About Allocation3M

Machine learning and data analytics are increasingly used in project management to improve productivity. In project management, the efficient allocation of resources helps maximize the impact of project resources. Allocation3M uses three classical allocation models to optimize resource allocation results from different perspectives. Resources can be time, manpower, products, materials, budget, etc.

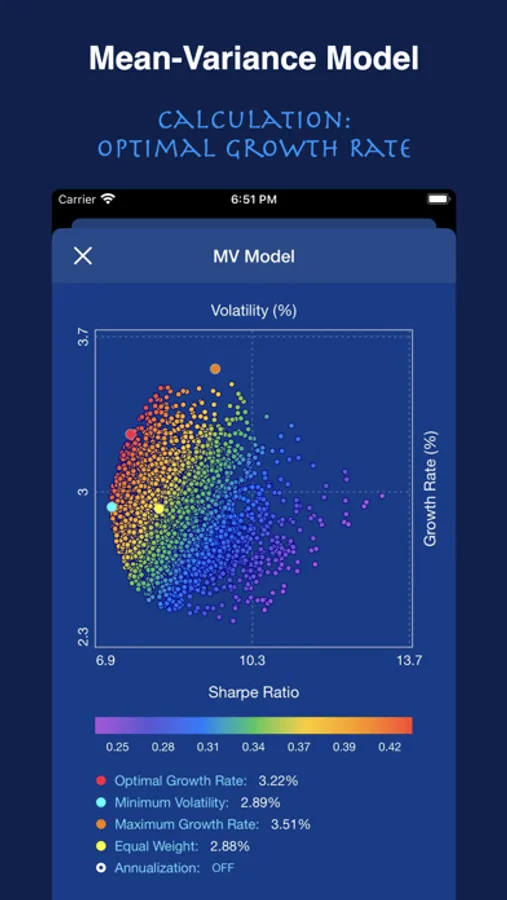

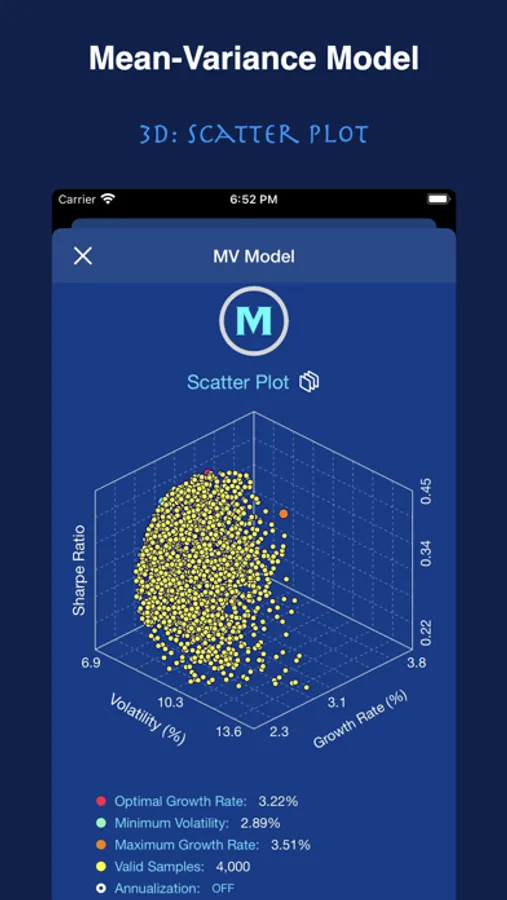

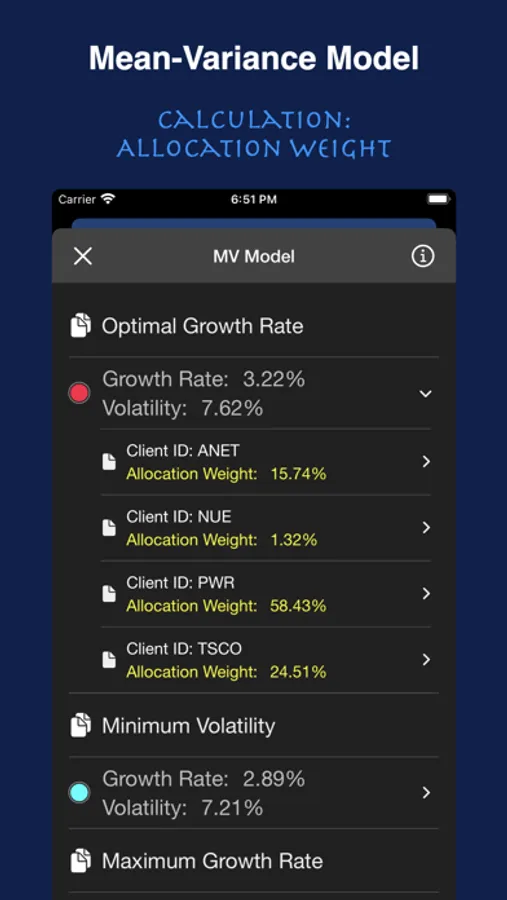

Mean-Variance Model:

The core idea of the Mean-Variance model is to reduce overall volatility through diversification (eg, low correlation between allocation objects).

For example, you could allocate resources based on the monthly sales performance of 50 European retail stores over the past three years. The Mean-Variance model uses the Monte Carlo method to find a set of allocation weights with the best growth rate.

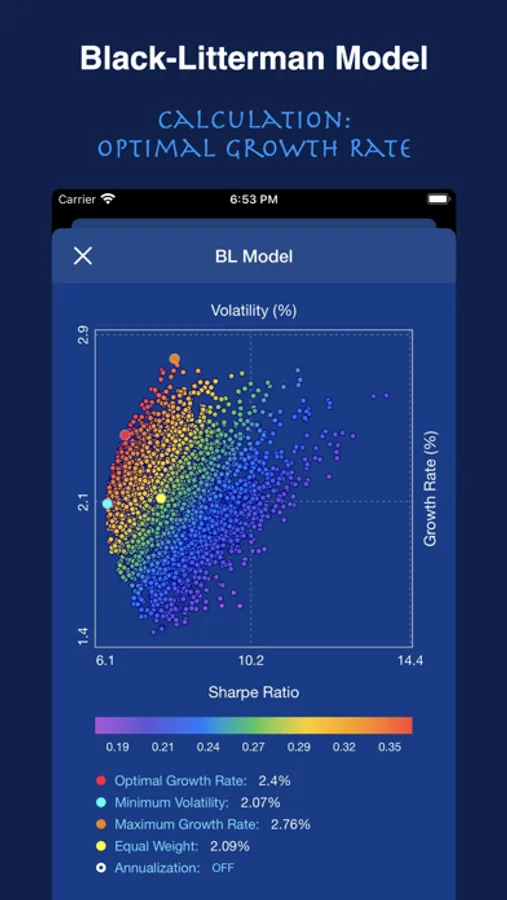

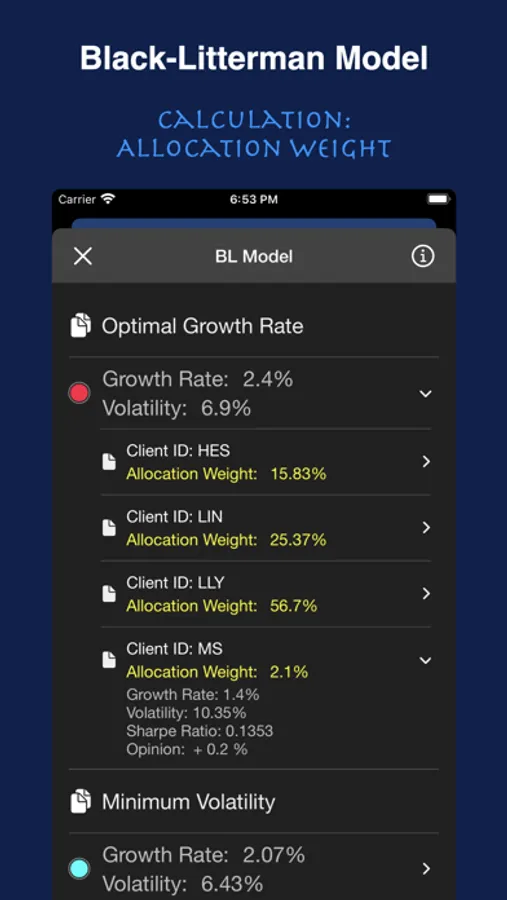

Black-Litterman Model:

The Black-Litterman model is based on the Mean-Variance model, adding user opinions on the growth rate to optimize the allocation results.

Continuing the previous example, the Black-Litterman model calculates and displays the average growth rate for each retail store for reference. You can adjust the growth rate parameters based on your experience or expert advice.

Risk-Parity Model:

Both the Mean-Variance model and the Black-Litterman model are designed to optimize "growth rate", while the Risk-Parity model is designed to optimize "volatility".

For example, you can allocate resources based on the monthly raw material prices of 20 suppliers in Asia Pacific over the past year. The Risk-Parity model uses Newton's method to find a set of allocation weights with equal volatility.

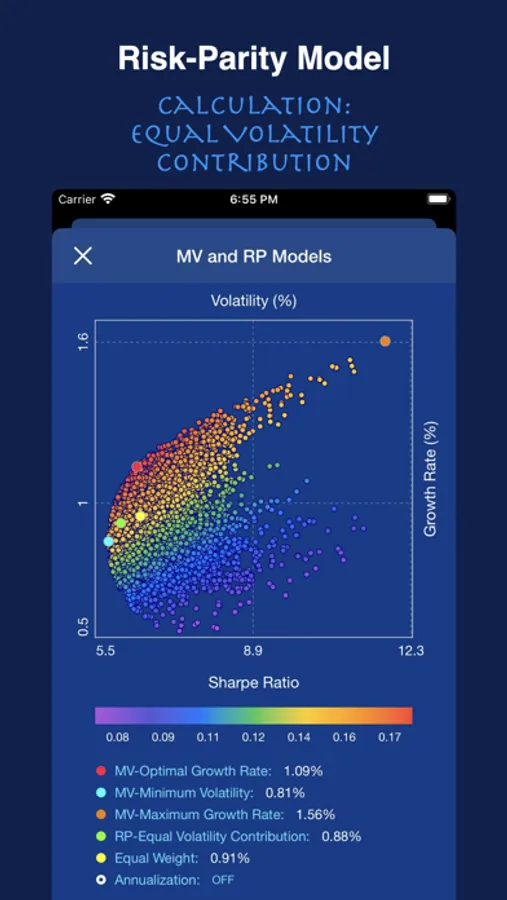

Mean-Variance Model:

The core idea of the Mean-Variance model is to reduce overall volatility through diversification (eg, low correlation between allocation objects).

For example, you could allocate resources based on the monthly sales performance of 50 European retail stores over the past three years. The Mean-Variance model uses the Monte Carlo method to find a set of allocation weights with the best growth rate.

Black-Litterman Model:

The Black-Litterman model is based on the Mean-Variance model, adding user opinions on the growth rate to optimize the allocation results.

Continuing the previous example, the Black-Litterman model calculates and displays the average growth rate for each retail store for reference. You can adjust the growth rate parameters based on your experience or expert advice.

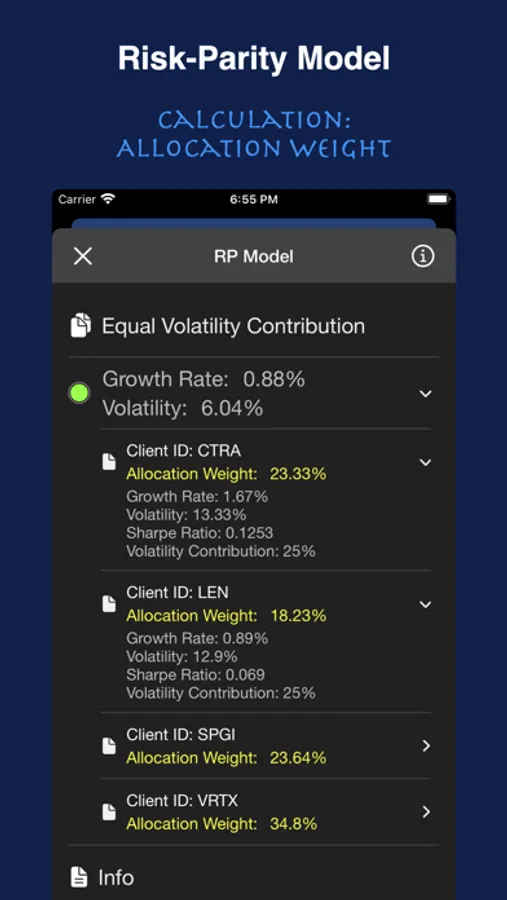

Risk-Parity Model:

Both the Mean-Variance model and the Black-Litterman model are designed to optimize "growth rate", while the Risk-Parity model is designed to optimize "volatility".

For example, you can allocate resources based on the monthly raw material prices of 20 suppliers in Asia Pacific over the past year. The Risk-Parity model uses Newton's method to find a set of allocation weights with equal volatility.