In this budget forecasting app, you can input your income and expenses to see future account balances. Includes balance projections, pending transactions, and expense categories.

About Green - Budget Forecasting

Know your future balance changes to organize your bills, track spending and manage your cash flow. Not just a budget app but your financial fortune teller.

Green lets you budget without having to budget. Green is not just another generic budgeting app. It is an income and expense tracking app with balance forecasting that automatically predicts your changing account balances over the next year.

HOW GREEN WORKS:

******************************

1. Create your forecast

-- Enter your current account balance

-- Enter your recurring income and expenses (mortgage/rent, groceries, utilities, savings, etc.) and their occurrence (weekly, monthly, bi-weekly, etc.)

2. Be informed

-- Know your 3 most important balances, current, pending and lowest

-- See where you will be financially in the future (a year from now, 6 months from now, etc.)

-- Make sure you will have enough income to cover future expenses.

-- Make sure you don’t miss any bills.

3. Budget decisions

-- Save for unseen expenses.

-- See how spending money today affects your future finances.

-- Experiment by adding, removing or adjusting expense items to find out how it affects your bottom line next week, next month even up to a year from now.

THE FINANCIAL FEED – Your personal finance tracker at a glance

*************************************************************

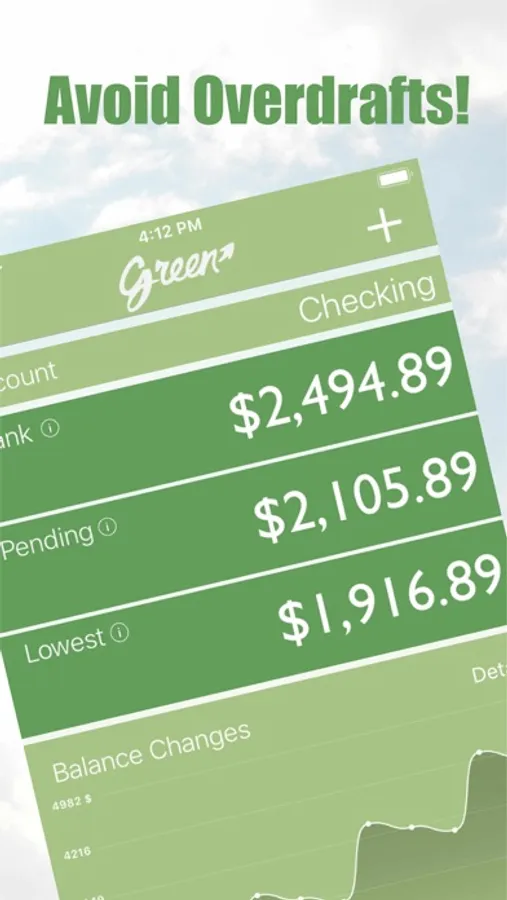

At the top of your financial feed are your three balances. The Bank balance is what the balance should be in your account. The Pending balance is the difference between outstanding transactions and the Bank balance. The Lowest balance is what your lowest balance may be in the upcoming year. Tap the Lowest title to display the expected date of the lowest balance.

After the balances is a forecast graph. This graph is the anticipated balances change over the upcoming year based on your budget. This is an easy way to know if your spending is trending up or down.

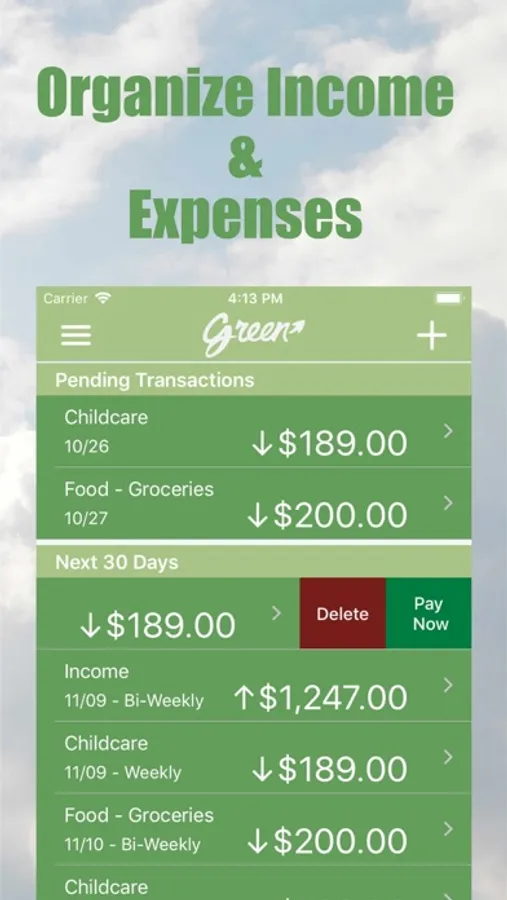

The last three sections are transactions. They are broken down into lists for pending, upcoming and past transactions. Pending transactions list income or expenses activities that you completed but it hasn’t reflected in your account yet. Once they have cleared your account, the transaction can be cleared in Green (swipe let on the transaction) and it moves to the Past 30 days’ section. The Past 30 Days’ section contains all the transactions that occurred in the last 30 days. Your whole account transaction history can be exported as an excel file for further evaluation by swiping left on an account in the settings menu. The upcoming section shows what transactions are coming up. Just swipe left on the transaction to pay early or wait for the scheduled date when the transaction automatically moves to the Pending section.

WHAT CAN YOU DO?

****************************

- Know when it's safe to spend

- Analyze your spending history

- Never forget another bill again

- Be budget aware even when you spend

- Have confidence in controlling your money

- Setup multiple budgets for different accounts

Don’t avoid controlling your money because it seems too intimidating and scary because with Green it’s easy. Because of Green’s forecast capability, you can plan for unexpected expenses, pay off debt earlier and finally take control of your money. Once you’re in control of your money your stress level will go down. Live life in control.

Green lets you budget without having to budget. Green is not just another generic budgeting app. It is an income and expense tracking app with balance forecasting that automatically predicts your changing account balances over the next year.

HOW GREEN WORKS:

******************************

1. Create your forecast

-- Enter your current account balance

-- Enter your recurring income and expenses (mortgage/rent, groceries, utilities, savings, etc.) and their occurrence (weekly, monthly, bi-weekly, etc.)

2. Be informed

-- Know your 3 most important balances, current, pending and lowest

-- See where you will be financially in the future (a year from now, 6 months from now, etc.)

-- Make sure you will have enough income to cover future expenses.

-- Make sure you don’t miss any bills.

3. Budget decisions

-- Save for unseen expenses.

-- See how spending money today affects your future finances.

-- Experiment by adding, removing or adjusting expense items to find out how it affects your bottom line next week, next month even up to a year from now.

THE FINANCIAL FEED – Your personal finance tracker at a glance

*************************************************************

At the top of your financial feed are your three balances. The Bank balance is what the balance should be in your account. The Pending balance is the difference between outstanding transactions and the Bank balance. The Lowest balance is what your lowest balance may be in the upcoming year. Tap the Lowest title to display the expected date of the lowest balance.

After the balances is a forecast graph. This graph is the anticipated balances change over the upcoming year based on your budget. This is an easy way to know if your spending is trending up or down.

The last three sections are transactions. They are broken down into lists for pending, upcoming and past transactions. Pending transactions list income or expenses activities that you completed but it hasn’t reflected in your account yet. Once they have cleared your account, the transaction can be cleared in Green (swipe let on the transaction) and it moves to the Past 30 days’ section. The Past 30 Days’ section contains all the transactions that occurred in the last 30 days. Your whole account transaction history can be exported as an excel file for further evaluation by swiping left on an account in the settings menu. The upcoming section shows what transactions are coming up. Just swipe left on the transaction to pay early or wait for the scheduled date when the transaction automatically moves to the Pending section.

WHAT CAN YOU DO?

****************************

- Know when it's safe to spend

- Analyze your spending history

- Never forget another bill again

- Be budget aware even when you spend

- Have confidence in controlling your money

- Setup multiple budgets for different accounts

Don’t avoid controlling your money because it seems too intimidating and scary because with Green it’s easy. Because of Green’s forecast capability, you can plan for unexpected expenses, pay off debt earlier and finally take control of your money. Once you’re in control of your money your stress level will go down. Live life in control.