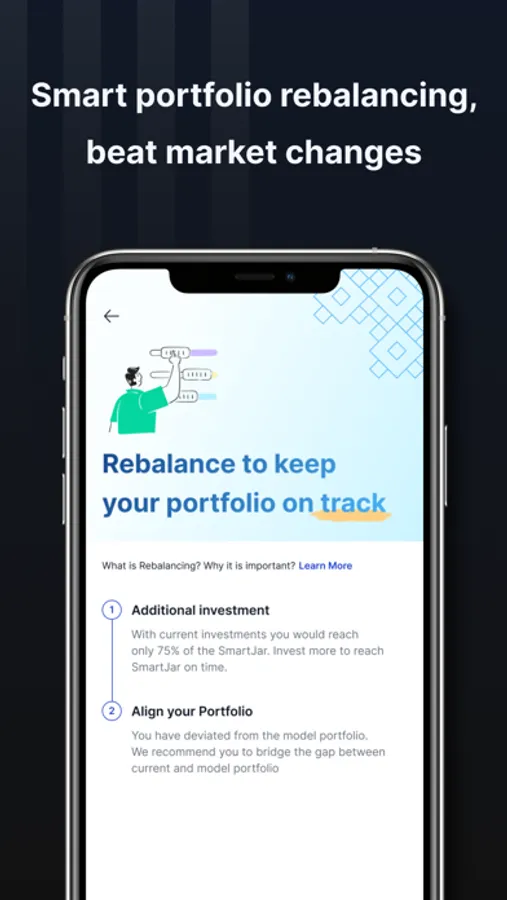

*Portfolio rebalancing

With the single click portfolio rebalancing feature, you can stay on track of your dreams – you can change the weightage of your assets and minimise the risk.

*Seamless portfolio diversification

Minimise your portfolio’s risk by diversifying it across different asset classes. Choose from Equity, Debt, Sectoral Funds, Index Funds, etc. Make your Mutual Fund (MF) investments or invest in FDs.

*Remote transactions

Make hassle-free investments instantly, regardless of your location. Our leading investment app allows you to invest in Mutual Funds, SIPs or open FDs from anywhere.

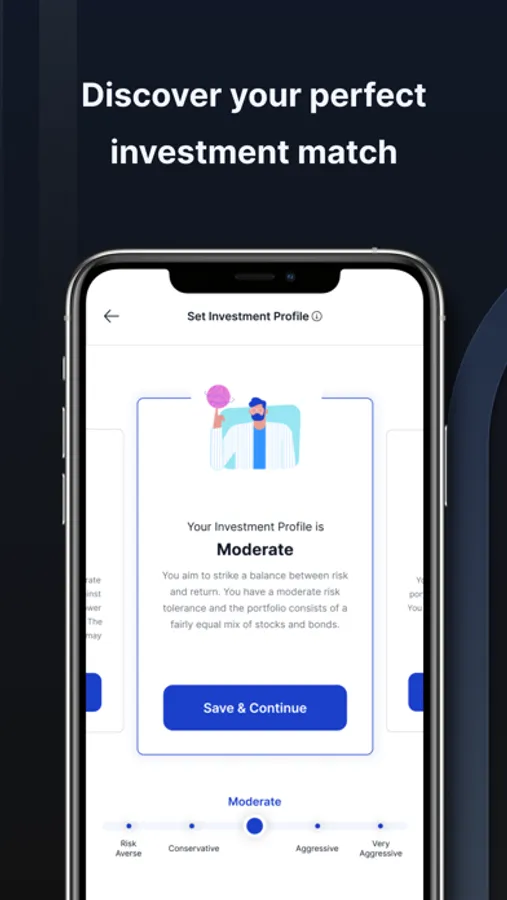

*Investment profile assessment

Get your investment profile assessed in under two minutes. Once done, we help you find an investment strategy that corresponds with your profile.

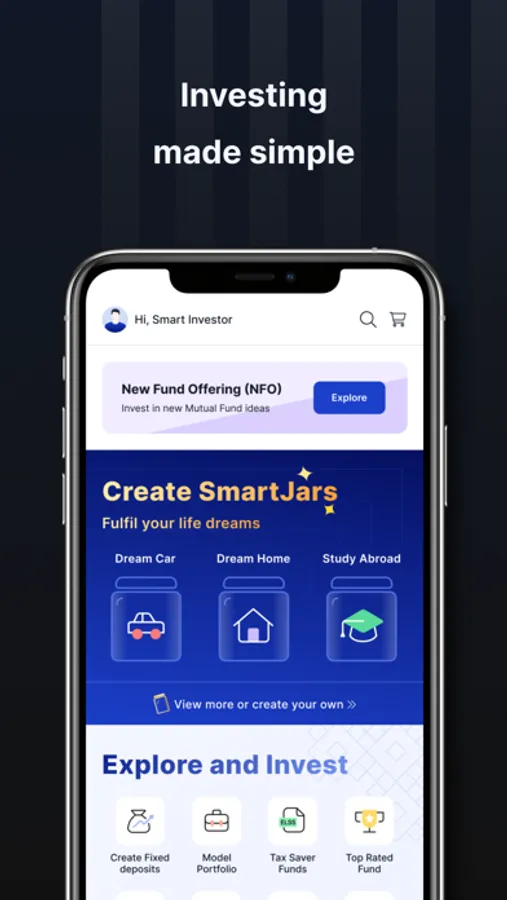

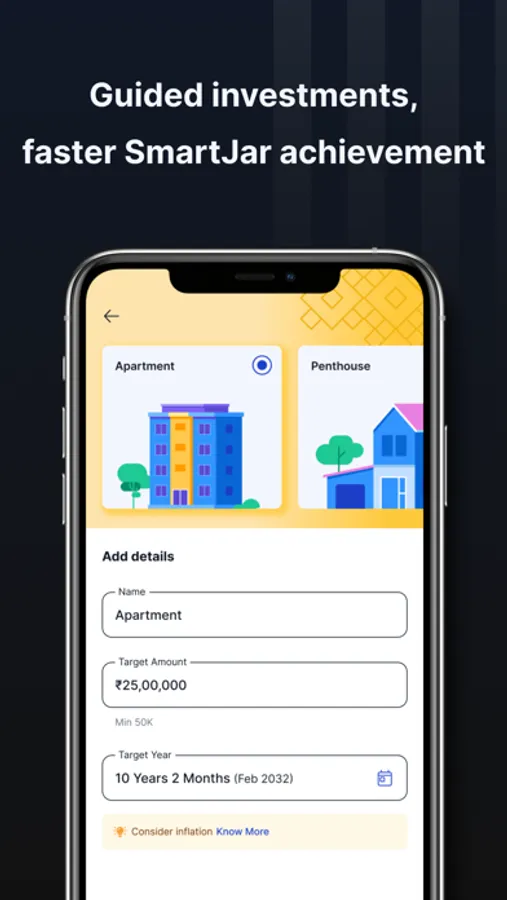

*Set customised SmartJars

Choose from a range of in-built financial milestones, a dream house, a car or even an exotic vacation. Alternatively, you can also customise your own milestones.

*Multiple Mutual Fund offerings

You can invest in tax-saving ELSS Funds, Debt Funds, Balanced Funds, etc. You can also use the app to invest in Index Funds, Sector Funds, Thematic Funds, and more.

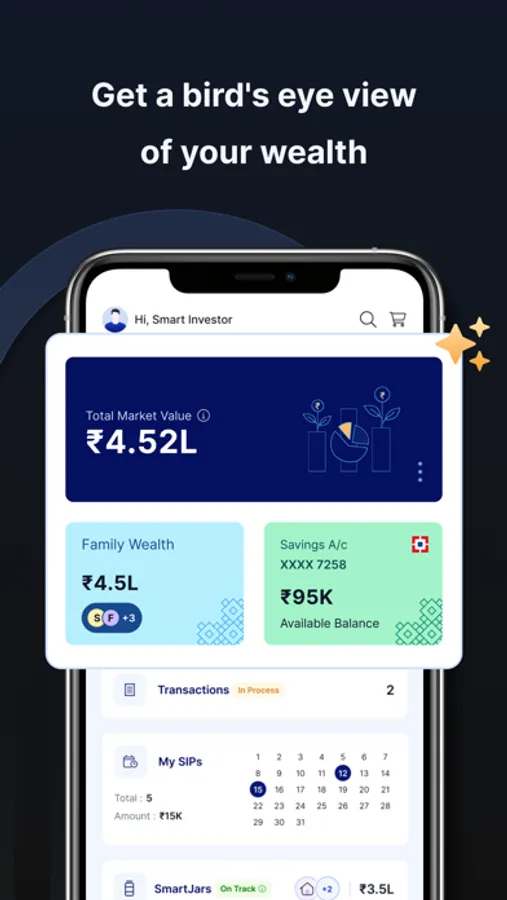

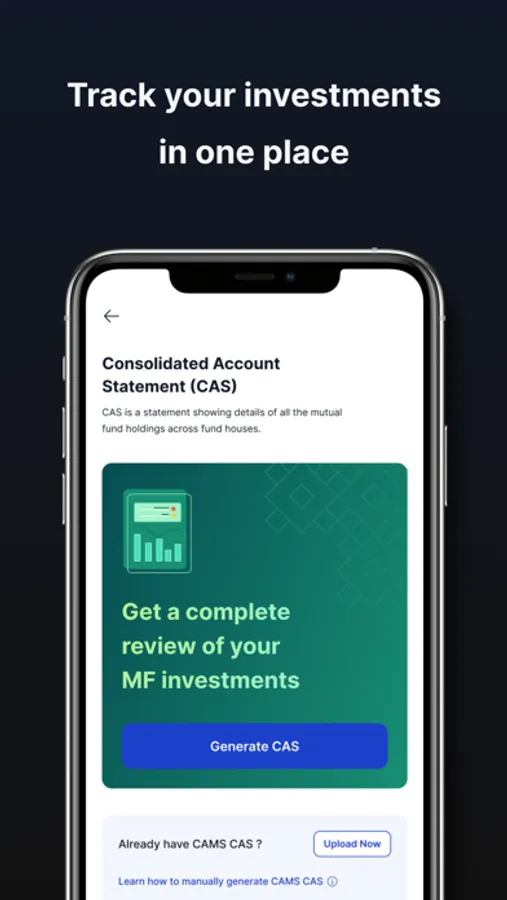

Track external Mutual Fund holdings

Track and analyse all your Mutual Fund holdings in one place. A consolidated account statement will give you access to existing MF investments against your Permanent Account Number (PAN).

*Investment insights

Stay ahead of the markets with free access to research and content on topics including investing, personal finance and financial products. Take advantage of our financial analysis to make sound investment decisions.

*Mutual Fund analysis

Along with facilitating Mutual Fund investments, the SmartWealth app also provides you with complete information on your preferred funds, including their historical performance, the asset management company’s (AMC) details, peer comparison, underlying holding details, risk return statistics and an independent rating.

*Track account statements

Get one-click access to all your investment statements with the SmartWealth app for reporting and filing your returns conveniently. You can also manage your FD – liquidate, nominee details, etc.

Need more information? You can write to us at smartwealth@hdfcbank.com

Stay updated on HDFC Bank’s latest product and service offerings by following us on our social handles:

Instagram: https://www.instagram.com/hdfcbank/

Facebook: https://www.facebook.com/HDFC.bank

Twitter: https://twitter.com/Hdfc_Bank

Why SmartWealth

Here’s how SmartWealth can help you make sound financial decisions:

*Simplified onboarding

Start investing immediately with a completely digital onboarding and Know Your Client (KYC) process. Sign up on the SmartWealth app and get investment-ready in under three minutes.

*Minimal initial investments

Start investing via the SmartWealth app, with amounts as low as ₹100.

*Personalised recommendations

Explore portfolio recommendations based on your risk appetite, investment profile and financial dreams. These recommendations are curated by Bank MF Research team and can help you construct your portfolio and make informed investment decisions.

*Flexible Systematic Investment Plans

You can invest in Mutual Funds with smaller amounts at fixed intervals through Systematic Investment Plans (SIPs). You can select a preferred SIP payment date, amount, etc. Besides using the investment app to invest in SIP, you can also use it to pause, stop or redeem your SIP instantly.

*Portfolio rebalancing

With the single click portfolio rebalancing feature, you can stay on track of your dreams – you can change the weightage of your assets and minimise the risk.

*Seamless portfolio diversification

Minimise your portfolio’s risk by diversifying it across different asset classes. Choose from Equity, Debt, Sectoral Funds, Index Funds, etc. Make your Mutual Fund (MF) investments or invest in FDs.

*Remote transactions

Make hassle-free investments instantly, regardless of your location. Our leading investment app allows you to invest in Mutual Funds, SIPs or open FDs from anywhere.

*Investment profile assessment

Get your investment profile assessed in under two minutes. Once done, we help you find an investment strategy that corresponds with your profile.

*Set customised SmartJars

Choose from a range of in-built financial milestones, a dream house, a car or even an exotic vacation. Alternatively, you can also customise your own milestones.

*Multiple Mutual Fund offerings

You can invest in tax-saving ELSS Funds, Debt Funds, Balanced Funds, etc. You can also use the app to invest in Index Funds, Sector Funds, Thematic Funds, and more.

Track external Mutual Fund holdings

Track and analyse all your Mutual Fund holdings in one place. A consolidated account statement will give you access to existing MF investments against your Permanent Account Number (PAN).

*Investment insights

Stay ahead of the markets with free access to research and content on topics including investing, personal finance and financial products. Take advantage of our financial analysis to make sound investment decisions.

*Mutual Fund analysis

Along with facilitating Mutual Fund investments, the SmartWealth app also provides you with complete information on your preferred funds, including their historical performance, the asset management company’s (AMC) details, peer comparison, underlying holding details, risk return statistics and an independent rating.

*Track account statements

Get one-click access to all your investment statements with the SmartWealth app for reporting and filing your returns conveniently. You can also manage your FD – liquidate, nominee details, etc.

Need more information? You can write to us at smartwealth@hdfcbank.com

Stay updated on HDFC Bank’s latest product and service offerings by following us on our social handles:

Instagram: https://www.instagram.com/hdfcbank/

Facebook: https://www.facebook.com/HDFC.bank

Twitter: https://twitter.com/Hdfc_Bank