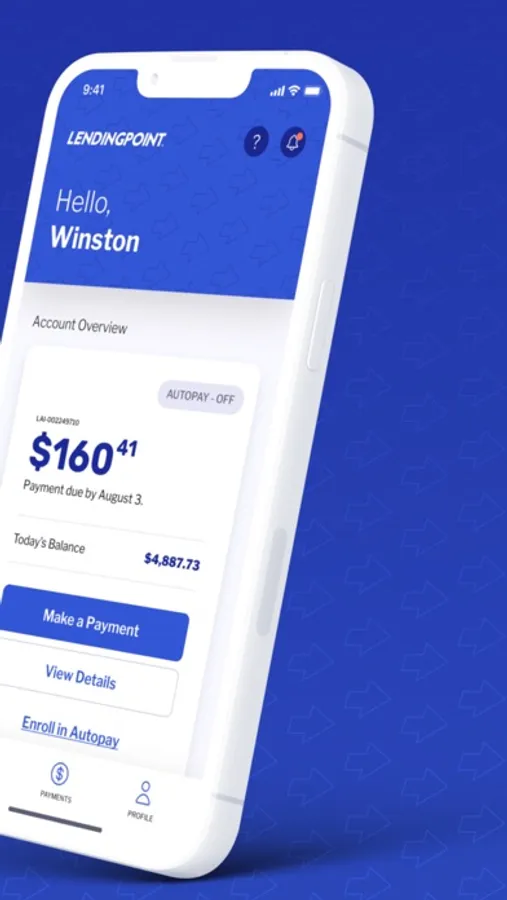

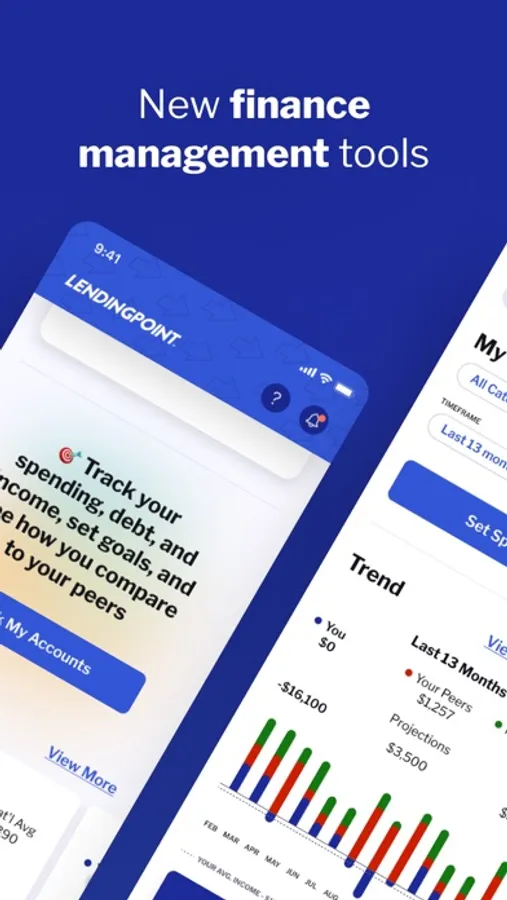

With this financial management app, you can check loan rates, make payments, and update personal information. Includes account management, loan tracking, and payment scheduling features.

AppRecs review analysis

AppRecs rating 4.5. Trustworthiness 77 out of 100. Review manipulation risk 25 out of 100. Based on a review sample analyzed.

★★★★☆

4.5

AppRecs Rating

Ratings breakdown

5 star

90%

4 star

5%

3 star

1%

2 star

0%

1 star

3%

What to know

✓

Low review manipulation risk

25% review manipulation risk

✓

Credible reviews

77% trustworthiness score from analyzed reviews

⚠

Pricing complaints

Many low ratings mention paywalls or pricing

About LendingPoint

Welcome to the LendingPoint app, a comprehensive mobile application created to empower individuals in effectively managing their finances. By utilizing the app's capabilities, users can pave the way toward financial well-being and confidently achieve their long-term financial goals. Whether you're interested in checking rates for a personal loan or already have a loan with LendingPoint, the app covers you. Experience a hassle-free way to manage your account, make payments, and update your personal information all in one place. The LendingPoint app is designed to be your comprehensive solution for all your financial needs.

Applications submitted on this website may be funded by one of several lenders, including: FinWise Bank, a Utah-chartered bank, Member FDIC; Coastal Community Bank, Member FDIC; and LendingPoint, a licensed lender in certain states. Loan approval is not guaranteed. Actual loan offers and loan amounts, terms, and annual percentage rates ("APR") may vary based upon LendingPoint's proprietary scoring and underwriting system's review of your credit, financial condition, other factors, and supporting documents or information you provide. Origination or other fees up to 10% may apply depending upon your state of residence. Upon final underwriting approval to fund a loan, said funds are often sent via ACH the next non-holiday business day. Loans are offered from $1,000 to $50,000, at rates ranging from 7.99% to 35.99% APR, with terms from 24 to 72 months. Minimum loan amounts apply in Georgia, $3,500; Colorado, $3,001; and Hawaii, $2,000. For a well-qualified customer, a requested loan of $10,000 by LendingPoint over a period of 48 months that has an APR of 24.99% with an origination fee of 10% may have a payment of $331.52 per month. (Actual terms and rate depend on credit history, income, and other factors.) Customers may have the option to deduct the origination fee from the disbursed loan amount if desired. If the origination fee is added to the financed amount, interest is charged on the full principal amount. The total amount due is the total amount of the loan you will have paid after you have made all payments as scheduled.

Applications submitted on this website may be funded by one of several lenders, including: FinWise Bank, a Utah-chartered bank, Member FDIC; Coastal Community Bank, Member FDIC; and LendingPoint, a licensed lender in certain states. Loan approval is not guaranteed. Actual loan offers and loan amounts, terms, and annual percentage rates ("APR") may vary based upon LendingPoint's proprietary scoring and underwriting system's review of your credit, financial condition, other factors, and supporting documents or information you provide. Origination or other fees up to 10% may apply depending upon your state of residence. Upon final underwriting approval to fund a loan, said funds are often sent via ACH the next non-holiday business day. Loans are offered from $1,000 to $50,000, at rates ranging from 7.99% to 35.99% APR, with terms from 24 to 72 months. Minimum loan amounts apply in Georgia, $3,500; Colorado, $3,001; and Hawaii, $2,000. For a well-qualified customer, a requested loan of $10,000 by LendingPoint over a period of 48 months that has an APR of 24.99% with an origination fee of 10% may have a payment of $331.52 per month. (Actual terms and rate depend on credit history, income, and other factors.) Customers may have the option to deduct the origination fee from the disbursed loan amount if desired. If the origination fee is added to the financed amount, interest is charged on the full principal amount. The total amount due is the total amount of the loan you will have paid after you have made all payments as scheduled.