In this financial app, you can manage payments, see your purchasing power, and schedule plans. Includes account overview, payment options, and deal discovery features.

AppRecs review analysis

AppRecs rating 4.1. Trustworthiness 0 out of 100. Review manipulation risk 0 out of 100. Based on a review sample analyzed.

★★★★☆

4.1

AppRecs Rating

Ratings breakdown

5 star

93%

4 star

4%

3 star

1%

2 star

0%

1 star

1%

What to know

✓

High user satisfaction

93% of sampled ratings are 5 stars

✓

Proven track record

Strong volume of user ratings

⚠

Pricing complaints

Many low ratings mention paywalls or pricing

About Affirm: Buy now, pay over time

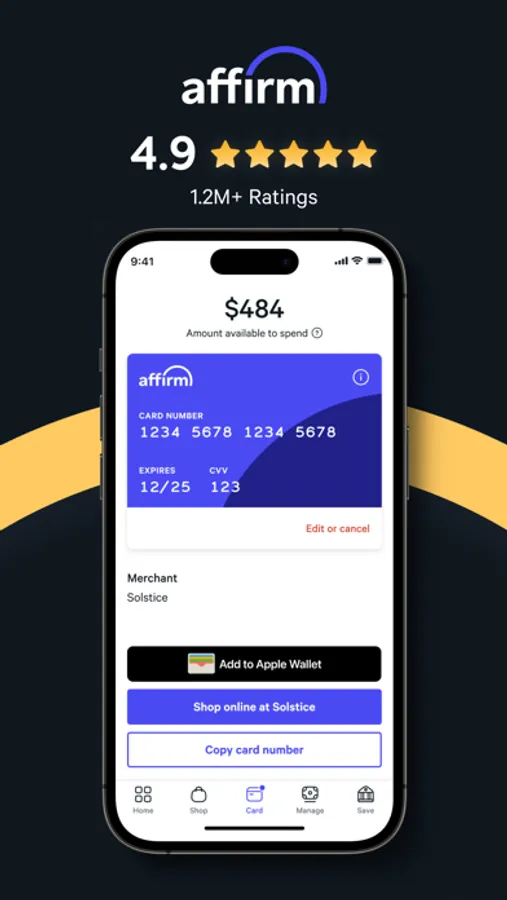

Pay over time with Affirm online, in-store, and in the app. Plus, eligible customers can get the Affirm Card™ to use anywhere Visa is accepted in the U.S., or pay with Affirm on Apple Pay.

Why you’ll love the Affirm app:

• See your purchasing power front and center

• Shop brands with clear, flexible payment options

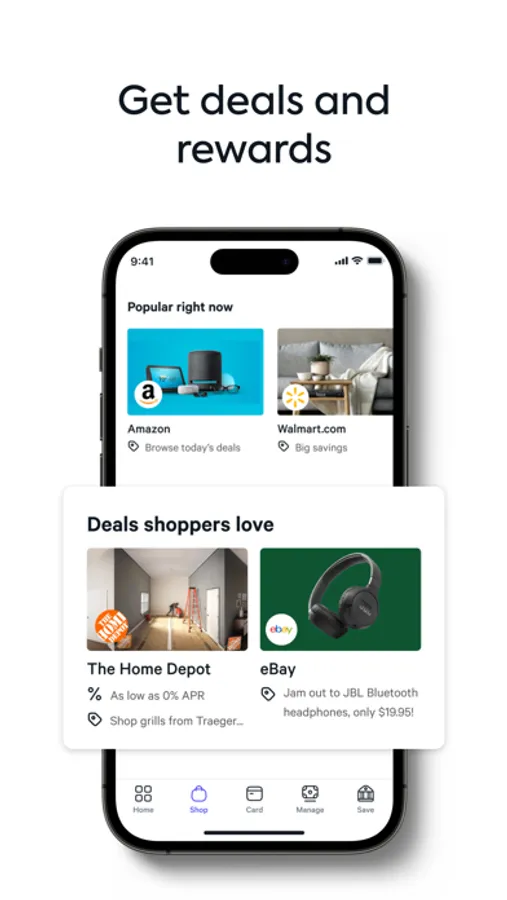

• Discover deals, 0% APR options, and plans over 12 months

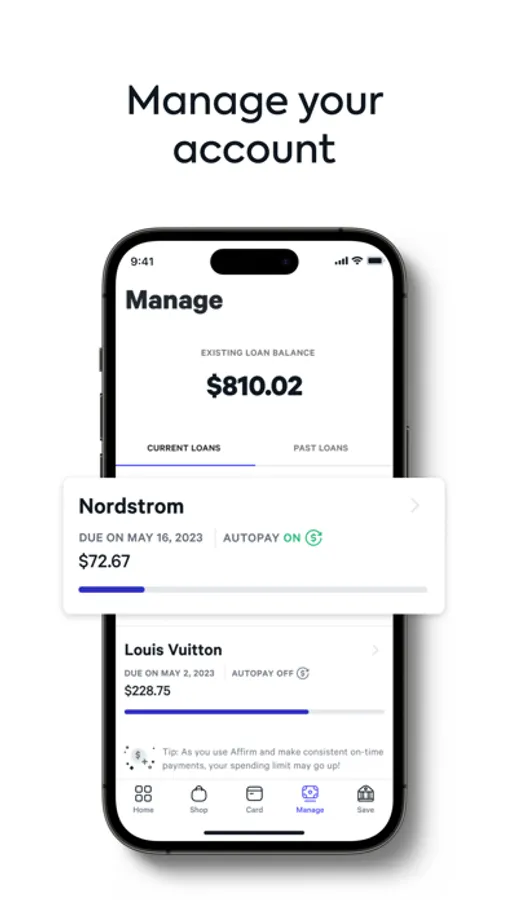

• Set up AutoPay or easily make early or one-time payments

• Request to pay over time with the Affirm Card online or in-store

Take your Affirm Card everywhere:

• Get a physical card and use it anywhere Visa is accepted in the U.S.

• No credit impact to apply, and no card or annual fees

• Discover 0% APR options or flexible plans at top brands, in-store and online

• Request a payment plan in the app before or after checkout. Minimum purchase may be required for payment plans. See footer for details.

Purchasing power is an estimate and may include a down payment at checkout. Approval and terms aren’t guaranteed.

The Affirm Card is a Visa® debit card issued by Evolve Bank & Trust (Evolve) or Stride Bank, N.A. (Stride), Members FDIC, pursuant to licenses from Visa U.S.A. Inc. Affirm is not a bank. FDIC insurance will only cover the failure of Evolve and/or Stride. Learn more at https://www.fdic.gov/resources/deposit-insurance/. Pay-over-time plans must be applied for each purchase in the mobile app, are subject to eligibility checks and are provided by affirm.com/lenders. Minimum purchases are required for pay over time plans; the amount is located in the Card tab of the app. For purchases that are not approved for and matched to a payment plan, you authorize Affirm to initiate an ACH debit from your linked bank account within 1-3 days of the purchase. CA residents: Loans by Affirm Loan Services, LLC are made or arranged pursuant to a California Financing Law license 60DBO-111681. For licenses and disclosures, see affirm.com/licenses.

Rates from 0 - 36% APR. For example, an $800 purchase could be split into 12 monthly payments of $77.99 at 30% APR, or 4 interest-free payments of $200 every 2 weeks. Loan options vary, are subject to eligibility, and may depend on whether your loan is applied for before or after your card purchase. There are minimum purchase amounts for loans, a down payment may be required, and may not be available in all states.

Why you’ll love the Affirm app:

• See your purchasing power front and center

• Shop brands with clear, flexible payment options

• Discover deals, 0% APR options, and plans over 12 months

• Set up AutoPay or easily make early or one-time payments

• Request to pay over time with the Affirm Card online or in-store

Take your Affirm Card everywhere:

• Get a physical card and use it anywhere Visa is accepted in the U.S.

• No credit impact to apply, and no card or annual fees

• Discover 0% APR options or flexible plans at top brands, in-store and online

• Request a payment plan in the app before or after checkout. Minimum purchase may be required for payment plans. See footer for details.

Purchasing power is an estimate and may include a down payment at checkout. Approval and terms aren’t guaranteed.

The Affirm Card is a Visa® debit card issued by Evolve Bank & Trust (Evolve) or Stride Bank, N.A. (Stride), Members FDIC, pursuant to licenses from Visa U.S.A. Inc. Affirm is not a bank. FDIC insurance will only cover the failure of Evolve and/or Stride. Learn more at https://www.fdic.gov/resources/deposit-insurance/. Pay-over-time plans must be applied for each purchase in the mobile app, are subject to eligibility checks and are provided by affirm.com/lenders. Minimum purchases are required for pay over time plans; the amount is located in the Card tab of the app. For purchases that are not approved for and matched to a payment plan, you authorize Affirm to initiate an ACH debit from your linked bank account within 1-3 days of the purchase. CA residents: Loans by Affirm Loan Services, LLC are made or arranged pursuant to a California Financing Law license 60DBO-111681. For licenses and disclosures, see affirm.com/licenses.

Rates from 0 - 36% APR. For example, an $800 purchase could be split into 12 monthly payments of $77.99 at 30% APR, or 4 interest-free payments of $200 every 2 weeks. Loan options vary, are subject to eligibility, and may depend on whether your loan is applied for before or after your card purchase. There are minimum purchase amounts for loans, a down payment may be required, and may not be available in all states.